BUDGETING IN SINGAPORE 27 Annual Meeting of Senior Budget Officials

BUDGETING IN SINGAPORE

27 th Annual Meeting of Senior Budget Officials

Sydney, 6 June 2006

Jón R. Blöndal

To begin…

• “Profile”

–More descriptive

•

OECD Asian Centre for Public Governance

–Government of Korea

Agenda

•Outline the architecture of Singapore’s system of public finance

•Discuss key features of Singapore’s budgeting system

Budget Concepts

•

Four Pillars

–Budget sector

–Central Provident Fund

–Government investment agencies

–Other special funds

Central Provident Fund

• Relieves budget sector from financing various social services

•

Personal savings accounts

–Mandatory

–Payroll contributions from both employers and employees

•33% of payroll

–Earn interest

–Withdrawals for approved uses

–Any remaining balances form part of estate

• CPF “surpluses” invested in government bonds

Central Provident Fund (2)

• Housing account – 20%

–For down-payment and servicing mortgages

• Retirement account - 6%

–Regular withdrawals from age 62

•

Medical account - 7%

–For hospitalisation and major outpatient treatments

Government investment agencies

•

Huge reserves

–Past budget surpluses and CPF “surpluses”

–At least USD 160 billion

• Invested in financial instruments and corporate shareholdings

•

Very limited disclosure

–Portfolio size, composition and rate of return not disclosed

•“To prevent market speculation”

–Differentials in rates of return vis-à-vis interest paid on CPF account balances

• “Ring-fenced” from budget sector

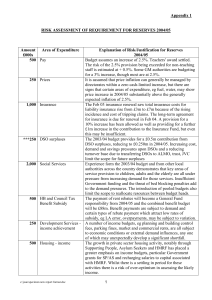

Other Special Funds

• “Netting” funds

–Example: Government Securities Fund

•

Endowment funds

–Budget surpluses deposited in them

–Subsequent annual investment income used to pay for good causes

–Example:

MediFund

–

25

20

Total Revenue

15

10

5

–

Total Expenditure

Budget Balance

0

-5

-10

FY86 FY88 FY90 FY92 FY94 FY96 FY98 FY00 FY02 FY04 FY06 (Bud)

Key Features

•Fiscal rule

•Block budgets

•Reinvestment dividends

– •Role of Parliament

•Financial management

•Government salaries

Fiscal Rules

• Balanced budgets

–Over government’s term of office

•

Limited use of investment income

–Up to 50% of realised income

• Enforcement

–External monitoring not feasible

–President as “fiscal guardian”

–

Block Budgets

• Five-year horizon

–Advances and carry-forwards

•

Linked to GDP

–Budget pegged to share of GDP

•Ministry of Education = 4% of GDP

–“Smoothened” GDP

•

Fungible

–One block per ministry

–Operating, transfer and capital expenditure all in one block

–

Reinvestment Dividends

• Across-the-board cuts in expenditure

–5% of all expenditure, i.e. including transfers and capital expenditure

• Ministries make bids to “reinvest” the cuts

–Innovative proposals

–Inter-ministerial co-operation

•

Significant part of cuts not “reinvested”

–

Role of Parliament

•

Specific restrictions

–MPs can only make proposals for S$100 nominal cuts

–MPs cannot make proposals for any increases or reallocations

•

Political environment

Financial Management

• Accrual financial reporting

–Greater awareness of non-cash costs in decision-making

•

Cash budgeting

–Better control

–Supplementary information on accruals available

•

NEV – Net Economic Value

–Incorporates cost-of-capital

Government Salaries

•

Pegged to private sector equivalents

–Ministerial salaries (USD 500,000-1,500,000)

•

Flexible wage system

–Responsive to economic conditions

•

Strengthening link with performance

• “Pure cash” wages

BUDGETING IN SINGAPORE

27 th Annual Meeting of Senior Budget Officials

Sydney, 6 June 2006

Jón R. Blöndal