Accordance VAT Recovery: From Analysis to Refund Guide

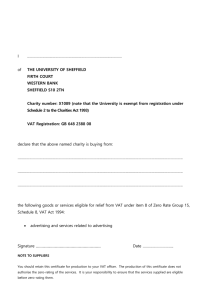

advertisement

ACCO R DA N C E VAT R E COV E RY: F R O M A N A LYS I S TO R E F U N D Europe’s cross-border VAT recovery process has been significantly – and beneficially – reformed over the last few years. But there are still areas of great complexity, often concerning whether VAT should have been charged by suppliers. Despite reform, companies in many sectors still have to negotiate confusing and risky terrain when applying for crossborder VAT refunds. This involves understanding the VAT implications of activities in a particular country and what action needs to be taken in order to ensure that they do not face a VAT cost. One consequence of not understanding the implications is that misdescribed claims get rejected. Another, is that many companies make unnecessary claims as a result of not grasping the rules. These are also rejected. In fact, many companies end up paying commission to third parties for obtaining credit notes - on claims that could be eliminated through better procedures. A B O U T ACCO R DA N C E Accordance is an international VAT consultancy and VAT compliance company. Our mission is to enable businesses to trade internationally. Getting VAT right is essential for international trade. We help businesses avoid fines and penalties, improve the cash-flow of expanding companies and ensure clients are VAT compliant by obtaining VAT registrations and handling VAT reporting. Millions of euros can be involved. The resultant cost and cash flow issues are serious. European tax authorities, under pressure to retain revenue in an austerity environment, are reluctant to help: the slightest error is often punished by a rejection of the claim. Accordance is a specialist cross-border European VAT practice. All our work is consultant led. We believe that the key to successful cross-border VAT recovery is accurate VAT analysis. We are committed to providing the most commercially efficient solution possible for our clients’ VAT recovery needs. Experienced VAT consultants specialising in cross-border transactions provide practical, commercially beneficial VAT assistance to companies across the EU and beyond – working across a range of industries and business sizes. We offer a single point of contact for international VAT - our one-stop shop makes it easier for clients to manage their international position. The procedure for recovering VAT incurred in the EU depends on whether you are established within the EU or outside the EU. Contact us to discuss further: • Reduction of the incidence of cross border VAT for businesses • Establishment of a simplified electronic refund mechanism for EU businesses • Removal (where possible) of the requirement to provide original invoices for electronic refund claims • Introduction of an obligation for claimants to self-assess the validity of their claim • Introduction of the right for tax authorities to issue penalties for invalid claims • Introduction of the right for tax authorities to deny VAT refunds where it could have been possible to exempt the supply Tower Point. 44 North Road Brighton. BN1 1YR. UK T +44 [0] 1273 573 950 info@accordancevat.com www.accordancevat.com T H E R E F U N D D I R E C T I V E ( 2 0 1 0) The changes to the Place of Supply introduced in 2010, and implemented in subsequent years, are now well established within The EU. Objectives of the reform included: In essence, the reforms were intended to make some of the administrative aspects of recovering VAT less onerous. But, at the same time, responsibility for claim accuracy on the part of businesses was greatly increased. Tax authorities managing austerity budgets will critically review larger Accounts Payable claims, leading to situations where companies have been denied millions of euros of VAT for what might seem inconsequential errors. C U R R E N T TA X AU T H O R I T Y P R AC T I C E European tax authorities now routinely refuse to refund VAT charged in respect of intra EU supplies even if the supplier did not have the evidence to apply the exemption. In their guidance, authorities say that taxpayers should contact their supplier for a credit note. Tax authorities will not hesitate to penalise. HMRC, for example, reserve the right to apply penalties. To assist in determining the correct level of penalty they ask the following: • What did you do to make sure your claim was correct? • If you were not sure about the correct tax treatment, what advice was available to you and what advice did you seek and who from? • If you did seek advice, what advice were you given and did you follow this advice? If you did not follow this advice, please explain why • Did you check HMRC’s guidance? If not please explain why. 1 3 T H E U VAT D I R E C T I V E The paper based mechanism applicable to non EU claimants (the 13th Directive) remains in place. The claim process is generally more efficient than in the past; but there is a far greater burden on businesses to make legitimate and accurate claims. Even the most trivial discrepancies can cause problems. Where tax authorities can reject a claim, they will reject a claim. N O N E U VAT R E F U N D S Not all non-EU countries with a VAT or indirect tax system allow refunds to overseas businesses, but many do. Sometimes, this can be achieved through a similar process to that in the EU where a claim form is completed and purchase invoices are submitted. Other countries may require a business to register for VAT locally in order to obtain a refund. CO M P L E X T R A N S AC T I O N S There are still a number of transaction types where a business will incur local VAT which has to be recovered. Some are industry specific and some are Member State specific. Some tax authorities are strictly applying their right to deny refunds of VAT which could have been exempted. It is crucial to understand whether or not the cross-border transactions you are managing are potentially exempt. M E M B E R S TAT E S P E C I F I C R E G U L AT I O N S EXTENDED REVERSE CHARGE Member States can make use of the extended reverse charge to avoid VAT registrations for non-established businesses making supplies in their State. Where these suppliers incur local VAT they must make a refund claim. I N D U S T RY S P E C I F I C R E G U L AT I O N S Certain industries operate in a way that inevitably exposes them to cross border VAT. Examples include: To o l i n g c h a r g e s Commonly occurs in the manufacturing/assembly industry. A manufacturer requires certain parts to be made by a third party, normally in a different EU Member State. A tool is required and local VAT is charged. C a r Te s t i n g There are driving tracks within the EU that are used by companies in the automotive industry to test tyres and seat belts in winter conditions. The hire of the track is typically subject to local VAT as it is considered to be connected to immovable property. Shop fitting Activities connected with shop fitting are normally considered as connected to immovable property and therefore subject to local VAT. Additionally, materials may be bought locally which will also be liable to local VAT. If the supplier is not able to register because of the extended reverse charge, they will need to recover the VAT via the refund directive. G o o d s i m p o r te d i n to t h e E U f o r d e m o n s t r a t i o n / ex h i b i t i o n (a n d co n s u m e d l o c a l l y) Goods imported into the EU to be consumed/given away at fairs or exhibitions are subject to import VAT. C o n f e r e n ce o r g a n i s e r s Professional Conference Organisers (PCOs) are typically not able to register for VAT in the Member State where events takes place as they are organising rather than hosting the event. Correctly charged local VAT must be recovered via a refund claim. L e a s i n g co m p a n i e s Where a company buys goods and then leases them to customers, the purchase of the equipment is a supply of goods and the lease is a supply of services. Where goods are purchased locally then VAT will normally be charged on the supplier invoice. These are just some examples of complex refund scenarios. Prudent claimants will take steps to establish whether their high-value claims require expert attention. U N N E C E S S A RY CO M M I S S I O N ? A further issue for many claimants using third party VAT recovery providers is of commission being paid annually on claims ‘recovered’ through credit notes. Very often, an appropriate VAT analysis would identify incorrect VAT charging, and enable a simple supplier invoicing change that would eliminate further VAT costs – and recurring commission. H I D D E N VAT Many companies post invoices with “foreign” VAT on a gross basis so that the VAT is expensed and invisible. As a result it is not possible to easily identify VAT recovery opportunities by looking at a company’s accounts. In these situations, it is necessary to consider the activities of the company to establish whether foreign VAT has been incurred. Expert analysis is required in order to determine where VAT may have been suffered and how it can be recovered. ACCO R DA N C E : C L A I M S E C U R I T Y T H R O U G H A N A LYS I S Companies recovering significant amounts of cross-border VAT face serious risks and challenges in the post-refund directive austerity environment. Authorities will not pay claims if they do not have to: and the refund framework is complex for many claim types. Claimants need to be confident either they or their provider has a real grasp of the technical VAT issues involved in their claims. Submission is no guarantee of success. High value claims are now routinely rejected by aggressive tax authorities, or can remain dormant or contested for many years. Accordance specialises in the analysis of cross-border VAT. Our Consultants lead the company’s compliance and reporting processes, as well as delivering cross-border VAT projects for international businesses. VAT Recovery at Accordance is based on the principle that accurate analysis will lead to successful refund applications. The larger the claim, the more important this becomes. Understanding the transaction is a prerequisite for effective VAT recovery. We offer expert claim management rather than a ‘factory’ for volume processing. • Consultant supervised procedures • Claims reviewed by consultants before submission • Wrongly-charged VAT identified – and eliminated in future years • Credit notes obtained • Best practice claim training provided to clients • Experienced claim managers • Expert liaison with tax authorities • Success only fees option