HMC Fact Sheet Insert 101012 - Investor Relations Solutions

advertisement

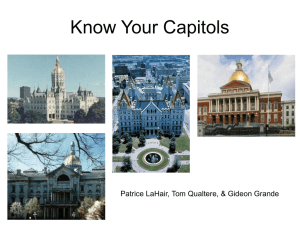

Rich History 121 years of building and operating mines U.S.-Based Operations two silver mines and four district-sized land packages (U.S./Mexico) Low Cash Costs strong silver margin with cash flow generation Strong Balance Sheet $233 million in cash and no debt (June 30, 2012) quarterly common stock dividend stock repurchase program Growth advancing organic growth projects and evaluating M&A opportunities INVES TOR FACT SHEET September 2012 Underground at Lucky Friday (top left). Miners on break at Greens Creek (middle). Exploration in North Idaho (above). Lucky Friday head frame (bottom left). Financial Highlights (dollars in thousands for the year ended Dec. 31) 2007 2008 2009 $ 157,640 $ 204,665 $ 312,548 53,197 (66,563) 67,826 64,995 11,046 119,165 373,123 36,470 104,678 Sales of products Net income (loss) Cash provided by operating activities Cash and cash equivalents at end of reporting period 2010 $ 418,813 48,983 197,809 283,606 2011 $ 477,634 151,164 69,891 266,463 H1/2012 $ 158,172 15,096 31,240 233,327 Cash Flow from Operating Activities Share Performance (millions) Actual Pro-forma $60.9 Q1 2011 $66.3 Q2 2011 $60.7 NYSE: HL as of September 28, 2012 $50.0(1) Q3 2011 $31.2 Q4 2011 Share Price: $ 6.55 52-Week Range: $ 3.70 - $ 7.00 Basic Shares: 285.3 million* Fully Diluted: 310 million* Market Capitalization: $ 1.8 billion H1/2012 $(118.0) *as of June 30, 2012 (1) Operating cash flow for 2011 was $69.9 million after environmental litigation settlement payment of $168 million in the fourth quarter. Low Cash Costs Cash Margin $27.05 $30 $20 Cash Cost Per Ounce $22.70 $25 $13.78 $14.40 $15.63 $16.59 $10.20 $13.72 $4.20 $1.91 2008 2009 Realized Silver Price $34.35 $34.15 $15 $26.02 $24.16 $10 $5 $0 ($5) ($2.81) 2007 Reconciliation of Cash Costs per Ounce to Generally Accepted Accounting Principles (GAAP) (dollars and ounces in thousands, except per ounce – unaudited) 2007 2008 Total cash costs(1) $ (15,873) $ 36,621 Divided by silver ounces produced 5,643 8,709 Total cash cost per ounce produced $ (2.81) $ 4.20 Reconciliation to GAAP: Total cash costs Depreciation, depletion and amortization Treatment costs By-product credits Change in product inventory Suspension-related costs (2) Reclamation and other costs Costs of sales and other direct production costs and depreciation, depletion and amortization (GAAP) $36.59 $35.30 $35 $/oz Total cash cost per ounce of silver represents a non-U.S. Generally Accepted Accounting Principles (GAAP) measurement. A reconciliation of total cash costs to cost of sales and other direct production costs and depreciation, depletion and amortization (GAAP) can be found below. Realized prices are calculated by dividing gross revenues for each metal by the payable quantities of each metal included in the concentrate and doré sold during the period. $40 $ $ 2009 20,958 10,989 1.91 ($1.46) 2010 $ $ 2010 (15,435) 10,566 (1.46) $ $ $1.15 $2.24 $1.03 2011 Q1/12 Q2/12 2011 10,934 9,483 1.15 $ $ Q1/12 2,976 1,329 2.24 $ $ Q2/12 1,410 1,365 1.03 $ (15,873) 12,323 (27,617) 112,079 (1,261) – 203 $ 36,621 35,207 (70,776) 164,963 20,254 – 537 $ 20,958 62,837 (80,830) 206,608 310 – 1,596 $ (15,435) 60,011 (92,144) 267,272 3,660 – 630 $ 10,934 47,066 (99,019) 254,372 (4,805) 4,135 (44) $ 2,976 9,661 (17,695) 46,353 1,805 – (149) $ 1,410 9,879 (16,164) 45,352 2,101 – 473 $ 79,854 $ 186,806 $ 211,479 $ 223,994 $ 212,639 $ 42,951 $ 43,051 (1) Cash cost per ounce of silver represents a non-U.S. Generally Accepted Accounting Principles (GAAP) measurement that the Company believes provide management and investors an indication of net cash flow. Management also uses this measurement for the comparative monitoring of performance of mining operations period-to-period from a cash flow perspective. “Total cash cost per ounce” is a measure developed by gold companies in an effort to provide a comparable standard; however, there can be no assurance that our reporting of this non-GAAP measure is similar to that reported by other mining companies. Cost of sales and other direct production costs and depreciation, depletion and amortization, was the most comparable financial measures calculated in accordance with GAAP to total cash costs. (2) Various accidents and other events resulted in temporary suspensions of production at the Lucky Friday mine during 2011. Care-and-maintenance, mine rehabilitation, investigation, and other costs incurred during the suspension periods not related to production have been excluded from total cash costs and the calculation of total cash cost per ounce produced. Operating Properties Greens Creek Admiralty Island, Alaska Silver Reserves – 98 million ounces The 100%-owned Greens Creek underground mine is located in southeast Alaska and produces silver, gold, lead and zinc concentrates. In 2008, Hecla acquired Rio Tinto’s remaining 70% interest in the operation, nearly doubling its overall silver reserves and production. In the second quarter of 2012, Greens Creek produced 1.4 million ounces of silver at a cash cost per ounce of $1.03, net of by-products. Greens Creek is one of the world’s largest high-grade, low-cost silver mines, with more than 200 million ounces produced in the last 20 plus years, during which time it has maintained an 8- to 10-year mine life. Lucky Friday Mullan, Idaho Silver Reserves – 49 million ounces The Lucky Friday silver mine is located in one of the world’s most prolific silver-producing districts: North Idaho’s Silver Valley. It is the deepest operating mine in the United States and has been in commercial production since 1942. Over the past 70 years, more than 150 million ounces of silver have been mined. In 2011, Lucky Friday produced 3.0 million ounces of silver with an average ore grade of 10.69 ounces of silver per ton. During the second quarter of 2012, rehabilitation work on the Silver Shaft was completed past the 4900 level, an important milestone for development work to resume. The resumption of development work, including construction of a bypass drift on the 5900 level, is part of a plan that has been submitted to MSHA. This development plan will prepare the mine for resumption of operations, which is targeted for the first quarter of 2013. Exploration For more than 10 years, Hecla’s strategy has been to build a solid asset base through acquisition and consolidation of district-sized land packages in four world-class mining areas. Exploration in proximity to our operating mines continues to add new resources and convert those to reserves. Significant progress has been made to define new resources at the Star mine in the Silver Valley and at the San Juan Silver property in Creede, CO. A recent, high-grade discovery on the Andrea vein at our San Sebastian property in Mexico will provide a complimentary resource to the Hugh Zone and could re-establish production in Mexico. Four Key Growth Initiatives Lucky Friday #4 Shaft (Mullan, Idaho) Once the Lucky Friday rehabilitation work is complete, construction of the #4 Shaft is expected to resume and will take approximately three years. The #4 Shaft is expected to increase silver production by 60% from approximately 3 million to 5 million ounces per year, mainly due to an expected increase in grade from 10.4 to 14.1 ounces of silver per ton. San Sebastian (Durango, Mexico) Options for accessing the existing resources at the Hugh Zone and a new mine plan have been completed. A preliminary economic analysis is expected to be completed in Q3 2012. A work plan and drill program to define the hydrology of the Andrea area have been completed and preliminary mine designs have begun to compliment potential production from the Hugh Zone. Star (Silver Valley, ID) Underground drilling was initiated in Q4 2011. With completion of the scoping study to evaluate the mineability of the “Upper Country” (above the water table at the 2500 level), a preliminary economic analysis is expected to be completed in Q3 2012. In addition, a dewatering study which is evaluating re-opening the mine below the current water level is also expected to be completed in Q3 2012. Rehabilitation work on the #5 Shaft continues which will provide for secondary surface access. San Juan Silver (Creede, CO) Equity ramp rehabilitation was completed and underground drilling initiated in Q4 2011. Drilling to date has encountered high-grade intercepts. New Bulldog decline portal construction began in Q4 2011. The design of the decline is being finalized with decline development expected to occur in September 2012. A study is under way to evaluate re-opening the Bulldog mine and completion is expected in Q4 2012. Company Profile Hecla Mining Company is the largest and lowest-cost silver producer in the United States with over a century of operating experience. Hecla was established in 1891 in North Idaho’s Silver Valley and trades on the New York Stock Exchange under the symbol “HL.” Hecla operates the Greens Creek and Lucky Friday mines in Alaska and Idaho, and owns district-sized land packages in the Silver Valley in Idaho, San Juan Silver in Creede, Colorado, and San Sebastian in Durango, Mexico. During 2012, the Lucky Friday will be conducting rehabilitation work with operations and production expected to resume as planned in early 2013. Hecla has developed a solid base with long-life, low-cost mines; organic growth opportunities; exploration upside; an excellent cash position with no debt; and recently introduced a new common stock dividend. Largest Institutional Owners (appx. 51% ownership, reported as of 09/28/12) Van Eck Associates Corporation BlackRock Institutional Trust Company, N.A. Vanguard Group, Inc. State Street Global Advisors (US) Neuflize OBC Investissements Royce & Associates, LLC New Jersey Division of Investment Jennison Associates LLC C.S. McKee, L.P. Global X Management Company LLC Analyst Coverage Michael Jalonen, BofA Merrill Lynch Andrew Kaip, BMO Capital Markets Steven Butler, Canaccord Genuity Jorge Beristan, Deutsche Bank John Bridges, JP Morgan Michael Curran, RBC Capital Markets Chris Lichtenheldt, UBS Securities Greens Creek Admiralty Island, Alaska operating property Corporate Office Vancouver, BC Corporate Office Coeur d’Alene, Idaho Silver Valley Wallace, Idaho pre-development project Lucky Friday Mullan, Idaho operating property San Juan Silver Creede, Colorado pre-development project San Sebastian Durango, Mexico pre-development project Directors Contacts Ted Crumley, Chairman Phillips S. Baker, Jr. John H. Bowles George R. Nethercutt, Jr. Terry V. Rogers Charles B. Stanley Dr. Anthony P. Taylor U.S. Corporate Office 6500 N. Mineral Drive, Suite 200 Coeur d’Alene, Idaho 83815-9408 208.769.4100 Canadian Corporate Office Suite 970, 800 West Pender Street Vancouver, BC, Canada V6C 2V6 604.682.6201 Officers Phillips S. Baker, Jr., President & CEO James A. Sabala, Sr. VP – Chief Financial Officer Larry Radford, VP – Operations Dean W. McDonald, VP – Exploration Don Poirier, VP – Corporate Development David C. Sienko, VP – General Counsel Investor Inquiries 800.432.5291 hmc-info@hecla-mining.com www.hecla-mining.com Transfer Agent American Stock Transfer & Trust Co. 69 Maiden Lane, Plaza Level New York, NY 10038 800.937.5449 Auditors BDO USA, LLP Cautionary Statements Statements made which are not historical facts, such as anticipated payments, litigation outcome, production, sales of assets, exploration results and plans, prospects and opportunities including reserves, resources, and mineralization, costs, and prices or sales performance are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “may”, “will”, “should”, “expects”, “intends”, “projects”, “believes”, “estimates”, “targets”, “anticipates” and similar expressions are used to identify these forward-looking statements. Forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from those projected, anticipated, expected or implied. These risks and uncertainties include, but are not limited to, metals price volatility, volatility of metals production and costs, environmental and litigation risks, operating risks, project development risks, political and regulatory risks, labor issues, ability to raise financing and exploration risks and results. Refer to the company’s Form 10-K and 10-Q reports for a more detailed discussion of factors that may impact expected future results. The company undertakes no obligation and has no intention of updating forward-looking statements other than as may be required by law. ©2012 Hecla Mining Company