Cointegrating VAR Models and Probability Forecasting: Applied to a Small Open Economy

advertisement

Cointegrating VAR Models

and Probability Forecasting:

Applied to a Small Open Economy

Gustavo Sánchez

April 2009

Summary

VEC and Cointegrating VAR Models

Estimate Parameters

Probability Forecasting

Simulate Forecasts

Summary Statistics to estimate

probabilities of events

Point Forecast and Confidence Interval

Forecast for lgdp

15.8

16

16.2 16.4 16.6

16.3 16.4 16.5 16.6 16.7

Forecast for lm1

Forecast for loilp

6.8

3

7

3.5

7.2

4

7.4

4.5

7.6

Forecast for lcpi

2008q4

2009q1

2009q2

2009q3

2009q4 2008q4

95% CI

2009q1

forecast

2009q2

2009q3

2009q4

Probability of Inflation Greater than 45

Proportion estimation

Number of obs

=

225

Proportion

Std. Err.

[95% Conf. Interval]

0

0.2888889

0.0302838

0.2292113

0.348566

1

0.7111111

0.0302838

0.6514336

0.770789

inf_45

0

.02

Density

.04

.06

Density Inflation

0

20

kernel = epanechnikov, bandwidth = 1.9987

40

inf

60

80

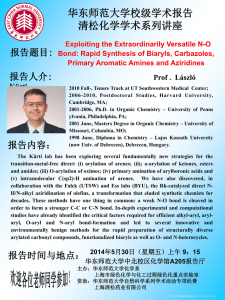

Cointegrating VAR models

Based on the vector error correction (VEC) model

specification.

The specification assumes that the economic theory

characterizes the long-run equilibrium behavior

The short-run fluctuations represent deviations

from that equilibrium.

The short-run and long-run (economic) concepts

are linked to the statistical concept of stationarity.

Cointegrating VAR models

Reduced form for a VEC model

p 1

zt a bt zt 1 i zt i t

i 1

Where:

zt :

:

I(1) Endogenous variables

Matrices containing the long-run adjustment coefficients and

coefficients for the cointegrating relationships

i : Matrix with coefficients associated to short-run dynamic effects

a,b :

t :

Vectors with coeficients associated to the intercepts and trends

Vector with innovations

Cointegrating VAR models

Reduced form for a VEC model

p 1

zt a bt zt 1 i zt i t

i 1

Identifying α and β requires r2 restrictions

(r: number of cointegrating vectors).

Johansen FIML estimation identifies α and β by

imposing r2 atheoretical restrictions.

Cointegrating VAR models

Garrat et al. (2006) describe the Cointegrating VAR

approach:

Use economic theory to impose restrictions to identify αβ.

Exact identification is not necessarily achieved by the

theoretical restrictions.

Test whether the overidentifying restrictions are valid.

** Restrictions on VEC system **

*** Restrictions on Beta lm1 ***

constraint 1 [_ce1]lm1=1

.

.

.

constraint 6 [_ce1]ltipp906bn=0

*** Restrictions on Beta lmt ***

constraint 8 [_ce2]lmt=1

.

.

.

constraint 11 [_ce2]ltipp906bn=0

*** Restrictions on alpha ***

constraint 12 [D_loilp]l._ce1=0

constraint 13 [D_loilp]l._ce2=0

** VEC specification **

vec

lm1 lmt lcpi loilp ltcpn lxt ltipp906bn lgdp ///

if tin(1991q1,2008Q4), lags(2) rank(2)

///

bconstraints(1/11) aconstraints(12/13)

///

noetable

Vector error-correction model

Sample: 1991q1 - 2008q4

No. of obs

AIC

HQIC

SBIC

Log likelihood = 659.9591

Det(Sigma_ml) = 1.51e-18

Cointegrating equations

Equation

Parms

chi2

P>chi2

------------------------------------------_ce1

2

50.19532

0.0000

_ce2

3

1639.412

0.0000

------------------------------------------Identification: beta is overidentified

Identifying constraints:

( 1) [_ce1]lm1 = 1

( 2) [_ce1]lmt = 0

( 3) [_ce1]lxt = 0

( 4) [_ce1]loilp = 0

( 5) [_ce1]lcpi = 0

( 6) [_ce1]ltipp906bn = 0

( 7) [_ce2]lm1 = 0

( 8) [_ce2]lmt = 1

( 9) [_ce2]lxt = 0

(10) [_ce2]ltcpn = 0

(11) [_ce2]ltipp906bn = 0

=

72

= -15.80442

= -14.6589

= -12.92697

-----------------------------------------------------------------------------beta |

Coef.

Std. Err.

z

P>|z|

[95% Conf. Interval]

-------------+---------------------------------------------------------------_ce1

|

lm1 |

1

.

.

.

.

.

lmt | (dropped)

lcpi | (dropped)

loilp | (dropped)

ltcpn |

.215578

.0697673

3.09

0.002

.0788365

.3523194

lxt | (dropped)

ltipp906bn | (dropped)

lgdp | -4.554976

.6489147

-7.02

0.000

-5.826825

-3.283127

_cons |

57.02687

.

.

.

.

.

-------------+---------------------------------------------------------------_ce2

|

lm1 | (dropped)

lmt |

1

.

.

.

.

.

lcpi | -.0317544

.0087879

-3.61

0.000

-.0489784

-.0145304

loilp | -.0780758

.0255611

-3.05

0.002

-.1281746

-.027977

ltcpn | (dropped)

lxt | (dropped)

ltipp906bn | (dropped)

lgdp | -2.519458

.1105036

-22.80

0.000

-2.736041

-2.302875

_cons |

26.26122

.

.

.

.

.

------------------------------------------------------------------------------

*** Point Forecast ***

fcast compute y_, step(4)

keep

y_lm1 y_lmt y_lcpi

///

y_loilp y_ltcpn y_lxt

///

y_ltipp906bn y_lgdp quarter

keep

if tin(2009q1,2009q4)

save

"filename"

** Residuals from the VEC equations **

foreach x of varlist lm1 lmt lxt loilp ///

ltcpn lcpi

///

ltipp906bn lgdp {

predict res_`x' if e(sample),

///

residuals

///

equation(D_`x')

}

Probability Forecasting

It is basically an estimation of the probability

that a single or joint event occurs.

We could define the event in terms of the levels of

one or more variables, for one or more future time

periods.

It is associated to the uncertainty inherent to

the predictions produced by regression models.

Probability Forecasting

This methodology can be applied to a wide

diversity of models. Our focus here is on the

predictions from a cointegrating VAR model.

In general, forecasting based on econometric

models are subject to:

Future uncertainty

Parameters uncertainty

Model uncertainty

Measurement and policy uncertainty

Probability Forecasting

Future and parameter uncertainty

Let’s consider the standard linear regression model:

yt xt ut

Where

u ~ N (0, 2 )

Probability Forecasting

Future and parameter uncertainty

For example, for

σ2

( j ,s )

y

known we could simulate T 1

yT( j ,1s ) xT' ˆ ( j ) uT( s)1

Where:

ˆ ( j )

j-th random draw from

uT( s)1

s-th random draw from

;

j=1,2,…,J ; s=1,2,…,S

N ˆT , 2 ( X ' X ) 1

N 0, 2

( j)

which is independent from the random draw for ˆ

Probability Forecasting

Computations for VAR cointegrating models

Let’s consider the VEC model

p 1

zt zt 1 i zt i a0 a1t H t

'

i 1

Non-Parametric Approach

1. Simulated errors are drawn from in sample residuals

2. The Choleski decomposition for the estimated Var-Cov

matrix of the error term is used in a two-stage

procedure combined with the simulated errors in (1).

** Matrix for Simulation (First Stage, Pag.167) **

matrix sigma=e(omega) /* V-C Matrix of the residuals */

matrix P=cholesky(sigma)

mkmat res_lm1 res_lmt res_lxt res_loilp ///

res_ltcpn res_lcpi

///

res_lgdp res_ltipp906bn ///

if tin(1991q1,2008q4),

///

matrix(res)

matrix invP_res=inv(P)*res'

matrix invP_rs1=invP_res‘

svmat invP_rs1,names(col)

** Program for Residual Resampling **

program mysim_np, rclass

preserve

bsample 4 if tin(1991q1,2008q4) /* 4 frcst. per. */

mkmat IP_R_D_lm1 IP_R_D_lm IP_R_D_lcpi ///

IP_R_D_loilp IP_R_D_ltcpn IP_R_D_lxt ///

IP_R_D_ltipp906bn IP_R_D_lgdp,

///

matrix(IP_R)

matrix PE_tr=P*IP_R'

matrix PE=PE_tr'

svmat PE,names(col)

●

●

●

●

●

●

●

●

●

****** Simulation ******

simulate “varlist", rep(###)

saving("filename",replace):

mysim_np

///

///

command: mysim_np

s_lm1_1: r(res_lm1_1)

s_lm1_2: r(res_lm1_2)

●

●

●

●

●

●

●

●

●

s_lgdp_3: r(res_lgdp_3)

s_lgdp_4: r(res_lgdp_4)

Simulations (###)

─┼─ 1 ─┼─ 2 ─┼─ 3 ─┼─ 4 ─┼─ 5

....................................................

●

●

●

●

●

●

●

●

●

50

**** Probability Forecasting ****

generate dgdp=gdp/gdp2008*100-100

if year==2009 &

replication>0

generate inf=cpi/cpi2008*100-100 ///

if year==2009 &

replication>0

///

///

///

generate gdp_n__inf45=cond(dgdp<0 & inf>45,1,0)

proportion gdp_n__inf35

Probability of Negative GDP and Inflation>45

Proportion estimation

Number of obs

=

225

Proportion

Std. Err.

[95% Conf. Interval]

0

.68

.0311677

.6185805

.7414195

1

.32

.0311677

.2585805

.3814195

gdp_1__inf45

Density GDP

.1

0

0

.05

.02

Density

.04

.15

.06

.2

Density Inflation

0

20

kernel = epanechnikov, bandwidth = 1.9987

40

inf

60

80

-10

-5

0

dgdp

kernel = epanechnikov, bandwidth = 0.6461

5

Cointegrating VAR Models

and Probability Forecasting:

Applied to a Small Open Economy

Gustavo Sánchez

April 2009