Board nomination in partly- privatized SOEs: Some lessons from the

advertisement

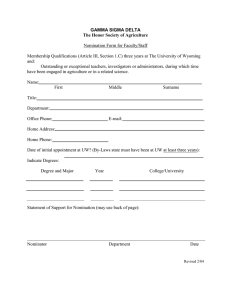

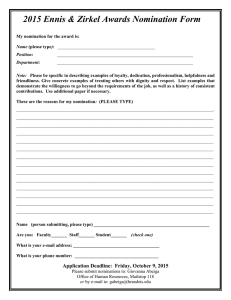

Board nomination in partly- privatized SOEs: Some lessons from the European Telecoms Industry Stilpon Nestor, Principal 4 Royal Mint Court, London EC3N 4HJ, United Kingdom NeAd Tel: 44 20 7073 0448 | Fax: 44 20 7481 6801 info@nestoradvisors.com www.nestoradvisors.com Ownership and Control of European Telecoms (2002) Gov’t Ownership Other Shareholders Total Free Float Golden Share OTE 33.8% 13.7% 47.5% 52.5% No Deutsche Telekom 43.1% 0.0% 43.1% 56.9% No France Télécom 60.6% 5.9% 66.5% 33.5% No Portugal Telecom 20.9% 5.2% 26.1% 73.9% Yes Swisscom 65.5% 0.0% 65.5% 34.5% No Telefonica 9.1% 0.0% 9.1% 90.9% Yes Telecom Italia 3.0% 55.0% 61.0% 39.0% Yes Telia 70.6% 12.8% 83.4% 16.6% No KPN 34.7% 0.0% 34.7% 65.3% Yes TDC 41.6% 7.8% 49.4% 50.6% No BT Group 0.0% 3.0% 3.0% 97.0% No NeAd Company 2 What is a high-quality board – An independent, competent and engaged board, capable of exercising its strategic and monitoring functions NeAd – …requires a managed nomination process that : 3 • achieves the right balance between competence and independence of directors • …which, in turn, drives their engagement and effectiveness • …and thus ensures the right balance between the monitoring and strategic functions of the board The two key operational constraints of SOEs NeAd 4 Politicization : – Company goals are defined politically… – …and, where public institutions are weak, clientelism prevails – …While perceptions of politicization constitute obstacles to growth Lack of commercial incentives: – Government is a weak governance principal – Managerial incentives are weak and perverse – ..and employees are often civil servants, in law or in fact Average composition of the board of directors of European Telecoms Employee representatives, 18.7% Executives, 12.9% NeAd Shareholder appointees, 24.1% 5 Independent, 6.7% Non-executives, 37.6% Constituency boards and shareholder nominated boards: Key problems (1) In constituency boards, there is important outside voice but…: – Loyalties are divided. – Competence might not be the primary concern of the nominating party – ..while management might not trust the board, resulting in weak board information A divided and low-competence board is a weak driver of strategy and corporate values. …a function crucial in all boards, – NeAd 6 Institutional investors with more than USD 5.3 trillion AUM require a specific strategy function …but especially important for SOEs in competitive industries – Board as primary change agent to counter politicization – Board identifies and manages the overall risk environment and policies in an organization not used to dealing with risk Constituency boards and shareholder nominated boards: Key problems (2) NeAd 7 In companies that follow “regular” but not managed AGM nomination procedures: – Boards are often politicized in a non-transparent way – …or are captured by management. – Formal independence requirements are weak protections in the presence of a dominant investor Cumulative voting—a limited dose of a constituency board-- might be the answer, where minorities can play a constructive role While minority representation will play a role where minorities have CG competences, a board- managed, shareholder- oriented nomination process, independent from both management and government, might be the answer everywhere else Nominating committees in European Telecom boards % Executives % NonExecutives % Independents Participation of CEO # Meetings Held OTE n/a n/a n/a n/a n/a Deutsche Telekom n/a n/a n/a n/a n/a France Télécom n/a n/a n/a n/a n/a Portugal Telecom n/a n/a n/a n/a n/a Swisscom n/a n/a n/a n/a n/a Telefonica 0% 100% 75% No 10 Telecom Italia n/a n/a n/a n/a n/a Telia 0% 20%* 0% n/i n/i KPN 0% 100% 0% Yes 4 TDC n/a n/a n/a n/a n/a BT Group 25% 75% 75% No n/i NeAd Company 8 The SOE nomination process NeAd 9 Director nomination by governments should de designed to facilitate both independent judgment and competence in the board: – The Swedish and Finnish experience – The French agency and the PRC SASAC The Corporate Governance and Nomination Committee should (inter alia): – Define and maintain a relevant competency profile for the board and keep control of job description for board vacancies; – Solicit candidates from key majority and minority shareholders – Screen and opines on the nomination of majority/minority/constituency candidates – Develop processes for nominating board’s own candidates – Develop consultation processes with key shareholders on board’s own nominations – Ensure that board competencies are enhanced through well-designed board induction process and relevant director training – Lead yearly board evaluation process – Lead individual director evaluation processes, at least whenever director terms come to an end. – Lead the development of a corporate governance statement and annual reviews Key lessons from the European Telecoms experience and challenges for China Some minority shareholder power is important but In the long run, constituency boards should be discouraged – …replaced by a shareholder- oriented nomination process – Is the restrictive view of independence (less than 1% of votes) compatible with shareholder orientation? – Should the PRC envisage cumulative voting, especially in the largest important statecontrolled enterprises? …managed by the board through an active corporate governance/nomination committee – NeAd 10 How can the CSRC avoid the pitfalls of constituency boards while remaining the ultimate authority in board nominations? Does the board of Chinese companies have enough authority to manage the nomination process? State ownership agencies need to develop explicit rules that are the “first filter” of good board composition – How can the director nomination guidelines of PRC SASAC aimed at facilitating independence and competence of government appointees in listed companies? Thank you NeAd www.nestoradvisors.com