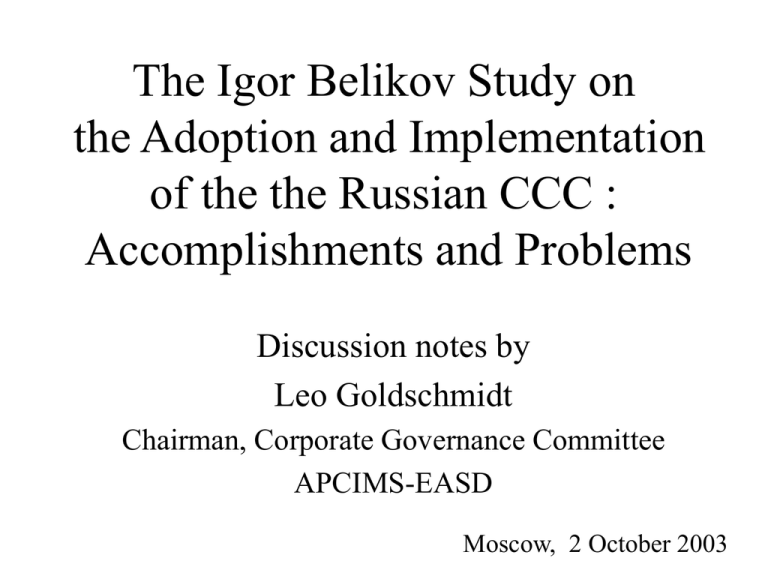

The Igor Belikov Study on the Adoption and Implementation Accomplishments and Problems

advertisement

The Igor Belikov Study on the Adoption and Implementation of the the Russian CCC : Accomplishments and Problems Discussion notes by Leo Goldschmidt Chairman, Corporate Governance Committee APCIMS-EASD Moscow, 2 October 2003 Survey of accomplishments – – – – Summer 2000 Nov 2001 April 2002 Apr 2002-Jun 2003 Work starts on CCC Government approves CCC CCC presented to community FCSM + Exchanges, Ministries conduct 10 regulatory events – Aut 2001-Sum 2003 RID + S&P and others conduct 9 surveys, polls and analyses Benefits Surveys, by their existence • Provide quantitative benchmarks enabling evaluation of past and measurement of future progress • Improve discriminatory abilities of investors • Should create investor expectations • Should prompt improvement by companies • Should initiate a virtuous circle Overall • Comprehensive, factual • Lucid, not complacent • Clear, striking • CG Assessment : 2 Groups – Major companies : interested but application uneven Motivation : raising capital but West more than Russia – Other large + SME : little interest, less application Capital markets no motive (no liquidity, alternatives) Problems • Is CG economically reasonable for SMEs (84) (see de-listings in the West) • Lack of monitoring instruments and resources (FCSM low, exchanges nil - caution needed) • Extreme inefficiency in sanctions • Government representatives on boards weak in fostering compliance • Banks no CG interest in credit due diligence • Investor organisations : no efforts to monitor Recommendations • Recognise company differences and prioritise • Focus on OJSC top 200, exchange traded, sector leaders, IPOs- increase their disclosure • Facilitate reorganisation of smaller OJSCs, reduce their CG obligations • FCSM to compel CG observance and disclosure and tighten sanctions • Exchanges to liaise with FCSM in enforcing • Distinguish between shares and bonds issuers Recommendations (2) • Government reps to include CG in oversight and reporting, appraisal for renewal of post • CG observance = condition for public sector contracts • Banks to include CG as element of credit due diligence • Investors/rating agencies to proclaim CG as important investment criterion Recommendations (3) • Carry out international comparisons • New NCGC with business associations to promote observance and give incentives e.g. awards for best CG section in report • Regular upgrading of CCC