2010 Form 10-K - Vishay Intertechnology

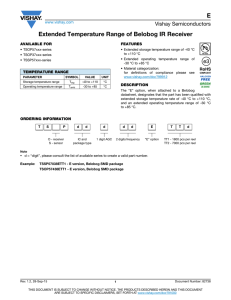

advertisement