NEW YORK UNIVERSITY Stern School of Business Principles of Financial Accounting C10.000.01

advertisement

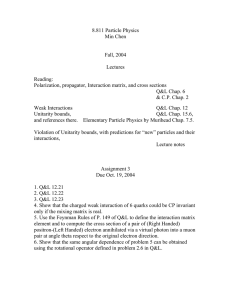

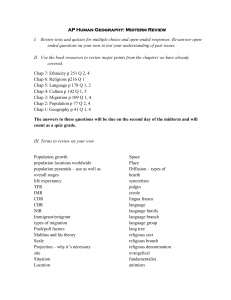

NEW YORK UNIVERSITY Stern School of Business Principles of Financial Accounting C10.000.01 Fall 2008 Instructor: Walter K. Scott, Esq. Daytime Telephone: 973-716-7524 Email: wscott@stern.nyu.edu Cell – 201-410-2525 Office: KMEC 10-98 Classroom: KMEC 4-60 Office Hours: before and after class or by appointment TA: TBD TA Email: TBD TA Office Hours/Room: TBD Course Description: This course provides an introduction to the fundamental concepts of financial accounting. The objective of the course is to help you become intelligent readers of financial statements: the balance sheet, income statement, statement of retained earnings and cash flow statement. Achievement of this goal requires an understanding of the basic principles that underlie accrual accounting, as well as an appreciation of the amount of judgment required in applying these principles. I will refer to current events that show the impact of accounting in the business world. A solid understanding of accounting is one of the basic building blocks of business education. Course Requirements: Attendance and class participation are expected and will make the class more interesting. Assigned readings and homework assignments should be completed prior to the relevant class session and selected problems will serve as a vehicle for class review Homework assignments will not be collected unless specifically noted ahead of time, however, assignments will represent the material you should understand for quizzes and exams. It is critical that you complete the assignments in order to learn the material. There will be some periodic, short quizzes covering previously covered material. Quizzes will be announced in advance and will last approximately 10 minutes. Make-ups are not permitted but the lowest quiz score will be dropped. Please check Blackboard regularly for announcements and postings. Required Text and Material: Horngren, Sundem & Elliot, Introduction to Financial Accounting, Custom Edition, Prentice Hall, 9th Edition (you cannot use the 8th edition). Supplemental case studies book (shrink-wrapped with the textbook); this is required for the core enhancement portion of your grade. Bring your text to each class session. Grading: Quizzes, Homework & Class Participation Core Enhancement Midterm Exam I Midterm Exam II Final Exam 10% 10% (details to be provided in class) 25% 25% 30% All exams are cumulative and there are no make-up exams. Calculators are permitted (no computers or blackberries). Please note: the dates and assignments listed below are subject to change: DATE September 2, 2008 September 4, 2008 September 9, 2008 September 11, 2008 September 16, 2008 September 18, 2008 September 23, 2008 September 25, 2008 CHAPTER Introduction of Chapter 1: Accounting: The Language of Business Chapter 1: Accounting: The Language of Business Chapter 2: Measuring Income to Assess Performance Chapter 2: Measuring Income to Assess Performance Chapter 3: Recording Transactions Chapter 3: Recording Transactions October 2, 2008 No Class Chapter 4: Accrual Accounting and Financial Statements Chapter 4: Accrual Accounting and Financial Statements Midterm 1 October 7 & 9 2008 Core Enhancement (no class October 14, 2008) October 16, 2008 Chapter 6: Accounting for Sales September 30, 2008 October 21, 2008 October 23, 2008 November 6, 2008 November 11, 2008 November 13, 2008 November 18, 2008 Chapter 6: Accounting for Sales Chapter 7: Inventories and Cost of Goods Chapter 7: Inventories and Cost of Goods Chapter 8: Long-Lived Assets and Depreciation Chapter 8: Long-Lived Assets and Depreciation Review Midterm 2 Chapter 9: Liabilities and Interest Chapter 9: Liabilities and Interest November 20, 2008 Chapter 9: Liabilities and Interest November 25, 2008 Chapter 5: Statement of Cash Flows November 27, 2008 December 2, 2008 December 4, 2008 December 9, 2008 No Class (Thanksgiving) Chapter 5: Statement of Cash Flows Chapter 10: Stockholder’s Equity Chapter 10: Stockholder’s Equity December 11, 2006 Review TBD Cumulative Final Exam October 28, 2008 October 30, 2008 November 4, 2008 ASSIGNMENT Chap 1: 26, 31, 33, 35, 36, 38 Chap 2: 34, 35, 45, 48, 49, 55 Chap 3: 19, 24, 27, 30, 34, 40, 49 Chap 4: 24, 30, 31, 35, 39, 46, 53 Chap 6: 34, 37, 41, 42, 45, 49, 54, 56, 58 Chap 7: 31, 34, 36, 41, 47, 48, 55, 56, 58, 66 Chap 8: 27, 29, 31, 37, 42, 47, 51, 53, 75 Chap 9: 33, 34, 40, 44, 46 Chap 9: 37, 53, 54, 56, 59, 63 Chap 5: 32, 40, 45, 47, 57, 62 Chap 10: 34, 37, 45, 46, 48, 55, 60, 62, 75