The Responsibility of the Board according to

advertisement

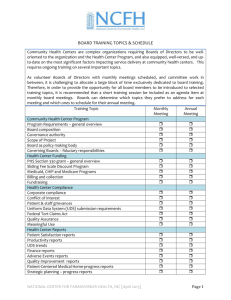

The Responsibility of the Board according to the OECD Principles and Patterns of Change in the aftermath of Recent Corporate Events Presentation for the Fourth Eurasian Corporate Governance Roundtable Elena Miteva, Administrator, OECD Bishkek, October 2003 1 Corporate governance and the OECD Principles CG OECD Principles •A set of behavioural patterns: vis-à-vis shareholders, stakeholders and boards •A normative framework Legal and voluntary norms Address both areas: • « Best provisions on behaviour » active ownership by institutions and intermediaries; competent boards LT value increasing behaviour of companies •Key normative requirements, e.g.: Shareholder protection and equitable treatment under the law. 2 Focus on corporate governance • Reduces equity risk Equity exposure of larger numbers of households CG signals information assymetries and probability of expropriation of shareholder value • Improves performance With good corporate governance, companies can improve their earnings potential • Improves institutions Lack of properly functioning private institutions and corporations impacts on growth by limiting access to equity financing and The distribution of income within a society • Spill-overs into the realm of public governance Lack of accountability potentially undermines the rule of law and Effectiveness of government 3 The OECD Principles and the Boards Functions Structure and profile Accountability Qualities of directors 4 Board functions Reducing risk Monitoring management to avoid expropriation Detecting incompetence in boards Improving performance Strategic guidance – selecting, compensating and firing management, reviewing strategy, preparation of strategic action plans, devising risk policy, overseeing major transactions, disclosure and compliance with law. Monitoring performance – review remuneration, reviewing conflicts of interest and related party transactions, ensuring the integrity of reporting systems Served as vehicle for reforms and financial innovation Supported the involvement of the private sector 5 Board profile and structure Monitoring Independence: from the ones monitored and from the that control the company (not in itself substitute of quality of boards) Integrity: capability for resisting pressure and litteracy in accounting and control systems Strategic guidance Knowledge of the company (products, functions, management systems) Capacity for strategy design 6 Independent boards Normative framework for independence Definition of independence Two ‘best behaviour’ clauses Separation of Chair and CEO Resources of the board and its independent members Cumulative voting 7 Board Committees ●Exercise functions focused on specific issues ●Particular importance of audit, nomination and remuneration committees 8 Board accountability to the company and its shareholders Companies elect and fire boards Boards are accountable to all shareholders Boards are elected regularly Boards take into account other stakeholders’ interests, such as employees and creditors 9 Director duties Duty of care Duty of loyalty •Potential for misinterpretation •Might limit risk-taking behaviour Rationale behind US “business judgement rule” •Important in the transition context, where the level of shareholder expropriation is higher •Envisage criminal consequences •Duty of compliance Other duties •Duty to act in good faith •Duty of oversight 10 Quality of directors Education Integrity and Ethics Professional associations of directors Voluntary codes Compensation Availability Limit multiple directorships Scarcity factor Access to information 11 A few points of relevance for Eurasia Some trade-off between monitoring and strategy formation functions Scope for voluntary rules Importance of individual company behaviour Boards are not substitutes of management Management accountability to boards 12 Recent corporate events and boards of directors Trust as a fundamental ingredient of the financial market “A corporate governance bear market, at least in part” Increasing responsibilities for boards and independent directors Failures of boards in current cases of corporate distress and scandals Response to the crisis impacts boards Enhanced liability and tougher rules Higher requirements for director professionalism and ethics 13 Implications for boards Integrity More responsibility for compensation and incentives Careful assessment of conflicts of interests Monitor risk Warning signals Timely response to problems Transparency Monitor disclosure practices Implementation and evaluation of management 14 Founded in 1961 as a follow on to the Marshall Plan, the Organisation for Economic Co-operation and Development promotes international codes, guidelines and principles by which countries can make their economic systems compatible. OECD Member Countries and Co-operating Countries Co-operation programmes Co-operation programmes and participation in OECD bodies* OECD Members (49) (16) (31) * Non-Members not participating in OECD bodies take part in OECD meetings and activities upon ad hoc invitations. 15 For More Information on Corporate Governance www.oecd.org elena.miteva@oecd.org 16