Proposal to be Retained as Fiscal Agent of the

advertisement

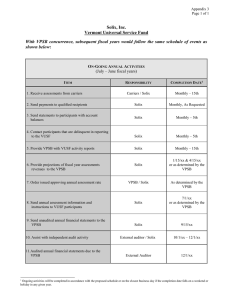

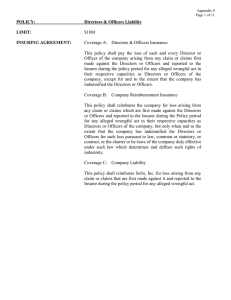

Proposal to be Retained as Fiscal Agent of the Vermont Universal Service Fund April 10, 2006 Proposal to be Retained as Fiscal Agent of the Vermont Universal Service Fund (VUSF) Submitted to: Ms. Cindy Muir Vermont Public Service Board 112 State Street (Fourth floor) Drawer 20 Montpelier, Vermont 05620-2701 From: Solix Inc. President & CEO: John C. Parry Contact For Clarifying Proposal Content Jean Snopkowski Account Manager – Business Development Solix Inc. 100 S. Jefferson Rd., P.O. Box 902 Whippany, NJ 07981 Phone: (973) 581-5247 Fax: (973) 581-7661 Email: jsnopko@solixinc.com Contact For Approving Agreement/Amendment Jack Miller Vice President – Business Development Solix Inc. 100 S. Jefferson Rd., P.O. Box 902 Whippany, NJ 07981 Phone: (973) 581-5300 Fax: (973) 581-7661 Email: jmiller@solixinc.com Proposed Contract Duration: July 1, 2006 through June 30, 2009 Date Submitted: April 10, 2006 TABLE OF CONTENTS SECTION PAGE NO. EXECUTIVE SUMMARY 1 A. STATEMENT OF REQUIREMENTS 5 B. WORK PLAN 6 B.1 START-UP AND IMPLEMENTATION ACTIVITIES 6 B.2 ONGOING ADMINISTRATION ACTIVITIES 6 B.2.1 COLLECTIONS FROM CARRIERS 7 B.2.2 DELINQUENCY PROCEDURES 8 B.2.3 FUND MANAGEMENT 8 B.2.4 FUND DISBURSEMENT 9 C. B.2.5 REPORTS 10 B.2.6 FINANCIAL ACCOUNTING AND AUDITS 11 B.2.7 VUSF CHARGE CALCULATION AND FUND SIZING 13 B.2.8 CUSTOMER SERVICE 13 B.3 CONFIDENTIAL INFORMATION 13 B.4 DISASTER RECOVERY/BUSINESS CONTINUITY 14 B.5 PROBLEM IDENTIFICATION AND RESOLUTION 14 CORPORATE EXPERIENCE 15 C.1 STATE FUND ADMINISTRATION 16 C.2 FINANCIAL CAPABILITY 20 C.3 STAFF EXPERIENCE 20 D. BUDGET 24 E. STATEMENT REGARDING POTENTIAL CONFLICTS OF INTEREST 25 F. FINANCIAL CAPABILITY 26 G. INSURANCE COVERAGE 27 APPENDICES Solix Inc. Proposal to be Retained as Fiscal Agent of the Vermont Universal Service Fund EXECUTIVE SUMMARY Solix Inc. (Solix) is pleased to submit this Proposal to the Vermont Public Service Board (VPSB) to continue serving as the Fiscal Agent of the Vermont Universal Service Fund (VUSF). We hold in high regard our role to support the VPSB’s efforts to maintain affordable rural telephone rates and to assist low-income and physically-challenged residents of Vermont gain access to telecommunications services. Our fundamental strength is the professional experience and dedication of our people. Solix has considerable expertise designing, implementing and managing a wide spectrum of complex governmental and quasi-governmental grant and funds distribution programs at both the federal and state levels. Having served as the Fiscal Agent for the VUSF since its inception in 1994, we are uniquely qualified to continue to administer this program and fully understand the nature and requirements of the VUSF as set forth in the Request for Bids (RFB) issued by the VPSB. Solix will utilize the skills and directly relevant experience of the staff members currently dedicated to the VUSF to meet the operational needs of the VUSF. As demonstrated by our successful and cost effective administration of the VUSF during the past twelve years, we adeptly translate statutes, rules and requirements into user-friendly, functioning systems. Our in-depth understanding of the VUSF procedures and processes, along with our customer-focused and professional interaction with fund participants and the VPSB enabled the Solix VUSF Program Manager and team to administer the VUSF while proactively accomplishing the following initiatives during the 2003 through 2006 contract period: Proposed USF Delinquency Procedures to the VPSB and provided the VPSB with a list of delinquent contributors to the Fund. Developed procedures to promptly and accurately inform the Vermont Department of Public Service (DPS) of changes affecting the status of carriers, e.g., bankruptcies, cessation of business operations in Vermont, address changes, etc. Page 1 of 27 Provided a monthly “Schedule of Net Assets” report to furnish the VPSB with the actual cash balance in the VUSF. Developed a “Quarterly Aging” Report upon request of the VPSB. Created information about telecommunications “Industry Trends” on the Yearly Fund Projection reports for the DPS. At the request of the DPS, provided them with annual Lifeline/Link-up Program information obtained from the Universal Service Administrative Corporation (USAC). Particularly relevant is our experience currently administering fifteen state funding programs as well as managing the funding application and review process for the multi-billion dollar federal Schools & Libraries and Rural Health Care programs. This experience has taught us that successful fund administration requires a multi-disciplinary approach, with demonstrated expertise in the following areas: Telecommunications issues and policy; Forecasting; Fund performance monitoring and reporting; Procedures and systems design; Calculation of assessment factors; Cash and investment management; Billing and collection; Delinquency monitoring and follow-up practices; Information Technology (IT) application development and implementation; Funds distribution; Fund sizing; Review of funding applications eligibility determination; Regulatory support; Impartial/professional carrier and customer relations and communications; Accounting; and Internal and external auditing, including fraud examinations, if necessary. Page 2 of 27 The successful management of a programmatically complex state or local universal service fund requires an administrator with in-depth knowledge and experience coupled with proven and directly-applicable information systems and financial system infrastructures. The background and abilities of our personnel encompass a broad range of demonstrated skill sets, including telecommunications industry experts, financial, regulatory and information systems professionals, internal auditors, and specialists with years of experience in handling the intricacies and challenges of daily operational processing. Solix can draw from its experience, currently administering thirteen state USFs, to expeditiously assist the VPSB with any changes that may occur to the VUSF. For example, the Texas PUC changed the revenue base upon which the Texas USF’s assessments are based to only retail intrastate revenues. Solix quickly instituted this change and notified all 2,200 carriers such that fund operations continued in a seamless manner. As evidenced by our proposed costs, retention of Solix will not only considerably reduce the significant risk normally involved in transitioning fund administration to another vendor, but will also ensure that the VPSB will not incur additional initial set-up/implementation/transition fees. We have developed very effective and efficient working relationships and channels of communication with the VPSB staff, as well as with all the Fund’s participants. Our in-depth understanding of VPSB procedures and processes, along with our customer-focused interaction with fund participants – contributors, recipients and the VPSB – continues to position Solix as the most capable and experienced business partner of the VPSB for this important task. To reiterate, the VPSB will benefit by retaining Solix to administer the VUSF because: We are a highly experienced, impartial, and efficient state fund administrator. We are the recognized leader in the administration and of state funds. We have in-place, knowledgeable and skilled professionals who can be counted upon to expeditiously and professionally manage and operate the VUSF in accordance with the agreed-upon work plan, as evidenced by our history of doing so – without exception since 1994. We only associate with sound, reputable, and experienced financial institutions, such as Mellon Bank. We have proven systems and procedures to administer various types of state funds. Page 3 of 27 Independent auditor reviews of our operations have verified the quality of our procedures, processes, and performance. We are financially sound and properly insured. We adhere to our bid price; we have never asked for an interim increase in fees unless it was justified by a substantial change in the administrator’s duties. We do not advocate positions on behalf of clients before the VPSB or any other state commission, nor are we affiliated with any law or consulting firm that represents clients who may be participants in the VUSF. We take great pride in our work as well as in our reputation as the preeminent firm in the state fund management/administration business. Consequently, Solix is in an exceptional position to continue to meet the requirements of the VUSF. We look forward to maintaining our close partnership with the VPSB in order to continue the success of the VUSF. Page 4 of 27 A. STATEMENT OF REQUIREMENTS In accordance with 30 V.S.A. §§ 7501-7525, the VPSB Letter of Interpretation issued on September 9, 1994, a second letter of interpretation issued in 1999 and other relevant statues, policies and procedures, Solix will manage the daily operations of the VUSF in an efficient, fair and competitively neutral manner. The VUSF currently supports the Vermont Enhanced 911 Program, the Vermont Telephone Lifeline Program, and the Telecommunications Relay Service program, including the Telecommunications Equipment Grant Program. Solix understands the managerial responsibilities of the VUSF Fiscal Agent to include: Accurately calculating a sufficient and reasonable projection for the VUSF Charge; Collecting assessments from fund participants; Interacting with participants to provide accurate and timely responses to their inquiries and to neutrally resolve assessment and/or disbursement disputes; Reviewing submitted data for accuracy of calculations and reasonableness; Processing revisions and true-ups of data and payments; Investing undistributed fund balances with an emphasis on safety and liquidity; Disbursing accurate and timely support payments to authorized recipients; Identifying new contributors and performing delinquency procedures to pursue late payers and non-reporters; Regular reporting to the VPSB on fund activity, fund balance and operational issues; Providing prompt, professional and courteous customer service; Creating and maintaining thorough records, databases and operating procedures; Ensuring the physical security and safeguard of proprietary data; Offering experience, expertise and resources to perform audits of fund participants; Satisfying requests for information made by internal and external auditors; and Serving as a knowledgeable resource to the VPSB in its efforts to successfully administer the VUSF. Page 5 of 27 B. WORK PLAN This work plan demonstrates Solix’s understanding of the VUSF program requirements based upon the directly applicable experience of our staff, which has been performing the role of fiscal agent for the VUSF, the criteria set forth in the RFB and the statutes governing the VUSF. 1 Solix will continue to follow all VUSF regulatory activities and will implement any necessary policy and procedural changes in a timely an accurate manner. Our approach and a description of the major tasks involved in the ongoing activities are detailed in this section. Solix will continue to utilize the same personnel already performing the daily operations of the VUSF, therefore, there will be no transition or implementation activities required, nor will there be any potential disruptions or associated costs or risks. Our proposed approach to accomplish the ongoing activities is based upon Solix’s proven method of fund administration, specifically tailored to the particular requirements of, and augmented by our experience with, the VUSF as well as our successful performance of these functions for numerous other state funds. Appendix 2 contains a list of Corporate References who may be contacted regarding confirmation of our exceptional performance in performing administrative duties for other state universal service programs. B.1 START-UP AND IMPLEMENTATION ACTIVITIES The staff has worked closely with the VPSB to manage the administrative duties of the Vermont Universal Service Fund for almost twelve years and therefore, no VUSF implementation activities will be required, nor will any related implementation costs or transition risks be incurred, if Solix is selected as the fiscal agent. As a result, all VUSF operational activities will continue in a manner seamless to both the VPSB and fund participants. B.2 ONGOING ADMINISTRATION ACTIVITIES Solix will continue to perform the collection, disbursement, reporting and other activities for the VUSF subject to the oversight and direction of the VPSB. Appendix 3 contains our proposed VUSF Annual Administration Activity Schedule. Ongoing administrative activities include interfacing 1 30 V.S.A. §§ 7501-7525. Page 6 of 27 and consulting with the VPSB and fund participants, calculating projected annual funding/assessment requirements, billing and collection of fund assessments, interfacing with the financial institution, reviewing contributor remittance worksheets, reviewing requests for and distributing appropriate disbursements, monitoring fund performance, prudently investing the undistributed fund balance and preparing required financial reports and statements. Solix will also fully cooperate with the independent auditor who is chosen and retained by the VPSB to perform an annual audit of the VUSF program. Details of our specific recurring administration functions are as follows: B.2.1 COLLECTIONS FROM CARRIERS Solix will continue to work with the VPSB to maintain a current list of carriers that are subject to the VUSF. This will include at a minimum, reviewing the list of carriers posted on the VPSB website and the Carrier Locator Directory published by the Federal Communications Commission (FCC) on an annual basis. Carriers obligated to contribute will be provided with electronic and/or paper versions of the VUSF remittance worksheets to allow them to self-report and certify revenues and any assessment due to the fund. We will review the carrier worksheets to ensure the completeness of required information as well as the accuracy of calculations and will contact providers whose accounts contain unusual variances in reported revenues or assessments. The capabilities of our collection processing system afford contributors the ability to make their VUSF payments electronically or by check. VUSF participants will continue to remit their payments and worksheets to a secure lock box established specifically for the fund. Solix will make all reasonable efforts to resolve any identified reporting irregularities by fund participants and notify the VPSB if, in our judgment, such reasonable efforts fail to substantiate unusual reporting variances. Likewise, we will immediately inform the VPSB if we have reason to believe that any party or entity has submitted false information. In addition, upon receiving notification from the VPSB (or a properly executed certification from a participant) that a company is no longer doing business in Vermont, we will promptly remove that carrier from the active list of entities subject to assessment. Solix has designed secure, Internet-based data collection systems for several State Commissions for use by state fund participants. The systems were designed to further ease the burden on the fund participants by allowing them to electronically submit information via the Internet. Should Page 7 of 27 the VPSB be interested in learning more about the online collection system, Solix will provide additional information and a price proposal for system design and implementation. B.2.2 DELINQUENCY PROCEDURES Solix will assess late payment charges at a rate of 1.5% per month (18% per year), as authorized by the VPSB. Notices of Delinquency will continue to be sent to all delinquent reporters (at the address provided by the contributor) when data and/or payments are 30 days past due. The initial delinquency notice is followed-up with at least one additional attempt to contact the contributor in order to pursue satisfaction of fund reporting requirements. Logs detailing these notices and contacts will be maintained and the VPSB will continue to receive a monthly list of delinquent/noncompliant fund participants. Entities whose delinquencies continue to persist will be sent a certified mailing and non-responders will be referred to the VPSB for a decision regarding further collection and/or enforcement activity. B.2.3 FUND MANAGEMENT Our Treasury group employs a comprehensive program to invest and preserve all undistributed funds in accordance with three primary objectives: safety, liquidity and yield. We have established relationships with several high-profile institutional investment management firms who, under our direction and guidance, invest funds in a variety of instruments including institutional money market accounts, overnight repurchase agreements, short-term government obligations and corporate commercial paper. Only minimal cash resources are maintained in the bank account established for the VUSF while balances await transfer to short-term investments or to cover outstanding disbursements. Our prudent and secure investment program for undistributed fund monies has customarily achieved investment returns equal to or exceeding those of standard money market benchmarks such as the iMoneyNet Institutional Money Market Fund index.2 At least quarterly, our Investment Committee meets to review the performance of all managed funds and evaluates the performance of the managers 2 Our 2005 average earnings for funds managed was 3.06%, which is eighteen (18) basis points better than the IMoneyNet Institutional Money Market Fund average rate (2.88%) during 2005. While these recent earnings results are modest (and are not guarantees of future performance), we strive to obtain maximum security and maximum return on its short-term investments, with optimum liquidity. Appendix 4 provides our Investment Policy. Page 8 of 27 as well as the appropriateness of our existing investment guidelines. Our investment strategy has earned a substantial amount of interest for the VUSF and the fact that this has been accomplished during an extended period of turmoil in the stock market, when many investment values have declined, further exemplifies the quality of the investment approach and the expertise of the individuals involved. Interest earned on the undistributed fund balance, net of investment and banking fees, can be used for purposes such as to offset fund obligations, reduce future funding requirements or as otherwise directed by the VPSB. Solix understands that only the VPSB shall determine the disposition of surplus fund monies. Accordingly, we will continue to report monthly on fund balance and fund activity to the VPSB so that timely decisions regarding the use of surplus funds can be made. Generally, our investment strategy focuses on using investment managers who will manage a portfolio specifically designed for and by our Investment Committee. In accordance with our policy, these portfolios will primarily consist of highly secure fixed income investments with durations of less than twelve months. Our managers are required to continually monitor and analyze market conditions, perform extensive credit research on potential investments, and canvass the market to determine the nature and duration of the most appropriate investments to be included in the portfolio. The overall goal for any fund that we manage/administer, is to provide maximum yield without compromising the safety of the investment principal. B.2.4 FUND DISBURSEMENT A fundamental tenet of our fund management policy is to operate on a payment-after-collection basis, using some “over funding” to minimize the possibility of a fund shortfall. Therefore, if our data analyses project a potential fund shortfall, or if fund disbursements are forecast to exceed receipts for a given period, we will promptly advise the VPSB so that it may consider appropriate alternative actions. We have developed proven disbursement systems that support the timely and accurate processing of more than 45,000 programmatic disbursements each year, exceeding $4 billion in annual payments. We utilize these systems for the disbursement of funds to eligible recipients designated to receive VUSF support. The disbursement systems also allow recipients several options for receipt of their payments, including the issuance of checks or electronic transfer of funds directly to a designated depository account. Solix will continue to work directly with VUSF recipients to deliver payments via their preferred method of receipt. Page 9 of 27 Solix will disburse funds to eligible VUSF recipients only upon receipt of properly completed and authorized requests. The staff will review monthly disbursement requests submitted by the recipient carriers/agencies in order to ensure that the requestor is properly authorized and to verify the accuracy of calculations. Internal processing of disbursements requires three levels of managerial review and approval prior to release. In order to ensure the integrity of our disbursement processes, as well as to provide proper control over the billions of dollars in cash flow managed, our disbursements systems are subject to periodic reviews by both internal and external auditors. The reviews of our systems and processes have confirmed that we provide substantial levels of internal control, including appropriate segregation of duties, thereby providing the VUSF assurance as to the accuracy and timeliness of disbursements to eligible recipients. In addition, only authorized personnel with appropriate executive oversight and approval have access to our systems or the ability to initiate disbursements from the funds administered by Solix. B.2.5 REPORTS A VUSF monthly activity report will continue to be provided to the VPSB. A sample VUSF monthly activity report is included in Appendix 5 to demonstrate the standard informational reports delivered to the VPSB to track revenue, disbursements and fund balance. This activity report summarizes fund assessments and disbursements (both current month and cumulative fiscal year results), fund balance, programmatic disbursements by recipient and delinquent reporters. We will continue to deliver these regular monthly reports and quickly respond to VPSB requests for additional periodic reports and ad-hoc analyses. In addition, on a quarterly basis Solix will deliver to the VPSB an aging report listing all carrier balances for the fund. Further, on an annual basis, we will provide unaudited statements of net assets, statements of revenues, expenses and fund net assets, and statements of cash flows for the fiscal year. Additional reports will be provided as mutually agreed upon between the VPSB and Solix. Page 10 of 27 B.2.6 FINANCIAL ACCOUNTING AND AUDITS Solix staff is highly experienced in the use of accounting programs and databases. Our stateof-the-art, integrated financial system covering general ledger, accounts receivable, accounts payable, and billing functions currently handles full accounting and reporting functions for 15 distinct business units, and maintains records for more than 6,000 vendors and 22,000 customers. Accounts Receivable, Accounts Payable, Treasury, and General Accounting staff are able to access appropriate areas of the system to process transactions and to produce a variety of financial reports, including the VUSF income statement, balance sheet, statement of cash flows, as well as customer aging and cash analysis reports. VUSF financial data will remain separate and distinct from all other financial data, and will be maintained with strict adherence to GAAP. Solix currently uses Oracle’s PeopleSoft Enterprise applications, which were specifically designed to meet the increased demands of complex business requirements. The PeopleSoft system is a fully functional financial package that is easily integrated with web-based systems and “home grown” applications. The most current version includes enhanced cash management, expense, time tracking, and payables functionality. PeopleSoft can be customized to meet varied customer requirements, and it supports a broad choice of technology infrastructure. Regulators and/or state laws often require periodic audits of state funds, as has been the case with the annual external audits of the VUSF performed during our staff’s initial tenure. Complete and accurate maintenance of financial reports and records, as well as adherence to generally accepted accounting principles, make such audits a welcome reflection of quality fund management. The successful administration of the VUSF has been well documented in the external audits performed. All annual financial audits have resulted in unqualified opinions and the audit of our controls and procedures was issued with no significant findings, further attesting to the quality and adequacy of our in-place procedures and processes. Solix anticipates that the VPSB will continue to periodically request an external audit of the administrator's operations. Accordingly, the pricing for this proposal includes the time and materials required for Solix to support one external audit per contract year. Solix will fully cooperate with VPSB’s approved auditor to provide the data and information reasonably required to support such audit activities. The fees and other charges billed by the external auditors are not included in our contract price and, as in the past, will be billed to the VUSF following VPSB review and approval. Solix Page 11 of 27 estimates that the fees charged to the VUSF for the external audits will total approximately $23,000 $25,000 per year. Additionally, on our own initiative, we periodically perform internal reviews of state fund processes and procedures to ensure the integrity and adequacy of our internal controls. Solix’s internal auditor, who is entirely independent of and organizationally separate from the State USF group, will continue to perform these internal reviews. To the extent that the VPSB may require additional audits of our operations, we will cooperate fully and reserve the right to request compensation at our daily rates plus expenses should the level of Solix’s involvement exceed a reasonable level. As authorized by the VPSB, Solix can perform carrier reviews to ensure compliance with VUSF rules, regulations, and procedures. While all participants’ revenue and assessment data is subject to scrutiny each month as the result of state-specific edits built into our databases, Solix recommends establishing a procedure for a more in depth review of a predetermined number of carriers on an annual basis. Carriers can be selected randomly, at the request of Solix or VPSB, or based on a combination of both approaches. Solix staff can review and/or monitor carrier documentation supplied either by the carrier or the VPSB, or obtained through publicly available resources. Documentation reviewed should be relevant to information needed in order to validate carriers’ reported revenues, paid contributions, and compliance with Vermont USF statutes. Documents required for carrier reviews may include relevant monthly carrier remittance online worksheets filed with Solix, filed tariffs, a random sample of end-user business and residential bills, annual reports filed with the Commission, company billing summaries, and, if necessary, more detailed financial information, including a Chart of Accounts, revenue totals by type, and details on uncollectibles. Carrier staff should be able to easily obtain the above listed documents and provide copies to Solix for review. Carrier tariffs and end-user bills would be used to validate the company’s compliance with the state-mandated access charge reduction schedule, as well as to help ensure that carriers are not over-recovering their Fund contributions. Carrier financials and annual reports are used to validate that information reported to Solix is consistent with information reported to the VPSB. While on-site reviews are sometimes required due to unique company circumstances or specific requests by the VPSB, the reviews can generally be conducted at our location, a practice that helps contain costs by eliminating travel related expenses. Reviews of VUSF participants, if requested by the VPSB, will be billed at the rates indicated in Appendix 1, Note 1. Page 12 of 27 B.2.7 VUSF CHARGE CALCULATION AND FUND SIZING On an annual basis, we will continue to supply the VPSB with the necessary data to compute the annual VUSF Charge for the following fiscal year. Solix’s efforts related to the development of the annual VUSF Charge are included in our ongoing administration fees. In addition, we will continue to provide the VPSB with recommendations for fund modifications and identification of potential operating efficiencies. B.2.8 CUSTOMER SERVICE As demonstrated by our experience with the VUSF, successful administration of state support programs requires frequent communication between the administrator, VPSB personnel and the entities contributing to and receiving disbursements from the fund. Solix designs and delivers information packages to all fund participants, maintains dedicated on-line information, and provides prompt, professional customer service responses to all telephone and/or written questions and requests for information. We will continue to promptly and thoroughly respond to requests for information from the VPSB. If desired by the VPSB, we can also provide additional information or reports.3 Additionally, Solix will post VUSF reporting forms and instructions on our website (http://www.solixinc.com/content/stfund.htm) to ensure that participants can easily access the required fund information. B.3 CONFIDENTIAL INFORMATION Solix understands the vital importance of protecting the confidentiality of non-public data entrusted to it for the purposes of managing its responsibilities. Proprietary data provided to, used or developed by us in our administration of the VUSF will be given only to the VPSB, or to other parties as directed by the VPSB. Only authorized staff or agents will have access to fund data. As evidenced by our performance in administering the VUSF, we will not permit data to be used in any form, by any other party or unauthorized staff person, for any purpose. The VPSB will have exclusive ownership 3 Expenses for routine reports and analyses are included in the proposal fees. Extraordinary activities including, but not limited to, in-person participation at VPSB proceedings, court activities associated with the duties of the Administrator, participation in lawsuits or collection proceedings as requested and authorized by the VPSB, will be billed at daily rates plus expenses (please see Section D - Budget, Appendix 1, Note 5). Page 13 of 27 and access to any and all data acquired and maintained by Solix for the purpose of administering the VUSF. We are committed to ensuring the confidentiality of all data collected, used and maintained in the course of our administrative duties. We utilize several mechanisms to safeguard proprietary information including: physical and data access controls, signed non-disclosure agreements, contractual agreements and employee education to ensure that data accumulated from individual companies is protected from unauthorized disclosure. We foster employee awareness of confidentiality issues and each individual who works on the VUSF is required to sign a non-disclosure agreement relative to protection of proprietary information (please see Appendix 6 - Non Disclosure Agreement). B.4 DISASTER RECOVERY/BUSINESS CONTINUITY The Corporate Disaster Recovery Plan is predicated upon adherence to a series of documented steps that must be followed should a disaster be declared and that remain in effect until operations are resumed at the affected site(s). This plan ensures that programmatic support services can be quickly recovered and become operational in the event that a disaster disables any component of the operations. The plan identifies critical business functions that need to be performed, the staff required to perform those functions and the operating procedures to be followed, as well as a communication plan and restoration procedures. Our disaster recovery site is located in Atlanta, GA and in the event of a disaster, critical staff will telecommute by accessing this site. All VUSF data stored on our servers is backed up nightly and transmitted to the back-up site in Atlanta. Periodic tests of disaster recovery and business continuity procedures are conducted to ensure that systems and procedures function as intended. B.5 PROBLEM IDENTIFICATION AND RESOLUTION As with any business undertaking, numerous issues and potential problems may arise during the course of accomplishing the myriad of tasks necessary to successfully administer governmental funding programs. Our previous experience in Vermont and in administering numerous other state and federal programs has afforded us exposure to a majority of the potential challenges that may arise. Page 14 of 27 Solix has developed and instituted effective and expedient problem resolution techniques and, even more importantly, the experience necessary to diligently plan and incorporate lessons learned in order to avoid repetitive problems. An ever-increasing risk in today’s business environment is the potential cash flow impact of lost revenues due to the very high rate of bankruptcies in the telecommunications industry, even including multi-billion dollar telecommunications companies. We have developed formal procedures to monitor bankruptcy activity, track company filings (both Chapter 7 and Chapter 11) and file Proof of Claims and other required documentation on behalf of impacted jurisdictions. A potential problem area more specific to state Universal Service programs is regulatory compliance. To this end, Solix has developed procedures to identify potential fund contributors and follow-up with those who may be required to contribute but do not submit information or payments. Although the dollar impact of this non-compliance may be minimal relative to the total fund size, we understand the importance of regulatory compliance requirements, which ensure that all service providers are treated equitably. A related problematic issue is the fact that some contributors dispute their obligation to the VUSF. Solix maintains internally shared documentation to ensure that information relayed to contributors is consistent, comprehensive and accurate. We will work with disputing carriers to fully explain fund requirements, practices and procedures (as well as the potential ramifications of non-compliance) and will forward a copy of all verbal and written correspondence to the VPSB. On the rare occasions that our efforts may be unsuccessful, we will so inform the VPSB for guidance on further action. Solix, at the request of the carrier, will offer oral or written information or clarification regarding 30 V.S.A. §§ 7501-7525, the VPSB Letter of Interpretation issued on September 9, 1994, a second letter of interpretation issued in 1999 and other relevant statues, policies and procedures. Solix will maintain a separate file with all interpretations and will provide the VPSB with copies. Solix may request that the VPSB revise the VUSF Rules or issue further clarification or declaratory ruling as necessary to resolve a carrier’s question. Page 15 of 27 C. CORPORATE EXPERIENCE Solix Inc. ("Solix"), an independent stock corporation, was founded in the year 2000 to pursue program management opportunities on a for-profit basis. The company, which was formerly known as NECA Services, grew out of NECA (National Exchange Carrier Association), a not-for-profit organization created in 1983 at the direction of the Federal Communications Commission (FCC) to support the restructuring of the telecommunications industry. Solix initially operated with few employees of its own, securing most of the resources and skilled personnel necessary to fulfill its contractual obligations through a services agreement with NECA. On July 4, 2004, 220 of NECA's employees were transferred to Solix, including most of the employees who administer state fund programs.4 Likewise, as of this date, 12 of 14 USF and similar programs administered by Solix employees were either under direct contract to Solix from their inception or were transferred from NECA to Solix upon contract renewal. C.1 STATE FUND ADMINISTRATION Solix’s primary strengths are the experience and expertise of its personnel, including professionals skilled in project management, accounting, auditing, information systems design and development, fraud detection and control, government regulation, as well as banking and investment management. These individuals have consistently demonstrated their competencies by successfully implementing and administering numerous support programs at both the state and federal levels during periods of rapid growth and change, and by professionally managing day-to-day operational responsibilities with an attention to detail and quality and without cost overruns. They are thoroughly familiar with the various support programs, laws5, regulations, and accounting requirements associated with the telecommunications industry in general, and state universal service funds in particular. Solix currently administers Universal Service funds and similar funds in 15 states and territories, including Vermont. In Arizona, Connecticut, the District of Columbia, Hawaii, Kansas, Nevada, New Mexico, Oklahoma, Pennsylvania, Puerto Rico, and Vermont, Solix was responsible for 4 As of January 1, 2005, all of the employees who administer state fund programs had been transferred to Solix. Solix's institutional knowledge of telecommunications law includes the federal Telecommunications Act of 1996, including all amendments pertaining to Universal Service. 5 Page 16 of 27 designing, testing, and implementing the procedures and systems necessary to launch the fund. In Texas, Solix developed an online system that allows carriers to enter their data. Possibly the strongest evidence of clients’ satisfaction with our performance is demonstrated by the renewal of their contractual agreements. In addition to Vermont, Arizona, Kansas6, Nevada7, Oklahoma, Pennsylvania, Puerto Rico, and Texas have each renewed, on one or more occasions, their initial agreements with us to act as administrator for their USF program. The Public Utility Commission of Texas (PUCT) gave Solix a strong vote of confidence by retaining us to assist the PUCT in administering one of the largest and most complex state USFs in the nation. Likewise, the Nevada PUC agreed to a two-year contract extension, the Kansas Corporation Commission approved a five-year extension, the Pennsylvania Commission renewed for two years, the Puerto Rico Commission renewed three times, the Arizona Commission renewed (for the third time) for three years, and the District of Columbia renewed for one year. Particularly noteworthy is the fact that the Oklahoma Corporation Commission (OCC) originally planned to retain NECA for only an 18-month period and then transition fund administration responsibilities to its own staff. As a result of the Commission's high level of satisfaction with our performance, the OCC instead renewed its contract with us for another two-year period, and, subsequently, for an additional three years. In addition to the VUSF, the following are summaries of the additional state Universal Service programs and other programs administered by Solix: Arizona Universal Service Program In 1997 Arizona contracted Solix to implement and manage its Universal Service Fund. Arizona subsequently renewed its contract three times. The Arizona USF is funded by more than 300 intrastate telecommunications companies, and provides approximately $1 million per year in High Cost support. California Universal Lifeline Telephone Service Program In October 2005, the California PUC chose Solix to administer its Universal Lifeline Telephone Program (ULTS) which provides discounted basic residential telephone services to low-income households. The program will be operational in July 2006 and we will qualify over 3 million households to receive low-income discounts in 2006. Connecticut Telecommunications Relay Service Fund In August 2002, Sprint/United Management Co. contracted Solix to implement a new funding mechanism and to perform ongoing billing and collections for Connecticut Telecommunications Relay Service. In administering the Fund, Solix collects more than $2.5 million annually from 370 contributors, and distributes the money to eligible recipients. 6 7 Solix administers the Kansas USF on behalf of NECA. Solix administers the Nevada USF on behalf of NECA. Page 17 of 27 District of Columbia Universal Service Trust Fund and Telecommunications Relay Service The District of Columbia Public Service Commission in October 2003 selected Solix to implement and manage the District’s Universal Service Trust Fund (USTF) and administer the Telecommunications Relay Service (TRS). The USTF provides a mechanism to recover from LECs the cost of supporting lifeline service, a telephone service subsidy for low-income customers; and TRS, a telephone transmission service that provides the hearing impaired or speech impaired individuals the ability to engage in telephone communications with non-impaired individuals through a third party who converts speech to text and vice-versa. Solix collects and distributes approximately $1.2 million in USTF funds annually. The DC Commission has also charged Solix with developing performance requirements and criteria for the provision of TRS in the District, to formulate an RFP for a TRS provider, to evaluate proposals from respondents, and to monitor corresponding service levels. Hawaii Telecommunications Relay Service Fund In July 2003, Sprint/United Management Co. contracted Solix to implement a new funding mechanism and to perform the ongoing billing and collection services to fund Telecommunications Relay Service in Hawaii. The Hawaii TRS provides more than $2.0 million annually to support the provision of relay service. Solix collects contributions from over 175 intrastate telecommunications providers and disburses authorized payments as designated by the Hawaii Public Utilities Commission. Kansas Universal Service Fund The Kansas Corporation Commission (KCC) selected NECA to implement and manage the Kansas Universal Service Fund in 1997. Solix now administers the KUSF on behalf of NECA. The Kansas USF receives contributions from over 350 intrastate telecommunications providers and makes approximately 45 monthly disbursements. The KUSF provides $65 million in annual support to four universal service programs including High Cost funding, Lifeline Service to qualified low income consumers, Dual Party Relay Service, Kan-Ed, and specialized telecommunications equipment for persons with physical impediments. Maine Universal Service Fund The Maine Public Utility Commission selected Solix Inc. to administer the Maine Universal Service Fund (MUSF) beginning in July 2005. The MUSF provides over $10 million in High Cost funding that helps keep telephone rates affordable. Solix collects from more than 100 telecommunications service providers and disburses funds to approximately 16 authorized recipients each quarter. Maine Telecommunications Education Access Fund The Maine Public Utility Commission selected Solix to administer the Maine Telecommunications Education Access Fund (MTEAF) beginning July 2005. The MTEAF offers schools and libraries across the state affordable access to information services. Each month, Solix collects from more than 100 contributors and makes approximately 100 disbursements, totaling $4.5 million annually. Page 18 of 27 New Mexico Universal Service Fund The New Mexico Public Regulation Commission selected Solix to administer the New Mexico Universal Service Fund (NMUSF) beginning in April 2006. The NMUSF is funded by more than 100 carriers and provides approximately $21.5 million in annual support to 14 authorized recipients. New Mexico is one of the first funds administered by Solix to use our newly developed online submission process allowing carriers to replace monthly paper filings with browser-based data entry. Nevada Universal Service Fund The Public Utilities Commission of Nevada contracted with NECA to implement and administer the Nevada Universal Service Fund in 1999, and Solix now administers the Fund on behalf of NECA. The NUSF provides funding for the state's High Cost program. As NUSF Administrator, Solix is responsible for collecting and disbursing approximately $500,000 per year on a quarterly basis. Solix also reviews and approves petitions from carriers for NUSF support. Oklahoma Universal Service Fund The Oklahoma Corporation Commission (OCC) selected NECA to implement and administer the Oklahoma Universal Service Fund in 1998. The Oklahoma USF is funded by more than 500 intrastate telecommunications providers to provide approximately $15 million annually in Universal Service support. Oregon Universal Service Fund Oregon contracted with Solix in 2005 to serve as the Oregon Universal Service Fund Administrator. The OUSF provides $48 million in annual support from 500 intrastate telecommunications companies to 30 High Cost providers. Pennsylvania Universal Service Fund The Pennsylvania Public Utility Commission contracted with NECA to serve as the Pennsylvania Universal Service Fund Administrator, following a period during which the company served as the Interim Pennsylvania USF Administrator. Pennsylvania has recently renewed the Fund contract, this time with Solix. The Pennsylvania USF provides $34 million in annual support to 32 small telephone companies. The fund is supported by contributions from more than 400 intrastate telecommunications service providers. Puerto Rico Universal Service Fund The Puerto Rico Telecommunications Regulatory Board contracted NECA to implement and administer the newly established Puerto Rico Universal Service Fund in May 2000, subsequently renewing the contract with Solix. The Puerto Rico USF was established to guarantee all citizens of Puerto Rico telecommunications service at a fair, reasonable, and affordable price. The PUSF provides $5 million in annual funding for Telecommunications Relay Services, Isolated Communities support, Lifeline, and other programs. The fund became effective in July 2001 and currently involves nearly 40 intra-island telecommunications providers. Page 19 of 27 Texas Universal Service Fund NECA was selected by the Public Utility Commission of Texas in 1998 to administer the Texas Universal Service Fund. In August 2002, after a competitive bidding process, the Commission selected Solix to continue administering the fund through 2006. The Texas USF is funded through monthly contributions from approximately 2,200 intrastate telecommunications service providers, including hotels and motels. The total annual size of the Texas USF is approximately $585 million. Solix’s responsibilities include managing several Universal Service programs, including High Cost support, small and rural Incumbent Local Exchange Carrier support, Lifeline, Linkup, Telecommunications Relay Services, Intralata Support, and a Specialized Equipment Distribution voucher program. C.2 FINANCIAL CAPABILITY Solix has been profitable from its first year of operations and remains so today. Solix has no long-term debt and maintains an unrestricted cash and short-term investment balance of between $5 million and $10 million. Solix’s year-end gross revenues for fiscal year 2005 were approximately $49 million. Solix's 2005 audited financial statements are included in Appendix 10. C.3 STAFF EXPERIENCE Solix's organizational structure is designed to be flexible and totally responsive to our clients, while achieving all objectives on time and within cost parameters. This structure fosters first-class performance, schedule adherence, and cost-effective use of resources through clearly defined duties and responsibilities, short and direct reporting lines to senior management, and proper management span of control. Solix proposes the following persons, all located in Whippany, New Jersey, to continue to carry out our responsibilities as VUSF Fiscal Agent. Solix will not substitute any personnel assigned to the VUSF without the prior approve of the VPSB. Staff resumes are contained in Appendix 8. Overall managerial direction and supervision of VUSF operations will be the responsibility of John H. Donovan III, Director of State Program and Product Operations. Mr. Donovan, who has worked at Solix since 2001, is responsible for overall direction and coordination of all state program operations. His career spans more than 30 years in the telecommunications industry, most of which was spent in key regulatory and marketing positions with AT&T and NYNEX. Mr. Donovan holds a B.S. in Economics from Boston College and an M.S. in Finance from Fairfield University. Lori Tasca, who has been with Solix for more than 7 years, reports directly to Mr. Donovan and will continue to serve as the VUSF Program Manager. Ms. Tasca has been performing the VUSF managerial duties since being promoted to this position in August 2005. Prior to her promotion, she Page 20 of 27 performed the VUSF desk operations. Lori has experience managing various state USFs, including those of Arizona, District of Columbia, Oklahoma, Oregon, and Texas. Ms. Tasca’s prior experience includes database management, data analysis, customer service and billing and collection procedures. She will continue to act as the primary point of contact with the VPSB, Vermont telecommunication carriers, and other interested parties. Ms. Tasca holds a B.A. of Arts degree from Montclair State University. Tim Devore, Associate Manager, will continue to perform VUSF desk operations, including interacting with participants to explain and ensure the satisfaction of fund requirements, processing carrier assessments, and preparing monthly reports and analysis. Tim works under the direct supervision of Ms. Tasca and has been with the State USF team for almost two years, with responsibility for database management, data analysis, customer service, and billing and collection procedures for various state USF programs. Tim has experience administering several other USFs. A Solix Data Analyst reporting to Tim Devore also will be assigned to the VUSF. Solix's Chief Financial Officer is Carol Kenner, CPA. Prior to joining Solix in 1998, Ms. Kenner worked for Alive Hospice, Inc., for three years as Director of Finance. Ms. Kenner has overseen accounting activities for all state fund programs, including the VUSF, since 1998. Ms. Kenner, a Certified Public Accountant, holds a B.A. in Economics from Tufts University and an M.S. in Accounting from New York University. Under the direction of Ms. Kenner, Monique Robinson, CPA, Director of General Accounting and Revenue Operations, will oversee the daily treasury, cash management, accounts receivable, risk management, all general accounting and financial reporting functions for the VUSF. Ms. Robinson has worked at Solix since 1999 and is responsible for daily treasury operations, including financial institution reconciliation functions, cash forecasting, and fund disbursement processing, and she actively monitors fund cash flows and ensures that undistributed funds are invested in accordance with our Investment Guidelines. Ms. Robinson has extensive experience in cash management operations, such as cash forecasting, money transfer, financial institution balance reporting, and general accounting. Ms. Robinson also has oversight of accounts receivable, risk management, all general accounting and financial reporting functions, general ledger activity, the generation of financial statements, all tax and accounting research, and the operation of our integrated financial system. Ms. Robinson is a Certified Public Accountant, and holds a B.S. in Accounting from Rutgers University and an M.A. in Mathematics Education from Kean University. Page 21 of 27 Under the direction of Ms. Kenner, Donna Casey, Director of Expense Operations, will oversee the accounts payable and disaster recovery operations for the VUSF. Ms. Casey has more than 25 years of experience in these areas, 20 of them with Solix. Ms. Casey has managed the activity for state fund program management, which includes VUSF general accounting and financial reporting functions, since 2001. From January 2000 to 2005, Ms. Casey managed various state USFs and other state programs, including the Arkansas USF, Arkansas Extension of Telecommunications Facilities Fund, Arizona USF, District of Columbia USF, Puerto Rico USF, Oklahoma USF, Oregon USF, Texas USF, Vermont USF, and the Vermont Energy Efficiency Utility Fund. Ms. Casey holds an A.S. in Business Administration from County College of Morris, and is currently pursuing a B.A. in Business Administration – Accounting at the College of St. Elizabeth. Under the direction of Ms. Robinson, Kathy Compton, Financial Reporting Manager, is responsible for preparing monthly and annual financial statements, processing and posting monthly journal entries, reviewing and balancing sheet reconciliations, and preparing analysis and other supporting schedule for auditors. Ms. Compton, who joined Solix in 1998, brings to the VUSF more than 12 years experience and holds an A.A.S. in Early Childhood Education from Bergen Community College and a B.A. in Accounting from William Paterson University, and she is currently working towards an M.S. in Management from College of Saint Elizabeth. Under the direction of Ms. Casey, Susan Kenny, Accounts Payable and Purchasing Manager, is responsible for the daily disbursements of payments for State Program Operations, Billing and Collections, and Product Operations. Ms. Kenny maintains vendor files and confidential bank information, and oversees all purchasing functions. Ms. Kenny holds a B.S. in Business from Kean University and an A.S. from County College of Morris in Business Administration. Ms. Kenny, who joined Solix in 1998, brings more than 20 years of financial experience to the VUSF. Under the direction of Ms. Robinson, Karin Benson, Billing and Collections Manager, is responsible for all daily billing, collection, and accounts receivable activity for State Funds, Billing and Collection Operations, and other lines of business. Ms. Benson is also responsible for coordinating and managing the flow of financial information within the Treasury, General Accounting, and B&C departments, as well as managing automated cash receipt lockbox interfaces for all programs. Ms. Benson, who joined Solix in 1994, has more than 12 years of experience in the finance and holds an A.S. in Biology from Union County College. Under the direction of Ms. Benson, Jose Monje, Accounts Receivable Specialist, is responsible Page 22 of 27 for daily cash applications, debits and credits, preparing invoice and statement applications, making journal entries for billing entities, and preparing bank transfers. Mr. Monje, who joined Solix in 2001, brings more than four years experience to the VUSF. He has a Certificate in Computer Hardware form Passaic Institute of Technology. Under the direction of Ms. Kenner, John Bochicchio, Senior Treasury Manager, is responsible for daily treasury operations, including financial institution reconciliation functions, cash forecasting, and fund disbursement processing. Mr. Bochicchio, who joined Solix in 2005, has managed the cash management operations for all state fund programs. Mr. Bochicchio has extensive experience in cash management operations, such as cash forecasting, money transfer, financial institution balance reporting, and general accounting. Mr. Bochicchio, who holds a B.S. in Accounting from Bloomsburg University and an M.B.A. from Farleigh Dickinson University, actively monitors fund cash flows and ensures that undistributed funds are invested in accordance with our investment guidelines. Under the direction of Mr. Bochicchio, Vincent Jarvis, Cash Management Associate Manager, is responsible for all daily cash balance reporting, transmittal of wire information, and reconciling ACH transactions for Billing and Collection, General Accounting, and State Program Operations. Mr. Jarvis, who joined Solix in 2000, has more than 20 years of experience in finance and accounting and holds an A.S. in Accounting from University of Guyana, and a B.S. in Accounting from Long Island University. Page 23 of 27 D. BUDGET Based upon the information provided by the VPSB in the Request for Bids, as well as our experience in administering the VUSF, we assume that we will continue to interact with approximately 400 active fund participants, while making monthly payments to an average of 15 authorized recipients. Solix reserves the right to request a corresponding modification of the proposed fees if the actual number of transactions significantly exceeds these assumptions. Ongoing administrative and additional VPSB-approved fees will be deducted from the VUSF balance on a monthly basis before any other disbursements are made from the fund. The monthly financial reports furnished to the VPSB will continue to itemize all pre-approved payments made to Solix. In order to manage the growth in the complexity and number of transactions for the VUSF over the past twelve years, our staff has employed a program of continually identifying and implementing operating efficiencies. As a result, we have never requested an increase to our agreed-upon fees and to the contrary, Solix proposes a reduction to the fees for the contract period of July 2006 through June 2009. Appendix 1 details Solix’s fees for the ongoing administration activities for the VUSF, as already outline in Section B, for each year of the contract period. In summary, our proposed annual administration fees for July 2006-June 2007 contract period represent approximately a 20% decrease from the July 2005-June 2006 contract period. Solix’s administration fees in years two and three of the contract period include a modest cost of living adjustment of only 3% per year. Solix’s proposed fees account for all supply-related expenses including software/media, telephone, mail/shipping expenses, printing and copying fees. The pricing also includes travel expenses for one person-trip to Montpelier, VT per fiscal year. Our pricing does not, however, include extraordinary legal fees or non-routine administrative expenses that may be authorized by the VPSB. External audit fees, if any, will be billed to the VUSF separate from Solix’s administrative fees. As we have done in the past, we will continue to partner with the VPSB to ensure that our costs of administration are reflective of the work requirements and we will mutually address future modifications to our administrative role in the same manner. Page 24 of 27 E. STATEMENT REGARDING POTENTIAL CONFLICTS OF INTEREST There are no past or present relationships between Solix, or any one of its officers, directors, principals, agents, proposed subcontractors or employees that present a conflict of interest. In addition, Solix will ensure that no future, actual or perceived conflicts or interest occur. The following relationships are being described in the interest of full disclosure, even though they do not present an appearance of conflict. Solix, on behalf of certain Vermont local exchange carriers, acts as their agent to provide billing and collection services for interexchange carriers. Solix may also sell various services and products to telecommunications service providers, some of whom may be located in Vermont. As an example, Solix is facilitating the provision of Directory Assistance service to telephone companies around the country through Excell Services, Inc., located in Lubbock, Texas, who will provide the necessary call center operations. Page 25 of 27 F. FINANCIAL CAPABILITY Incorporated in the State of Delaware on July 1, 2000, Solix is a privately held, for-profit corporation that operates in a non-regulated environment (please see Appendix 10 for Solix’s 2005 audited financial statements). Solix completed its initial private equity financing arrangement in December 2000, raising $7.5 million through investments from 188 shareholders. No one shareholder owns more than 7.5% of the outstanding shares, as restricted by the corporate certificate of authority. A stand-alone and self-supporting entity, Solix has been profitable from its first year of operations and remains so today. Page 26 of 27 G. INSURANCE COVERAGE Solix is covered by a comprehensive insurance portfolio and maintains levels of insurance that are in full compliance with applicable state laws. This protection extends to all Solix functions and would cover activities of Solix staff in administering the VUSF. All insurance companies providing coverage to Solix are A-rated by Best's Key Rating Guide. Appendix 9 provides detailed descriptions of our insurance policies, including the specific coverage amounts. Page 27 of 27