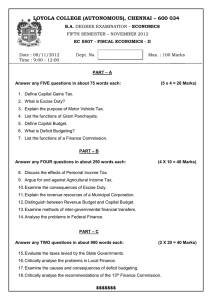

Question No.1 is compulsory. Attempt any five from

advertisement

ADMG

No. of Pages:6

No of Questions: 7

Total Marks: 100

Time Allowed: 3 Hrs

Question No.1 is compulsory. Attempt any five from remaining six questions.

Working notes should form part of the answers

1. (a) TQ Ltd. implemented a quality improvement programme and had the following results:

` In ‘000

Particulars

2010

2011

Sales

6000

6000

Scrap

600

300

Rework

500

400

Production inspection

200

240

Product warranty

300

150

Quality training

75

150

Materials inspection

80

60

Classify the quality costs as prevention, appraisal, internal failure and external failure and

express each class as a percentage of sales.

(5 Marks)

(b) What are the advantages and limitations of Zero base Budgeting?

(5 Marks)

(c) P Ltd. manufactures plastic cans of a standard size. The variable cost per can is `4 and the

selling price is `10 each. The factory of the company has eight machines of identical size. Any

individual machine can produce 30 cans per hour. The factory works on 300 days per annum

basic and the actual available hour per machine per day is 7.5. The company has an order of

4,20,000 cans from an oil company, to supply. The yearly fixed cost of the company is `20 lacs.

P Ltd has received an order from another firm for supplying 60,000 nos. of plastic moulded toys.

The price of the toys is `60 each and the variable cost is `50 each. While this order would be

acceptable for supplying for total quantities only, on acceptance, a special mould costing

`2,25,000 would required to be acquired to manufacture the toys. The time study exercise has

revealed that 15 nos. of toys can be produced per hour by any of the machines;

Advise the company, with reasons in the following situations:

(i) Whether to accept the order of manufacturing moulded toys, in addition to supplying

4,20,000 nos. of cans or not;

(ii) While a sub-contractor is willing to supply the toys, either whole or part of the required

quantities at an all inclusive rate of `57.50 each, what would be the minimum excess

capacity needed to justify the manufacturing of any portion of the toys order, instead of subcontracting?

(5 Marks)

PRIME / ME33 / FINAL

1 (d) M Ltd. manufactures a special product purely carried out by manual labour. It has a capacity of

20,000 units. It estimates the following cost structure:

Direct material

30 `/ unit

Direct labour (1 hour / unit) 20 `/ unit

Variable overhead

10 `/ unit

Fixed overheads at maximum capacity is `1,50,000. It is estimated that at the current level of

efficiency, each unit requires one hour for the first 5,000 units. Subsequently it is possible to

achieve 80% learning rate. The market can absort the first 5,000 units at `100 per unit. What

should be the minimum selling price acceptable for an order of 15,000 units for a prospective

client?

(5 Marks)

2. (a) You are Management Accountant of a medium sized company. You have been asked to

provide budgetary information and advice to the board for a meeting where they will decide the

pricing of an important product for the next period. The following information is available from the

records.

Particulars Previous period

1300

(100,000 units at `13 each)

Sales

Costs

1000

Profit

300

Current period

1378

(106,000 units at `13 each)

1077.4

300.6

You find that between the previous and current period there was 4% general cost inflation and it

is forecasted that costs will raise a further 6% in the next period. As a matter of policy the firm did

not increase the selling price in the current period although competitors raised their prices by 4%

to allow for increased costs. A survey by economic consultants was commissioned and has

found that the demand for the product is elastic with an estimated price elasticity of demand for

1.5. This would mean volume would fall by one and a half times the rate of real price increase.

Various options are considered by the board.

(i)

(ii)

(iii)

(iv)

Show the budgeted positions if the firm maintains `13 as selling price for the next

period (when it is expected that competitors will increase their price by 6%).

Show the budgeted position if the firm also raises its price by 6%.

Write a report to the board with appropriate figures recommending whether the firm

should maintain `13 as selling price or raise it by 6%

Make your assumptions.

(3+3+3+3 Marks)

(b) How does the JIT approach help in improving an organisation’s profitability?

3.

(4 Marks)

(a) Four products A, B, C and D have `5, `7, `3 and `9 profitability respectively. First

type of material (limited supply of 800 kgs.) is required by A, B, C and D at 4kgs, 3kgs, 8kgs and

2kgs respectively per unit. Second type of material has a limited supply of 300kgs and is for A, B,

C and D at 1kgs, 2kgs, 0kg and 1kg per unit. Supply of other type of materials consumed is not

limited. Machine hours available are 500 hours and the requirements are 8, 5, 0, 4 hours for A, B,

C and D each per unit. Labour hours are limited to 900 hours and requirements are 3, 2, 1 and 5

hours for A, B, C and D respectively.

PRIME / ME33 / FINAL

2 How should the firm approach so as to maximise its profitability? Formulate this as a linear

programming problem. You are not required to solve the LPP.

(6 Marks)

(b) The output of a production line is checked by an inspector for one or more of three different

types of defects, called defects A, B and C. If defect A occurs, the item is scrapped. If defect B or

C occurs, the item must be reworked. The time required to rework a B defect is 15 minutes and

the time required to rework a C defect is 30 minutes. The probabilities of an A, B and C defects

are 0.15, 0.20 and 0.10 respectively. For ten items coming off the assembly line, determine tile

number of items without any defects, the number scrapped and the total minutes of rework time.

Use the following random numbers,

RN for defect A

48 55 91 40 93 01 83 63 47 52

RN for defect B

47 36 57 04 79 55 10 13 57 09

RN for defect C

82 95 18 96 20 84 56 11 52 03

(5 marks)

(c) Explain the concept of discretionary costs. Give two examples. How control may be exercised

over discretionary costs

(5 Marks)

4. Attempt any four:

(4x4=16 Marks)

(a) You are the manager of a paper mill (XYZ Ltd) and have recently come across a particular type

of paper, which is being sold at a substantially lower rate (by another company –ABC Ltd) than

the price charged by your own mill. The value chain for one use of one tonne of such paper for

ABC Ltd is as follows,

ABC Ltd.

Merchant

Printer

Customer

ABC Ltd sells this particular paper to the merchant at the rate of `1,466 per tonne. ABC Ltd

pays for the freight which amounts to `30 per tonne. Average returns and allowances amount to

4% of sales and approximately equals `60 per tonne.

The value chain of your company, through which the paper reaches the ultimate customer, is

similar to the one of ABC Ltd. However, your mill does not sell directly to the merchant, the latter

receiving the paper from a huge distribution center maintained by your company at Haryana.

Shipment costs from the mill to the Distribution Center amount to `11 per tonne while the

operating costs in the Distribution Center have been estimated to be `25 per tonne. The return

on investments required by the Distribution Center for the investments made amount to an

estimated `58 per tonne.

You are required to compute the “Mill manufacturing Target Cost” for this particular paper for

your company. You may assume that the return on the investment expected by your company

equals `120 per tonne of such paper.

(b) What are the areas in which activity based information is used for decision making?

PRIME / ME33 / FINAL

3 (c) The following information of manufacture and sale is obtained from the records of Vee Aar Ltd.

for the 12 months ending 31.12.2008:

Product

A

B

C

D

E

F

Total

Contribution (`)

500

200

1,500

75

100

125

2,500

You are required to prepare a Pareto product contribution chart and comment on the results.

(d) Explain the concept of theory of constraints. What are the key measures of theory of

constraints?

(e) X ltd. Has been approached by a customer who would like a special job to be done for him and

is willing to pay `22,000 for it. The job would require the following materials;

Materials

Total units

required

A

B

C

D

1,000

1,000

1,000

200

Units

already in

stock

0

600

700

200

Book value of

units in stock

(`/unit)

2

3

4

Realisable

value(`/unit)

Replacement

cost (`/unit)

2.5

2.5

6

6

5

4

9

(i) Material B is used regularly by X ltd. and if stocks were required for this job, they would need to

be replaced to meet other production demand.

(ii) Materials C and D are in stock as the result of previous excess purchase and they have a

restricted use. No other use could be found for material C but material D could be used in

another job as substitute for 300 units of material, which currently cost `5 p.u (of which the

company has no units in stock at the moment).

What are the relevant costs of material, in deciding whether or not to accept the contract?

Assume all other expenses on this contract are to be specially incurred besides the relevant cost

of material is `550

5. (a) Division Z is a profit centre, which produces four products A, B, C and D. Each product is sold

in the external market also. Data for the period is as follows:

A

`

Market Price per unit

150

Variable cost of Production per Unit 130

Labour Hours required per Unit

3

PRIME / ME33 / FINAL

4 B

C

D

`

`

`

146 140 130

100 90 85

4

2

3

Product D can be transferred to division Y but the maximum quantity that might be required for

transfer is 2,500 units of D. The maximum sales in the external market are:

A

2,800 units

B

2,500 units

C

2,300 units

D

1,600 units

Division Y can purchase the same product at a slightly cheaper price of `125 per unit instead of

receiving transfers of product D from division Z. What should be transfer price for each unit for

2,500 units of D, if the total labour hours available in division Z are 20,000 hours?

(11 Marks)

(b) “Cost can be managed only at the point of commitment and not at the point of incidence.

Therefore, it is necessary to manage cost drivers to manage cost”. Explain the statement with

reference to structural and exceptional cost drivers.

(5 Marks)

6. (a) Solve the following transportation problem.

1

2

3

4

5

Demand

1

73

62

96

57

56

6

2

40

93

65

58

23

8

3

9

96

80

29

87

10

4

79

8

50

12

18

4

5 Stock available

20

8

13

7

65

9

87

3

12

5

4

(8 Marks)

(b) How would you use the Monte Carlo Simulation method in inventory control?

(4 Marks)

(c) What do you mean by a dummy activity? Why is it used in networking?

(4 Marks)

7. (a) The following is the Operating Statement of a company for April 2011:

Budgeted Profit

Variances:

Favourable (`)

Sales Volume

Sales Price

9,600

Direct Material Price

Direct Materials Usage

Direct Labour Rate

Direct Labour Efficiency

3,600

Fixed Overheads Efficiency

2,400

Fixed Overheads Capacity

Fixed Overheads Expense

1,400

17,000

Actual profit

PRIME / ME33 / FINAL

Adverse (`)

4,000

`

1,00,000

4,960

6,400

3,600

4,000

22,960

5 5,960 (A)

94,040

Additional information is as under:

Budget for the year

1,20,000 units

Budgeted fixed overheads

`4,80,000 per annum

Standard cost of one unit of product is:

Direct Materials

5 kg.@ `4 per kg.

Direct Labour

2 hours @ `3 per hour

Fixed overheads are absorbed on direct labour hour basis.

Profit

25% on sales

You are required to prepare the Annual Financial Profit / Loss Statement for April, 2011 in the

following format:

Account

Sales

Direct Materials

Direct Labour

Fixed Overheads

Total Costs

Profit

Qty./ Hours

Rate / Price

(12 Marks)

(b) Explain the main features on ‘Enterprise Resource planning’.

PRIME / ME33 / FINAL

Actual Value `

6 (4 Marks)

PRIME ACADEMY

33rd SESSION MODEL EXAM - FINAL

ADVANCED MANAGEMENT ACCOUNTING

SUGGESTED ANSWERS

1. (a) Statement computing profit and analyzing quality cost

Particulars

Sales

Prevention Cost

Quality training

Appraisal cost

Production inspection

Material Inspection

Total

Internal failure cost

Scrap

Rework

Total

External Failure cost

Product warranty

Total cost

Profit

2010

`

6000

2011

`

6000

75

150

200

80

280

240

60

300

600

500

1100

300

400

700

300

1755

4245

150

1300

4700

(b) Advantage of ZBB

(i) It provides a systematic approach for evaluation of different activities and ranks them in order

of preference for allocation of scare resource.

(ii) It ensures that the various functions undertaken by the organisation are critical for the

achievement of its objectives and are being performed in the best way.

(iii) It provides an opportunity to the management to allocate resources for various activities only

after having a thorough cost-benefit analysis.

(iv) The area of wasteful expenditure can be easily identified and eliminated.

(v) Departmental budgets are closely linked with corporate objectives.

(vi) The technique can also be used for the introduction and implementation of the system of

‘management by objective’.

Limitations of ZBB

(i)

(ii)

(iii)

(iv)

Various operational problems are likely to be faced in implementing the technique.

The full support of top management is required.

It is time consuming as well as costly.

It requires proper trained managerial staff.

PRIME / ME33 / FINAL

7 (c) Statement showing Profit / Loss of company

(i) (If it accepts the order of manufacturing moulded toys)

Total available machine hours: (A)

(8 machine × 7.5 hours / day × 300 days)

Machine hours required for producing 4,20,000 cans: (B)

(4,20,000 cans /30 cans)

Balance machine hours: {(A) – (B)]

Total number of production of moulded toys in balance hours

(4,000 hours × 15 toys / hour)

Total contribution on 60,000 moulded toys (`)

Less: Fixed expenses of mould (`)

Net profit (`)

`

18,000

14,000

4,000

60,000

6,00,000

2,25,000

3,75,000

Decision: It is advisable for the company to accept the order of 60,000 moulded toys as it will

increase its profit by `3,75,000.

(ii)

Let the minimum excess capacity needed to justify the manufacturing of any portion of

the moulded toys order be x.

If toys are manufactured, the profit is = (`60 – `50) x – `2,25,000

and, if toys are sub-contracted, the profit is = (`60 – `57.50) x

Indifference point would be 10x – `2,25,000 = 2.5x

or x =

30,000 moulded toys

Toys produced per hour =15 toys

Therefore, 2,000 (30,000 toys / 15 toys) excess machine hours are required to justify

manufacturing of toys by the company, instead of sub-contracting.

(d)

5,000 units 20,000 units

Material

1,50,000

6,00,000

Direct Labour

1,00,000

2,56,000(Wn.1)

Variable Overhead

50,000

2,00,000

Total Variable Cost

3,00,000

10,56,000

Fixed Cost

1,50,000

1,50,000

Total Cost

4,50,000

12,06,000

Total cost / unit

90

60.3

Sales 100 × 5,000

5,00,000

5,00,000

15,000 × x(assumed selling price)

15,000 x

(Total Sales less Total Cost) = Profit 50,000

15,000 x 7,06,000

Or minimum selling price = 50.4(refer to Working Note ii)

Working Note: I

PRIME / ME33 / FINAL

Units

5,000

10,000

Hours

5,000

10,000 × 1 × .8 = 8,000 hours

20,000

20,000 × 1 × .8 × .8 = 12,800 hours

8 Working Note: II

15,000 x – 7,06,000 > 50,000

15,000 x > 7,56,000

or x > 50.4

Alternative Solution:

Total cost / unit of capacity 20,000 = 60.3

Weighted average selling price > 80.4

i.e. 5,000 × 100 + 15,000 x > 60.3

20,000

= 5,00,000 + 15,000 x > 60.3 × 20,000

= 15,000 x > 12,06,000 – 5,00,000

Or

15,000 x > 7,06,000

x > 47.06

Minimum price to cover production Cost = 47.06

Minimum price to cover same amount of profit = 50.40 (refer to Working Note 1)

Working Note 1

(− 47.06 + 50.04) × 15,000 units

= `50,000

2. (a) (i) Budgeted position when Selling price is `13

`

Particulars

Computation

Sales

106000 units x 109% =115540 units x13 1,502,020

Less: Variable cost 115540 units x 6.6144

764,228

Contribution

737,792

Less: Fixed cost

440,960

Profit

296,832

(ii) Budgeted position when selling price is `13.78 (Increased by 6%)

`

Particulars

Computation

Sales

106000 units x 13.78 1,460,680

Less: Variable cost 106000 units x 6.6144

701,126

Contribution

759,554

Less: Fixed cost

440,960

Profit

318,594

•

•

Working notes:

Current period cost at previous period price level

Current period cost=`1077.44

Current period cost at previous period price level=1077.44/1.04 =`1036

Variable and fixed cost:

Variable cost = Change in cost/change in units = (1036-1000) ÷ (106-100) =Rs.6/unit

Fixed cost = Total cost – Variable cost = 1000-6x100= `400

PRIME / ME33 / FINAL

9 •

Variable and fixed cost at next year’s price level:

Variable cost = 6x104%x106% = `6.6144 p.u

Fixed cost = 400x104%x106% = `440.96

(iii) The option of increasing selling price is recommended because it gives the highest budget

profit. In the Option 1, keeping selling price constant helps to increase the volume but the

volume increase also increases the variable cost.

(iv) Assumptions:

•

•

•

•

Price is the sole factor influencing the demand

The Price elasticity is accurately estimated

Both variable and fixed cost has the same rate of inflation

Decision is made purely on the basis of economic factors.

(b) JIT approach helps in the reduction of costs/increase in prices as follows:

(i) Immediate detection of defective goods being manufactured so that early correction is

ensured with least scrapping.

(ii) Eliminates/reduces WIP between machines within working cell.

(iii) OH costs in the form of rentals for inventory, insurance, maintenance costs etc. Are reduced.

(iv) Higher product quality ensured by the JIT approach leads to higher premium in the selling

price.

(v) Detection of problem areas due to better production/scrap reporting/labour tracing and

inventory

(vi) Accuracy lead to reduction in costs by improvement.

3. (a) Tabulation:

Products

Profitability/unit(Rs.)

Material requirement/ unit (kg)

-First type (total 800 kg.)

Second type (total 300 kg.)

Machine hrs requirement/ unit (Total 500 hrs)

Labour hrs requirement/ unit (total 900 hrs.)

A

5

B

7

C

3

D

9

4

1

8

3

3

2

5

2

8

0

0

1

2

1

4

5

Formulation:

Taking X1, X2, X3 and X4 as optimal quantities of A, B, C and D respectively.

Maximise Objective function (Total Profit)

Z = 5X1 + 7X2+ 3X3+ 9X4

Subject to:

4X1 +3X2 +8X3+ 2X4 < 800 (Material No-1 Constraint)

1X1 +2X2 +0X3+ 1X4 < 300 (Material No-2 Constraint)

8X1 +5X2 +0X3+ 4X4 < 500 (Machine hrs constraint)

3X1 +2X2 +1X3+ 5X4 < 900 (Labour hrs Constraint)

X1, + X2, X3 and X4 > 0 (Non-negativity Constraint)

PRIME / ME33 / FINAL

10 (b) The probabilities of occurrence of A, B and C defects are 0.15, 0.20 and 0.I0 respectively. So, tile

numbers 00-99 are allocated in proportion to the probabilities associated with each of the three

defects

Defect C

Defect A

Defect B

Random numbers

Random numbers

Random numbers

Exists?

Exists?

Exists?

assigned

assigned

assigned

Yes

00-14

Yes

00-19

Yes

00-09

No

15-99

No

20-99

No

10-99

Let us now simulate the output of the assembly line for 10 items using the given random

numbers in order to determine the number of items without any defect, the number of items

scrapped and the total minutes of rework time required:

Item

No.

RN for

defect A

RN for

defect B

48

55

91

40

93

01

83

63

47

52

47

36

57

04

79

55

10

13

57

09

1

2

3

4

5

6

7

8

9

10

RN for

defect

C

82

95

18

96

20

84

56

11

52

03

Whether

any defect

None

None

None

B

None

A

B

B

None

B,C

Rework time

(in exists

minutes)

–

–

–

15

–

–

15

15

–

15 +30=45

Remarks

–

–

–

–

–

Scrap

–

–

–

–

During the simulated period, 5 out of the ten items had no defect, one item was scrapped and 90

minutes of total rework time was required by 3 items.

(c) Discretionary costs can be explained with the help of following two important features

(i) They arise from periodic (usually yearly) decisions regarding the maximum outlay to be

incurred.

(ii) They are not tied to a clear cause and effect relationship between inputs and outputs.

Examples of discretionary costs includes: advertising, public relations, executive

training, teaching, research, health care and management consulting services. The note

worthy feature of discretionary costs is that mangers are seldom confident that the

“correct” amounts are being spent.

Control:

To control discretionary costs control points/parameters may be established. But these points need

to be devised individually. For research and development function to control discretionary costs,

dates may be established for submitting major reports to management. For advertising and sales

promotion, such costs may be controlled by pre-setting targets. In the case of employees benefits,

discretionary costs may be controlled by calling a meeting of employees union and making them

aware that the company would meet only the fixed costs and the variable costs should be met by

them

PRIME / ME33 / FINAL

11 4. (a) Computation of Target Cost

Per tonne (in `)

1,466

( 30)

( 60)

(120)

1,256

(11)

(25)

1,220

(58)

ABC Ltd selling price to the merchant

Less freight paid by ABC Ltd

Less normal sales returns and allowances

XYZ Ltds Capital charge

Target cost for XYZ Ltd

Ship to Distribution Centre

Distribution Centre operating cost

Subtotal

Distribution centre capital charge

Mill target manufacturing cost

1,162

(b) The areas in which Activity based information is used for making are as under:

(i)

Pricing

(ii)

Market segmentation and distribution channels

(iii)

Make-or-buy decisions and outsourcing

(iv)

Transfer pricing

(v)

Plant closed down decisions

(vi)

Evaluation of offshore production

(vii)

Capital Investment decisions

(viii)

Product line profitability.

(c) Let us rearrange the products in descending order of contribution and find out the cumulative

contribution percentage.

Product Contribution (Rs.) Cumulative

contribution (Rs.)

C

1,500

1,500

A

500

2,000

B

200

2,200

F

125

2,325

E

100

2,425

D

75

2,500

2,500

Cumulative

contribution (%)

60

80

88

93

97

100

On analysis it is found that 80% of the total contribution is earned by two products C and A. The

position of these products needs protecting, perhaps through careful attention to branding and

promotion. The other products should be investigated to see whether their contribution can be

improved through increased prices, reduced costs, increased sales volume, etc.

(d) The theory of constraints focuses its attention on constraints and bottlenecks within organisation

which hinder speedy production. The main concept is to maximize the rate of manufacturing

output is the throughput of the organisation. This requires to examine the bottlenecks and

PRIME / ME33 / FINAL

12 constraints. A bottleneck is an activity within the organization where the demand for that resource

is more than its capacity to supply.

Key measures of theory of constraints:

(i) Throughput contribution: It is the rate at which the system generates profits through sales. It

is defined as, sales less completely variable cost, sales – direct are excluded. Labour costs

tend to be partially fixed and conferred are excluded normally.

(ii) Investments: This is the sum of material costs of direct materials, inventory, WIP, finished

goods inventory, R & D costs and costs of equipment and buildings.

(iii) Other operating costs: This equals all operating costs (other than direct materials) incurred to

earn throughput contribution. Other operating costs include salaries and wages, rent, utilities

and depreciation.

(e) Computation of relevant cost of the job:

A

(1000 x 6)

6000.00

B

(1000 x 6)

5000.00

C

[(700x2.5) + (300x4)]

2950.00

D

(300 x 5)

1500.00

15,450.00

Add: Other Expenses

550.00

16000.00

As the revenue from the order, which is more than the relevant cost of `.16,000, the order

should be accepted.

5. (a) Working Notes:

Ranking of products when availability of time is the key factory

Product

A

B

Market Price per unit

`150

`146

Less: Variable cost of Production per Unit `130

`100

Contribution per unit

20

46

Contribution per hour

6.66

11.50

(`20/3 hrs.)

(`46/4 hrs.) (`50/2 hrs.)

Ranking

IV

III

(i)

C

`140

`90

50

25

(`45/3hrs.)

I

Statement of production mix (when total available hours in division Z are 20,000)

Product

(Refer to

W.N.)

(a)

Maximum

demand

(units)

(b)

C

Hours

per unit

Units

produced

Hours

used

Balance

hours

(c)

(d)

(e)=(b)×(c)

2,300

2

2,300

4600

D

1,600

3

1,600

4800

B

2,500

4

2,500

10000

(f)

15,400

(20,0004,600)

10,600

(15,400 4,800)

600

PRIME / ME33 / FINAL

13 D

`130

`85

45

15

II

A

2,800

3

200

600

(10,600 10,000)

NIL(600600)

Note: Time required to meet the demand of 2,500 units of product D for division Y is 7,500 hours. This

requirement of time viz., 7,500 hours for providing 2,500 units of product D for division Y can be met by

sacrificing the production of 1,725 units of product B (1,725 units × 4 hours) and 200 units of product B

(200 units × 2 hours = 600 hours)

Statement of Transfer Price for each unit for 2,500 units of D

Transfer price

2,500 units of

Product D

2,12,500

4,000

Per unit of

Product D

85.00

1.60

Variable cost (2,500 units × `85)

Opportunity cost of the contribution foregone by not producing

200 units of A. (200 units × `20)

Opportunity cost of the contribution foregone by not producing

79,350

31.74

1,725 units of B (1,725 units × `46)

Transfer price

2,95,850

118.34

(b)

(i) A firm commits costs at the time of designing the product and deciding the method of production.

It also commits cost at the time of deciding the delivery channel (e.g. delivery through dealers

or own retail stores).

(ii) Costs are incurred at the time of actual production and delivery. Therefore, no significant cost

reduction can be achieved at the time when the costs are incurred. Therefore, it is said that

costs can be managed at the point of commitment.

(iii) Cost drivers are factors that drive consumption of resources. Therefore, management of cost

drivers is essential to manage costs. Structural cost drivers are those which can be managed

by effecting structural changes.

(iv) Examples of structural cost drivers are scale of operation, scope of operation (i.e. degree of

vertical integration), complexity, technology and experience or learning. Thus, structural cost

drivers arise from the business model adopted by the company.

(v) Executional cost drivers can be managed by executive decisions, examples of executional cost

drivers are capacity utilization, plant layout efficiency, product configuration and linkages with

suppliers and customers. It is obvious that cost drivers can be managed only at the point of

structural and operating decisions, which commit resources to various activities.

PRIME / ME33 / FINAL

14 6. (a)

The transportation cost = 9 × 8 + 8 × 3 + 13 × 4 + 96 × 6 + 65 × 3 + 29 × 2 + 23 × 5 + 12 × 1

= 72 + 24 + 52 + 576 + 195 + 58 + 115 + 12

= 1104

The above initial solution is tested for optimality. Since there are only 8 allocations and we require 9 (m +

n – 1 = 9) allocations, we put a small quantity in the least cost independent cell (5, 5) and apply the

optimality test. Let u5 = 0 and then we calculate remaining ui and vj.

PRIME / ME33 / FINAL

15 Since some of the Aij's are negative, the above initial solution is not optimal. Introducing in the cell

(Dummy) with most negative Aij an assignment e. The value of e and the new solution as obtained from

above is shown below. The values of ui's, vj's are also calculated. The solution satisfies the conditions of

optimality. The condition Aij = Cij – (ui + vj) > 0 for non allocated cells is also fulfilled.

The above table gives the minimum cost.

PRIME / ME33 / FINAL

16 The cost is

= 9 × 8 + 8 × 4 + 13 × 3 + 65 × 4 + 96 × 5 + 57 × 1 + 29 × 2 + 23 × 4 + 12 × 1

= 72 + 32 + 39 + 260 + 480 + 57 + 58 + 92 + 12

= 1102

(b) Steps involved in carrying out Monte Carlo simulation are:

•

•

•

•

•

•

Define the problem and select the measure of effectiveness of the problem that might be

inventory shortages per period.

Identify the variables which influence the measure of effectiveness significantly for example,

number of units in inventory.

Determine the proper cumulative probability distribution of each variable selected with the

probability on vertical axis and the values of variables on horizontal axis.

Get a set of random numbers.

Consider each random number as a decimal value of the cumulative probability distribution

with the decimal enter the cumulative distribution plot from the vertical axis. Project this point

horizontally, until it intersects cumulative probability distribution curve. Then project the point

of intersection down into the vertical axis.

Then record the value generated into the formula derived from the chosen measure of

effectiveness. Solve and record the value. This value is the measure of effectiveness for that

simulated value. Repeat above steps until sample is large enough for the satisfaction of the

decision maker.

(c) Dummy activity is a hypothetical activity which consumes no resource or time. It is represented

by dotted lines and is inserted in the network to clarify an activity pattern under the following

situations.

PRIME / ME33 / FINAL

17 (i) To make activities with common starting and finishing events distinguishable.

(ii)

To identify and maintain the proper precedence relationship between activities that are

not connected by events.

(iii) To bring all “loose ends” to a single initial and single terminal event.

Dummy (2) – (3) is used to convey that can start only after events numbered (2) and (3) are over:

7. (a) Working notes:

1. (a)

(b)

2. (a)

Budgeted fixed overhead per unit:

= (Budgeted fixed overheads p.a / Budgeted output for the year)

= `4,80,000 p.a. / 1,20,000 units = `4 per unit.

Budgeted fixed overhead hour:

= Budgeted fixed overhead per unit / Standard labour hours per unit

= `4 / 2 hours = `2 per hour

Standard cost per unit:

`

(b)

3 (a)

Direct material

(5 kg × `4/- per kg)

Direct labour

Fixed overhead

(2 hours × `2)

Total standard cost (per unit)

Budgeted selling price per unit

Standard cost per unit

Standard profit per unit

(25% on slaes or 33 – 1/3% of standard cost)

Budgeted selling price per unit

(2 hours × `3/- per hour)

20

6

4

-------30

30

10

---------40

Actual output units for April, 2001:

Fixed overhead volume Variance = Efficiency variance + Capacity variance

or (Budgeted output units – Actual output units) Budgeted fixed overhead p.u.

=`2,400 (Favourable) + `4,000 (Adverse) = `1,600 (Adverse)

or (10,000 units – x units) `4 – `1,600 (Adverse)

or (10,000 units – 400 units) = x (Actual output units)

or Actual output units = 9,600 units

PRIME / ME33 / FINAL

18 (b) Actual fixed overhead expenses:

(budgeted fixed overhead – Actual fixed overhead) = Fixed overhead expenses variance

or (`40,000 – x) = `1,400 (Favourable)

or x = `40,000 – `1,400 = ` 38,600

4. (a) Actual sales quantity units: Sales volume variance

= `4,000 (Adverse) = `10 (x – 10,000 units)

or 400 units = x – 10,000 units

or x (Actual sales quantity) = 9,600 units

(b) Actual selling price per units

or `9,600 (Fav.) = (x – `40) × 9,600 units

or Actual selling price per unit = `41/5. (a) Actual quantity of material consumed:

or 6,400 (Adv.) = (9,600 units × 5 kgs.) `4

or x kgs. = 49,600 kgs.

(actual quantity of material consumed)

(b) Actual price per kg:

Material price variance = (Standard price per kg – Actual price per kg) Actual quantity of material

consumed

-`4,960 = (`4 –Rs. y per kg.) 49,600 kg.

-0.1 = (`4 – `y per kg)

or y = `4.10 per kg.

6. (a) Actual direct labour hour used:

Labour efficiency variance = (Standard hours – Actual hours) Standard rate per hour

`3,600 (Favourable) = (9,600 units × 2 hours – p hours) Rs.3

`3,600 (Favourable) = (19,200 hours – p hours) Rs.3

P hours = (19,200 hours – 1,200 hours) – 18,000 hours

(Actual direct labour hours)

(b) Actual direct labour hour rate:

`3,600 (Adverse) = (`3 per hour – t per hour) 18,000 hours

or t = `3 + `0.20 – `3.20 per hour

(actual direct labour hour rate)

PRIME / ME33 / FINAL

19 7. Actual fixed overheads:

Fixed overhead expense variance = Budgeted fixed overhead – Actual fixed overhead

or `1,400 (Favourable) = 10,000 units × `4 p.u. – Actual fixed overhead

or Actual fixed overhead = `40,000 – `1,400

or Actual fixed overhead = `38,600

Annual financial Profit /Loss Statement

(for April, 2011)

Account

Qty./ Hours

Rate/Price

Actual/ Value

(a)

(b)

(c)

(d)=(b)×(c)

Sales: (A)

9,600 units

41

3,93,600

(Refer to working note 4)

Direct Materials

49,600 kgs. 4.10 per kg.

2,03,360

(Refer to working note 5)

Direct labour

18,000 hours 3,20 per hour

57,600

(Refer to working note 6)

Fixed Overheads

18,000 hours 2.14444 per hour

38,600

(Refer to working note 6 (a) and 7)

(`38,600/18,000 hours)

(absorbed on direct labour hour basis)

Total costs: (B)

2,99,560

Profit : [(A) – (B)]

94,040

(b) Some of the major features of “Enterprise Resource Planning” (ERP) areas follows:

(i)

ERP facilitates company-wide integrated information system covering all functional areas like

manufacturing, selling and distribution, payables, receivables, inventory etc.

(ii)

It performs core activities and increases customer services thereby augmenting the

corporate image.

(iii)

ERP bridges the information gap across organization.

(iv)

ERP provides complete integration of systems.

(v)

It is a solution for better project management.

PRIME / ME33 / FINAL

20 DTTS

No. of Pages: 6

No of Questions:7

Total Marks: 100

Time Allowed: 3 Hrs

Question No.1 is compulsory. Answer any 5 questions from the remaining 6 questions.

Working notes should form part of the answers

1. (a) X Ltd. furnishes the following particulars for the P.Y. 2010-11. Compute the deduction allowable

under section 35 for A.Y.2011-12, while computing its income under the head “Profits and gains

of business or profession”.

Particulars

(i) Amount paid to Indian Institute of Science, Bangalore for scientific research

(ii) Amount paid to IIT Delhi for an approved scientific research programme

(iii) Amount paid to X Ltd., a company registered in India which has as its main

Object scientific research and development, as is approved by the prescribed

authority

(iv) Expenditure incurred on in-house research and development facility as

approved by the prescribed authority

a. Revenue expenditure on scientific research

b. Capital expenditure (including cost of acquisition of land `5,00,000) on

scientific research.

`

1,00,000

2,50,000

4,00,000

3,00,000

7,50,000

(5 Marks)

(b) During the P.Y.2010-11, XYZ Ltd, an Indian Company,

(i) Contributed a sum of `2 lakh to an electoral trust; and

(ii) Incurred expenditure of `25,000 on advertisement in a brochure of a political party.

Is the company eligible for deduction in respect of such contribution/expenditure? If so, what is

the quantum of deduction?

(5 Marks)

(c) Can the assessing officer refer valuation of assets to the departmental valuation officer for the

purpose of making an assessment in a case where no return of wealth has been filed by the

assessee.

(5 Marks)

(d) Can stamp vendors be treated as agents of the Government for marketing stamp papers? If yes,

can tax be deducted under section 194H in respect of discount given on sale of stamps by the

Treasury to the stamp vendor?

(5 Marks)

PRIME / ME33 / FINAL

1

2.

(a) X enters into a partnership with three other persons on July 1, 2010 to start a manufacturing

business. The following capital assets are contributed by X as his capital contribution:

Date of Acquisition

Fair market value on the date of transfer

by X to the firm (i.e., July 1, 2010)

Stamp duty value

Amount recorded in the books of the firm

Cost of Acquisition

Fair market value on April 1, 1981

17,00,000

Shares

Gold

June 10, 2008 Nov 2, 2009 (`)

(`)

6,00,000

3,00,000

17,60,000

16,00,000

1,500

52,220

5,90,000

2,10,000

-

Land

May 1, 1944 (`)

3,50,000

2,70,000

-

On July 31, 2011, he deposits `12,00,000 in a bank account for purpose of availing exemption U/S

54F ( he owns one residential house).

Construction of a residential house at Bombay is completed on June 21, 2013. `9,50,000, being

the amount of investment, is financed by withdrawing from the deposit account. Assuming that

income of X from other sources (except capital gain) for the previous years 2010-11 and 2013-14 is

`90,000 and `2,10,000, respectively. Determine the net income of X for the assessment year

2011-12 and 2014-15.

(10 Marks)

(b) Mr. Mohan is a resident both in India and Malaysia. He owns some immovable properties

(Rubber Plantations) in Malaysia. During the P.Y.2009-10, he earned income from rubber

estates in Malaysia. The Assessing Officer contented that the business income is assessable in

India and brought the same to tax. Discuss the correctness of the contention of the Assessing

Officer, taking into consideration the following(i)

Mohan has no permanent establishment in India in respect of the business of Rubber

plantations.

(ii)

Article 4 of the Double Taxation Avoidance Agreement between India and Malaysia

provides that where an individual is a resident of both the Contracting States, he shall

be deemed to be resident of the Contracting State in which he has a permanent home

available to him.

If he has a permanent home available to him in both Contracting States, he shall be

deemed to be resident of the Contracting State with which his personal and economic

relations are closer.

(6 Marks)

3. (a) Pursuant to a search conducted in the premises of Mr. Ram, certain seizures were made. Mr.

Ram filed an application for settlement in terms of section 245C claiming to have received the

amount by way of loan from several persons. The Settlement Commission accepted his

statement and made an order U/S 245D(4). The CBI, however, conducted enquiry at the

respect of the Revenue regarding the loans and opined that the alleged lenders had no means

or financial capacity to advance such huge loans to the assessee and were mere money

lenders. The Commissioner filed an application U/S 245D(6) praying for the order to be declared

void and for withdrawal of benefit granted. Mr. Ram, however, contented that the order of the

Settlement Commission was final in terms of section 245-I and any fresh analysis would amount

to sitting in judgement over an earlier decision, for which the Settlement Commission was not

empowered. Discuss the correctness of Mr. Ram’s contention.

(6 Marks)

PRIME / ME33 / FINAL

2

(b) X and Y (3:2) are partners of a firm based in Bombay. For the year ended March 31, 2011, the

Firm returns the following income:

(`)

Long-term capital gains in respect of preference shares

30,000

Profit from newly set up small scale industrial undertaking in a backward district 2,15,000

(production commenced during the P.Y 2001-02)

Profits and gains from the business of export of telecast rights

1,38,000

Profits and gains from export of machines of Sri Lanka

2,45,000

Winning from Lottery

50,000

Gift received by the firm from A on Dec 1, 2010

2,00,000

The firm makes the following expenditures (not deducted from the aforesaid income):

Donation to the Prime Minister’s National Relief Fund

10,000

Interest for money borrowed for payment of Income-Tax

7,000

Determine the net income of the firm for the A.Y. 2011-12.

(10 Marks)

4. (a) X (age: 35 years) gifts `10 lakh to Mrs. X (age: 31 years). She deposits the same in a bank

@ 8% per annum. Y is minor child of X and Mrs. X. Y has a bank deposit of 70,000 (rate of

interest @ 8.25%) which was gifted to him by his grandfather. Other income of X and Mrs. X are

as follows- X: `3,00,000 (Salary: `2,10,000, bank interest: `90,000), Mrs. X: `2,00,000 (interest

as company deposits). Out of interest income, Mrs. X deposits `1,000 in PPF. X’s contribution

to the recognized provident fund is `40,000. Find out the income chargeable to tax and tax

thereon for the A.Y 2011-12.

(3 Marks)

(b)

(i) X is a resident individual. He annually deposits a sum of `15,000 with LIC for the

maintenance of his handicapped grandfather who is wholly dependent upon him. The

disability is one which comes under section 2(i) of the Persons with Disabilities (Equal

Opportunities, Protection of Rights and Full Participation) Act, 1995. A copy of certificate from

medical authority is submitted. Determine the amount of deduction available under section

80DD for the A.Y 2011-12.

(2 Marks)

(ii) How is a poultry shed classified for depreciation purposes- plant or building ? (2 marks)

(iii) Discuss the tax liability of the employee whose employer failed to deduct and pay tax at

source

(2 marks)

(c) X & Co. ( a firm of X and Y with unlimited liability) is engaged in the business of whole-sale

trading (turnover of 2010-11 being Rs. 57,80,000). It wants to claim the following deductionSalary and interest to partners [as permitted by section 40(b)]

Salary to employees

Depreciation

Cost of material used

Other Expenses

Total

Net Profit (`57,80,000 minus `57,55,000)

`

60,000

4,90,000

2,70,000

45,90,000

3,45,000

57,55,000

25,000

Determine the net income of X & Co. For the A.Y 2011-12 assuming that long-term capital gain is

`40,000 and the firm is eligible for a deduction of `5,000 under section 80G.

(4 Marks)

PRIME / ME33 / FINAL

3

(d) Can penalty be levied where a return is filled belatedly under section 139(4)?

(3 Marks)

5. Attempt any Four

(a) Anirudh filed return of income for A.Y. 2010-11 claiming a refund of `37,500. The said refund

was granted and paid to the assessee on 1st March, 2011 after processing the return under

section 143(1). Later on, the case was taken up for regular assessment by issue of notice under

section 143(2) and the said assessment was completed on 7th Sep, 2011 resulting in demand of

`. 6,300. Is the assessee liable to pay interest on the amount of refund already granted to him

and if so, what is the amount of such interest?

(b) Rallis Ltd. filed its original return for the previous year 2008-09 on 28th Sep, 2009 declaring loss

of `16.25 lakhs. Thereafter, it filed a revised return on 28th Feb, 2011 declaring loss of `19.3

lakhs. The assessment of Rallis Ltd. was not completed at that point of time. The Assessment

Officer opined that the loss indicated in the original return alone can be carried forward for setoff in the subsequent years, since section 80 does not contemplate that a revised return can be

filed. Is the contention of the Assessing Officer correct? Discuss.

(c) The assessee, Mr. Ram, declared the cost of construction of cinema theatre at `10.53 lakh,

based on the registered valuer’s report. The Assessment Officer accepted the value of the

theatre as declared by the assessee and completed the assessment. However, the

Commissioner, on enquiry, found that the assessee had availed a loan of `17 lakh from a

leasing company declaring the value of the theatre at `27.40 lakh. Therefore, the

Commissioner, after giving the assessee an opportunity of being heard, set aside the order of

assessment and directed the Assessment Officer to make fresh assessment after verification

and enquiry. On appeal before the Tribunal, the assessee questioned the order of the

Commissioner by contending that the invocation of the provident under section 263 is not

sustainable in law, since there was no information relating to any proceedings under the

Income-tax Act available before the Assessment Officer which show that the assessment was

erroneous and prejudicial to the Revenue. Discuss the correctness of the assessee’s

contention.

(d) SFS Ltd. was engaged in the sale and export of sea food. It obtained a permit to fish in the

Exclusive Economic Zone of India. In order to exploit the said fishing rights, it entered into an

agreement chartering two fishing vessels, with a non-resident company. As per the terms of the

agreement, SFS Ltd. had to pay 85% of fish catch towards the hire charges to the said nonresident company. This receipt in the form of 85% of the fish catch by the non-resident

company was in India and all the formalities were completed in India. The assessing authority

held that the assessee had made the payment to the non-resident company within the meaning

of section 195 and was liable to deduct tax at source therefrom. Is the contention of the

assessing authority correct? Discuss.

(e) ABC Ltd. failed to deduct tax at source under section 194J in respect of fees for professional

services paid by it. The Assessing Officer levied penalty under section 271C for failure to

deduct tax at source. In addition, the Assessing Officer also levied penalty under section

272(2)(c) for failure to furnish return under section 206 and under section 272A(2)(g) for failure

to furnish certificate of tax deducted at source as per the requirement of section 203. Is the

action of the Assessing Officer correct in law?

(4x4=16 Marks)

PRIME / ME33 / FINAL

4

6.

(a) The Director of Income Tax received information that Mr. X has unaccounted cash exceeding

`50 lakh. Can the Director pass orders for seizure of the cash invoking his powers under

section 131(1A)? Does the Director have any other course open to him for the seizure of cash?

(7 Marks)

(b) X Ltd. had let out the house property owned by it to the employees of its sister concern, Y Ltd.

Under what head of income should the income from the house property of X Ltd., occupied by

the employees of its sister concern Y Ltd., be assessed? Can X Ltd. claim that such income is

not chargeable under the head “Income from house property”, on the ground that the property

has been occupied for the purpose of its business or profession?

(9 Marks)

7.

(a) R Ltd. has the following assets and liabilities as on 31-3-2004. Compute the net wealth and

wealth-tax payable for the A.Y 2004-05.

Assets

Book Value

Market Value

as on 31-3-2004 as on 31-3-2004

`

`

Commercial premises used by the company for office and

2,50,000

40,00,000

godown

Commercial premises in an office complex let out on rent

1,50,000

35,00,000

Residential Bungalow allotted to a director drawing annual

1,00,000

20,00,000

emoluments of `6 lakhs

Jewellery held as investment and not for business purpose

1,50,000

15,00,000

Station wagon used for the purpose of business

2,50,000

4,00,000

Indian car used for hiring business to tourist and others

1,50,000

2,00,000

3,00,000

12,00,000

Imported car allotted to director for personal and office use

Investments in shares

2,00,000

7,00,000

5,00,000

7,00,000

Plant and Machinery

Furniture and Fixture

1,00,000

1,50,000

Stock-in-trade

1,00,000

1,00,000

Debtors and other receivables

4,00,000

4,00,000

Cash in hand (as per books)

75,000

75,000

27,25,000

Liabilities

Preference Capital

3,00,000

Equity share capital issued for cash

5,00,000

Bonus share issued in 1991

2,50,000

General reserve

2,00,000

Profit and Loss a/c balance

2,75,000

Bank loan against plant and machinery

2,00,000

Creditors and other payables

10,00,000

27,25,000

(5 Marks)

PRIME / ME33 / FINAL

5

(b) What is the procedure under wealth tax Act, for the assessment of persons residing

outside?What are the provisions for the recovery of tax from him?

(5 Marks)

(c) R made an agreement to sell his property for `20 lakhs on 8-10-2003. He received

`2,00,000 as earnest money; the balance amount is received on 27-03-2004 but the

conveyance deed is executed on 10-4-2004. The documents are registered on 6-6-2004. The

property was shown and assessed for Wealth-tax purposes at `17,00,000 for the A.Y 2003-04.

Advice R regarding the above transaction for submission of his return on net wealth for the A.Y

2004-05.

(3 Marks)

(d) X inherited a house plot situated in the Mumbai Corporation limits, from his deceased father

who had an outstanding income-tax liability of `12 lakhs. The property was sold in April 2004

and the above outstanding liability was collected from the sale consideration by the

department. Is the said liability of the deceased father a deductible debt while considering the

net wealth as on 31-3-2004?

(3 Marks)

PRIME / ME33 / FINAL

6

PRIME ACADEMY

33RD SESSION MODEL EXAM - FINAL – DIRECT TAX LAWS

SUGGESTED ANSWERS

1.

(a) Computation of deduction under section 35 for the A.Y 2011-12

Particulars

Payment for scientific

Research

Indian Institute of Science

IIT, Delhi

X Ltd.

Expenditure incurred on

in-house research and

development facility

Revenue expenditure

Capital expenditure

(excluding cost of

acquisition of land

`5,00,000)

`

Section

1,00,000

2,50,000

4,00,000

35(1)(ii)

35(2AA)

35(1)(iia)

175%

175%

125%

1,75,000

4,37,500

5,00,000

3,00,000

2,50,000

35(2AB)

35(2AB)

200%

200%

6,00,000

5,00,000

Amount

% of

of

weighted

deductions deduction

(`)

------------22,12,500

Deduction allowable under Section 35

(b) An Indian Company is eligible for deduction under section 80GGB in respect of any sum contributed

by it in the previous year to any political party or an electoral trust. Further, the word contribute in

section 80GGB has the meaning assigned to it in the section 293A of the Companies Act, 1956,

and accordingly, it includes the amount of expenditure incurred on advertisement in a brochure of

a political party.

Therefore, ABC Ltd. is eligible for a deduction of `2,25,000 under section 80GGB in respect of

sum of `2,00,000 contributed to an electoral trust and `25,000 incurred by it on advertisement in

a brochure of a political party.

It may be noted that there is a specific disallowance under section 37(2B) in respect of

expenditure incurred on advertisement in a brochure of a political party. Therefore, the

expenditure of `25,000 would be disallowed while computing business income/ gross total

income. However, the said expenditure incurred by an Indian Company is allowable as a

deduction from gross total income under section 80GGB.

(c) The question was answered in the Punjab & Haryana High court in CWT v. Anil Tayal (HUF)

(2006).The high court observed that the object of section 16A of the Wealth Tax Act ,1957 is to

enable the assessing officer to refer the issue relating to the value of any asset to a Valuation

Officer for the purpose of making assessment. The expression ‘in any other case” in clause (b) of

PRIME / ME33 / FINAL

7

Section 16A (1)is wide enough to include a case where no return has been filed by the assessee .If

a narrow view is taken that the reference under Section 16A(1) can be made only when return has

been filed, then the expression “in any other case” in clause (b) of section 16A(1) and the

expression “where no such return has been made” in subsection (4) of Section 16A would become

redundant. Therefore, a reference under section 16A(1) could be made even when no return has

been filed by the assessee under section 14 or section 15.

(d) In Kerala Stamp Vendors Association Vs Office of the Accountant General (2006) 282 ITR 0007,

the High Court held that stamp vendors cannot be treated as agents of Government for marketing

stamp papers. The discount given on sale of stamp by the Treasury to the stamp vendor is outside

the scope of TDS provisions under section 194H.

The High Court observed that only commission and brokerage are subject to tax deduction under

section 194H. Commission or brokerage is paid for services rendered in the course of sale. This

implies services rendered by third parties like brokers or agents. It cannot mean services rendered

by a buyer because a buyer is not rendering any service expect for buying. A price discount given to

the seller by the buyer cannot be treated as commission or brokerage for services rendered in the

course of buying and selling of goods. This is because the act of buying does not constitute

rendering any service. Therefore, stamp vendors cannot be treated as agents of the Government for

marketing stamp papers and consequently, TDS provisions under section 194H are not attracted.

2.(a) Assessment Year 2011-12 (Previous Year 2010-11)

Capital Gains

Value of consideration received as a result of transfer of assets

to firm (i.e. amount recorded in books of accounts)

Less: Cost of Acquisition

Indexed cost of Acquisition [`52,220 * 711/100]

Balance

Less: Exception under section 54F (`12,00,000 / `16,00,000 *

`12,28,716)

Land

(`)

16,00,000

Gold

(`)

5,90,000

Shares

(`)

3,50,000

3,71,284

12,28,716

9,21,537

2,10,000

3,80,000

-

2,70,000

80,000

-

3,07,179

3,80,000

80,000

Capital gains

7,67,179

Other income

90,000

Net Income (rounded off)

8,57,180

Since X has not fully utilised the deposit account for purchase/ construction of residential house, the

amount left utilised by June 30, 2013 will be considered for calculating deemed capital gains.

Amount utilised out of deposit account (a)

Sale proceeds of land (b)

Capital gains (c)

Amount of exemption [(a)/(b)*(c)]

Amount of exemption availed during the A.Y 2011-12

Excess of exception taxable as deemed long term capital gains

Other income

Net Income (rounded off)

PRIME / ME33 / FINAL

8

`

9,50,000

16,00,000

12,28,716

7,29,550

9,21,537

1,91,987

2,10,000

4,10,990

(b) The issue arising in this case is similar to the issue which has been settled by the Apex Court in CIT

v. P.V.A.L. Kulandagan Chettiar (2004) 137 Taxmen 460. In this case, the Apex Court observed the

following:

(i) Section 90(2) of the Income Tax Act, 1961 makes it clear that in any case of conflict between

the provisions of Double Taxation Avoidance Agreement (DTAA) and the Income Tax Act,

1961, the provisions of Double Taxation Avoidance Agreement (DTAA) would prevail over the

provision of the Act.

(ii) The tax liability arising in respect of a person residing in both the Contracting States has to be

determined with reference to that State with which his personal and economic relations are

closer. The person shall be deemed to be a resident of that Contracting State in which he has a

habitual abode.

(iii) The immovable property in question (Rubber Plantations) is situated in Malaysia and income

was derived from that property. Further, there was no PE in India in regard to the business of

rubber plantations. Therefore, the business income from rubber plantation could not be taxed

in India because of closer economic relations between the assessee and Malaysia, being the

place where

(1) the property is located

(2) the PE has been set up.

These two factors go to determine the fiscal domicile.

(iv) If an assessee is deemed to be a resident of a contracting State where his personal and

economic relations are closer, then in such a case, the fact that he is a resident in India to be

taxed in terms of section 4 and 5 would become irrelevant, since the DTAA prevails over

section 4 and 5.

Therefore, in this case, the contention of the Assessing Officer is not correct.

3.(a) The Apex Court, in CIT v. Om Prakash Mittal (2005) 143 Taxman 373/273 ITR 0326, observed

that a bare reading of section 245D(6) shows that every order passed under sub-section (4) has

to provide for the following:

• The terms of settlement and

• That the settlement would become void if it is subsequently found by the Settlement

Commission that it has been obtained by fraud or misrepresentation.

The decision whether the order has been obtained by fraud or misrepresentation is that of the

Settlement Commission. However, there is no requirement that the Settlement Commission

must suo motu initiate the action. The Revenue can move the Settlement Commission for

decision on an issue if it has material to show that the order was obtained by fraud or

misrepresentation of facts.

The Supreme Court observed that the foundation for settlement is an application which an

assessee can file at any stage of a case relating to him in such form and manner as may be

prescribed. The fundamental requirement of the application under section 245C is that there

must be full and true disclosure of the income along with the manner in which it has been

derived. If an order is obtained by fraud or misrepresentation of facts, it cannot be said there is

a full and true disclosure. That is why the Legislature has prescribed the condition relating to

declaration of order void when it is obtained by fraud or misrepresentation of facts.

PRIME / ME33 / FINAL

9

The Supreme Court held that merely because section 245-I provides that the order of settlement

is conclusive, it does not take away the power of the Settlement Commission to decide whether

the settlement order has been obtained by fraud or misrepresentation of facts. If the

Commissioner is able to establish that the earlier decision was void because of

misrepresentation of facts, then it is open for the Settlement Commission to decide the issue. It

cannot be called by any stretch of imagination to be a review of the earlier judgement or the

subsequent Bench sitting in appeal over the earlier Bench’s decision.

Mr. Ram’s contention is therefore not correct.

`

(b) Computation of Net Income of the firm:

Capital gains

Profit from newly set up industrial undertaking

Profits from the business of export of telecast rights

Profits from export of machines of Sri Lanka

Income from other sources:

Winning from Lottery

Gift (gift is taxable only in the hands of an individual / HUF subject to certain conditions)

Gross Total Income

Less: Deductions u/s 80C to 80U

U/S 80G in respect of donation to the Prime Minister’s National Relief Fund (100% of

`10,000)

U/S 80-IB in respect of profits from newly set up industrial undertaking (25% of Rs.

2,15,000)

Net Income

30,000

2,15,000

1,38,000

2,45,000

50,000

6,78,000

10,000

53,750

6,14,250

4.(a)

X

`

2,10,000 -

Salary

Income from other sources

- Bank interest of Mrs. X

- Bank interest of Y (8.25% of

`70,000 – `1,500)

- Bank interest of X

Interest of company deposit

Gross total income

Less : Deduction u/s 80C

Net Income (rounded off)

Income – Tax

Add: Surcharge (not applicable)

Tax

Add; Educational Cess

Add: Secondary and higher education cess

Tax Liability

PRIME / ME33 / FINAL

10

Mrs. X

`

Y

-

80,000

4,275

-

-

90,000

3,84,275

40,000

3,44,280

18,428

18,428

369

185

18,980

2,00,000

2,00,000

1,000

1,99,000

900

900

18

9

930

-

(b) (i) As grandfather does not come within the definition of “dependent” in section 80DD, nothing

shall be deducted under section 80DD.

(ii) A poultry shed is not a plant enabling the assessee to claim a higher rate of depreciation as

applicable to a plant but is entitled to depreciation as applicable to buildings only held the

Andhra Pradesh high court in CIT v.Padmavathi Hatcheries (P) Ltd.& Ors.

(iii) The Full Bench of the Uttarkhand High Court has in DIT &Anr.v. Maersk Co., Ltd., has

taken the view that where an employer has failed to deduct and pay tax at source on salaries

paid to the employee,the employee was liable to pay the tax thereon directly under section

191 but was not liable to pay interest under section 234B.

(c)

Income from the wholesale business (8% of `57,55,000)

Less: Expenses

Salary and interest to partners [as permitted by section 40(b)]

Other expenses [except Salary and interest to partners in the case of firm, no other

expenditure is deductible]

Income from business

Capital gains

Gross total Income

Less: Deductions u/s 80C to 80U

Total

`

4,62,400

60,000

Nil

4,02,400

40,000

4,42,400

5,000

4,37,400

(d) Penalty of `5000 is attracted u/s 271F for failure to furnish return of income as required u/s

139(1) before the end of the relevant A.Y. The time allowed for filling a belated return is upto

one year from the end of the relevant A.Y. or before the completion of the assessment,

whichever is earlier. If the belated return u/s 139(4) is filed before the end of the relevant A.Y,

penalty u/s 271F is not attracted. However, if the same is filed after the end of the relevant A.Y,

penalty u/s 271F is attracted.

5.(a) As per section 234D, where any refund is granted to the assessee after processing the return

u/s 143(1) and later on, in the regular assessment there is no refund due or the amount

refunded exceeds the amount refundable, the assessee shall be liable to pay simple interest at

½% for every month or part of a month from the date of grant of refund to the date of such

regular assessment on the whole or the excess amount so refundable.

The assessee was granted refund on 1.3.2011 after processing the return u/s 143(1). The

regular assessment u/s 143(3) was completed on 7.9.2011 and resulted in tax payable of

`6,300. Therefore, no refund was due on regular assessment. Accordingly, the assessee is

liable to pay interest u/s 234D on `37,500 at ½ % for 7 months.

Interest payable by the assessee u/s 234D works out to `1,313 (i.e `37,500 * ½ % * 7 months).

(b) Rallis Ltd. has filed its original return u/s 139(3) before the time allowed u/s 139(1) i.e. before

30th Sep, 2009. It has also filed the revised return within the time allowed u/s 139(5) i.e. before

the expiry of one year from the end of relevant A.Y or before completion of assessment,

whichever is earlier. In this case, the assessment was yet to be completed and one year from

the end of relevant A.Y expires on 31.3.2011. Since Rallis Ltd. has filed its revised return on

28.2.2011, it was within the time allowed u/s 139(5).

PRIME / ME33 / FINAL

11

A perusal of section 139(3) makes it clear that a return of loss filed u/s 139(3) may be filed

within the time allowed u/s 139(1). One such a return is filed; all the provisions of the Act shall

apply as if such return has been filed u/s 139(1). In other words, a return filed u/s 139(3) is

deemed to be a return filed u/s 139(1). The provision contained in section 139(3) makes it clear

that all the provisions of the act shall apply to such a return as if it were a return u/s 139(1). In

view of such specific provision, there is no further necessity in section 80 to refer to such

provision. Hence, there is no reason to exclude the applicability of section 139(5) to a return

filed u/s 139(3). Therefore, a loss return filed u/s 139(3) can be revised by filing a revised return

u/s 139(5) within the time allowed. Such loss, as per the revised return can be carried forward,

even though section 80 does not specifically provide for carry- forward of loss which has been

determined in pursuance of return filed u/s 139(5).

This principle has been supported by the Madras High Court in CIT v. Periyar District Co-op.

Milk Products Union Ltd. (2004) 137 Taxman 364 (Mad.).

The contention of the Assessing Officer is therefore, incorrect.

(c) This issue was resolved by the Madras High Court in CIT v. Dr.K.Ramachandran (2004) 139

Taxman 320. The High Court observed that the Explanation to section 263 provides that the

term record shall include and shall be deemed always to have included all records relating to

any proceeding under the Act available at the time of examination by the Commissioner. In Cit

v. Shree Manjunathesware Packing Products & Camphor Works (1998) 231 ITR 53(SC), the

Apex Court made it clear that section 263 enables the Commissioner to call for and examine the

records of any proceedings under the Act and pass such orders thereon as the circumstances

of the case justify, including an order enhancing or modifying the assessment or cancelling the

assessment and directing a fresh assessment, if he considers that the order passed by the

Assessing Officer is erroneous and prejudicial to the interest of the Revenue. For this purpose,

record would include not only record which was available to the Assessing Officer at the time of

passing the assessment order, but would include the records available with the Commissioner

at the time of passing the order by the Commissioner.

The High Court also relied on its earlier decision in the case of CIT v. M.N.Sulaiman(1999) 238

ITR 139, wherein it followed the above decision of the Supreme Court. The High Court further

held that the explanation added to section 263(1) in the year 1998 has to be regarded as

declaratory.

Therefore, since the term record shall include all records available at the time of passing of

order under section 263 by the Commissioner and is not restricted to information available to

the Assessing Officer at the time of passing the assessment order, the assessee’s contention is

not correct.

(d) The Andhra Pradesh High Court settled this issue in Kanchanganga Sea Foods Ltd. v. CIT

(2004) 136 Taxman 8, where it was held that 85% of fish catch which was adjusted in discharge

of liability of the assessee towards hire charges, would be receipts in the hands of non-resident

company under section 5(2). Further, this receipt in the form of 85% of the fish catch by the nonresident company was in India since all the formalities were completed in India. It was further

held that payment contemplated under section 195 not only includes cash payment or payment

by cheque or draft, but also a payment given by any other mode. Therefore, the payment of hire

charges made by the assessee by giving 85% of fish catch to the non-resident company

amounted to payment as contemplated under section 195.

Therefore, the contention of assessing authority is correct.

(e) This issue came up before the High Court of Allahabad in CIT-II, Lucknow vs. Sahara Airlines

Ltd. The high Court held that the provisions of sections 203 and 206 would be applicable only if

PRIME / ME33 / FINAL

12

tax has been deducted at source by the person concerned and he commits default in complying

with any of the provisions of section 203 or 206. However, in a case where no tax has been

deducted at source, the aforesaid provisions would not be attracted. For failure of the assessee

in deducting tax at source, penalty can be imposed upon him under section 271C. Once a

person concerned has been subjected to a penalty under section 271C for not deducting tax at

source, there would not arise any occasion for levying penalty u/s 272A(2)(c) and 272(2)(g) for

non-compliance of the provisions of section 206 and 203. In other words, in case the tax has not

been deducted at source, the question of issuing the certificate of tax deducted u/s 203 and that

of filing of return u/s 206 would not arise at all. Therefore, the question of imposing penalty for

violation of the provisions of section 203 and 206 would not arise.

Therefore, the action of the Assessing Officer imposing penalty u/s 272A(2)(c) and 272(2)(g) in

a case where tax has not been deducted at source is not correct in law.

6.(a) The powers u/s 131(1A) deal with power of discovery and production of evidence. They do not

confer the power of seizure of cash or any other asset. The Director, for purposes of making an

enquiry or investigation relating to any income concealed or likely to be concealed by any

person or class of persons within his jurisdiction shall be competent to exercise powers

conferred u/s 131(1), which confine to discovery and inspection, enforcing attendance,

compelling the production of books of accounts and other documents and issuing commissions.

Thus, the power of seizure of unaccounted cash is not one of the power conferred on the

Director u/s 131(A).

However, u/s 132(1), the Director has the power to authorise any Assistant Director, Deputy

Director, Assistant Commissioner or Deputy Commissioner or Income-tax Officer to seize

money found as a result of search [Clause iii of section 132(i)], if he has reason to believe that

any person is in possession of any money which represents wholly or partly income which has

not been disclosed [Clause (c) of section 132(1)]. Therefore, the proper course open to the

Director is to exercise his power u/s 132(1) and authorize the Officers concerned to enter the

premises in which the cash is kept and seize the unaccounted cash.

(b) These questions have been answered by the Madras High Court in CIT v. TVS (2005) 145

Taxman 380/ (2004) 271 ITR 0079. The High Court observed that in order to claim exemption in

respect of income from house property u/s 22, the assessee must satisfy two conditions namely:

1) The property or portion thereof must be occupied by the assessee for the purposes of

business or profession; and

2) The profits of such business should be chargeable to income-tax.

The issue under consideration is that in order to avail the exemption u/s 22, is it necessary that

the property must be –

(i) In direct occupation of the assessee-company and

(ii) Used as such for transaction of the assessee’s business or profession.