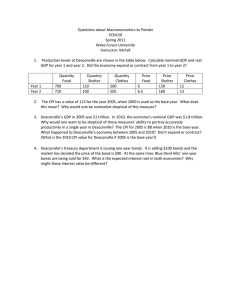

The Macro-Economics of Pensions Adair Turner September 2

advertisement

The Macro-Economics of Pensions Adair Turner September 2nd, 2003 Pensioner Income as a % of GDP Today 2030 If we assume 13.5 • Average retirement age unchanged 9.3 Private 3.8 State 5.5 8.0 +4.5 5.5 1 • Average pensioner income a constant proportion of average income Pension Claims Against Future Output – Three Current Models PAYG STATE SYSTEM Nature of Claim Against totality of GDP Enforced via contributions/taxes Risks Political Indirectly – Demographic and Macro-economic FUNDED DC Against profits Volatility of: o Profit slice of GDP o Market price of equities and bonds Via ownership of equities and bonds FUNDED DB Against profits Via ownership of equities and bonds in the fund But also via bond-like promise of the individual company 2 Volatility of: o Profit slice of GDP o Bond and equity prices Bankruptcy of the individual firm Two Near Equivalences Compulsory DC scheme invested in Government index linked bonds and Tax financed PAYG DC scheme invested in corporate bonds If the rate of return on indexlinked government bonds is equal to rate of growth. Still different in respect to and DB average salary scheme •Life expectancy risks •Diversification of bond portfolio But similar since DB schemes are bond-like liabilities 3 Key Question: How Best To Structure Pension Claims? Against Future GDP Against Future Profit Slice of GDP PAYG DC in equities DB Funded in government bonds DC in corporate bonds 4 Two Possible Routes To Increased Pensioner Income • Investment and future output unchanged, but some other group of savers relinquishes a matching claim on future assets and profits • Savings and investments increase, and as a result, so does future output 5 Real Return On Large Stocks: US 1926 - 2000 No. of 20 Year Periods with Return in Range (57 Periods) 8 Median 7.9 7 Mean 7.2 7 7 5 4 3 3 3 2 2 2 3 1 0-1 1-2 2-3 ____________________ Source: Ibbotson Associates: 2002 Yearbook 3-4 4-5 5-6 6-7 7-8 8-9 9-10 10-11 11-12 12-13 13-14 % Cumulative Average Return Over 20 Year Periods 6 Real Return On Large Stocks: US 1926 - 2000 Mean 7.64 Median 8.55 No. of 5 Year Periods with Return in Range (72 Periods) 16 10 8 4 4 5 6 5 6 3 3 1 1 -12 -9 -6 ____________________ Source: Ibbotson Associates: 2002 Yearbook -3 0 3 9 6 12 15 18 21 24 0 27 % Cumulative Average Return Over 5 Year Periods 7 Real Returns on Large Company Stocks: US 1926 – 2001 Median 7.04 10 Mean 6.86 No. of 30 Year Periods with Return in Range (47 Periods) 9 8 7 6 4 3 2-3 3-4 4-5 ____________________ Source: Ibbotson Associates: 2002 Yearbook 5-6 6-7 7-8 8-9 9-10 10-11 11-12 12-13 % Cumulative Average Return Over 30 Year Periods 8 Real Returns on Large Company Stocks: US 1926 – 2001 9 Median 6.99 No. of 50 Year Periods with Return in Range (27 Periods) 7 4 4 2 1 2-3 3-4 ____________________ Source: Ibbotson Associates: 2002 Yearbook 4-5 5-6 7-8 6-7 8-9 9-10 10-11 11-12 % Cumulative Average Return Over 50 Year Periods 9 Claims And Risks PAYG OR FUNDED IN Claim Against Inherent Risks Totality of future GDP Wages and profits Unanticipated variations in future GDP Profit slice of future GDP Unanticipated variations in future profits — GOVERNMENT BONDS FUNDED IN CORPORATE CAPITAL 10 Dividend Valuation Model: Inherent Uncertainty PV = Rational value of equities D0 = Current year dividends r = risk free rate D0 (1 + g) PV = 1 + r + p PV = + p = equity risk premium g = rate of growth D0 (1 + g)2 (1 + r + D0 r+p-g 11 p)2 + D0 (1 + g)3 (1 + r + p)3 Risk Management And Risk Sharing In Funded Schemes 1. DC schemes – Managing the crystallisation risk 2. The DB to DC Shift Is it concerning or desirable? Is it inevitable? 3. Should DB schemes invest in equity? 12 Risks In Final Salary DB Schemes CATEGORY OF RISK ABSORBED ABSORBED BY EMPLOYER BY EMPLOYEE CONSEQUENCE Investment return x Changes in life expectancy x No incentives for later retirement Individual salary progression x Complex accrued rights and transfer values – to disbenefit of early leavers 13 Overall risk borne by employer is high DB / DC Hybrids –Risk Sharing Alternatives CATEGORY OF RISK ABSORBED BY EMPLOYER ABSORBED BY EMPLOYEE x Changes in life expectancy x Pensionable ages increasing over time in line with life expectancy estimates Individual salary progression x Average salary based not final Investment return risk 14 Who Killed DB? • Unanticipated increases in life expectancy Slow response to 1980s and 1990s mortality declines • Increased life expectancy not matched by later retirement ages or increased contributions • Irrational exuberance, apparent “surpluses” and contribution holidays • Tax and residual ownership disincentives to very large surpluses • “Costless” tax increase of 1997 15 How To Increase Resources For Future Pensioners With aggregate savings, investment and output unchanged OPTION 1: Future pensioners claim higher share of future capital and profits …. At expense of other savers OPTION 2: Profits rise as % of GDP… At expense of future workers Via increased savings, investment and output OPTION 3: Domestic investment rises and thus GDP (and GNP) OPTION 4: Overseas investment rises and thus GNP (but not GDP) 16 Option 1: Pension Saving Up, Some Other Saving Down Either • Increased pension saving, but offsetting dissaving by the same people • Increased pension saving but offsetting dissaving by “others” 17 1963 1964 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2 2002 001 (est) Percent UK Pension Fund Assets As a % Of GDP 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% ____________________ Note: Occupational schemes only 18 % of UK Equities owned by individuals & UK pension funds 1963-93 70 60 Percent 50 40 30 20 10 0 1963 1969 1975 1981 1989 1990 1991 1992 UK Pension funds ____________________ Note: After 1993 the % owned by individuals continued to fall, but so too did the % owned by UK pension funds. But the growing category in 1993-2002 was overseas investors (1993: 16%, 2002: 32%), many of whom are pension funds; and conversely UK pension funds have invested more overseas. The overall pension fund role in the market has therefore probably continued to grow 19 1993 Individuals Capital Investment And The Marginal Product Of Capital Savings Schedule 1 Savings Schedule 2 Rate of return Quantity of capital invested 20 Fishing Boats, Fish And A Falling Population Steady State Demographic Change •1,000 population •500 per generation •500 working, 500 retired •Workers work Half time fishing Half time building a boat •Boats wear out over one working life • 500 generation of retirees followed by 250 generation of workers • Retirees would like to sell 500 boats they have built • Workers only need to buy 250 boats Relative price: 1 boat = ½ of catch for one working life 21 Price of boats, relative to fish, will fall Funded Pensions in Corporate Capital: Two Dimensions Claim on future Cash Profits Inter-Generation Funds Flow • Selling price of accumulated assets must equal the discounted value of future cash profits thereafter • Value of Generation 1’s asset decumulation must equal Generation 2’s asset accumulation • Future pensioners consumption is financed from future workers’ consumption deferral • Funded pensions are a claim on future profits 22 Rising Longevity, Constant Fertility Same trade-off in each generation No change in retirement age Different trade-off • G 1 saves more • G 1 saves more • Capital stock increases, returns decline • Capital stock increases, returns decline • Asset prices unchanged since • Asset prices fall since G 2 chooses later retirement G 2 has same target capital stock as G 1 Required returns fall in line with actual 23 G 2 has lower target capital stock than G 1 G 2’s required returns have not fallen (relative to the no rise in longevity base case) Falling Fertility, Constant Longevity • Generation 1 keeps saving as before (since longevity unchanged) • In Generation 2, unchanged capital stock but less labour Lower returns to capital Higher real wages • Value of assets falls because Returns down, discount rate unchanged G 2 has lower target capital accumulation than G 1 24 Demographic Impacts on Returns to Capital: Model Results Garry Young: Baby-boom generation Increased longevity Falling fertility David Miles: Given future actual trends in UK demographics, returns fall: • 4.56% (1990) to 4.22% (2030) • 4.56% (1990) to 3.97% (2060) if PAYG phased out 25 -0.1% -0.1% -0.3% Financial Asset Prices – Transitional Effects Increase in Aggregate Savings Rate Fall in Anticipated Future Rates of Return Long-Term Impact – Higher Capital Stock – Lower Long-Term Returns Transitional Impact – Increased demand for initially sticky supply – Rising financial asset prices Long-Term Impact – Fall in long-term equilibrium returns – e.g. 4.6% 4.2% Transitional Impact – From PV= 4.6 r+p 4.2 – To PV= r+p – Fall of 10% if r and p unchanged 26 Overseas Investment as the Solution – Conditions Required Other countries to invest in which have Increasing numbers of productive and prosperous future workers able to: •Different demographics – dependency ratios not rising • Provide future output available for consumption • Buy capital assets from decumulating savers in the investor countries •Economic success – growing per capita GDP + 27 Small numbers of domestic decumulating pensioners also trying to sell assets Demographic Change in UK and China – UN Medium Variant % Population by Age Band UK China 2000 2050 21 30 60 54 19 16 10 30 65 54 25 16 60+ 15-59 28 0-15 Years 26 The Fundamental Choice Some mix of: Increasing longevity plus falling fertility • Future pensioners poorer relative to average income than today • Future workers must give up more consumption in savings, contributions or taxes • Retirement ages must rise 29