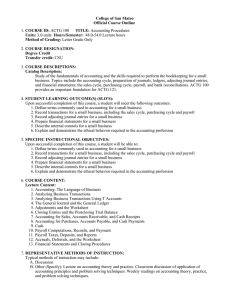

Session 4 Adjusting Journal Entries and Closing Entries

advertisement

Session 4 Adjusting Journal Entries and Closing Entries FINANCIAL ACTG. - BUS 020 - SPRING 2015 Measuring TransactionsThe Basics At least two account The integrity of the accounting equation Debits (left-side entries) = Credits (right-side entries FINANCIAL ACTG. - BUS 020 - SPRING 2015 Measuring TransactionsMethodology Determine the accounts Determine the direction of the exchange Determine the amounts Note pages 54- 71 very carefully FINANCIAL ACTG. - BUS 020 - SPRING 2015 The “T-Account” ASSETS & EXPENSES Debit Credit FINANCIAL ACTG. - BUS 020 - SPRING 2015 LIABILITIES, EQUITY & REVENUES Debit Credit Accounting ProcessDetail Analyze Transaction (Exchange) Measure and Record Summarize Accounts Unadjusted Trial Balance Adjusting Journal Entries (AJE’s) Adjusted Trial Balance Prepare Income Statement Closing Entries Final Trial Balance Prepare Balance Sheet, SCF and SSE FINANCIAL ACTG. - BUS 020 - SPRING 2015 Focus on 9/3 Focus on 9/5 Adjusting Journal Entries Accruals Prepayments Accruals/Deferrrals Unearned Revenue Cost Expirations FINANCIAL ACTG. - BUS 020 - SPRING 2015 Close Worksheet Account Title Unadjusted T/B Dr. Cr. Adjusting Entries Dr. Cr. FINANCIAL ACTG. - BUS 020 - SPRING 2015 Adjusted T/B Dr. Cr. Closing Entries Dr. Cr. Final T/B Dr. Cr. Closing Entries Temporary accounts Zero them out Revenue, expenses and dividends Permanent accounts Retained earnings is the final location for the temporary accounts FINANCIAL ACTG. - BUS 020 - SPRING 2015 Financial Statement Preparation Headings are IMPORTANT Company, Title and Date Note how the T-Account balances track to the actual financial statements FINANCIAL ACTG. - BUS 020 - SPRING 2015 Financial Statement Relationships Balance Sheet Current Assets Noncurrent Assets Current Liabilities Longterm Debt Income Statement Revenue Cost of Goods Sold (COGS) Gross Margin Operating Exps. Statement of Cash Flows Operating Cash FINANCIAL ACTG. - BUS 020 - SPRING 2015 Beginning S/E Investing Cash Financing Cash Change in Cash Net Income Less: Dividends Beginning Cash Equity Net Income Stmt of Sharehldrs Eq. Ending Cash Ending S/E Competencies by Session 4 What are the primary financial statements in the F/S Package? What are their uses? What are the other key components of the F/S Package? What are their uses? Describe the Financial Accounting Model. What is the accounting equation? Relate it to the Balance Sheet. Relate it to the Income Statement. What is Statement of Financial Accounting Concepts #1 (SFAC #1)? What are the financial accounting assumptions? What are the financial accounting principles? FINANCIAL ACTG. - BUS 020 - SPRING 2015