Document 17923410

advertisement

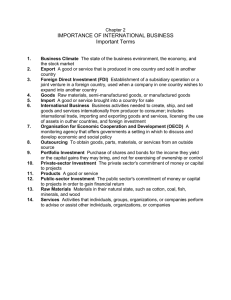

LEARNING OBJECTIVES After studying this chapter, you should be able to: 1. understand the vocabulary associated with foreign direct investment (FDI) 2. use the resource- and institution-based views to explain why FDI takes place 3. understand how FDI results in ownership, location, and internalization (OLI) advantages 4. identify different political views on FDI based on an understanding of FDI’s benefits and costs to host and home countries 5. participate in two leading debates on FDI 6. draw implications for action THE FDI VOCABULARY foreign direct investment (FDI) - Investments in activities that control and manage value creation in other countries multinational enterprise (MNE) - A firm that engages in foreign direct investment and operates in multiple countries THE FDI VOCABULARY foreign portfolio investment (FPI) - Investment in a portfolio of foreign securities such as stocks and bonds that do not entail the active management of foreign assets management control rights - The rights to appoint key managers and establish control mechanisms THE FDI VOCABULARY FDI is direct - requires significant equity ownership and provides the combination of equity ownership rights and management control rights significant ownership rights provide much needed management control rights FPI represents essentially insignificant ownership rights and no management control rights To compete successfully, firms need to deploy overwhelming resources and capabilities to overcome their liabilities of foreignness; FDI provides one of the best ways to facilitate extension of firm-specific resources and capabilities abroad THE FDI VOCABULARY horizontal FDI - A type of FDI in which a firm duplicates its home country-based activities by producing the same products or offering the same services in a host country as firms do at home vertical FDI - A type of FDI in which a firm moves upstream or downstream in different value chain stages in a host country THE FDI VOCABULARY upstream vertical FDI - A type of vertical FDI in which a firm engages in an upstream stage of the value chain downstream vertical FDI - A type of vertical FDI in which a firm engages in an downstream stage of the value chain THE FDI VOCABULARY FDI flow - The amount of FDI moving in a given period (usually a year) in a certain direction FDI inflow - Refers to inbound FDI moving into a country in a year FDI outflow - Refers to outbound FDI moving out of a country in a year FDI stock - The total accumulation of inbound FDI in a country or outbound FDI from a country OLI Advantages A firm’s quest for ownership (O) advantages, location (L) advantages, and internalization (I) advantages: Ownership - Refers to MNEs’ possession and leveraging of certain valuable, rare, hard-to-imitate, and organizationally embedded (VRIO) assets overseas in the context of FDI Location - Refers to advantages enjoyed by firms operating in certain areas Internalization - Refers to the replacement of cross- border markets (such as exporting and importing) with one firm (the MNE) locating in two or more countries OLI Advantages Licensing – An external market transaction in which firms buy and sell technology and intellectual property rights. Market Imperfections (or market failure) The imperfect rules governing international transactions. – OWNERSHIP ADVANTAGES dissemination risks - risks associated with unauthorized diffusion of firm-specific know-how OWNERSHIP ADVANTAGES Knowledge has two basic categories: (1) explicit and (2) tacit (implicit). Explicit – is codifiable (that is, it can be written down and transferred without losing much of its richness). Tacit (implicit) – is noncodifiable, and its acquisition and transfer require hands-on practice. LOCATION ADVANTAGES agglomeration - location advantages that arise from the clustering of economic activities in certain locations knowledge spillovers - Knowledge diffused from one firm to others among closely located firms that attempt to hire individuals from competitors LOCATION ADVANTAGES When one firm enters a foreign country through FDI, its rivals are likely to follow in order to: 1. Acquire location advantages themselves 2. Neutralize the first mover’s location advantages oligopoly – Industries populated by a small number of players INTERNALIZATION ADVANTAGES international transaction costs - tend to be higher than domestic costs – costs associated with doing business – many times as a result of significant imperfections and uncertainties associated with international market transactions market failure – is a result of high transaction costs arising from imperfections of the market mechanisms that make transactions prohibitively costly and sometimes prevent transactions from taking place intrafirm trade - international trade between two subsidiaries in two countries controlled by the same MNE REALITIES OF FDI – POLITICAL VIEWS radical view - political view that is hostile to FDI free market view - political view that suggests that FDI, unrestricted by government intervention, will enable countries to tap into their absolute or comparative advantages by specializing in the production of certain goods and services (win-win) pragmatic nationalism - political view that approves FDI only when its benefits outweigh its costs Benefits and Costs of FDI to Host Countries host country – recipient countries balance of payments – a country’s payments to and receipts from other countries technology spillovers - foreign technology diffused domestically that benefits domestic firms and industries Benefits and Costs of FDI to Host Countries demonstration effect (contagion or imitation effect) - reaction of local firms to technology spillovers repatriate – send back Benefits of FDI to Home Countries home country – source country Repatriated earnings of profits from FDI Increased exports of components and services to host countries Learning via FDI from operations abroad HOW MNEs AND HOST GOVERNMENTS BARGAIN bargaining power – The ability to extract a favorable outcome from negotiations due to one party’s strengths obsolescing bargain - deal struck by MNEs and host governments, which change their requirements after initial FDI entry expropriation - Government’s tactics that include removing incentives, demanding a higher share of profits and taxes, and confiscating foreign assets sunk costs - point at which a firm has invested substantial sums of resources FDI versus Outsourcing A strategic debate is whether FDI (captive sourcing) or outsourcing (offshoring) will serve firms’ purposes better? captive sourcing – performing an activity in-house at an overseas location Facilitating versus Confronting Inbound FDI Can foreigners and foreign firms be trusted in making decisions important to the local economy?