Policyholder Protection Schemes

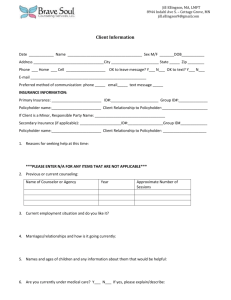

advertisement