Fiscal Design across Levels of Government: EU Applicant States and EU Member States

advertisement

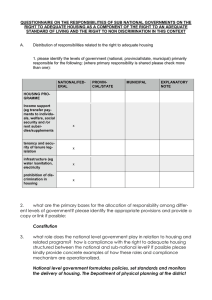

Fiscal Design across Levels of Government: EU Applicant States and EU Member States By Jeffrey Owens Head Centre for Tax Policy & Administration OECD Workshop on “Decentralisation: trends, perspectives and issues at the threshold of EU enlargement” Copenhagen, October 10-11, 2002 Main Topics I. Accession: opportunities & challenges II. Fiscal decentralisation: main findings of the OECD- CTPA Surveys III. Some general conclusions and perspectives Slide no. 2 Current and Prospective EU Members Current EU Members Prospective EU Members Slide no. 3 0 Turkey Slovenia Slovak Republic Romania Poland Malta Lithuania Latvia Hungary Estonia Czech Republic Cyprus Bulgaria Mean 13 Applicants States Mean 15 EU member States GDP per head GDP per head 25000 20000 15000 10000 5000 GDP per head Slide no. 4 Key Indicators Bulgaria* Cyprus Czech Republic Estonia Hungary Latvia Lithuania Malta Poland Romania* Slovak Republic Slovenia Turkey* Population (in 1000) Size (km2) Growth Inflation rate Public deficit (% GDP) Public debt (% GDP) 8,170 757 10,273 1,436 10,024 2,373 3,696 391 38,646 22,435 5,401 1,990 65,293 110,971 9,251 78,866 45,227 93,030 64,589 65,300 316 312,685 238,391 49,035 20,273 769,604 4.00 4.00 3.30 5.00 3.80 5.90 7.70 -0.80 1.10 5.30 3.30 3.00 -7.40 10.3 4.9 3.9 3.9 10 2.6 0.9 2.4 10.1 45.7 12.1 8.9 54.9 -0.7 -3.2 -4.2 -0.7 -3.1 -2.7 -3.3 -6.6 -3.5 -3.8 -6.7 -2.3 -11 76.9 63 17.3 5.3 55.7 14.1 23.7 60.6 40.9 22.9 32.4 25.8 57.8 2.54 1.50 8.45 2.30 -3.67 -0.60 36.58 63.00 Weighted average 10 Applicant States Weighted average 15 Member States Slide no. 5 I. Accession: opportunities & challenges Accession will fundamentally change the nature of the European Union: – Frontiers will move to the East – The new Union will be confronted with a greater economic diversity – The experience of Germany suggests this will be an expensive and difficult integration Slide no. 6 I. Accession: opportunities & challenges But it will fulfill the vision of the founder of the Community: – to build a truly integrated Union – with markets and skills that can match the United States – and with the economic and political weight to make its voice heard on the global stage Realising this vision is the business of all levels of government Slide no. 7 What are the new opportunities? Continuing the process of promoting local democracy drawing upon the experience of EU Countries that have long histories of decentralised government Tapping into a wider pool of experimentation Accessing resources available in Brussels Helping the expanded community to stay in touch with citizens Slide no. 8 What are the new challenges? Meeting the Stability Pact requirements Meeting the State Aid Rules Financing implementation of EU Directives Central government squeezed between higher & lower levels Making sure the voice of local government is heard in Brussels Slide no. 9 II Main findings Current approaches to sub-national government within the EU – Federal approach (Austria, Germany, Belgium) – Tradition of relatively strong sub-national government (Denmark, Finland, Sweden) – Tradition of relatively weak sub-national government (Greece, Ireland, Portugal) – Intermediate approach (France, Italy, Luxembourg, Netherlands, Spain, UK) Slide no. 1 Current approaches to sub-national government in 10 Applicant Countries Unitary approach Four countries with genuine regional level (Czech Republic, Latvia, Poland, Slovak Republic) Only two countries with two tiers of local government (Latvia, Poland) Slide no. 1 Distribution of municipalities by size range 80.0 70.0 50.0 40.0 30.0 20.0 Population of authority 10.0 Over 100000 50000-100000 10000-50000 5000-10000 2000-5000 1000-2000 Under 1000 Slovenia Slovak Republic Romania Poland Lithuania Latvia Hungary Estonia Czech Republic 0.0 Bulgaria % of authorities 60.0 Slide no. 1 Decentralisation profiles Sub-national expenditure levels (% of GDP) Slide no. 1 Decentralisation profiles Sub-national revenue levels Slide no. 1 The allocation of responsibilities (sub-national spending by function as a percentage of total subnational spending. Mean values) 35.0 30.0 Applicant States 25.0 20.0 Selected member States 15.0 10.0 5.0 Others Transport Culture Housing Welfare Health Education Gen. pub. services 0.0 Slide no. 1 0% United Kingdom Sweden Spain Netherlands Italy France Denmark Belgium Slovenia Slovak Republic Romania Poland Lithuania Latvia Hungary Estonia Czech Republic Bulgaria Composition of sub-national revenues 100% 90% 80% 70% 60% 50% 40% Grants 30% Non-tax revenues 20% Tax revenues 10% Slide no. 1 The choice of sub-national taxes Slide no. 1 Local tax autonomy Level Bulgaria (2000) Czech Republic (1999) Estonia (1999) Hungary (1999) Latvia (1999) Lithuania (1999) Poland (1999) Romania (2000) Slovak Republic (2000) Slovenia (2000) Mean (by country) Belgium (1995) Denmark (1995) Netherlands (1995) Spain (1995) Sweden (1995) United Kingdom (1995) Mean (by tier) Sub-national government taxes as % of total tax revenue SNG sets tax rate and base SNG sets tax rate only SNG sets tax base only (a) (b) (c) …is set by SNG (d1) Revenue sharing where the CG:SNG revenue split… …can be …is set in legis-lation …is set annually changed only if and may be changed by CG as part of SNG agree uni-laterally by CG the budget (d2) (d3) (d4) CG sets both rate and tax base of SNG tax Total (e) 100.0 Local Local Local Local Local Local Local Local Local Local - 10.0 11.1 16.2 10.4 17.1 22.0 8.3 10.5 4.0 7.9 11.8 2.7 49.2 7.0 16.7 7.6 5.6 9.2 41.9 6.0 28.2 0.6 9.2 0.6 0.6 0.4 0.2 0.0 0.0 39.0 91.7 90.8 57.6 82.3 36.1 61.0 50.8 75.0 64.8 25.2 100.0 100.0 18.4 21.8 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 Local Communities Regional Municipalities Counties Municipalities Polder boards Local Regions Municipalities Counties Local - 6.0 13.0 10.0 22.0 9.0 1.0 1.0 9.0 5.0 22.0 11.0 4.0 9.4 13.0 8.0 33.0 15.0 4.0 6.1 84.0 3.0 92.0 96.0 93.0 100.0 100.0 51.0 7.0 96.0 100.0 100.0 76.8 0.0 0.0 97.0 16.0 78.0 15.9 2.0 4.0 0.5 1.0 0.1 7.0 0.6 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 - Slide no. 1 Mean Slovenia Slovak Republic Poland Lithuania Latvia Hungary Estonia Czech Republic Bulgaria 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Romania Free revenues and tied revenues Tied revenues (specific grants) Other free revenues (general grants and tax categories d-e) Ow n revenue (tax categories a-c and non tax revenues) Slide no. 1 III Some general conclusions Problem of fragmentation; too many; too small Total government spending in relation to GDP is 40% in applicant States (45% in EU), but the applicants decentralise much less (7% of GDP against 16%) Inverse relation between degree of decentralisation and importance of tax revenue as source of sub-national finance Autonomy over sub-national taxes: overall lower in Applicant States Institutional framework for central/local relations in the applicant States: emerging systems of negotiations; still many countries have not established standard procedures (e.g. on “bailouts”) Slide no. 2 What are the issues that Applicant States will face? The balance between national fiscal targets and sub-national fiscal discretion – How fiscal decentralization may be coordinated with macroeconomic stability? – Can stabilisation agreements be developed between different levels of government? What possible institutional framework for dialogue between EU and sub-national governments? Slide no. 2 Further perspectives How to strengthen ties between sub-national government in the expanded Union Need to reexamine the role of intermediate government Need to share experiences and identification of “best practices” both within and outside of EU Need to develop reliable internationally comparable statistics The OECD Forum on Fiscal Relations across Levels of Government Slide no. 2