guide to selling and buying a residential property

advertisement

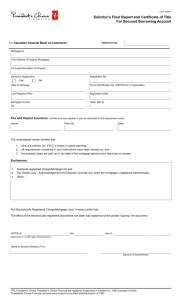

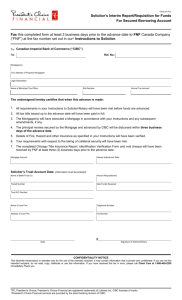

GUIDE TO SELLING AND BUYING A RESIDENTIAL PROPERTY SELLING A RESIDENTIAL PROPERTY Signing your contract Once you have received and accepted an offer on your property you will need to instruct a solicitor to act on your behalf. Once the contract has been approved by your buyer’s solicitor you will be contacted by your solicitor to sign it in readiness for exchange. Once you have a solicitor in place you will need to advise the estate agents of their details so the memorandum of sale can be produced. Once the memorandum of sale has been issued to all parties your solicitor will prepare the contract pack as follows: Legal Work prior to contracting to sell Your solicitor will require that you complete copies of the ‘Property Information Form’ and the ‘Fixtures, Fittings and Contents Form’. These are standard forms which seller’s are required to complete. If your property is leasehold you will also need to complete a ‘Seller’s Leasehold Information Form’. Once your solicitor has obtained the title deeds and you have returned the standard forms these are sent to your buyer’s solicitor for approval together with a supporting package which will include documents dealing with title, planning and any guarantees that are applicable. If the property that you are selling is leasehold your solicitor will receive a standard managing agents questionnaire from the buyer’s solicitors which is sent on to relevant landlord/managing agents/residents association. Once your buyer’s solicitor has examined this paperwork they may need to seek clarification on certain points. They are entitled to raise enquiries with your solicitor who may need to liaise with you to provide the information requested. The buyer is entitled to rely upon any information that is supplied on your behalf so it is important that information supplied to your solicitor is accurate and that you make a full disclosure of any relevant facts about your property. Your mortgage Your lender will supply an up to date statement to your solicitor detailing the amount which is required to repay your mortgage. You should provide your solicitor with details of all loans secured against your property as these will need to be repaid upon completion of your sale. Exchange of contracts Before an exchange can take place all the parties involved need to agree on a completion date. From the point at which contracts are exchanged you are legally bound to sell and your buyer is legally bound to buy. Should either party back out the other will be entitled to claim compensation for losses arising. Between exchange and completion Your solicitor will send you a statement detailing their charges, loans to be repaid and all other outgoings. Any balance due to your solicitor will need to be cleared in their account prior to the completion date. You will be required to sign a transfer of deed in readiness for completion. On completion Your solicitor will pay off any mortgages and other expenses, give an undertaking to your buyer’s solicitor to send your lender’s formal release of mortgage and send the title deeds and signed transfer to your buyer’s solicitor. Once your solicitor has confirmed that all the remaining monies have arrived your sale has completed. You should arrange to drop off the keys with the agent for the buyer to collect. BUYING A RESIDENTIAL PROPERTY Once the seller has accepted your offer • Your instructed conveyancer will contact the seller’s solicitor to obtain the draft contract. • Your conveyancer will negotiate the draft contract, taking into account your requirements. • The copy of the draft contract; fixtures, fittings and contents form; a property information form and - if applicable copies of previous title deeds will be checked and approved. • Your conveyancer will check the legal title and contract and papers and raise any enquiries they feel are necessary. A draft transfer deed and requisitions on title will be sent to the seller’s solicitors for their approval at this time. • Your conveyancer will negotiate and agree the contract with the seller’s solicitors and request any amendments they feel are necessary. Enquiries to seller’s solicitors can include, boundary issues, planning constraints and permissions, rights of way, restrictive covenants affecting the property, guarantees or insurance policies, services connected to the property and details of the list of fixtures and fittings included in the sale. If the property is leasehold landlords and management company enquiries will be raised at this time. Your conveyancer will also request searches which may include: • Local Authority Searches Once your conveyancer has received satisfactory replies to enquiries, has received clear search results and has satisfied all mortgage conditions the final report will be prepared. The final report will cover all aspects of your property purchase and will include copies of enquiries raised and responses received. The report will also contain all documents you are required to sign and will also have a completion statement enclosed showing the balance required from you in order to complete the purchase. Once you have signed and returned all the documents and have transferred the required balance monies to the conveyancer’s nominated bank we will be ready to exchange contracts and set a completion date with the seller’s solicitors. • Exchange of contracts is when your purchase becomes legally binding and the agreed completion date is ‘set is stone’. • Deposit is also paid to the seller’s solicitors at this point. • Once exchange of contracts has taken place your conveyancer will then request your mortgage advance from your lender. • Your conveyancer will carry out final searches and enquiries including Land Registry checks and land charges checks. YOU ARE READY TO COMPLETE • You will get the keys to your new home. • Drainage searches • Your conveyancer will tie up any final administration issues with the Land Registry. • Coal/Mining searches You can now move in! • Environmental searches • Commons search If your property is a new build there may be other checks we need to undertake. Your conveyancer will negotiate and agree the contract with the seller’s solicitors. A formal mortgage offer should now be in place and the conveyancer will check that all mortgage conditions have been satisfied. www.gordonsllp.com GOR.046 TRUSTED AS PEOPLE VALUED AS LAWYERS