1099 Reporting 2014 Calendar Year For

advertisement

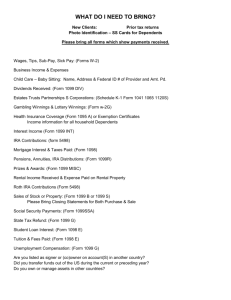

Sonoma County Office of Education 1099 Reporting For 2014 Calendar Year IT Department December 17, 2014 1099 Reporting 2014 1 7/26/2016 Important Dates for 2014 1099 Reporting EVENT Dates Due District Responsibilities: Reviewing of Object Account Component December 10 – Jan 14 ** Verification of Vendor/1099 data in Production Vendor Record Review ReqPay18 Review December 15 - Jan 14 **Audit and Edit Vendor 1099 List in Production December 15 – Jan 14 **Last APY Run for 2014 Backup Due by Noon December 23 - Noon **FINAL Verification of Vendor/1099 data in Production Vendor Record Review ReqPay18 Review Audit and Edit Vendor 1099 List December 18 January 14 **1099 Verification Reports Due to SCOE ReqPay07 ReqPay16 Both Reports Must be signed by Chief Business Official January 14- 4:30 pm or Before Additional 1099 Data Changes Requires Business Services January 14 - 26 1099 Printing/No new 1099 Entry allowed January 27 Interim 1099 Review/Communication with SCOE January 27 – March 25 Periodic 1099 Vendor Review March – December 2015 IT Responsibilities: Installation of 14.3 in Production December 14 Printing of 1099 Forms January 27 Printed Form 1099 Mailed to Recipients - Districts will be billed for postage via a County Transfer January 30 2014 1099 Reporting 2 7/26/2016 Vendor Classification See separate 2014 Instructions for Form 1099-Misc o You must provide a 1099 Miscellaneous form for: Income of $600 or more for rents, services (including parts and materials) Medical and health care payments Gross Proceeds of $600 or more paid to an attorney Non-profit organizations (engaged in a trade or business) o You are not required to provide a 1099 Miscellaneous form for: Generally, payments to a corporation Wages paid to an employee (reported on W2) Business travel allowances (reported on W2) Payments to tax-exempt organizations o Special circumstances that must be reported on 1099 Miscellaneous form See 2014 Instructions for Form 1099-MISC (separate handout) Reportable payments to Corporations include: Medical and health care payments to be reported in Box 6 Attorney fees to be reported in Box 7 o See page 2, second column Gross proceeds paid to an attorney in Box 14 o See page 2, second column Deceased employee’s wages o See page 3, first column o See W2 Process Workbook, Addendum A o Watch definition of Independent Contractors vs an Employee Three types of check Behavioral control Financial control Type of relationship Training vs teaching staff/others Penalties/back taxes will be accessed A current, valid W9 is a must Form will allow you to properly set up and review a vendor’s 1099 needs in a timely manner o The form requires the vendor to designate their taxable status o See separate W-9 handout You may reprint this one or download a new one from the website: www.irs.gov/1099 o Please highlight the following sections on the W-9 form: Check appropriate box for tax classification (page 1) Part 1 Taxpayer Identification Number/TIN (page 1/3) You are subject to a penalty of $50 for each failure (page 2) Sole Proprietor (page 2) Limited Liability Company/LLC (page 2) However, the IRS prefers that you use your SSN (page 3, column 2) What Name and Number to Give the Requester Chart (page 4, column 1) 2014 1099 Reporting 3 7/26/2016 Certain rules do apply as noted below: o A 1099 vendor can have only one active Social Security number or Tax Payer Identification number for the same business for a given period Watch for Incorporation of business during the year Watch for the Sale of business during the year Watch for Merger of business during the year Best defense is a new W-9 o A vendor can be a sole proprietor and not be an Independent Contractor In both cases you must have the 1099 Yes field marked o A vendor that supplies you with a social security number must supply their full name Check early for current W-9 information o A vendor that supplies you with a EIN/TIN must give you the business name Check early for current W-9 information o A vendor may have changed business types May now need to be flagged for 1099 inclusion Previous a 4XXX type business o An Independent Contractor must supply you with a social security number for SB542 reporting but can be reported as a 1099 vendor with their EIN/TIN number Make sure you understand the vendors preference o A Partnership must supply one EIN/TIN number that can be associated with the business name o An LLC must report as either a P for a partnership or a C/S for a corporation or a S corporation o Fines/penalties will be/have been assessed by the IRS and Business Services will be passing the amounts on to you as they occur The IRS will send 1099 inaccuracies back to SCOE after the official 1099 filing If the information supplies does not match you will be notified You will be asked to correct and refile 2014 1099 Reporting 4 7/26/2016 Review 1099 Component Setup Finance – Setup – Chart of Accounts – Account Components Review the 1099 form box in the Account Components activity. Designations have been made here to allow the system to automatically know anything paid to these objects will be dropped into the correct 1099 form boxes (First place Escape looks for 1099 coding) Escape then looks for payments that have been made to the object codes designated for 1099 inclusion In all cases vendors must be set up to be reportable in the vendor record Remember that many of the 6XXX objects should be reported 6XXX usually relate to construction projects Please see the separate copy of the 2014 Miscellaneous Form and pages 4-9 of the 2014 Instructions for Form 1099-Misc Review the box definitions for use in the Account Component 1099 boxes noted above o Box 1- Rents Real Estate Rentals (Not the agent) Machine Rentals (Only the actual rental fee) o Box 3-Other Income Beneficiary of deceased employee o Box 6-Medical and health payments No exemption from reporting even if a corporation Not required to report drug payments o Box 7-Nonemployee Compensation $600 or more paid for services performed by a nonemployee Could have been to an individual, partnership, estate and in some cases a corporation Attorney fees, even if a corporation must be reported here Should include Attorney fees only o Box 14-Gross Proceeds Paid to an Attorney When you cannot determine what part of the payment is a settlement and what part is the actual attorney’s fee 2014 1099 Reporting 5 7/26/2016 To Change 1099 Object Definition Finance – Setup – Chart of Accounts – Account Components Not all APY users will have access to the Account Component activity o Please check with the correct person in your district to make any needed changes o First designation for inclusion as 1099 amounts Can be overridden at the vendor level o Object codes can be changed now and the system will go back and pick up any payments made to the new object designation when a new 1099 search is made 2014 1099 Reporting 6 7/26/2016 Review Vendor Setup Finance – Purchasing – Vendors o Vendor is a critical part of 1099 review o If you do not have access to the vendor screens, please allow time to work with the appropriate person that does have this activity o Review the following: Tax Id is formatted correctly Watch Federal and State Numbers o Federal number must be associated with a company name o Social Security numbers must reference an individual’s name o 1099 process first looks for the Federal Tax id o SB542 first looks for the State Tax id (Independent Contractor) 1099 Form Box is filled in appropriately Verify that this box is coded 0 (N/A) or the system will override all object designations and report all vendor payments to this one box o A vendor that has several types of payments should not have this box hardcoded to box 7 (Non-Employee compensation) or any rents would not automatically go to box 1 (Rents) 1099 Flag is set to Yes (a must to create a 1099 form) If the flag is set to no, you can change it now and then any the vendor payments will appear on all future 1099 vendor searches o Report searches can be run using this designation 2014 1099 Reporting 7 7/26/2016 2014 1099 Reporting Verify the 1099 address Set the default in the Address section o If there is no 1099 address marked the system will take the last paid address (or remit to) Watch vendor names and address that are longer than 30 digits o Use the // to separate lines (either name or address) P O Box 70049//123 Main Street will print on two lines The IRS only allows for 40 characters on one line as a street address, while Escape allows 60 characters spread over two lines You may want to create a separate address for 1099 remits Watch out of country vendors o Escape Chapter 8 Vendor Management Page 10 has an example of vendor set up If you are reporting a vendor with a ssn and have paid using a vendor name be sure to have a DBA vendor address (see example on previous page) Watch for business changes o Sole Proprietor to Corporation Add a new vendor for the corporation New payments to the new vendor 1099 amounts may need to be altered See pages 11/12 of this manual o Business sale Trade name may be the same but the taxpayer id will not be Add a new vendor 1099 amounts may need to be altered See pages 11/12 of this manual o Change in business needs May not have originally been flagged for 1099 inclusion 4XXX now 5XXX, 6XXX business type o Suspect a business change Ask for a new W-9 Adjust vendor as needed 8 7/26/2016 Working the 1099 List Finance – Processes – Tax Reporting – Vendor 1099 Chapter 19, 1099 Reporting, pages 11-15 Tutorial Available from Tools in upper right hand corner of Escape screen Define your search to produce a list that addresses your current process needs o First time search use all defaulted values (all blanks as shown below) Search criteria to watch thereafter o With Changes Yes - Only vendors that you have modified through the 1099 process will appear on the list No - Excludes vendors from the list that have changes already made through the 1099 process Blank - Allows the list produced to include all vendors regardless of changes made to them (default) o 1099 Yes – Produces a list of all 1099 qualified vendors and that have no errors The vendors are currently ready to go to the IRS as is No – Produces a list of vendors that do not qualify to receive a 1099 for a variety of reasons Under the $600 limit Undefined object boxes Not flagged to receive a 1099 Blank – Shows all vendors, all errors, all dollar amounts (default) o Include Closed Years Yes – Gives you access to both prior closed and current year data Only current year 1099 data is editable No – Gives you a listing of only current year (editable) records 2014 1099 Reporting 9 7/26/2016 Review the produced list for any changes needed o Verify that there is an identification number present for each vendor o Verify TIN/EIN’s have business names o Verify any ssn’s have a individuals name o Review the list for any errors that show in the far right column of the list o Review the Vendor 1099 column on the left of the report and verify that all the vendors you expected to create 1099’s for are marked with a Y Changes needed must be done from either the Quick link or in the Vendor activity The status field indicates if a 1099 will print Note the Blank Tax Id# Note that the list will group by error For any highlighted line on the list, the Paper/Magnifying Glass on the tool bar will produce a 1099 snapshot o No Tax Payer Identification number on the list 2014 1099 Reporting 10 7/26/2016 o Note that this record showed on our original list for review as the vendor was: Flagged to report on the vendor record Component involved had been set to deposit the rental dollars in Box 1 Investigating From the List/Editing Data Finance – Process – Tax Reporting – Vendor 1099 Vendor changes needed must be done from either the Quick link or in the Vendor activity The example below has 1099 Vendor turned off, tax payer id indicates a business and an amount over the $600 reporting limit o Seems like one worth checking on Once I open the line for vendor 054700 Academy Theatrical Lighting, I can then use the Quick link to take me to the vendor screen (small yellow icon) 2014 1099 Reporting 11 7/26/2016 The vendor screen then allows us to look further based on what is shown at the vendor level In my example I am questioning what accounts the vendor was paid from o I see no Incorporation in the vendor name and I do see that the field W9 required was set to Yes The 1099 field however is set to No Unless this field is set to yes, no 1099 will print no matter the paid amount I opened the Payment tab from the screen and selected the quick link for a payment I felt would show the account code From the payment I selected the quick link (small yellow icon) to see the actual payment screen o Payment coding is one way to determine if additional review is needed o If the payments should have been reported then I need to request a W9 form o I may need to change the vendor screen to appropriately classify this vendor 2014 1099 Reporting 12 7/26/2016 Now I can determine that the payment went to a 5899 object and should have been reported on a 1099 and make the necessary adjustments o I should review all the payments to this vendor while I have the screens open Normally a 1099 reportable object (5899) 2014 1099 Reporting 13 7/26/2016 Manually Adjust 1099 Form Box Amounts To change the reportable amounts on your original 1099 list o Select the vendor you need and open the record o From the task menu drop down Select edit and the fields on the sample 1099 screen will open Note that only the first box in each section will open The remaining fields are locked as those amounts came in from system generated activities Enter negative and /or positive adjustments o I entered a positive 500.00 as this vendor had a ASB (Student Body) payment made to him outside of the normal Accounts Payable process o I did not want to use the Import process Example shown on the next page 2014 1099 Reporting 14 7/26/2016 Save/Close the record As the 1099 list returns you can see the adjusted amounts on your list Note that with the addition of the 500.00 he will now need to have a 1099 generated and the system made the adjustment in the status field 2014 1099 Reporting 15 7/26/2016 Manually Add a Miscellaneous Vendor Amount Select New from the 1099 vendor list you originally created This method can be used to add miscellaneous vendors rather than using the Import feature As with the Import Process the Vendor must exist and be active in ESCAPE o o o o Enter the Vendor Code (Vendor must already exist) Enter all necessary 1099 data for the vendor Adjustment reason (ASB Vendor) Save/Close 2014 1099 Reporting 16 7/26/2016 For the added vendor to now show on your 1099 vendor list, you will need to research using the Go function in the initial 1099 Vendor search screen Always review the entry on the list o This manual vendor record still needs some editing to report The 1099 vendor field shows a No There is no tax payer id number available in the vendor record Both are a must for the record to be valid and reportable Follow the process outlined on page 11 of this manual to change the vendor fields Print a snapshot to complete the verification if needed o Example shown before the corrections Note no vendor tax id on the form 2014 1099 Reporting 17 7/26/2016 Importing 1099 Amounts Chapter 19 1099 Reporting, pages 25-26 and pages 29-30 Tools/Tutorial Not a good process for only a few vendors (see pages 13/14 for alternative reporting method) Strongly advise viewing the Tutorial Warrants issued outside of Escape need to be included in the 1099 process. This is a two-step process o Creation of the CSV File May contain ASB, Charter Schools, Petty Cash payments o Importation of the file into Escape Rules to remember o See the file layout template for initial field definition for input http://www.escape.com/documents/1099templ.csv o Each district can have only one file If there was something left off the first file, the second file must contain all the previous records in addition to the new information. The last imported file information will be what’s reported on the 1099 o All vendors on the file must exist in Escape prior to the file importation Import all vendors o There could be instances where once the vendor amounts are combined the vendor reaches the $600 threshold and should be report 2014 1099 Reporting 18 7/26/2016 Report Use 1099 List Processes - Tax Reporting – Vendor 1099 Can be run using the defaulted features to begin o Vendor name ranges available (a..g) o Searches can be made for specific research goals o Shows all vendors that are flagged as requiring 1099 or not o Shows all taxpayer id’s, present or not o Shows all problems associated with each vendor on the list Once changes are made to any vendors/component designation, the1099 list must be rerun to show the most current vendors to be reported Grid List Can be run from any vendor/1099 search menu 1099 Snapshot Process – Tax Reporting –Vendor 1099 A exact copy of the proposed 1099 form is available from the opened list Changes with each new 1099 vendor list search ReqPay18 Vendor Check Details Finance – Reports – Req/Payment Watch tax year (calendar, not fiscal) Review report sampler Provides object detail for all payments Reqpay16 Vendor 1099 Detail Finance – Reports – Req/Payment Review report sampler Designate errors requested from drop down menu ReqPay07 Vendor Log Finance – Reports – Req/Payment Review report sampler New Report Warehouse for financial reports Finance – Report Warehouse o ReqPay16 o Runs at 1099 generation o Only see your own district reports o No deletion of reports Permanent in nature 2014 1099 Reporting 19 7/26/2016 Have you checked these items? Chapter 19, pages 19-20 Every vendor record must be corrected before its 1099 can be printed Vendors with errors will cause the Escape system to reject all 1099 printing requests Most Common areas of concern o Tax Payer number is incorrectly formatted or missing W-9 o Vendor address is missing 40 1099 lines characters 60 Escape vendor characters DBA Vendor o Payments did not reach the $600 threshold ASB/Petty cash entries made Vendor status reviewed after manual additions o The vendor is flagged to not receive a 1099 and they should be o If their classification is "Corporation" and they provided medical or legal services Are the services truly considered "medical" What classification did they put on their W9 o Reclassification of rental payments Object coding is best o Stale dated or cancelled warrants Escape reports ignore Manually adjust 1099 amounts Duplicate Vendors o Determine which Vendor Record has more requisitions recorded against it Inactivate the other record by changing the vendor’s active flag to No o Edit the Vendor 1099 Record of the inactive vendor, adjusting the amounts to zero Put a note in the Adjustment Reason field referring to the other vendor’s code o Edit the Vendor 1099 Record of the active vendor, adding the amounts from the inactive vendor Put note in the Adjustment Reason field referring to the other vendor’s code Duplicate/Multiple Tax ID’s o Research the vendor list o Modify the Vendor Records accordingly Negative Amounts o Review vendor to determine why the amount was negative and make an adjustment with a detailed reason in the Vendor 1099 Record o You may have created a credit memo and used a different object code than used in the original invoice 2014 1099 Reporting 20 7/26/2016 All of the vendors listed below are ones you should pay close attention to in determining whether or not to send them a 1099: o o o o o o ANOVA Easter Seals NPS (Non Public Schools) Redwood Pediatrics School & College Legal Selpa If for Behavioral Assistance, not considered medical Physical Therapy is not really considered medical If marked Corporation and providing OT (Occupational Therapy) OT is considered medical Exempt Part of SCOE What/When to Submit **1099 Verification Reports Due to SCOE ReqPay07 ReqPay16 Both Reports Must be signed by Chief Business Official January 14- 4:30 pm or Before Additional 1099 Data Changes Requires Business Services January 15 - 25 1099 Printing/No new 1099 Entry allowed January 26 Interim 1099 Review/Communication with SCOE January 27-March 25 Periodic 1099 Vendor Review March – December 2015 After SCOE has generated the 1099 file, no NEW data can be added to the 1099 form by the districts o You will need to contact Erin Graves @ SCOE 2014 1099 Reporting 21 7/26/2016