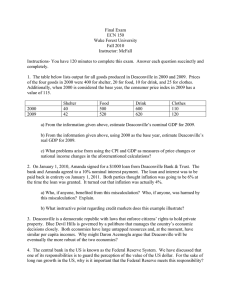

Specifications on the implementation of the Stability and

advertisement