New financial sector delineation in ESA 2010: Austria

advertisement

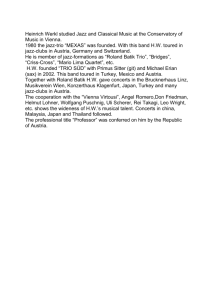

New financial sector delineation in ESA 2010: First assessment for the financial accounts in Austria Workshop on SNA 2008 / ESA 2010 OECD - October 2011 Michael Andreasch (michael.andreasch@oenb.at) Content • Sector classification according to ESA 1995 and ESA 2010 • Content of each sector • Classification in practice – possibilities and challenges draft version (work in progress) • What have we achieved – and what not? Proposal for further steps Financial sector delineation in Austria – OECD workshop on SNA 2008/ESA 2010, October 2011 2 Central bank S.121 Central bank S.121 Other MFI S.122 Other MFI S.122 Other financial intermediaries S.123 Financial auxiliaries S.124 Insurance corporations and pensions funds S.125 Money market funds S.123 Non-MMF S.124 Other financial intermediaries S.125 Financial Auxiliaries S.126 Captive Financial Institutions S.127 Insurance corporations S.128 Pensions funds S.129 Holding companies, SPEs Non-financial corporations S.11 Financial sector delineation in Austria – OECD workshop on SNA 2008/ESA 2010, October 2011 3 Central bank S.121 Other MFI S.122 MMF S.123 • The classification will be made under the responsibility of the central bank in Austria. The ECB is providing a list of MFIs including MMFs. • Data on each sub-sector on a who-to-whom basis are available in Austria. Financial sector delineation in Austria – OECD workshop on SNA 2008/ESA 2010, October 2011 4 Non-MMF S.124 • Classification in Austria is based on national legislation: Funds registered in Austria according to the “Investment fund law” and “Real estate fund law”. • The classification will be made under the responsibility of the central bank in Austria. • Data on the sub-sector on a who-to-whom basis are available in Austria. Financial sector delineation in Austria – OECD workshop on SNA 2008/ESA 2010, October 2011 5 Financial vehicle corporations engaged in securitisation transactions (FVC) Security and derivative dealers (SDD) Financial corporations „engaged in lending“ Financial leasing (FLC) Other financial intermediaries S.125 Hire purchase and the provision of personal or commercial finance (HP) Factoring (FA) Specialised financial corporations Venture and development capital companies (VC) Export/import financing companies (EIF) Financial intermediaries vis as vis MFI only (FIM) Financial sector delineation in Austria – OECD workshop on SNA 2008/ESA 2010, October 2011 6 Other financial intermediaries S.125 ? • Classification in Austria is mainly based on national legislation according to the banking law (except for VC, EIF) and will be made under the shared responsibility of the central bank and the central statistics office in Austria. • Challenges: At present there is an unclear situation classifying “financial leasing” in Austria: different views how to classify entities included in “real estate leasing activities”(NACE 2008 classification) based on information derived from the company register (influenced by national tax legislation) and credit register (based on banking supervisory treatment and even IAS) • Data on FVC, SDD and FLC are available in Austria. Data on all other units are (partly) difficult to achieve and partly not important in Austria Financial sector delineation in Austria – OECD workshop on SNA 2008/ESA 2010, October 2011 7 Insurance/loan/securities broker, financial service consultants Payment institutions Financial Auxiliaries S.126 Corporations providing stock exchange and insurance exchange as well as infrastructure for financial markets, arranging derivative/hedging instruments, manage the issue of guarantees, … Managers of pension funds, mutual funds, etc. Central supervisory authorities (separate units only) Head offices of financial corporations classification by convention according to ESA 2010 based on NACE 2008 classification Financial sector delineation in Austria – OECD workshop on SNA 2008/ESA 2010, October 2011 8 Financial Auxiliaries S.126 • Classification in Austria is partly based on national legislation; for head-offices based on type of activity (NACE 2008: 70.100), equity holdings of daughter companies in the balance sheets, turnover, number of employees (at present: 47 out of 3377), but: ? equity as % of total liabilities Turnover / Total liabilites ratio Number of employees of which: Head-offices Holdings 65% 78% < 40% (76%) < 40% (71%) < 10 (85%) < 10 (95%) 0 (41%) 0 (60%) • The classification will be made under the shared responsibility of the central bank and the central statistics office in Austria. • Data on payment institutions, managers of mutual/pensions funds are available on a quarterly basis. All other units are under consideration (annual balance sheet data, FDI data) Financial sector delineation in Austria – OECD workshop on SNA 2008/ESA 2010, October 2011 9 Trusts, estates, brass plate companies Captive Financial Institutions S.127 Special Purpose Entities (SPE) partly previously included in S.11, delineation to S.13 Sovereign Wealth Funds (if classified as S.12) Units providing financial services with own funds or funds provided by a sponsor Holding companies of financial and non-financial corporations based on NACE 2008 classification Financial sector delineation in Austria – OECD workshop on SNA 2008/ESA 2010, October 2011 10 Captive Financial Institutions S.127 • There is nearly no legal legislation for these units; holdings are classified in line with NACE 2008 classification (NACE 2008: 64.200) • Challenge: Correct allocation of the type of economic acitivity (see S.126) • The classification will be made under the shared responsibility of the central bank and the central statistics office in Austria. • Data on holding companies, SPE with cross-border activities on an annual basis using balance sheet data, FDI data (counterpart data information under consideration) should be available. Financial sector delineation in Austria – OECD workshop on SNA 2008/ESA 2010, October 2011 11 Insurance corporations S.128 Pensions funds S.129 • Classification in Austria is based on national legislation: Insurance corporations and pension funds are defined by law The reporting of IC is based on “home country” principle. Open issues: Issuer of standardised guarantees (ICPF, Banks Gov.,..) ? ? Pension Manager ? • The classification will be made under the responsibility of financial market supervisory body (FMA). • Data on the sub-sectors (on a who-to-whom basis for assets only) are available in Austria. Financial sector delineation in Austria – OECD workshop on SNA 2008/ESA 2010, October 2011 12 What have we achieved up to now … • Comparison between ESA 1995 and 2010 on major changes in the sector delineation • Identification of important amended / new entities in the financial sector • First assessment for the financial account in Austria Financial sector delineation in Austria – OECD workshop on SNA 2008/ESA 2010, October 2011 13 Data sources Data Direct data availability source Reports by other entities Population Sub-sector of the financial sector Central bank S.121 Other MFI excluding MMF S.122 Money market funds S.123 Non-MMF S.124 Other financial intermediaries S.125 Y Y Y Y Partly Y (Reports) Y (Reports) Y (Reports) Y (Reports) Y (Reports, BS data) SHS SHS, ICPF BSI, SHS BSI, SHS BSI, SHS, ICPF Financial auxiliaries S.126 Partly Y (Reports, BSI, SHS, ICPF; (for BS data) head-offices under consideration) Captive financial institutions S.127 Partly Y (Reports, for holdings under BS data) consideration Insurance corporations S.128 Pension funds S.129 Y Y Y (Reports) BSI, SHS Y (Reports) BSI, SHS 1 780 24 2.179 > 150 > 100 > 2.000 59 17 Reports = defined reporting requirements to the NCB. BSI = Banking Statistics, SHS = Security holdings statistics, ICPF = Statistics provided by insurance corporations and pension funds. BS = Balance sheet data. Financial sector delineation in Austria – OECD workshop on SNA 2008/ESA 2010, October 2011 14 Financial position of the financial sector and NFC - comparing ESA 1995 and ESA 2010 % of GDP 400 350 300 250 Position according to ESA 95 Amendments in line with ESA 2010 Position according to new data sources 200 150 100 50 0 -50 Source: OeNB. Financial sector delineation in Austria – OECD workshop on SNA 2008/ESA 2010, October 2011 15 … – and what not, next steps: • Coordinated work on the classification of head-offices, holding companies and leasing companies between NSI and Central bank with the aim of a harmonized list of entities • Investigation on amendments of reports to the Central bank improving reporting guidelines and exchange of information on (selected) individual entities Challenge: Distinction between head offices (if part of sector S.11) and holding companies in counterpart statistics (like banking statistics, ICPF statistics, security holdings statistics by custodians). • Work on the integration of balance sheet data as part of the regular compilation and • Investigations on the compilation of back-data Financial sector delineation in Austria – OECD workshop on SNA 2008/ESA 2010, October 2011 16