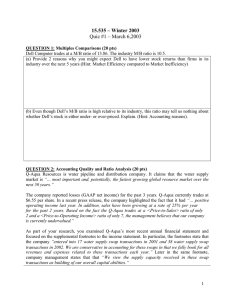

hewlett packard co(hpq) 10-q

advertisement