Tax Burden Indicators for Labour and for Capital (Taxing Wages model)

advertisement

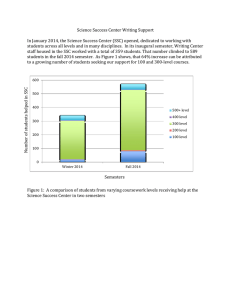

Organisation for Economic Co-operation and Development Tax Burden Indicators for Labour (Taxing Wages model) and for Capital (METR/AETR model): W. Steven Clark OECD Centre for Tax Policy and Administration LAC Tax Policy Forum 16-17 September 2010, Panama City Centre for Tax Policy and Administration Backward-looking versus parameter-based tax burden indicators Policy interest in various measures of the tax burden on labour and capital (‘tax burden indicators’). Backward-looking indicators: derived using data on taxes paid, as a percentage of pre-tax income (at the taxpayer or aggregate level). Parameter-based (forward-looking) indicators: derived from tax calculations for representative taxpayers, based on tax legislation (statutory tax rates, base provisions). • Taxing Wages framework (OECD) – used to assess marginal and average tax rates on labour income, and tax policy issues • METR/AETR framework – used to assess marginal and average tax rates on capital income, and tax policy issues. Recent OECD work highlights need to account for corporate tax planning. 2 Part I - Taxing Wages framework Taxing Wages framework - used by OECD countries to: • Derive internationally comparable average and marginal tax rates on labour income, for different wage levels and household types • • Measure tax rates at various multiples of the average wage (AW) Measure tax rates for single/married individuals, with/without children • • Progressive personal income tax (PIT) Regressive social security contributions (SSC) • Compare the composition of tax rates on labour income (tax mix): • Measure impact on tax rates of family benefits, in-work tax credits, benefit abatement (reduction in benefits as income increases) • Measure overall progressivity of tax burden on labour income • Assess possible tax effects on decision to enter the labour market (primary and secondary earners), decisions on work effort. 3 Gross and net income measures Total labour costs - employer social security contributions Gross earnings - employee social security contributions - personal income tax + cash benefits Net earnings 4 Average tax rate measures personal income tax (PIT) Average income tax = gross earnings PIT + employee SSC – cash transfers Average income tax plus employee SSC – cash transfers = gross earnings gross earnings – net earnings = gross earnings 5 PIT + employee SSC – cash benefits + employer SSC Average tax wedge = gross earnings + employer SSC total labour costs – net earnings = total labour costs 6 Marginal tax rate measures ∆ (PIT + employee SSC – cash transfers) Marginal rate (income tax plus = employee SSC – cash transfers) ∆ (gross earnings) ∆ (PIT + employee SSC – cash transfers + employer SSC) Marginal tax wedge = ∆ (gross earnings) + ∆ (employer SSC ) ∆ (gross earnings) = +1 currency unit 7 Consideration of different multiples of gross wage earnings (AW) and family types: Single Single Single Single Married Married Married Married 8 67% of AW 100% of AW 167% of AW 67% of AW 100% - 0% of AW 100% - 33% of AW 100% - 67% of AW 100% - 33% of AW 0 children 0 children 0 children 2 children 2 children 2 children 2 children 0 children Comparison of average tax wedge and components, 2007 (single, no children, 100% of AW) Personal income tax Employee SSC Employer SSC 60 50 OECD average tax wedge single taxpayer at 100% of the AW (0 children) in 2007 40 30 20 10 BEL HUN GER FRA AUT ITA SWE NLD FIN CZE POL TUR GRC DNK SPA SVK LUX NOR PRT UK CAN US SWI JPN ICL AUS IRL NZL KOR MEX 0 9 Average tax wedge components: Czech Republic (single, no children, 2008) 250 240 230 220 210 200 190 180 0% 170 0% 160 10% 150 10% 140 20% 130 20% 120 30% 110 30% 100 40% 90 40% 80 50% 70 50% 60 60% 50 60% -10% -10% -20% -20% -30% -30% -40% -40% 10 employer SSC as % of total labour costs employee SSC as % of total labour costs average local income tax as % of total labour costs average central income tax as % of total labour costs family benefits as % of total labour costs average tax wedge (sum of the components) net personal average tax rate as % of gross wage earnings Average tax wedge components: Czech Republic (married, two children, 2008) 240 230 220 210 200 190 180 0% 170 0% 160 10% 150 10% 140 20% 130 20% 120 30% 110 30% 100 40% 90 40% 80 50% 70 50% 60 60% 50 60% -10% -10% -20% -20% -30% -30% -40% -40% 11 employer SSC as % of total labour costs employee SSC as % of total labour costs average local income tax as % of total labour costs average central income tax as % of total labour costs family benefits as % of total labour costs average tax wedge (sum of the components) net personal average tax rate as % of gross wage earnings Marginal tax wedge components: Czech Republic (married, two children, 2008) 12 240 0% 230 0% 220 10% 210 10% 200 20% 190 20% 180 30% 170 30% 160 40% 150 40% 140 50% 130 50% 120 60% 110 60% 100 70% 90 70% 80 80% 70 80% 60 90% 50 90% marginal employer SSC marginal employee SSC marginal local income tax marginal central income tax marginal family benefits marginal tax wedge (sum of the components) net personal marginal tax rate Comparison of PIT progressivity ((PIT(167)-PIT(67))/PIT(167))*100 140 2000 2007 120 100 Statutory personal income tax progressivity: OECD average in 2000 and 2007 80 60 40 20 AUS AUT BEL CAN CZE DNK FIN FRA GER GRC HUN ICL IRL ITA JPN KOR LUX MEX NLD NZL NOR POL PRT SVK SPA SWE SWI TUR UK US 0 13 Comparison of PIT+SSC progressivity ((TW167-TW67)/TW167)*100 2000 2007 70 60 50 Statutory tax wedge progressivity: OECD average in 2000 and 2007 40 30 20 10 -10 -20 14 AUS AUT BEL CAN CZE DNK FIN FRA GER GRC HUN ICL IRL ITA JPN KOR LUX MEX NLD NZL NOR POL PRT SVK SPA SWE SWI TUR UK US 0 Extension of Taxing Wages model to include benefit programs Extension of TW model includes other benefit programs: Enables calculation of net replacement rates (NRR): 15 • Unemployment insurance/assistance • Social assistance • Housing benefits • Family benefits • Lone-parent benefits • Employment-conditional benefits • NRR= net income while out of work / net income while in work • Proportion of in-work income maintained when unemployed. Enables assessment of ‘unemployment traps’ and also ‘inactivity traps’ (ATR) Part II – METR/AETR framework METR/AETR framework - used by OECD countries to: • Derive internationally comparable marginal and average tax rates on capital income for different assets, industries, sources of finance • • Measure tax distortions to investment and the allocation of capital across assets (machinery, buildings, land) and locations Domestic and cross-border METR/AETR measures • Separately identify and assess the impact on the effective tax rate on investment of key tax parameters influencing after-tax profits: • • • • • • 16 Statutory corporate income tax rates Tax depreciation methods and rates Investment tax credits/allowances/incentives Capital taxes Sales taxes on capital goods Interest deductibility, shareholder taxes (dividends, capital gains) Applications of METR/AETR framework 17 Assess contribution of different CIT parameters (e.g. basic statutory tax rate, tax depreciation rates) to economy-wide and sectoral METR/AETRs. Identify unintended tax distortions to allocation of capital – underpins analysis of base broadening options. Assess intended tax distortions to the level and allocation of capital, resulting from tax incentives for investment. Assess change in the tax burden on investment (ΔETR ) resulting from corporate tax reform. Assess impact on investment of corporate tax reform, using estimates of the sensitivity (tax elasticity) of investment to METR/AETR. Example: METR application in Canada 18 Applications in LAC countries 19 Taxing Wages framework may be usefully applied to compare across LAC (and OECD) countries taxes paid on labour income (tax mix, average, marginal tax rates), to address labour taxation issues. Information gathered for LAC Revenue Statistics can be used to inform Taxing Wages modelling (e.g. treatment of social security contributions). METR/AETR framework may be applied to compare across LAC countries taxation of capital income, to address tax distortions to investment and effects of tax planning. Use of common/agreed measures enables meaningful tax burden comparisons to inform policy analysis/discussions. Organisation for Economic Co-operation and Development Thank you Centre for Tax Policy and Administration