eCheck.Net User Guide

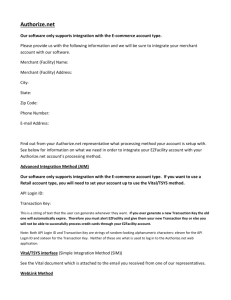

advertisement