This document describes the objectives, data and modeling

advertisement

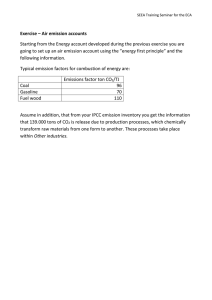

TM Methodology Documentation This document describes the objectives, data and modeling methods underlying the myPowerTM model. This document available at: http://www.energy.wisc.edu/?page_id=78 For additional information, contact Dr. Paul Meier at meier.paulj@gmail.com. TM ‐ myPower is a trademark of Meier Engineering Research LLC. This software is licensed for use by the UW Energy Institute at no cost for educational purposes. Background myPower is a long‐term simulation of electricity supply and demand. The underlying model relies on a long‐standing approach to power‐sector simulation, termed a load duration curve (LDC) model. Many variations of LDC models have been used for both research and regulatory purposes.1,2,3 myPower’s electric power model is most similar to the approach underlying the Oak Ridge Competitive Electricity Dispatch (ORCED) model, used for the evaluation of competitive power markets.4 The data underlying myPower is based largely on information from U.S. EPA’s Integrated Planning Model (IPM), an LDC model used for evaluation of the cost and emissions impacts of proposed policies to limit emissions power plant pollution control.5 The Electric Generation Expansion Analysis System (EGEAS) is an LDC model developed by the Electric Power Research Institute and used in Wisconsin and elsewhere for regulatory analysis of electric utility construction proposals.6 myPower’s objective is to provide an extremely simply and transparent approach for building and evaluating hypothetical scenarios for electricity supply and demand. This is different than other approaches that use optimization algorithms to identify least cost expansion plans, or that apply iterative computation to reach equilibrium with fuel supply curves. Rather, myPower provides transparent accounting for user‐prescribed scenarios. A typical scenario will be developed to forecast changes to electric power demand, meet that demand with a portfolio of infrastructure investments, satisfy emission constraints over time, and evaluate sensitivity to changes in fuel price. An advantage to the scenario approach is that it reduces the number and types of decisions that the model makes internally (black box) for improved transparency. It is also less computationally intensive, and hence interactive, for use as an educational tool. This document will describe the methodology for myPower’s scenario analysis. Power Sector Data Data sources for myPower will change slightly between versions, but in general are based on uniform data sets and modeling guidance from the U.S. Environmental Protection Agency (EPA), the U.S. Department of Energy’s Energy Information Administration (EIA), and the U.S. Federal Energy Regulatory Commission. myPower relies on EPA’s IPM Base Case Version 4.1 for electricity demand data, default fuel prices, as well as data describing U.S. power plants (NEEDS database) location, capacity, heat rate, fuel type, and default emission factors.5 NEEDS emission factors are compared to the actual emission rates reported by the Clean Air Markets (CAM) program.7 Where discrepancies occur, myPower uses CAM emission rates in place of NEEDS emission rates. Emission limits are based on EPA's 2015 state‐ level SO2 / NOx budgets published as part of the Clean Air Interstate Rule.8 Assumptions for pollution control retrofits and retirement is based on state level data collected by the Lake Michigan Air Directors Consortium (LADCO).9 New power plants available for construction are characterized based on the technology and cost assumptions provided by the Energy Information Administration's Annual Energy Outlook report (AEO).10 Additional customized power plants may be implemented in accordance with user‐defined parameters. Power generation limits for resource‐restricted sources (e.g. hydro‐electric 2 units) are based on annual generation reported by EIA.11 In some versions, financial information describing power plant capital, maintenance and fuel costs are compiled from FERC Form 1.12 Model Functions To support user‐defined scenario analysis, the MER model provides feedback on compliance with power capacity requirements, emission limitations, and fuel mix mandates (i.e., renewable portfolio standards). The model solves the user‐defined scenario using five primary calculations: load shape, power plant dispatch, market interactions, emissions (including pollution controls), and cost. These primary functions are described below, and a more detailed schematic is included as Figure 2 at the end of this document. Load shapes are constructed from hourly demand data that is transformed into load duration curves by splitting the data into seasons, sorting the demand data from highest to lowest, and replacing the hourly data with a polynomial spline (a series of equations which provide a close curve fit to the underlying data). There is no functional limit to the number of seasons or the number of splined polynomials. Unless otherwise warranted, however, the load shape is typically constructed using two annual seasons (peak and off‐peak seasons), each characterized by curve‐fitting with two polynomial segments. To simulate future years, the LDC is scaled to match demand projections that account for growth in energy consumption and then adjusted to reflect any load‐reducing investments (e.g., energy efficiency investments) or load‐increasing investments (e.g., electric vehicles). Future load shapes can be generated by increasing demand uniformly in response to growth factors, adjusting the relative “peakiness” of the load shape, or “hard‐wiring” prescribed future load shape. The dispatch routine estimates electricity generation from each power plant to satisfy seasonal load duration curves (LDC) defining demand. To solve the LDC, individual power plants are dispatched in the ranked order of their marginal operating cost. Marginal operating cost is calculated as a function of plant’s mean heat rate, fuel price, variable operating and maintenance, and any other cost factors (e.g., emission prices) assigned to the plant. Operational limits can be imposed for each LDC season and period, to reflect planned or forced outages, renewable resource constraints, or “must run” units which are forced to generate a prescribed amount of electricity. This forcing limits generation from renewable technologies to realistic estimates of their resource availability. Forcing can be used to adjust the performance of a power plant that functions differently than merit order would predict (e.g., a must‐run unit that supports voltage in a load pocket) where justified. In addition to resource constraints, power plants are de‐rated to reflect planned and forced outages. Each power plant’s electricity generation is established by their available capacity for each period, the amount of energy needed to satisfy the local system’s load shape. Except as limited by constraints described above, the dispatch routine assumes no operational constraint by the local transmission system – such that each plant has uniform access to meet local demand. Each unit’s generation, however, may be increased or decreased according to market interactions, for which transmission constraints are applied as described below. 3 Figure 1. Illustration of load duration curve dispatch and market interaction. Marginal Cost (cent/kwh) Market Price hours MW Unit Generation hours Market Price Unit Generation Market Price Duration Curve Load Duration Curve Local Unit 4 on Margin Simultaneous Transfer Limit Local Unit 3 on Margin Unit 4 Market Sale Local Unit 2 on Margin Unit 4 Generation for Native Load *heat rate impacts neglected Unit 3 Market Sale Unit 3 Generation for Native Load Unit 2 Market Sale Unit 2 Generation for Native Load Unit 1 Generation for Native Load Market Purchase 4 myPower simulates market interactions between the local system and power markets via a single tie to an “external” wholesale power market (for additional discussion of this LDC modeling approach, see documentation for ORCED model).1 The tie to the market is expressed as MW of transfer capacity. This “band‐width” constrains the capacity of power that may move into or out of the external market, the magnitude of which may vary for each LDC segment. The market has a price duration curve that establishes whether the local power plant is generating power that is more expensive, or less expensive, than the wholesale market price. As shown in Figure 1, when the market price is less expensive than the local unit generating on margin (the last unit dispatched), the model will ask this unit to export generation to the wholesale market, as possible according to surplus capacity of the unit, and the limit of the transmission tie. Conversely, a unit whose power is more expensive than the market will have generation displaced by wholesale power, to the extent the transmission capacity permits. A market price curve can be constructed to represent a hypothetically competitive market, such that the local system realistically exchanges power (e.g., local units are at times importing power and at other times exporting power). A market price curve can also be constructed based on evaluation of marginal costs of generating units within a defined market region. Power plant‐specific emission estimates are calculated as a function of electricity generated, heat rate (fuel required per unit generated), emission rate (emission mass per unit of fuel input), and air pollution control efficiency (fraction of pollutant removed by control device). As described above, the quantity of electricity generated is determined by the dispatch routine. Fuel throughput is estimated based on the average heat rate (btu fuel input / kwh electricity generated) of the power plant, for which default emission rates are based on the NEEDS database.5 Emission rates are based on either NEEDS or CAM data (where substitution allows, actual historic emission rates from the CAMS database replaces NEEDS emission rates). Pollution controls may be installed on generating units characterized by a defined control efficiency, capital cost, operating cost, as well as impact on heat rate. Cost estimates are estimated for each power plant based on its capital cost, variable and fixed operating and maintenance cost, and fuel cost. The capital cost may be based on generic assumptions from modeling guidance, or may be compiled on a plant by plant basis from FERC data.12 Fuel prices are assigned default costs, based on guidance from EPA or EIA, but are treated as variables that may be adjusted globally (for all plants of fuel type) or adjusted for any individual power plant. Cost of capital is estimated for each power plant for each simulation year according to assumed (or established) rates of debt and equity financing, and with consideration of depreciation and tax rates. Capital cost and operating costs for transmission or distribution systems, if included, are typically assigned simple average costs in terms of capital ($) per installed capacity, which is scaled according to the total mega‐ watts of installed generating capacity. 5 Figure 2. myPower model calculation schematic. Load Shape & Load Growth Generating Unit VOM, HR, Fuel Prices, APC, Prod Credits DSM Adjustment Adjusted Load Shape Market Power Price, Transfer Capability Dispatch Order Capacity Credits, Resource Limits Generating Unit Availability Reserve Margin Dispatch Unit Generation & Fuel Requirements DSM Capital, O&M Plant & APC Capital, O&M, Fuel Price, Heat Rates, Prod Credits Emission Rates, Pollution Control T&D Capital, O&M, market purchases Emissions Emission Credit Price Financing Production Cost 6 References Hadley S, Hirst E. ORCED: A Model to Simulate the Operations and Costs of Bulk‐Power Market: Oak Ridge National Laboratory; 1998. Retrieved 2010: http://www.ornl.gov/~webworks/cpr/rpt/97691.pdf. 1 2 Malik AS. Modelling and economic analysis of DSM programs in generation planning. International Journal of Electrical Power & Energy Systems. 2001;23(5):413‐9. 3 Gardner DT. Efficient Formulation of Electric Utility Resource Planning Models. J Operational Res Society. 2000;51(2):231‐6. 4 Available Reports on Studies using ORCED. Oak Ridge National Laboratory (ORNL); 1997–2003. Retrieved 2010: http://www.ornl.gov/sci/ees/etsd/pes/cooling_heating_power/orced/reports.htm. 5 U.S. EPA. EPA's IPM Base Case v.4.10. Retrieved 2010: http://www.epa.gov/airmarkt/progsregs/epa‐ ipm/BaseCasev410.html. 6 Public Service Commission of Wisconsin and Wisconsin Department of Natural Resources. Application Filing Requirements for Fossil Fuel Electric Generation Construction Projects. Version 12a / February 2012. Retrieved 2012: http://psc.wi.gov/utilityinfo/electric/construction/documents/powerPlantAFR.pdf. 7 U.S. Environmental Protection Agency. Clean Air Markets. Retrieved 2010: http://camddataandmaps.epa.gov/gdm/index.cfm?fuseaction=emissions.wizard. 8 U.S. Environmental Protection Agency. Clean Air Interstate Rule Technical Information. Retrieved 2010: http://www.epa.gov/cair/technical.html. 9 Mark Janssen, Emissions Modeler/System Administrator, Lake Michigan Air Directors Consortium. Personal communication, 2012. 10 U.S. Department of Energy (DOE), 2010. Energy Information Administration, Annual Energy Outlook 2012. Retrieved 2012: http://www.eia.gov/forecasts/aeo/. 11 U.S. Department of Energy, Energy Information Administration (EIA). Electricity Data; 2010. Report No.: Monthly Time Series File EIA‐906/920/923. 12 Federal Energy regulatory Commission. Documents and Filing. Retrieved 2012: http://www.ferc.gov/docs‐filing/forms.asp. 7