FIN 495 Name: ___________________________________ Fixed Income Derivatives Dr. Clay M. Moffett

FIN 495

Fixed Income Derivatives

Dr. Clay M. Moffett

Fall 2014 Midterm

Name: ___________________________________

Answer both questions from Part I and any 4 from Part II. If you work them all I will grade the first 4.

PART 1

1) Spreads for MBS will widen when compared to bullet bonds as yields decrease. Why? Show graphically the effect on price.

2. Consider a bond with one year to maturity. It pays a semi-annual coupon of 4% on a par value of 100. It is priced to yield 6%. What is the DV01? What is the Modified Duration? Why are these seen as risk measures?

PART II

1.

You need to hedge a long position in $10 million par value of the current 2-year T-note. You decide to use the current 10-year T-note to perform the hedge. A)How would you accomplish this – what hedge amounts would you use? B)What is the implied view taken on the yield curve when the hedge is put in place? Under what circumstances this position can lose money? C) what rates does the short leg pay and receive if a repo is used?

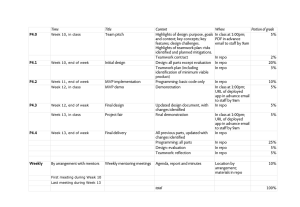

Settlement Date 9/12/2007

Security

Par value $100

T-Note

T-Bond

2- year

3-year

5- year

10-year

30- year

Coupon Maturity Clean

Price

(32nds

4.000% 8/31/2009 100.04

4.500% 5/15/2010 101.12

4.125% 8/31/2012 100.09

4.750% 8/15/2017 103.02

5.000% 5/15/2037 105.21

Clean

Price

(decs)

100.12

101.39

100.31

103.08

105.66

Yield Clean PVBP per

Price $million

'@'+1bp

3.933% 100.10567

3.945% 101.36507

4.056% 100.26168

4.364% 102.99761

4.646% 105.49642

187.68

253.66

446.51

812.84

1665.26

2.

What is Option Adjusted Spread and what does it tell us about a securities price?

3. Describe 3 motivations for “When Issued” trading:

4. What is a flash order?

5. Why would the imposition of penalty on “repo fails” might lead to negative repo rates?

6. Describe how negative repo rates arise. Why would a penalty on ‘repo fails’ lead possibly lead to negative repo rates?

ANSWER KEY

PART 1

1) Spreads for MBS will widen when compared to bullet bonds as yields decrease. Why? Show graphically the effect on price.

It’s common with MBS to confuse the effects of convexity and spread widening. As yields decrease it is common to see a callable bond’s price compression, which is the “stickiness” in a bond’s price at a certain point above par value, being attributable to its “negative convexity.” While not precisely a function of convexity, this compression does represents spread widening; spreads typically widen when prices reach a certain price level because fewer investors will purchase bonds at prices substantially over par. This locks in the yield, irrespective of the continuing decline in market yields.

This phenomenon is illustrated both graphs. The first contrasts two situations associated with price changes of a hypothetical bond due to declining yields. In one case, the bond’s price is moving along the original price–yield curve; the change in the bond’s price can be approximated using duration and convexity. At the inflection point Y* the yield curve shifts, due to changes in the bond’s spread and the price being ‘capped’ by the call price. This type of exogenous change can also be the result of a shift in the price–yield curve.

2. Consider a bond with one year to maturity. It pays a semi-annual coupon of 4% on a par value of 100. It is priced to yield 6%. What is the DV01? What is the Modified Duration? Why are these seen as risk measures?

Price at 5.995%:

P

1

4

0 .

05995

2

1

4

100

0 .

05995

2

2

101 .

91832 .

Price at 6.005%:

P

'

1

4

0 .

06005

2

4

100

0 .

06005

2

2

101 .

90862 .

The slope is: dP dy

P

P '

0 .

0001

101 .

91832

101 .

90862

10 , 000

97 .

05992

MD= -(97.05992/101.913) = 0.9523

These are risk measures b/c they explain the convex price-yield relationship. They give a first approximation of the

changes in price with corresponding changes in yield.

PART II

3.

You need to hedge a long position in $10 million par value of the current 2-year T-note. You decide to use the current 10-year T-note to perform the hedge. A)How would you accomplish this – what hedge amounts would you use? B)What is the implied view taken on the yield curve when the hedge is put in place? Under what circumstances this position can lose money? C) what rates does the short leg pay and receive if a repo is used?

Settlement Date 9/12/2007

Security

Par value $100

T-Note

T-Bond

2- year

3-year

5- year

10-year

30- year

Coupon Maturity Clean

Price

(32nds

4.000% 8/31/2009 100.04

4.500% 5/15/2010 101.12

4.125% 8/31/2012 100.09

4.750% 8/15/2017 103.02

5.000% 5/15/2037 105.21

Clean

Price

(decs)

100.12

101.39

100.31

103.08

105.66

Yield Clean PVBP per

Price $million

'@'+1bp

3.933% 100.10567

3.945% 101.36507

4.056% 100.26168

4.364% 102.99761

4.646% 105.49642

187.68

253.66

446.51

812.84

1665.26

Answer:

A. Note that $10 million par long position has a price risk of $1,876 for a basis point change in 2-year yields. To hedge this we must short $2.31 million par of the 10-year note. This is based on the fact that the ratio of PVBPs between the 2-year and the ten-year is 0.2310 (Hedge Ratio = 1876.8 / 8128.4)

B. The implied assumption in this trade is that the yield curve is shifts will be parallel or that the curve will steepen.

However, this trading strategy will lose money if the yield curve flattens.

C. The short position earns the reverse repo rate on the cash proceeds associated with the market value of the tenyear T-note that was sold short. d) The short position costs the dealer the accrued coupon on the ten-year T-note.

4.

What is Option Adjusted Spread and what does it tell us about a securities price?

OAS adjusts the CF of the bond to be priced for the embedded option prices(s). It takes the difference between fair price and market price and converts it to a yield spread measure – how much return is available to take on the risks of the embedded options. It is affected by volatility – the higher the vol or the ST rate, the lower the theoretical price of a callable bond and lower the price of a putable. This results in a lower (higher) OAS for the callable bond.

OAS reconciles fair value to mkt value by finding a spread that equates the value ot the two. OAS reflects the richness or cheapness of a security.

3. Describe 3 motivations for “When Issued” trading:

WI trading allows for “credible” book building by dealers. It allows them to discover demand for a forthcoming auction.

WI trading is a commitment to deliver securities to customers, even before the auction takes place.

Customers get a specified amount at a known price

Dealers with “short” positions prior to the auction are likely to bid much more aggressively in auctions.

This is good for the Treasury.

4. What is a flash order?

Typically on trades, exchanges pay rebates to traders who post shares to buy or sell and charge fees to traders who respond to those offers. This setup creates an incentive to earn rebates. That is one place where flash orders come in.

With a flash order, a trading firm can keep its order on a certain exchange for up to half a second without matching an existing buy or sell order on another exchange, a move that puts it in a position of poster, rather than responder.

The hope is that another trader who needs to buy or sell quickly steps in on the other side of the trade. This dynamic boosts the chance the flash-order trader will complete the trade on the exchange and get the rebate.

Exchanges offer flash orders to keep market share.

Regulators worry that certain unscrupulous participants in the market with ultrafast computer technology could game these orders, trading ahead of them and affecting the price of the security.

5. Why would the imposition of penalty on “repo fails” might lead to negative repo rates?

Prior to the imposition of penalties, counterparties had an incentive to fail when the Fed funds rates (and repo rates) are low. This is due to the fact that the failing counterparty simply foregoes the interest on the days he/she fails. But when there is a penalty, counterparties have an incentive not to fail. Note that the borrower of security will deliver cash, and if he fails to deliver the security next day, a penalty of 300 basis points could be assessed. The borrower will be happy to pay interest to the security lender up to (but less than) 300 basis points to avoid the penalty. This drives the repo rates into negative territory.

6. Describe how negative repo rates arise. Why would a penalty on ‘repo fails’ lead possibly lead to negative repo rates?

Prior to the imposition of penalties, counterparties had an incentive to fail when the Fed funds rates (and repo rates) are low. The short-demand for a security can outweigh the available supply causing settlements to fail, which can then lead to negative repo rates. The counterparty with the hard-to-find securities would loan against an equal amount of general collateral (GC), except the spread between the two rates would be more than the prevailing GC rate, generating the equivalent of a negative rate. Also the failing counterparty simply foregoes the interest on the days he/she fails. When there is a penalty, counterparties have an incentive not to fail. Note that the borrower of security will deliver cash, and if he fails to deliver the security next day, a penalty could be assessed. The borrower will be happy to pay interest to the security lender up to (but less than) the penalty cost to avoid the penalty. This drives the repo rates into negative territory.