Recent Cross-border Financial Activity Working Party on Trade on Goods and Services

advertisement

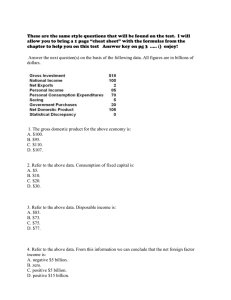

Recent Cross-border Financial Activity Working Party on Trade on Goods and Services November 2009 Cross-border financial activity increased in recent years… Increased liberalization of international flows (online brokers, mergers and acquisitions activity) Increased use of new investment vehicles (Assetbacked securities, derivatives) Increased number of participants in the market (small investors, public pension plans) Regulatory changes Increased outward direct investment; increased M&A activity Canada’s exposure to foreign financial markets has increased Canada's international portfolio investment position at market value billions of dollars 800 700 Portfolio liabilities 600 500 Portfolio assets 400 300 200 100 Net portfolio position 0 -100 -200 -300 -400 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 Impact of regulatory changes on foreign investment billions of dollars FPR 12% - 18% 20% 25%-30% No restriction 75 60 45 30 15 0 -15 -30 1990 1992 1994 1996 1998 Debt securities 1. Reverse of Balance of Payments signs. 2000 2002 Stocks 2004 2006 2008 Canadian holdings of foreign securities: a country perspective Holdings of foreign securities: Geographical distribution % 70 65 60 United States 55 50 45 40 35 Europe and Asia 30 1997 1999 2001 2003 2005 2007 Concentration of investment in foreign equities: % Share for selected countries % 100 Canada Australia 75 US 50 UK World 25 Japan 0 2001 2002 2003 2004 2005 2006 2007 2008 Increased outward FDI activity and geographical diversification Canadian dire ct inv e stme nt abroad Ge ographical distribution 100% $79.8 B. $637.3 B. 90% 80% Other countries 70% As ia/Oceania 60% Caribbean 50% Europe 40% 30% United States 20% 10% 0% 1988 2008 Less geographical diversification for inward FDI Foreign direct investment in Canada Geographical distribution 100% $114.2 B. $504.9 B. 90% 80% Other countries 70% As ia/Oceania 60% Caribbean 50% Europe 40% 30% United States 20% 10% 0% 1988 2008 Summary Higher Canadian demand for foreign securities: • • • • Increased exposure to global financial markets Increased exposure to markets’ volatility Increased exposure to currency fluctuations Increased exposure to financial shocks Higher Canadian direct investment abroad: • Increased exposure to foreign economies Recent financial events evidenced by the international accounts program Key issue: Canadian institutional investors’ reactions to deteriorating global credit conditions in 2007 ● Immediate ● Marked ● Sustained Rapid-sustained change in Canadian portfolio investment at outset of global credit concerns billions of dollars 30 25 20 15 10 5 0 -5 -10 -15 -20 -25 I II III IV I II 2005 III 2006 IV I Foreign debt instruments 1. Reverse of Balance of Payments signs. II III 2007 IV I Foreign stocks II III 2008 IV I 2009 II Reduction in holdings of foreign debt in response to global credit concerns billions of dollars 10 8 6 4 2 0 -2 -4 -6 -8 -10 J J 2006 J 2007 Foreign debt 1. Reverse of Balance of Payments signs. J 2008 J 2009 Holdings of foreign short-term paper reduced drastically in August 2007 billions of dollars 6 4 2 0 -2 -4 -6 -8 -10 -12 III 2005 IV I II III IV 2006 Government 1. Reverse of Balance of Payments signs. I II III 2007 Corp Fin IV I II III 2008 Corp Non-fin IV I II 2009 Investment in foreign long-term debt instruments also declined billions of dollars 21 15 9 3 -3 -9 -15 III IV I II III IV Maple Bonds 1. Reverse of Balance of Payments signs. I II III IV Other Bonds I II III IV I II Canadians repatriated funds for the first time in 30 years billions of dollars 90 80 70 60 50 40 30 20 10 0 -10 -20 1979 1981 1984 1987 1990 1993 1996 Foreign securities 1. Reverse of Balance of Payments signs. 1999 2002 2005 2008 … to invest in relatively safe government of Canada T-bills billions of dollars 22 18 14 10 6 2 -2 -6 -10 Jun Dec Mar 2008 Net new issues Jun 2009 Net purchases from non-residents Foreign demand for T-bills continued in 2009 and expanded to federal bonds Foreign portfolio investment in Canada billions of dollars 35 30 25 20 15 10 5 0 -5 -10 -15 I II III 2005 IV I II III 2006 bonds IV I III II 2007 IV money market I III II 2008 IV I 2009 II Canadians returned to foreign markets, mostly stock markets in 2009 Canadian portfolio investment abroad1 billions of dollars 30 25 20 15 10 5 0 -5 -10 -15 -20 -25 II 2005 III IV I II III IV 2006 Debt securities 1. Reverse of Balance of Payments signs. I II III IV I 2007 II 2008 Stocks III IV I 2009 II Foreign direct investment lost steam as of 2008 Foreign direct investment¹ billions of dollars 60 50 40 30 20 10 0 -10 II III 2005 IV I II III 2006 IV I II III 2007 IV I II III 2008 IV I II 2009 Foreign direct investment in Canada Canadian direct investment abroad 1. Reverse o f B alance o f P ayments signs fo r Canadian direct investment abro ad. Mergers and acquisitions mostly explained the reduced inward activity Foreign direct investment in Canada billions of dollars 100 90 80 70 60 50 40 30 20 10 0 -10 I II III 2005 IV I II III 2006 Acquisitions IV I II III 2007 IV I II III 2008 Other IV I II 2009 Survey vehicles for the measurement of portfolio investment Canada’s international transactions in securities (monthly) • Foreign investment in Canadian securities • Canadian investment in foreign securities Other position surveys – Annual • Inward • Outward - CPIS • Book and market value Summary Immediate, marked and sustained reaction of Canadian institutional investors in mid-2007 with respect to their holdings of foreign securities … prelude to financial crisis that erupted in the late summer and fall of 2008? Current reluctance of these same investors to rebuild holdings of foreign securities, especially debt instruments … sending a signal about perception of some degree of fragility in global financial markets? Comments/questions?