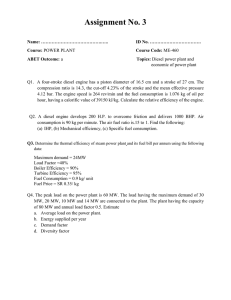

SPARK THERMIONICS

advertisement

SPARK THERMIONICS The Opportunity There is a better way for converting heat to electricity What if we could change this?... …Into this? …and unlock infinite opportunities Thermionics can actually do this! The Technology Solid state heat to electricity conversion How do thermionics work? Rejected heat Collector Vacuum Thermionic space emission Cathode Heat Electrical load How is it different from thermoelectrics? Heat source 225 725 1225 1725 (°C) Current flows through material n p n p Lower temperatures 1.0 eV 1.5 eV Heat sink I ZLoad Thermoelectric ZT = 1 Typical Thermionic 2.0 eV Less efficient 450 1350 2250 3150 (°F) Why Now? Using microfabrication and vacuum gap to radically increase efficiency of thermionics “I still think we will achieve 30% efficiency…” – V.C. Wilson, General Electric Research (1968) Daniel Riley, Ph.D. Jared Schwede, Ph.D. Forgotten by NASA, revived by microfabrication High Temperature High Power Density Low Maintenance Scalable Looking for markets… The real value of thermionics lies in uses where temperature, maintenance, scalability and weight are a constraint Competitive technologies landscape Fuel cell Steam turbine Stirling engine Gas turbine IC engine Thermoelectics Thermionics Fuel to electricity convertor Heat to electricity convertor Solid state heat to electricity convertor Competitive technologies landscape 50% Steam turbine plant High 45% efficiency 40% Efficiency % Gas turbine plant Fuel Cell 35% 30% Large scale applications IC Engine Small scale applications Stirling engine 25% 20% Thermionics 15% 10% Low 5% efficiency Thermoelectrics 0% 4.5 4 High cost 3.5 3 2.5 2 Cost $/W 1.5 1 0.5 0 Low cost Competitive technologies landscape 50% Steam turbine plant High 45% efficiency 40% Efficiency % Gas turbine plant Fuel Cell 35% 30% Large scale applications IC Engine Small scale applications Stirling engine 25% 20% Thermionics 15% 10% Low 5% efficiency Thermoelectrics 0% 4.5 4 High cost 3.5 3 2.5 2 Cost $/W 1.5 1 0.5 0 Low cost Competitive technologies landscape Down scalable to Watt 50% Steam turbine plant High 45% efficiency 40% Efficiency % Gas turbine plant Fuel Cell 35% 30% Large scale applications IC Engine Small scale applications Stirling engine 25% 20% Thermionics 15% 10% Low 5% efficiency Thermoelectrics 0% 4.5 4 High cost 3.5 3 2.5 2 Cost $/W 1.5 1 0.5 0 Low cost Competitive technologies landscape No moving parts 50% Steam turbine plant High 45% efficiency 40% Efficiency % Gas turbine plant Fuel Cell 35% 30% Large scale applications IC Engine Small scale applications Stirling engine 25% 20% Thermionics 15% 10% Low 5% efficiency Thermoelectrics 0% 4.5 4 High cost 3.5 3 2.5 2 Cost $/W 1.5 1 0.5 0 Low cost Competitive technologies landscape High temperature 50% Steam turbine plant High 45% efficiency 40% Efficiency % Gas turbine plant Fuel Cell 35% 30% Large scale applications IC Engine Small scale applications Stirling engine 25% 20% Thermionics 15% 10% Low 5% efficiency Thermoelectrics 0% 4.5 4 High cost 3.5 3 2.5 2 Cost $/W 1.5 1 0.5 0 Low cost Numerous potential applications Mobile applications Stationary applications Submarines Primary power generation Drones Mobile gensets Power plants Micro-CHP scale scale Rockets High temperature waste heat recovery Remote heating Automobiles CSP Heavy industries Aircraft scale scale Numerous potential applications Mobile applications Need for power density Short term Stationary applications Easier to integrate Larger markets Longer term Numerous potential applications Primary power generation High temperature waste heat recovery High temperature Better economics Need for modularity Short term Longer term Numerous potential applications Short term Longer term Small scale (W to kW) Large scale (MW to GW) Need for scalability Need for low maintenance Larger markets scale Most promising applications Mobile applications Stationary applications Submarines Primary power generation Drones Mobile gensets Power plants Micro-CHP scale scale Rockets High temperature waste heat recovery Remote heating Automobiles CSP Heavy industries Aircraft scale scale Most promising applications Mobile applications Stationary applications Power plants Primary power generation Micro-CHP Drones scale High temperature waste heat recovery scale Micro-CHP Low Integration complexity High The path to market Power plants topping cycle Drones Short Term Long Term Drones Preparing for a new era Why? Challenge in drones: Low energy density of Li-ion battery Solution: Spark Thermionics + Fuel Better autonomy Higher power Potentially cheaper ST Power Generation Unit Fuel Enhancing autonomy Li-ion Battery: 12 mins Fuel + TEC: 60 mins 10 Battery/Fuel tank weight (kg) 9 8 Battery 7 Fuel 6 5 4 3 2 1 0 12:00:00 AM 12:15:00 AM 12:30:00 AM 12:45:00 AM Autonomy (Mins) 1:00:00 AM 1:15:00 AM 1:30:00 AM Market Categories Region Type Application North America Aerial Defense Europe Ground Logistics & Warehouses Asia Marine Agriculture & Field Ops Rest Of World Other Surface Healthcare Entertainment Others Market Categories Region Type Application North America Aerial Defense Europe Ground Logistics & Warehouses Asia Marine Agriculture & Field Ops Rest Of World Other Surface Healthcare Entertainment Others Liberal regulations Energy density (energy/weight) Autonomy How much? Logistics Drone Market Size Projections [US$MM] $20,000 By 2025… $18,000 $16,000 $14,000 $12,000 North America $10,000 Europe $8,000 Asia $6,000 ROW $4,000 1.4 m. units $22 bn. market $2,000 $0 2020 2025 2030 Field Operations Drone Market Size [US$MM] $20,000 $18,000 $16,000 $14,000 $12,000 North America $10,000 Europe $8,000 Asia $6,000 ROW $4,000 $2,000 $0 2020 2025 2030 1.6 m. units $26 bn. market Go-to market strategy Revenue model Joint technology development • Co-develop ST power generation unit with industry drone manufacturers Partnerships • Logistics Risks Industry drone manufacturers Agricultural inspection Surveying & mapping Legislation & Perception • Legislation around drone uses • Potential reluctance of drone manufacturers/users towards using fuel Micro CHP Enhancing distributed energy generation Why? Small: less than 1 MW Micro: less than 5 kW Internal Combustion Engine Efficiency Installed Cost ($/kW) Power Generation Unit Micro turbine ˜30% ˜25% Competitive Fuel Cell Stirling Engine ˜45% ˜25% Efficiency Thermionic CHP *potentially ˜30% $2,000 $3,000 Cost $6,000 Lower $8,000 <$1,000 Scalability 10kW – 5 MW 30 kW – 1 kW – Scalable 250 kW 2 MW <250 kW Any Moving Parts? YES YES NO Fuel No Moving Parts YES NO A $2.5 bn market in 2021 Global small-micro CHP forecast ($million) 12.2% CAGR 3000 Strong growth in the near future 2500 2000 +500 MW in 2021 1500 Capacity forecast for small/micro CHP 1000 500 0 2012 Japan and Germany 2013 2014 2015 Japan 2016 Germany 2017 UK 2018 ROW 2019 2020 2021 Best potential entry countries Go-to-market strategy Revenue model CHP incumbents • Sell thermionic converter to incumbent companies in the industry • Co-develop product with CHP manufacturers Partnerships Risks Current CHP leaders Regulation • Government support: FIT, tax credits, environmental regulation etc. • Spark Spread: Cost of electricity - Cost of fuel Power plant topping cycle Reducing our carbon footprint Why thermionics for power plant topping cycle Problem: High temperature of the combustion Huge constraints on the first blades (moving parts) Need temperature drop before entering the turbine Opportunity: Using thermionics (no moving parts) as a topping cycle to extract some energy and lower the temperature before the turbine Fuel Combustion chamber Compressor Fresh air Turbine Exhaust gases Higher efficiency and Lower CO2 emissions Lower cost A $1,5b/yr market in the US only Cumulative Electric Power Sector Additions AEO2015 Reference case + 140 GW Additional conventional power plants needed in the US by 2040 160 140 120 + 50 TWh/yr GW 100 Additional power generation if thermionics were used as topping cycle for those new plants (+10% efficiency) 80 60 40 + $1.5b/yr 20 Additional revenue for power producers Combined Cycle Combustion Turbine/Diesel Source: Energy Information Administration 2040 2038 2036 2034 2032 2030 2028 2026 2024 2022 2020 2018 2016 2014 2012 0 - 10 million tCO2/yr Avoided CO2 emissions at constant electricity production Go-to-market strategy Revenue model Thermionics units manufacturer • Co-develop product with turbines manufacturers • Sell thermionics units to them Partnerships Risks • Integration • Long time to market • Few very powerful potential clients Gas and steam turbines manufacturers Complexity Path to success Aiming at the right markets at the right time Next Steps Milestone 2017 Prototype 1.0 – 3.0 2020 Prototype 4.0 – 5.0 2023 Pilot Product Funding Partner Goal Grant Prove Features Partnership Create Drone/CHP Prototype Equity / Debt Create commercial Pilot Product Victor Pol-Hervé Gerardo Kayo Mitch Stephanie MBA Candidate MBA Candidate MBA Candidate MBA Candidate MS Mech. Engineering Ph.D. Chemistry