BUDGETING IN ROMANIA

advertisement

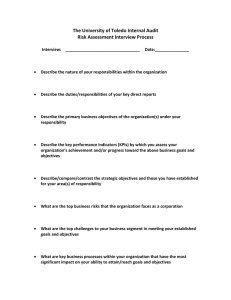

BUDGETING IN ROMANIA Den Haag, the Netherlands 11 November 2004 Michael Ruffner Administrator Budgeting and Management Division Background • In 1998, OECD started “reviewing” country budget systems • System reviews using functions of budget and stages of budget as base • Learning device – principally descriptive • Romania first non-OECD non-observer country to be reviewed General Comments • System in movement – Structures and Processes • Impressive reforms over a short period of time – Reforms similar to other countries • Strongly legalistic tradition with ex-ante control Fiscal Rules • Government Programme – Broad political consensus about EU accession and high level macro-economic goals – Generally successful – lower inflation, general 3% of GDP deficit limit on expenditures, 29% of GDP Debt • Not passed in law The Budget First things, first … • More comprehensive – fewer off budget funds, quick privatisation • Budget Year + 3 year MTEF – Looks realistic • Economic Assumptions – Good performance, recently – Some steps to ensure independence Budget Reporting • Monthly, quarterly, annual • No Mid-year Report – Update of economic situation (already provided by National Forecast Commission • Timeliness of annual report Specific Disclosures • Room for Improvement – Contingent Liabilities – Tax expenditures – Asset registry (How far, linked to accruals) • Privatisation lowers risks -- Where are the ties to budgets? Loan guarantees? Role of Parliament • Lengthened but still relatively short time frame for action • Rights to amend budget, can’t increase deficit • Does have access to specialised staff – Two chambers work together • Two tiered Committee Structure – Sectoral review followed by budget committee Budget Execution • Treasury system with 3 levels of credit holders (Ministry, Program, Street level) • Ex-ante Control – “Own” control and “Delegated” control • Tight rules on virement (transfers) • New Internal Audit – just starting • Still ability to overspend External Audit •Audit Court produces report by December •Previously longer delays, but timing is still not optimal •Court has improved its interaction with media •Court reports to parliament, but there is no audit committee •Capacity for performance audit is being developed •Main audit report discussed in a joint sitting of both houses •Formal vote on budget execution •Parliamentary process largely formalistic Civil Society • Institutionalised consultations through Economic Social Council (CES) – Very high standard (consensus/near consensus) – Other tri-partite discussions • Some academic review – especially in macroeconomic assumptions Budget Transparency According to OECD Guidelines Romania Item 1. Budget Reports The Budget Pre Budget Report Monthly Reports Mid-Year Report Year End Report Pre-Election Report Long Term Report 2. Specific Disclosures Economic Assumptions Tax Expenditures Assessment ●↑ The Budget is more comprehensive than in past, but there still are extra-budgetary funds ● ●↑ ● ●↑ Financial Liabilities ●↑ and Assets Non-Financial Assets Employee Pension ●↑ Obligations Contingent Liabilities 3. Integrity, Control and Accountability Accounting Policies ●↑ Internal Audit and ●↑ Control Audit ●↑ Parliamentary Scrutiny Civil Society Scrutiny Comments ●↑ ●↑ While there are monthly and quarterly execution reports, there is no comprehensive mid-year report – although some important sectors like pension and health do produce mid-year reports Year end report is released but not time ly Quality of assumptions assured by outside factors, need to think of how forecasts are constructed in the future There is some analysis on tax expenditures, but it is not comprehensive or part of the budget documents Foreseen with the implementation of accruals Foreseen with the implementation of accruals Internal control is effective but not efficient, internal audit is new and has not reached critical mass Could be more timely with audit of year end report, better follow up needed, increase in performance audits Little civil society involvement in budget process, CES lends institutionalised civil society involvement ● = Item substantially met, ● ↑ = Item met, situation needs improvement Conclusion • Solid Base of Transparency – Improvements happening rapidly – Time needed to implement and judge success of reforms • Internal audit, program budgeting, accruals • New disclosures – Contingent liabilities, Mid year update to parliament, reconciliation line in MTEF