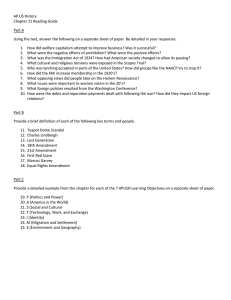

***I DRAFT REPORT

advertisement