M F S

advertisement

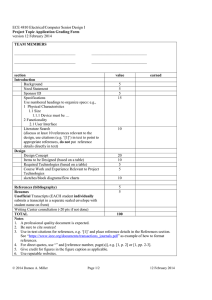

MILLER FINANCIAL SERVICES, LLC Bill Miller, Principal 7 Lupine Lane South Burlington, VT 05403 802-233-3370 • bmiller357@att.net October 24, 2005 RESPONSE TO REQUEST FOR PROPOSALS FOR A FISCAL AGENT ISSUED BY THE STATE OF VERMONT PUBLIC SERVICE BOARD 1 MILLER FINANCIAL SERVICES, LLC Bill Miller, Principal 7 Lupine Lane South Burlington, VT 05403 802-233-3370 • bmiller357@att.net October 24, 2005 Cynthia Muir, Business Manager Vermont Public Service Board 112 State Street, Drawer 20 Montpelier, VT 05620-2701 In re: Requests for Proposals for a Fiscal Agent, dated September 30, 2005 Dear Ms. Muir: This proposal is in response to the Request for Proposals (RFP) referenced above. Please find attached (per Section III of RFP): Project Approach Related Experience Staff Qualifications References Business Organization Cost Proposal By this transmittal letter, I certify that Miller Financial Services, LLC, accepts the standard state contract provisions, as well as the terms, conditions, and stipulated administrative requirements in the RFP. I also commit that Miller Financial Services, LLC, if selected, shall perform the duties outlined in the RFP from January 1, 2006, through December 31, 2008. The name and address of my company is per the letterhead. I also certify that Miller Financial Services, LLC, is independent of the Energy Efficiency Utility and of all distribution utilities and related parties. The total bid amount for the projected scope of work, including 8 hours per month, travel to Montpelier once during the contract period, hardware, software, insurances, bank fees, and other administrative costs is $55,550. The company contact for questions regarding this proposal is myself, Bill Miller. My telephone number (cell) is 802-233-3370; my fax number is 802-864-4009; and my email address is bmiller357@att.net. 2 I strongly support the board’s service to the state through this program, and I believe that my background and qualifications can ensure accurate and timely tracking of the program’s funding, as well as cooperative functional relations with all interested parties. I look forward to talking with you. Sincerely, Bill Miller MILLER FINANCIAL SERVICES, LLC Response to Request for Proposals for a Fiscal Agent 3 October 24, 2005 PROJECT APPROACH Miller Financial Services, LLC, proposes to take the following approach to the project: Accounting method shall be on an accrual basis using fund-accounting methods, replicating and maintaining the consistency in the work already done in accounting for program funds. Receivables and payables, revenue and expenses shall be recognized as historically done by NECA Services, Inc., for the Fiscal Year as defined for Vermont Energy Efficiency Utility contribution period (which is the calendar year, per 2004 Remittance Worksheet Instructions on the NECA Services website). (See Section III.B. of RFP.) Accounting software shall be QuickBooks, 2005 Premier edition. The various distribution utilities (DUs) shall be categorized using the “Class” feature in QuickBooks, which will allow for sub-classes to track Burlington Electric Department separately from all other DUs. (See Section III.B. of RFP.) The financial reports given as examples in the RFP shall be easily generated, either directly from QuickBooks using account and class filters, or by the simple export feature into the Excel spreadsheet program; all formats of financial reports shall remain the same except as requested by the Public Service Board (PSB). (See Section III.B. of RFP.) Hardware shall be the existing laptop used by Miller Financial Services, LLC. It is a 17” wide screen Toshiba Satellite with 80-gigabyte hard drive and 3-gigahertz Pentium 4 CPU running Windows XP and Office 2003. (See Section III.B. of RFP.) Weekly backup shall be made to the existing Kanguru 250-gigabyte external hard drive in service at Miller Financial Services, LLC, utilizing both a “ghost” backup (the whole hard drive in completely restorable form) with four generations of total hard drive contents, plus a weekly QuickBooks archive backup. The external hard drive shall be stored off-site in a bank’s safe deposit box except when actually used for backup. (See Section III.B. of RFP.) Accounting work shall be done in South Burlington at company offices. The principal shall perform all accounting work unless specifically approved in writing by the PSB. Miller Financial Services, LLC, is also currently engaged in Montpelier at the Vermont Humanities Council, and in Northfield at Wall/Goldfinger, Inc., which will make physical access to several DUs or to the PSB or Department of Public Service (DPS) or Energy Efficiency Utility (EEU) quite simple in most instances. (See Section II of RFP.) A locally owned Vermont bank shall be used to receive and disburse funds. The bank shall provide a mature lockbox service with sufficiently secure Internet access (using at least 128-bit encryption and other comparable security) to all of the account features required by the Fiscal Agent (FA). DUs shall either use the existing Remittance Forms provided by NECA Services (updated to MILLER FINANCIAL SERVICES, LLC Response to Request for Proposals for a Fiscal Agent 4 October 24, 2005 reflect new banking and FA support relationships), or new forms which shall be designed per changes in legislation (Act 61) in cooperation with the PSB, the DPS, and the EEU. (See Section I.D. of RFP.) Transition to the new bank and to the new FA support shall be accomplished on a timely basis by direct meetings of the principal of Miller Financial Services, LLC, with each of the DUs’ accounts payable (AP) staff and other interested staff; AP staff shall be provided with new remittance forms and new instructions for using the forms well prior to March 23, 2006, the date on which remittances for the new year should be due (assuming no change in due dates). Remittance Forms and Instructions for Remittance Forms shall be available to DUs either at the Miller Financial Services, LLC, website, or by fax, email (as PDF forms), or paper. Procedures for determining when a late payment shall be reported to the PSB on a Report of Delinquent / Non-Compliant Contributor form shall either be according to past practice, or improved, if there has been a lack of communication or clarity. (This is not to imply that there has been any lack of communication or clarity, but simply to offer the service of improving in this regard if required.) Again, the proximity of Miller Financial Services, LLC, to many of the DUs should facilitate face-to-face meetings to reconcile issues related to late payments. (See Section II.A. of RFP.) Funds collected shall be invested to maximize security, liquidity, and yield. Miller Financial Services, LLC, plans to maintain an FDIC-insured operating account of no more than $100,000, utilizing a sweep feature into an interest-earning account. Funds in excess of $100,000 shall be transferred daily to an account offering higher interest and reasonable liquidity, but no loss of principal. (For example, a local bank recently offered a CD account with a 3.5% interest rate, with weekly unlimited withdrawals.) Transfers back to the operating account to support monthly check runs shall be accomplished either electronically or by paper check drafts on a timely basis. (See Section II.B. of RFP.) Disbursements of funds shall be as authorized by the RFP and any related documents, on a timely basis (monthly, per the RFP), and shall be reconciled to bank statements on a timely basis each month. Procedures shall be followed as in the past, or modified as necessary, for issuing pro-rata or proportionate payments when cash available is insufficient to meet immediate demands. (See Section II.C. of RFP.) Funds collected and disbursed shall be accounted for in such a way as to enable rapid, timely generation of the sample reports included in the RFP, including the reports due in September of each year to the DPS, PSB, and Contract Administrator (CA) for the purpose of establishing rates for the following EEC year. (See Section II.E. of RFP.) Miller Financial Services, LLC, shall procure an annual audit of its procedures and financial reports; the cost of this audit is not included in this proposal, per RFP Section II.F. (footnote), and Section III.G. Copies of the audit shall be provided as described in Section II.F. of the RFP. (See Section II.F. of RFP.) MILLER FINANCIAL SERVICES, LLC Response to Request for Proposals for a Fiscal Agent 5 October 24, 2005 Customer-specific and competitively sensitive information shall be segregated from the set of information that can be distributed to DUs or other entities that might gain competitive advantage from such information. Existing policies as to the level of aggregate information that is provided to DUs shall be reviewed to determine the potential for analysts to estimate the cost or revenue structure at competitive entities, and thus gain an advantage. Most likely, existing policies provide adequate safeguards. Miller Financial Services, LLC, shall maintain a strict boundary between information that can be distributed to DUs and other competitive entities, and information that can be distributed to the PSB, DPS, and CA. This shall be accomplished through the computer file structure at Miller Financial Services, LLC. Files aggregated for distribution to DUs shall be held separately from files for distribution to the PSB, DPS, and CA. In addition, if necessary, there shall be an authorized individual at each DU and other competitive entity who shall be authorized to receive information; paper documents shall be mailed to this individual marked “Confidential,” and emails shall be addressed to this individual alone. Similarly, information given in person or over the telephone shall be given only to the authorized individual at each DU. (See Section II.G. of RFP.) Miller Financial Services, LLC, shall coordinate with the CA as needed throughout the project as defined in Section II.H. of the RFP, and shall provide such other reports, policies, and procedures as may be required from time to time at a minimum as described in Section II.I. of the RFP. Miller Financial Services, LLC, shall review existing policies as to refunds and credits, and shall either accept them and operate on the same basis, or propose improvements if appropriate. (See Section II.H. of RFP.) Unit data (kWh, kW, etc.) from DUs shall be tracked in an appropriate database depending on the volume of data. Every effort shall be made to retain consistency with prior data storage; however, if a new system is required due to increased data volume, Miller Financial Services, LLC, is capable of transferring existing data to a new system (e.g., transferring to Access from Excel), and creating reports that demonstrate both consistency with prior reports, and faster turnaround at higher data volumes with the same (or new) reports. (See Section II.H. of RFP.) Based on the estimate of 8 hours per month, it must be assumed that most of the difficult reconciliations of DU remittances have been accomplished over the past five years, and that barring major changes in methodologies used to calculate the Energy Efficiency Charge (EEC) or unassisted staff changes at the DUs, frequent, major efforts to assist DUs in reconciling their statements will not be necessary. Miller Financial Services, LLC, will of course be available to assist in these efforts as necessary; time incurred above 8 hours per month will be billed without overtime at the simple quoted hourly rate contained in the Cost Proposal section, per Section II.K of the RFP. Miller Financial Services, LLC, shall meet at least once with the PSB in Montpelier during the contract period, which shall run from January 1, 2006, through December 31, 2008, per Sections II.J and K of the RFP. All work and property purchased with state funds under this contract shall be the property of the state of Vermont, per Section II.L. of the RFP. MILLER FINANCIAL SERVICES, LLC Response to Request for Proposals for a Fiscal Agent 6 October 24, 2005 Prior to February 20 of each year, DUs may submit an invoice for uncollectible amounts of the prior year’s EEC to the CA with amounts calculated in accord with Section 5.304(C) of PSB Rule 5.300, except that each DU shall substitute its actual uncollectible amounts for the estimates in the 5.304(C) calculation. On or before March 1 of each calendar year, Miller Financial Services, LLC, shall pay each DU that submitted an invoice the total EEC uncollectible amount for that DU’s service territory in the prior calendar year, subject to the “Guidelines for Disbursements from EE Fund” adopted by PSB as part of its oversight of the FA, as amended by the PSB. (See Section 5.310(A) of Rule 5.300.) Miller Financial Services, LLC, shall document all procedures relating to FA duties so that a successor or temporary, substitute FA shall be able to perform all required FA duties on a timely and accurate basis. To perform the tasks of the FA on an emergency basis if Mr. Miller becomes temporarily unable to perform them, Miller Financial Services, LLC, shall contract with and train a local, reputable CPA firm to carry out the duties of FA for up to 3 months if necessary. If Mr. Miller is unable to perform the FA duties for longer than 3 months, the PSB shall be contractually free either to transfer the FA contract directly to the backup CPA firm, or to conduct a new search for an FA. MILLER FINANCIAL SERVICES, LLC Response to Request for Proposals for a Fiscal Agent 7 October 24, 2005 RELATED EXPERIENCE Bill Miller of Miller Financial Services, LLC, has extensive experience as a leader of finance and administrative departments. His principal strengths are a collaborative style and the ability to create targeted financial reports that provide a solid knowledge base for management decisions. Staying connected to clients and other stakeholders has enabled him to advance the mission of each organization he has worked with. Mr. Miller has wide experience in accounting and financial analysis. He has tracked costs for multimillion dollar grant projects using restricted funds (for example, from the National Science Foundation). He has developed applications in Excel, Access, and other computer programs, saving substantial analytical and operational time. He has structured banking relationships that have included cash management, lines of credit, and portfolios of long- and short-term investments. Mr. Miller currently monitors the bank finances of two clients on a daily basis over the Internet, to ensure that cash balances are adequate for projected needs, and to avoid overdraft fees. He transfers funds as necessary to maximize return (within completely safe savings accounts) and minimize cost. As an example of his energy-related analytical background, Mr. Miller was asked to compare energy costs before and after installation of a co-generational natural gas-fired engine at the (nonprofit). Mr. Miller performed the analyses several times from 2002-2004, and finally (with a new Executive Director at the nonprofit) met with executives and analysts at the (energy utility), and helped provide the factual basis for negotiation of a settlement of several issues. In 2003, Mr. Miller was brought in to analyze an outsourced accounting situation at the (nonprofit). He interviewed the managers and directors of the organization, recommended bringing the accounting function in-house with new software, and was asked to stay on and help ensure the progress of the implementation, even in the midst of a very tight budget. The conversion was successful, and Mr. Miller has aided in establishing new banking relationships as well. Mr. Miller has been an active and avid supporter of energy-saving projects; he switched lighting at the (nonprofit) in the early 1990s using a low-interest loan from Burlington Electric Department. He has attended several energy-related conferences and symposia over the past decade. In addition, Mr. Miller has worked with (person 1); (person 2); and (organization), on a challenge grant to improve energy efficiency at the new Montpelier home of the (nonprofit). The (nonprofit) eventually selected several projects which will decisively reduce energy consumption and increase staff comfort at the new office. The prime advantage that Miller Financial Services, LLC, brings to this project is close personal support: Mr. Miller is committed to, and capable of, leading people through sometimes difficult calculation methodologies or changes in operational procedures. Having someone who understands the calculations and can explain them at whatever level is required – from the most conceptual to the most basic – will set apart the services that Miller Financial Services, LLC, offers. MILLER FINANCIAL SERVICES, LLC Response to Request for Proposals for a Fiscal Agent October 24, 2005 STAFF QUALIFICATIONS (See attached resume) 8 MILLER FINANCIAL SERVICES, LLC Response to Request for Proposals for a Fiscal Agent 9 October 24, 2005 REFERENCES (person 1) (person 2) (person 3) (person 4) MILLER FINANCIAL SERVICES, LLC Response to Request for Proposals for a Fiscal Agent 10 October 24, 2005 BUSINESS ORGANIZATION Miller Financial Services, LLC, is organized as a Limited Liability Company in the state of Vermont, with a subchapter S recognition by the Internal Revenue Service. MILLER FINANCIAL SERVICES, LLC Response to Request for Proposals for a Fiscal Agent 11 October 24, 2005 COST PROPOSAL ITEM: 8 hrs per month at $125 per hour for 12 months Retainer and annual training for backup CPA firm Insurances as required in RFP (including employee dishonesty) Annual meetings with DU staff – 21 1-hr meetings, plus travel at 50% Total Annual Contract Cost Over 3 years One meeting in Montpelier over contract period Travel (assuming continuation of other clients in Montpelier or Northfield) Four hours for meeting Total Contract Cost, 3 years ANNUAL COST: $12,000 $400 $2,000 $3,950 $18,350 $55,050 $0 $500 $55,550 12 BILL MILLER Expert management of finance and support operations 7 Lupine Lane South Burlington, VT 05403 802-233-3370 (cell) bmiller357@att.net SKILLS AND STRENGTHS Experienced and effective leader: Manage cost-effective financial and administrative departments Identify and implement infrastructural and managerial strategies Guide staff to meet changing organizational needs Team player: collaborative, responsive, and communicative Quick study: rapidly implement cost-effective new technologies to support business goals EMPLOYMENT HISTORY VICE PRESIDENT, FINANCE & ADMINISTRATION (manufacturing firm) 2004-CURRENT Researched and led selection of new accounting and job-cost software; finalizing installation. Developing budgets and business plans in accordance with strategic plans. Reduced high-cost borrowing by converting unutilized assets to cash; worked with VEDA to develop low-cost financing for major equipment purchase. DIRECTOR OF FINANCE & ADMINISTRATION (nonprofit) 2003-CURRENT Providing financial analyses, strategic support, and human resources leadership to achieve long-term goals. Installed new accounting software during successful audit. Led renovations to new office space in Montpelier. PRINCIPAL, MILLER FINANCIAL SERVICES 2003-CURRENT Provide contract CFO services to small and medium-sized companies and organizations. Create multi-year financial models and business plans; evaluate accounting and administrative structures; oversee implementation of recommendations. CHIEF FINANCIAL OFFICER (manufacturing firm) 2001–2003 Successfully implemented new manufacturing computer system with job-costing and "lineof-business" profitability reports. Developed efficiency and profitability reports for strategic redirection into new areas. Introduced monthly cash flow analysis; projected ability to buy or lease capital equipment. Consolidated inventory reporting to support management decision making. 13 BILL MILLER Expert management of finance, benefits, and support operations VICE PRESIDENT, FINANCE AND OPERATIONS (nonprofit) 1992–2000 Spearheaded major financial turnaround in 1992–1993; evaluated financial performance of individual business lines, reduced expenses, turned loss into positive cash flow. Helped shaped strategic sale of Internet assets, establishing organization's endowment. Established telecommunications for Internet development, which expanded revenue base. Redesigned accounting structure to obtain more accurate and accessible view of finance. Led staff through warehouse expansions, office moves, plans for new headquarters. Regularly improved staff benefits on a cost-effective basis. VICE PRESIDENT, FINANCE AND ADMINISTRATION (college) 1989–1991 Evaluated several lines of business; determined profitability of each; recommended and monitored innovations to improve overall organizational cost-effectiveness. Brought external security operations in-house; hired effective security supervisor who initiated training for officers. FINANCIAL ANALYST / CHIEF FINANCIAL OFFICER (nonprofit) 1982–1989 Guided major financial turnaround; reduced costs by more than $20mm on $80mm budget. EDUCATION PH.D., PHYSIOLOGY - University of Michigan, Ann Arbor, Michigan Specialized in data analysis, computer modeling B.A., PSYCHOLOGY - University of California, Los Angeles, Los Angeles, California