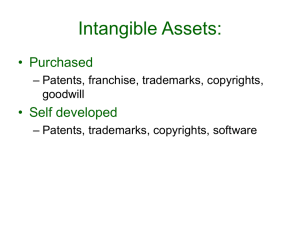

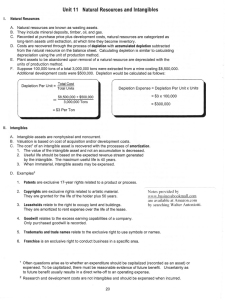

Intangible Assets

advertisement