Table of Contents: ART OF THE ESTATE TAX RETURN

advertisement

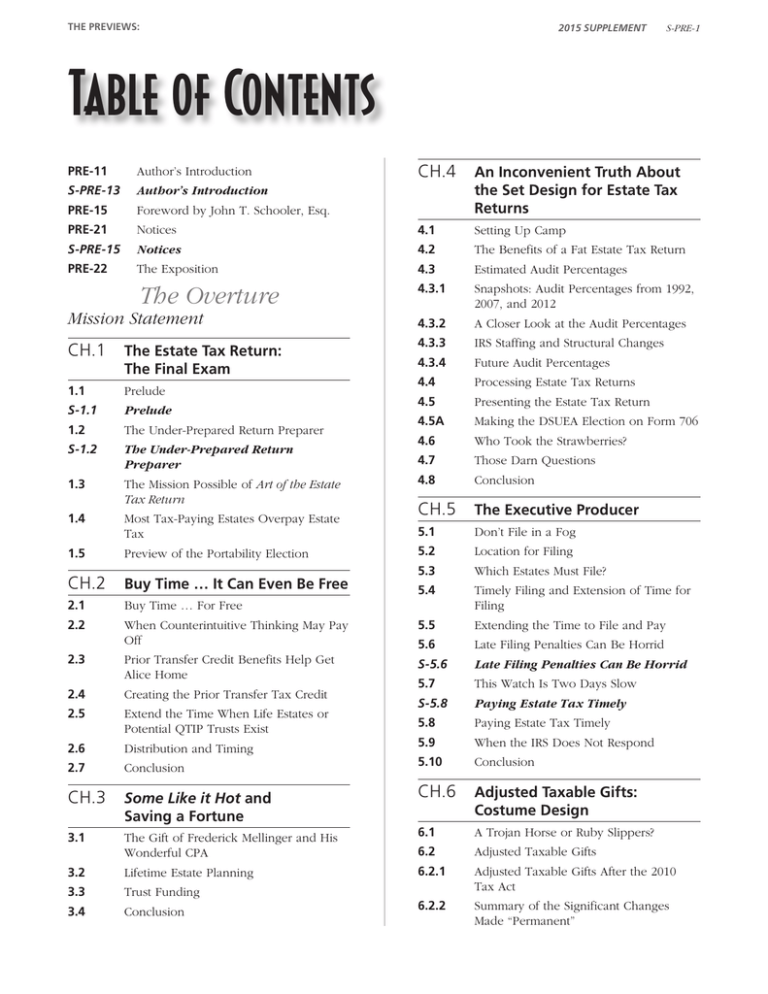

THE PREVIEWS: 2015 SUPPLEMENT S-PRE-1 Table of Contents PRE-11 Author’s Introduction CH.4 An Inconvenient Truth About the Set Design for Estate Tax Returns S-PRE-13 Author’s Introduction PRE-15 Foreword by John T. Schooler, Esq. PRE-21 Notices 4.1 Setting Up Camp S-PRE-15 Notices 4.2 The Benefits of a Fat Estate Tax Return PRE-22 4.3 Estimated Audit Percentages 4.3.1 Snapshots: Audit Percentages from 1992, 2007, and 2012 4.3.2 A Closer Look at the Audit Percentages 4.3.3 IRS Staffing and Structural Changes 4.3.4 Future Audit Percentages 4.4 Processing Estate Tax Returns 4.5 Presenting the Estate Tax Return 4.5A Making the DSUEA Election on Form 706 4.6 Who Took the Strawberries? 4.7 Those Darn Questions 4.8 Conclusion The Exposition The Overture Mission Statement CH.1 The Estate Tax Return: The Final Exam 1.1 Prelude S-1.1 Prelude 1.2 S-1.2 The Under-Prepared Return Preparer The Under-Prepared Return Preparer 1.3 The Mission Possible of Art of the Estate Tax Return 1.4 Most Tax-Paying Estates Overpay Estate Tax 1.5 Preview of the Portability Election CH.2 Buy Time … It Can Even Be Free CH.5 The Executive Producer 5.1 Don’t File in a Fog 5.2 Location for Filing 5.3 Which Estates Must File? 5.4 Timely Filing and Extension of Time for Filing 2.1 Buy Time … For Free 2.2 When Counterintuitive Thinking May Pay Off 5.5 Extending the Time to File and Pay 5.6 2.3 Late Filing Penalties Can Be Horrid Prior Transfer Credit Benefits Help Get Alice Home S-5.6 Late Filing Penalties Can Be Horrid 2.4 Creating the Prior Transfer Tax Credit 5.7 This Watch Is Two Days Slow 2.5 Extend the Time When Life Estates or Potential QTIP Trusts Exist S-5.8 Paying Estate Tax Timely 5.8 Paying Estate Tax Timely 2.6 Distribution and Timing 5.9 When the IRS Does Not Respond 2.7 Conclusion 5.10 Conclusion CH.3 Some Like it Hot and Saving a Fortune 3.1 The Gift of Frederick Mellinger and His Wonderful CPA 3.2 Lifetime Estate Planning 3.3 Trust Funding 3.4 Conclusion CH.6 Adjusted Taxable Gifts: Costume Design 6.1 A Trojan Horse or Ruby Slippers? 6.2 Adjusted Taxable Gifts 6.2.1 Adjusted Taxable Gifts After the 2010 Tax Act 6.2.2 Summary of the Significant Changes Made “Permanent” S-PRE-2 2015 SUPPLEMENT ESTATE PLANNING AT THE MOVIES® — ART OF THE ESTATE TAX RETURN 6.2.3 Gift Tax Exemption Use With Reduced Gift Tax Rate 6.7.11 6.2.4 Computation of the Gift Tax on the Gift Tax Return 6.7.11.1 Income Tax Recognition by Donor If Gift Tax Exceeds Donor’s Basis 6.2.5 Pre-2002 Taxable Gifts May Create a Phantom Portability Amount 6.7.11.2 Net Gifts and the Three-Year Rule 6.2.6 Gift Splitting 6.3 Taxable Gifts and Their Calculation 6.4 Did the Decedent File Gift Tax Returns? 6.5 Did the Decedent Make Gifts That Were Not Reported on a Gift Tax Return? 6.5.1 Is It a Loan or a Gift? 6.5.2 Unreported Gifts of Real Estate 6.5.3 Do Retained Powers of Appointment Render a Transfer Incomplete? 6.6 Action Steps When Prior Gifts Are Discovered Net Gifts S-6.7.11 Net Gifts 6.7.11.3 Net Gifts and the Line 7 Credit 6.8 Grantor Retained Annuity Trusts S-6.8 Grantor Retained Annuity Trusts 6.8.1 Summary of GRAT Features 6.8.2 GRAT Requirements 6.8.3 Zeroed-Out GRAT 6.8.4 Term of the GRAT 6.8.5 Enhanced GRAT Results with Gifts of Entity Interests 6.8.6 Payment of Income Tax by the Grantor 6.8.7 Pre-Death IDGT Buy-Back S-6.6 Action Steps When Prior Gifts Are Discovered S-6.8.7 Pre-Death IDGT Buy-Back 6.8.8 IDGTS Best Long-Term GRATs 6.7 Raiders of the Lost Ark in Gift Tax Law 6.9 Adequate Disclosure and Sales S-6.7 Raiders of the Lost Ark in Gift Tax Law 6.10 Sales or Gifts to Intentionally Defective Grantor Trusts 6.7.1 Favorable Adjustments to Line 4 of Form 706 S-6.10 Sales or Gifts to Intentionally Defective Grantor Trusts 6.7.2 Make Timely Delivery of Year-End Gifts 6.11 Self-Canceling Installment Notes 6.7.3 Watch Out for Present-Interest Challenges to Gifts of Entity Interests 6.12 Conclusion 6.7.4 Caution With Rescission or Reformation of Gifts CH.7 Concluding Audits and Appeal Rights S-6.7.4 Caution With Rescission or Reformation of Gifts The Agent – Be Nice, Ari 6.7.5 7.1 The Loyal Opposition 7.2 Practical Audit Tips and Setting Up the Best Result on Appeal or Trial S-7.2 Practical Audit Tips and Setting Up the Best Result on Appeal or Trial 7.3 Appeals Is an Independent Branch From Audit Formula Clauses Receiving More Favorable Treatment, Though Challenges Remain S-6.7.5 Formula Clauses Receiving More Favorable Treatment, Though Challenges Remain 6.7.6 Cross Beneficiaries of Annual Exclusion 6.7.7 Indirect Gifts by Entities 7.4 S-6.7.7 Indirect Gifts by Entities Alternate Dispute Resolution 7.5 6.7.8 Protective Refund Claim on State Taxes Gift Taxes on Gifts Paid Within Three Years of Death 7.6 Refunds and Refund Claim Proceedings 6.7.9 Transfers Must Be Effective to Be Respected S-7.6 Refunds and Refund Claim Proceedings 6.7.10 Qualified Disclaimers 7.7 Conclusion: Playing Fair THE PREVIEWS: 2015 SUPPLEMENT S-PRE-3 Main Street CH.7A Portability Elections: A New Era in Estate Planning and Compliance 7A.1 Jackie Robinson and Portability Elections: The New World of Estate Planning and Compliance 7A.2 Identifying the Black Swan … but From What Angle? 7A.3 Strategic Planning Considerations With Portability Elections S-7A.3 Strategic Planning Considerations With Portability Elections 7A.3.1 Trusts Remain Relevant for Tax and NonTax Purposes 7A.3.2 Can the Estate Plan Create a Gray Swan? 7A3.3 Portability Elections as a Form of Estate Tax Insurance 7A.3.4 To QTIP or Not QTIP, That Is the Question 7A.3.5 No Inflation Adjustment on the DSUEA 7A.3.6 Significance of State Taxation S-7A.3.7 Protecting the Marital Deduction . . . Distributions to a Survivor’s Trust Are Not the Same as Distributions Directly to the Surviving Spouse [New Topic] S-7A.8 Regulations Governing Portability Elections on the Estate Tax Return of the Deceased Spouse 7A.8.1 Significant Terminology 7A.8.2 Determining Who Controls the Portability Election 7A.8.3 Computation of the DSUEA 7A.8.3.1 Computing the DSUEA When the Surviving Spouse is the Beneficiary of a QDOT 7A.8.4 Making the Portability Election 7A.8.4.1 Drilling Down on the Timely Return Requirement for Portability Elections 7A.8.4.2 Requirement for a Complete and Properly Prepared Return 7A.8.4.3 Defining the Spouse 7A.8.4.4 Temporary Relief to File Late Portability Election under Rev. Proc. 2014-18 S-7A.8.4.4 Temporary Relief to File Late Portability Election Under Rev. Proc. 2014-18 7A.8.4.5 Temporary Relief to Refund Claim As a Result of Windsor 7A.8.4.6 Pre-2002 Gifts and Impact on the DSUEA S-7A.8.4.6 Pre-2002 Gifts and Impact on the DSUEA 7A.9 Simplified Requirements to Report Values S-7A.9 S-7A.3.7.1 Background Considerations [New Topic] Simplified Requirements to Report Values 7A.10 S-7A.3.7.2 A Trust Established by the Surviving Spouse Is Not the Same as Outright Distribution to the Surviving Spouse [New Topic] The Problem of Establishing Income Tax Basis With Portability Elections and Simplified Reporting in Particular 7A.10.1 The Fundamentals S-7A.3.7.3 Transient Limitations Defeat Most of a Lifetime of Virtual Omnipotence [New Topic] 7A.4 Fiduciaries Beware 7A.5 Marital Deduction Trusts and Portability Elections 7A.6 QTIPing a Credit Shelter Trust 7A.7 General Power of Appointment Trust 7A.8 Regulations Governing Portability Elections on the Estate Tax Return of the Deceased Spouse 7A.10.2 The Estate Tax Return Must Be Required 7A.10.3 Evidencing Fair Market Value: Standard vs. Simplified Reporting 7A.10.4 Narrowing Practical Benefit of Simplified Reporting 7A.11 Limitations for Simplified Reporting When State Death Tax Returns Need Federal Return Information S-7A.11 Limitations for Simplified Reporting When State Death Tax Returns Need Federal Return Information S-PRE-4 2015 SUPPLEMENT 7A.12 ESTATE PLANNING AT THE MOVIES® — ART OF THE ESTATE TAX RETURN 8.4 Highest and Best Use 8.5 Completing Schedule A 8.6 Post-Death Facts: When Do They Count? S-8.6 Post-Death Facts: When Do They Count? 8.7 What Kind of Appraiser Do You Need? 7A.12.2 How Can a Refund Claim Function When No Tax Is Payable to Refund? 8.8 Hiring and Communicating With the Appraiser 7A.12.3 The IRS, Not the Taxpayer, Can Adjust the DSUEA by Statute 8.9 Overview of Fractional Interest Discounts 8.10 Fractional Interest Discount Cases 7A.12.4 To What Court, if Any, Can the Deceased Spouse’s Estate Seek Recourse to Determine an Increase in the Portability Amount? 8.11 Bogus Argument: FID Is Limited to the Cost of Partition or Aloha 8.12 Does the Size of the Fractional Interest Owned Determine Discount? 8.13 Fractional Interest Disclosure: Who to Hire and How to Prove the Case 8.14 No Fractional Interest Discount With Joint Tenancy Property 8.15 Role of the Valuation Engineer and the Taxpayer’s Rights 8.16 Strike it Rich: Recourse and Non‑Recourse Debt and the FID 8.17 The Impact of Debt on the Total Value Being Taxed 8.18 Potential for Negative Return Value What Would Natalie’s Character Say? 8.19 Audit Defense Point APPENDIX I: Comparison of Exemption Trust and QTIP Trust (3% Growth) 8.20 Discounts on the Death of the First Spouse APPENDIX 2: Comparison of Exemption Trust and QTIP Trust (6% Growth) S-8.20 Discounts on the Death of the First Spouse APPENDIX 3: Sample Prior Gifts Calculation 8.21 Bulk and Blockage Discounts 8.22 Toxics, Hazardous Waste Code Compliance, and Drawbacks to Value 8.23 Alternate Valuation Date Election S-8.23 Alternate Valuation Date Election 8.23.1 Interest 8.23.2 Rent 8.23.3 Dividends 8.23.4 Anti-Kohler Regulations 8.24 Portability and Real Estate Valuation 8.25 Conclusion Reporting Portability Elections When Unknown Liabilities, Claims, and Deductions Exist at the Time of Filing That Are Not Currently Deductible on the Federal Estate Tax Return 7A.12.1 Limitations on Schedule J and K Deductions: Generally Payment Required 7A.12.5 Deduct Allowable Expenses and Claims on the Portability Electing Return to the Extent Allowable 7A.12.6 Building Flexibility With Finality of the DSUEA 7A.13 Extended Audit Period to Challenge Portability Election 7A.14 Regulations for Portability Applicable to the Surviving Spouse’s Estate 7A.14.1 Special Rule When Surviving Spouse Receives DSUEA From a Decedent Who Established a QDOT 7A.15 APPENDIX 4: Sample Page 4, Part D to Form 706: DSUEA From Predeceased Spouse The Cast of Characters: The Schedules CH.8 Schedule A: Real Estate Tara 8.1 Real Estate: It’s Called “Real” for a Reason 8.2 First Focus on Underlying Value S-8.2 First Focus on Underlying Value 8.3 Inform the Appraiser About the Facts of the Property APPENDIX I: Sample Brief Attachment for Fractional Interest Discount APPENDIX 2: Additional Discussion to Section 8.11: Bogus Argument: FID is Limited to the Cost of Partition or Aloha THE PREVIEWS: CH.9 Schedule A-1: Special-Use Valuation Elections 2015 SUPPLEMENT S-PRE-5 10.4 Valuation of the Closely Held Corporation: The Entity-Level Appraisal S-10.4 Valuation of the Closely Held Corporation: The Entity-Level Appraisal 10.5 Taxpayers Are Prevailing on the Deduction for Built-in Gain (“BIG Discount”) Tax Characteristics and S Corporations How Green Is Your Valley? 9.1 Keeping the Family Farm 9.2 Purpose of the Special-Use Election S-9.2 Purpose of the Special-Use Election 9.3 Special-Use Qualifications 10.5A 9.4 Making the Code §2032A Election 9.4.1 Timing and Content S-10.5A Tax Characteristics and S Corporations 9.4.2 Relief to Make Late Special-Use Elections 10.6 9.4.3 Protective Code §2032A Elections No Built-In Gain Deduction With FLPs, IRAs, or General IRD Items 9.4.4 Partial Code §2032A Elections 10.7 9.4.5 The Practical IRS Approach to Audits of Code §2032A Elections Discounts and Premiums Relating to the Value of Closely Held Stock 10.8 Survey of Minority Interest Discounts 9.5 Providing Evidence of Farm Rent Comparables 10.9 Lack of Marketability Discount S-10.9 Lack of Marketability Discount 10.10 No “Safe Harbors” 10.11 Community Property and the Minority Interest Discount 10.12 Control Premiums 10.13 Restrictive Agreements and Covenants 9.6 9.7 Discounts and Their Relation to SpecialUse Valuation Special-Use Elections and AV Date Elections S-9.7 Special-Use Elections and AV Date Elections 9.8 Material Participation Test: Pre-Death and Post-Death Planning Traps 9.9 Recapture or Cessation of Special Use S-9.9A Special-Use Elections and GST Tax [New Topic] 9.10 Income Tax Basis Adjustment Election in the Event of Additional Tax 9.11 Problems Created by the Reduced Basis With Special-Use Elections 9.12 IRS Lien on the Recapture Tax 9.13 Special-Use Valuation and Portability Elections 9.14 Planning Considerations and Summary APPENDIX I: Questions and Responses of Dean Bretney, Esq. CH.10 Schedule B: Stocks and Bonds “Greed is Good” and Billy Madison 10.1 Setting the Stakes 10.2 Valuation of Publicly Traded Stocks and Bonds 10.3 Fair Market Value S-10.3 Fair Market Value 10.13A Valuation of Options, Puts, and Call Rights 10.14 The Added Burden of Code §2703 10.15 Broad Application of Code §2703 10.16 Appraisal Assistance on Comparability Test 10.17 Marital Deduction Warning 10.18 Warning About Inconsistency With the Business/Economic Deal 10.19 Blockage Discounts 10.20 Warning: Avoid Adding Closely Held Stock to FLPs/LLCs 10.21 Portability Elections and Schedule B 10.22 Conclusion CH.11 Schedule C: Cash and Promissory Notes Money Makes the World Go Around 11.1 Opening the Account 11.2 Reporting Account Balances 11.3 Valuation of Promissory Notes 11.4 Apparent Disconnect Between Gift Tax and Estate Tax Value S-PRE-6 2015 SUPPLEMENT ESTATE PLANNING AT THE MOVIES® — ART OF THE ESTATE TAX RETURN 11.5 Valuation of Promissory Note Bequeathed to the Maker S-14.2 Valuation of Limited Partnerships and LLCs: The Entity Wars 11.6 Portability and Schedule C Reporting 14.3 11.7 Valuation Is a Cabaret The Tax Benefits of Entities (or something like that) 14.4 The Starting Point: Code §2036 S-14.4 The Starting Point: Code §2036 14.5 Overview and History of the IRS’s Challenges to Entities 14.6 29 Action Steps to Defeat IRS Attacks Against Entities S-14.6 29 Action Steps to Defeat IRS Attacks Against Entities 14.7 Code §2036(a)(1): Disregarding the Entity 14.8 Determine the Nature of the Interest Being Valued 14.9 Significance of State Law 14.10 Code §2704 and Lapsing Rights 14.11 Code §2701 and Distribution Preferences CH.12 Schedule D: Life Insurance Where Hartford is Capital 12.1 Woody Allen, Mr. Smith, Robert De Niro, and Life Insurance 12.2 Reporting Life Insurance and Form 712 12.3 Avoiding Incidents of Ownership 12.4 Issues With a Non-Citizen Spouse 12.5 Cross-Trust Doctrine 12.6 Life Insurance and the Credit Shelter Trust: Be Cautious 12.7 Life Insurance Payable to a Corporation or Partnership Controlled by the Insured 12.8 GST Warning 12.9 Under-Purchased Asset 12.10 Life Insurance and the Net Investment Income Tax 12.11 Life Insurance and Portability Elections 12.12 Conclusion S-14.11 Code §2701 and Distribution Preferences 14.12 Discovery Issues and Experts 14.13 Sampling of Entity Valuation Discount Cases 14.14 Amount of Estate Tax Inclusion and Application of Code §2043 CH.13 Schedule E: Joint Tenancies Ralphie’s Gun 14.15 Tiered Discounts 14.16 Protect Mellinger Discounts When Surviving Spouse Dies 13.1 The Strange World of Joint Tenancies 14.17 The Danger Zone: Unfunded Trusts 13.2 What to Report on Schedule E S-14.17 The Danger Zone: Unfunded Trusts 13.3 Qualified and Non-Qualified Interests 14.17.1 Contingent Fee Claims 13.3A Windsor and Qualified Joint Tenancies 13.4 State Law Characteristics of Joint Tenancies 14.17.2 Malpractice Claims or Cause of Action of Estate 13.5 Tracing Contributions of the Surviving Joint Tenant 14.17.4 Mineral, Oil, and Gas Rights 13.6 Disclaimer of Joint Tenancies 14.17.6 Contingent and Disputed Claims 13.7 Reporting Joint Tenancies With Portability Elections 14.17.7 Beauty is in the Eye of the Beholder — Valuation of Art 13.8 Conclusion 14.17.7.1Passion, the World of Art, and Maybe More S-12.12 Conclusion CH.14 Schedule F: 14.17.3 Wrongful Death Recoveries 14.17.5 Copyrights and Patents Hardly Miscellaneous S-14.17.7.1 Passion, the World of Art, and Maybe More 14.1 Action Central With a Sedating Title S-14.17.8 14.2 Valuation of Limited Partnerships and LLCs: The Entity Wars 14.18 Unlawful Assets [New Topic] Hidden Assets THE PREVIEWS: 14.19 Portability Elections and Schedule F 14.20 Summary APPENDIX 1: Discussion of Significant Code §2036 and Indirect Gift Cases CH.15 Schedule G: Transfers During Life 2015 SUPPLEMENT S-PRE-7 S-16.3 The Release or Exercise of a General Power of Appointment 16.4 Reprise the Trojan Horse … Crummey Powers and Crummey Trusts 16.5 Crummey Complexities 16.6 Income Tax Effects on the Power Holder 16.7 Gift Tax Effects on the Power Holder 15.1 Boomerang Gifts and Strings 16.8 Estate Tax Effects on the Power Holder 15.2 Narrowed ‘Gift in Contemplation of Death’ Rule (Modified Three-Year Rule) 16.9 GST Tax Considerations 15.3 Invalid Withdrawal From Trust Under Durable Power of Attorney 16.10 General Powers of Appointment and Portability S-15.3 Voidable Gifts and Withdrawals Under Durable Power of Attorney [Amended Heading] 16.11 Troy Did Not Fall APPENDIX I: 5/5 Limitation Illustration APPENDIX 2: Demand and Withdrawal Right Time Requirement Chart by Rod Goodwin, MST 15.4 Uniform Transfers to Minors 15.5 Sale of Remainder Interest Marital Trusts 15.5A Sale of Remainder Interest of a QTIP Trust 15.5B Gifts from the Sale or Disposition of Interests in QTIP Trusts 15.5C Gap in the Regulations Needs Closing QTIP Trust Arising With Simplified Reporting 17.1 Gee, Isn’t Pleasantville Swell? 17.2 Overview of Schedule I 15.6 Gross-Up for Gift Tax on Gifts Made Within 3 Years of Death 17.2.1 General Requirements for Annuities 17.2.2 Annuities Under Approved Plans 15.7 Reduction of Adjusted Taxable Gifts When Included in the Gross Estate 17.3 Private Annuities 17.4 Employee Death Benefits 15.8 One Step Is Better Than Two 17.4.1 15.9 Valuation of GRATs 15.10 Retained Agreement for Use or Enjoyment Estate Tax Inclusion When the Decedent Received No Benefit and Had No Right to Receive Benefits 17.5 15.11 Intentionally Defective Grantor Trusts IRAs, Qualified Retirement Benefits, and Community Property 15.12 Self-Settled Asset Protection Trusts 17.6 Lottery Winnings 15.13 Answering the Ambiguous Question 13e on Page 3 of Form 706 17.7 Benefits for Those Who Wait 15.14 Schedule G Should Be Rated “B” — Beware! CH.16 Schedule H: Powers of Appointment I Don’t Own It, But It’s Mine 16.1 The Tax Preference for the Ages 16.2 Defining General Power of Appointment 16.3 The Release or Exercise of a General Power of Appointment CH.17 Schedule I: Annuities The Action is in the Pre-Death Planning APPENDIX 1: Questions and Answers from Michael Jones, CPA CH.18 Schedule J: Funeral and Administrative Expenses 18.1 Prelude to the Deduction Battle 18.2 Funeral Expenses 18.3 Administrative Expenses 18.3.1 Actual and Necessary Requirement: Majority and the 7th Circuit 18.3.2 Requirements Under the 2009 Regulations S-PRE-8 2015 SUPPLEMENT 18.3.3 Legal and Accountant Fees 18.3.4 Operation of a Business 18.3.5 ESTATE PLANNING AT THE MOVIES® — ART OF THE ESTATE TAX RETURN 19.5.2 Claims Based on Relinquished Marital Rights Deduction for Expenses of Sale 19.5.3 Palimony 18.3.6 Deduction for Interest 19.5.4 Foreign Death Taxes 18.3.7 Deduction for Repair and Maintenance Expenses 19.5.5 Guarantees 19.5.6 Income Tax and Gift Tax Liability 18.3.8 Deduction for Statutory Interest on Delayed Distribution 19.5.7 Estate Tax Penalties 19.5.8 State Death Tax Deduction 18.4 “Swing-Item” Deductions 19.5.9 Care-Giving Services 18.5 Rev. Proc. 2011-48 In-Depth 19.5.10 Family-Related Loans 18.6 Portability Elections and Schedule J Deductions 19.5.11 Malfeasance by the Decedent as a Fiduciary S-18.6 Portability Elections and Schedule J Deductions 19.5.12 No Deduction for Income Taxes Paid From an IRA Account 18.7 Mortality and the Code §2053 Regulations 19.5.13 Deduction for Unpaid Mortgages CH.19 Schedule K: Debts of the Decedent 19.1 Unplug the Power Cord 19.2 October 2009 Final Regulations and Notice 2009-84 S-19.2 October 2009 Final Regulations and Notice 2009-84 19.2.1 Claims and Expenses Must Be Bona Fide 19.2.2 Court Decrees and Settlements 19.2.3 The Amount Deductible 19.2.4 Application of Post-Death Facts S-19.5.14 Review Electronic Records [New Topic] 19.6 Schedule K and Portabilty Elections 19.7 Plugged In and Turned On CH.20 Schedule L: Losses and Deductions Not Subject To Claims 20.1 Schedule of Lonely Deductions 20.2 Losses 20.3 Expenses Incurred for Administration of Property Not Subject to Claims S-19.2.4 Application of Post-Death Facts 20.4 Schedule L Deductions and Portability 19.2.5 Refund Claims 20.5 19.2.6 Mortgages and Deeds of Trust Conclusion: L is for Lonely — Leave it Alone 19.2.7 Cross-Claims and Liabilities With Respect to Particular Assets 19.2.8 Contingent and Non-Contingent Obligations 19.2.9 Relief for Claims and Expenses Totaling $500,000 or Less 19.2.10 Deduction for Taxes CH.21 Schedule M: Marital Deduction Marriage: The Great Estate Tax Deal 21.1 Marriage Sires the Best Deduction S-21.1 Marriage Sires the Best Deduction 21.2 The Essentials of Marital Deductions 21.3 Basic Requirements S-21.3 Basic Requirements 19.3 Are the 2009 Regulations Legal When They Conflict With Circuit Court Law? 19.3.1 Disclosures on Estate Tax Returns 21.4 Survivorship 19.4 Deductions of the First & Second Category S-21.4 Survivorship 21.5 Terminable Interest Rule 19.5 Review of Various Deductions and Claims S-21.5 Terminable Interest Rule 19.5.1 21.6 Unproductive Property Checks Outstanding as of the Date of Death 21.7 Specific Portion Requirement THE PREVIEWS: 21.8 Tax Payment Allocated to the Marital Deduction Gift 21.9 Marital Deduction Trusts 21.9.1 Estate Trusts 21.9.2 General Power of Appointment Trusts 21.10 QTIP Trusts 21.11 The All Net Income Requirement 21.11.1 Stub Income: Accrued but Unpaid Income At Death 21.11.2 Equitable Recoupment 21.12 No Benficiaries Other Than the Survivng Spouse 21.13 Irrecovable Election 21.13.1 Elections 21.13.2 Relief From Erroneous Elections or Omissions of a QTIP Election 21.14 Marital Deduction With Charitable Remainder 21.15 Post-Death Administration Expenses S-21.15 Post-Death Administration Expenses 2015 SUPPLEMENT S-PRE-9 22.4 Amount of the Charitable Deduction 22.4.1 Limitations on Deductions of Partial or Split Interests 22.4.2 Death Taxes and Expenses Paid Out of the Charitable Transfer 22.5 Reformation Proceedings and Corrective Steps S-22.5 Reformation Proceedings and Corrective Steps 22.6 Gifts of Partnership Interests to Charitable Trusts or Family Foundations 22.7 Disclaimers for the Benefit of Charity 22.8 What’s Up With Charitable Giving … or Non-Giving? 22.9 Business-Related Charitable Planning 22.9 S-Business-Related Charitable Planning 22.10 Portability Elections and the Charitable Deduction 22.11 Pay It Forward 21.16 Marital Deduction and IRAs Distributable to a QTIP Trust CH.23 Schedule P: 21.17 Community Property Rights of the Non‑Participant Spouse Traveling Men (and Women) 21.18 Non-Pro Rata Division of Community Property 23.1 IRS Seeks Out the Beautiful World 23.2 Situs of the Property 21.19 Allocating Assets to Marital Deduction: Relationship to Value in Gross Estate 23.3 Limitations on the Credit 23.3.1 21.20 Qualified Domestic Trusts (Code §2056A) Marital Deduction and Charitable Deduction Limitations S-21.20 Qualified Domestic Trusts (Code §2056A) 23.4 Valuation of the Property and Credit 23.5 21.21 Valuation of the Credit The Rev. Proc. 64-19 Reminder 23.6 21.22 Credit Under Treaties Transactions Between the Marital Trust and Third Parties, and Other Limitations 23.7 Proof of the Credit 21.23 Marital Deduction Through a Disclaimer 23.8 Period of Limitation 21.24 Settlement of Estate or Trust Disputes and the Marital Deduction 23.9 Deduction Under Code §2053(d) 23.10 Tax Planning in the Beautiful World 21.25 Portability and the Marital Deduction 21.26 What’s in a Yawn? CH.22 Schedule O: Charitable Deductions The Kindness of Strangers 22.1 When Charity Does Not Begin At Home 22.2 Availability of the Charitable Deduction 22.3 Documentation and Verification Foreign Death Tax Credit CH.24 Schedule Q: Prior Transfer Credit Groundhog Day 24.1 Reliving the Past 24.2 Valuation of Property Transferred 24.3 Defining Property 24.4 Defining Transfer 24.5 Limitations on the Credit S-PRE-10 2015 SUPPLEMENT ESTATE PLANNING AT THE MOVIES® — ART OF THE ESTATE TAX RETURN 24.6 The Estate Tax Must Be Paid 25.8.2 Lifetime GST Exemption 24.7 Additional Tax Arising With Respect to Special-Use Property and the PTC 25.8.3 The GST Exemption Allocation: Applicable Fraction and Inclusion Ratio 24.8 Getting It Right 25.8.4 Lifetime Transfers CH.25 Schedule R: GST Tax Rube Goldberg and Transfer Tax Law 25.8.4.1 Pre-January 1, 2001 Rules 25.8.4.2 Post-December 31, 2000 Rules 25.8.5 Timely Allocations of GST Exemption and Valuation 25.8.6 Late Allocations 25.8.7 Use of Exemption Increase for Late Allocations S-25.1A GST Tax Law in 2010—Moonlight Serenade 25.8.8 Allocation of GST Exemption Under Relief Provisions 25.2 Thirteen Summary Points 25.8.9 GST Exemption Allocation on Death 25.3 Chronological Exemptions 25.8.10 ETIP Exception 25.4 Additions to a Chronologically Exempt Trust 25.8.11 Excessive Exemption Allocations 25.4.1 Actual Additions 25.8.12 Relief Provisions for Late Allocation of GST Exemption 25.4.2 Constructive Additions S-25.8.12 25.4.3 Constructive Additions and Limited Powers of Appointment 25.8.13 Relief at a Discount 25.5 Avoid Substantial Modifications 25.9 Identity of the Transferor S-25.5 Avoid Substantial Modifications S-25.9 Identity of the Transferor 25.6 GST Taxable Events 25.9.1 Reverse QTIP Elections 25.6.1 Skip Persons and Non-Skip Persons S-25.9.1 Reverse QTIP Elections 25.6.2 Predeceased Ancestor Exception (Code §2651(e)) 25.9.2 Gift Splitting 25.6.3 25.9.3 The Move-Down Rule Interests Through Entities 25.6.4 25.9.4 Lapsing Crummey Powers GST Trusts (The ‘Cure’: But Do They Help?) 25.10 Completing Schedule R 25.6.5 Direct Skips 25.6.6 Multiple Skips 25.6.7 Taxable Distribution 25.6.8 Taxable Terminations 25.6.9 Trusts 25.7 Separate Share Rule 25.7.1 Separate Share Relief: Qualified Severance Under Code §2642(1)(3) 25.7.2 Pecuniary Trusts and Bequests 25.7.3 Multiple Transferors With Respect to a Single Trust 25.8 GST Exclusions and Exemptions S-25.8 GST Exclusions and Exemptions 25.8.1 Annual Exclusion Gifts Under the Gift Tax System: See the Traps 25.1 25.1A Over-Burdensome Laws Suffocate a Simple Principle GST Tax Law in 2010 — Moonlight Serenade Relief Provisions for Late Allocation of GST Exemption S-25.10 Completing Schedule R 25.11 GST Exemption and Portability Elections 25.12 Allocation of GST Tax CH.26 Schedule U: Qualified Conservation Easements Conservation Easements Without a Conservation Purpose; or Alice in Deduction and Exclusion Land 26.1 Once Upon a Time 26.2 The Potential Benefits 26.3 Summary of the Qualified Conservation Easement Exclusion Under Code §2031(c) 26.3.1 The Definition of Land Subject to a QCE 26.3.2 The Definition of QCE THE PREVIEWS: 2015 SUPPLEMENT S-PRE-11 26.3.3 Limitations on the Amount of the Exclusion 27.10 Summary of Terminations of Code §6166 Elections 26.3.4 Reduction for Acquisition Debt 27.11 26.3.5 Reduction for Retained Development Rights Tax Court Review of Code §6166 Election Denials 27.12 Code §6166 and Standing Before District Court or Court of Claims 27.13 Extension of Time to Pay Estate Tax on Remainder and Reversion Interests Under Code §6163 26.4 Charitable Contribution 26.5 Indirect Ownership of Real Property and QCE 26.6 Valuation 26.7 Restricted for Conservation Purpose 26.8 Practical Assistance From Qualification for Land Trusts 26.9 27.13.1 Making the Election 27.13.2 Amount of Tax Deferrable 27.14 Discharge From Liability Income Tax Basis Downside 27.15 Presto! Closing Letters 26.10 The Relationship of QCEs to Special-Use Valuation 27.16 Ringing of the Bell 26.11 Summary CH.27 Paying the Piper: It’s Got to Happen 27.1 If Not Never, Then Pay Later (Legally) 27.2 Overview of Code §6166 Elections S-27.2 Overview of Code §6166 Elections 27.2.1 Reprise of Recourse vs. Non-Recourse Debt 27.2.2 Interest Rate on Deferral and Term 27.2.3 Protective Elections S-27.2.3 Protective Elections APPENDIX I: Sample Attachment to Support IRC §6166 Election Chapters 28-37: Chapters 28–37 include estate tax returns for decedents dying in years 2009–2012. To receive those chapters electronically, as well as electronic newsletters and news flashes, subscribe to the author’s Update Service by visiting: www.EstatePlanningAtTheMovies.com The author’s subscription Update Service serves as a complement to this Second Edition of Art of the Estate Tax Return—Estate Planning at the Movies®, and to any supplements to this Second Edition offered by Bloomberg BNA. 27.2.4 Initial Review and Response From the IRS 27.3 The Three-Year Rule and Code §6166 Qualification 27.4 The Decedent Must Own an Interest in a Closely Held Business 27.5 Rental Real Estate and the Conduct of Business CH.38 Sample Estate Tax Return for 27.6 Acceleration of Estate Tax Liability From Sales, Dispositions, Distributions, and Withdrawals CH.39 Sample Estate Tax Return for The Dénouement Death of First Spouse in 2013 the Death of an Unmarried Individual in 2013 S-27.6 Acceleration of Estate Tax Liability From Sales, Dispositions, Distributions, and Withdrawals 27.7 Interest Deduction as an Additional Administrative Expense 27.8 Discharging the Executor From Estate Tax Liability Under Code §6166 40.1 Potential for Avoiding the Obligation to Post Bond or Security Death of the First Spouse in 2013 (DSUEA) 40.2 Electing Out of the DSUEA in 2013 27.9 CH.40 Sample Estate Tax Return for an Estate Making a DSUEA Election S-PRE-12 2015 SUPPLEMENT ESTATE PLANNING AT THE MOVIES® — ART OF THE ESTATE TAX RETURN 40.3 Considerations With the DSUEA S-43.3 40.4 Background Facts to the Illustrated Estate Tax Return Considerations With the DSUEA in 2014 S-43.4 Background Facts to the 2014 Illustrated Estate Tax Return 40.4.1 The Simplified Method of Reporting Value 40.4.2 Comparing Valuation Methods 40.4.3 Is Simplified Reporting Desireable Even If Available? 40.5 General Form of the Return CH.41 Sample Estate Tax Return for S-43.4.1 The Simplified Method of Reporting Value S-43.4.2 Comparing Valuation Methods S-43.4.3 Is Simplified Reporting Desirable Even if Available? S-43.5 Death of First Spouse in 2014 [New Chapter] S-41.1 Death of the First Spouse in 2014 CH.42 Sample Estate Tax Return for the Death of an Unmarried Individual in 2014 [New Chapter] S-42.1 Death of an Unmarried Individual in 2014 CH.43 Sample Estate Tax Return for an Estate Making a DSUEA Election, Death in 2014 [New Chapter] S-43.1 Death of the First Spouse in 2014 (DSUEA) S-43.2 Electing Out of the DSUEA in 2014 General Form of the Return The Ovation O.1 Afterword O.6 Rolling the Credits O.7 Index of Terms S-O.1 Index of Terms O.27 Index of Cases S-O.23 Index of Cases O.31 Index of Movies S-O.27 Index of Movies