Future Fund Management Agency Agency Resources and Planned

advertisement

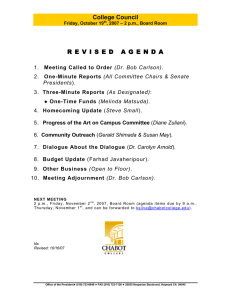

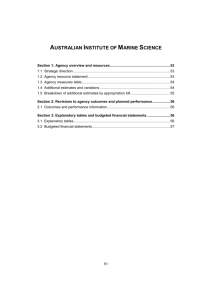

Future Fund Management Agency Agency Resources and Planned Performance FUTURE FUND MANAGEMENT AGENCY Section 1: Agency Overview and Resources ......................................................... 147 1.1 Strategic Direction Statement ....................................................................... 147 1.2 Agency Resource Statement ........................................................................ 148 1.3 Budget Measures .......................................................................................... 148 Section 2: Outcomes and Planned Performance ................................................... 149 2.1 Outcomes and Performance Information...................................................... 149 Section 3: Explanatory Tables and Budgeted Financial Statements................... 153 3.1 Explanatory Tables ....................................................................................... 153 3.2 Budgeted Financial Statements .................................................................... 154 145 FUTURE FUND MANAGEMENT AGENCY Section 1: Agency Overview and Resources 1.1 STRATEGIC DIRECTION STATEMENT The Future Fund Management Agency (FFMA) was established by the Future Fund Act 2006 to support and advise the Future Fund Board of Guardians (the Board) in its task of investing the assets of the Future Fund. The scope of the FFMA and the Board was extended by the Nation-building Funds Act 2008 to include the management of investments to grow other Australian Government Asset Funds as a means to provide financing sources for substantial future investments in the Australian economy. As a result the FFMA now supports the Board in managing investments of the Future Fund, Building Australia Fund (BAF), Education Investment Fund (EIF) and Health and Hospitals Fund (HHF). Since its establishment the FFMA has focused on supporting and advising the Board of Guardians in developing and implementing appropriate investment strategies for the funds. Particular focus has been placed on effectively managing the Future Fund portfolio during the most significant period of market upheaval in recent decades. The FFMA will continue to consolidate its capabilities to ensure adequate resources are available to support the Board. The long term asset allocation and associated investment approach for the Future Fund was detailed in the 2010-11 Annual Report. Recognising the potential for continued volatility in investment markets, an important emphasis for the FFMA and the Board is maintaining a long term investment perspective and strategy that balances risk with expected return as required under the Investment Mandate. The FFMA provides support and advice to the Board in relation to the BAF, EIF and HHF and is focused on developing and implementing investment strategies consistent with the legislation and mandates. The investment strategies and approach for these funds is detailed in the 2010-11 Annual Report. 147 FFMA Budget Statements 1.2 AGENCY RESOURCE STATEMENT Table 1.1 shows the total resources from all sources. The table summarises how resources will be applied by outcome and by administered and departmental classification. Table 1.1: Future Fund Management Agency Resource Statement — Budget Estimates for 2012-13 as at Budget May 2012 Estimate of prior year amounts available in 2012-13 $'000 Special Accounts Opening balance Non-appropriation receipts to Special Accounts Total Special Accounts Total net resourcing for FFMA Reader note: All figures are GST exclusive. Total estimate Actual available appropriation 2012-13 $'000 2012-13 $'000 2011-12 $'000 - - - - - 421,262 421,262 421,262 421,262 380,864 380,864 - 421,262 421,262 380,864 + Proposed at Budget = Note: Future Fund does not receive any Appropriations. Its outputs are funded as payments from the Future Fund Special Account. 1.3 BUDGET MEASURES There are no budget measures in 2012-2013 for FFMA. 148 FFMA Budget Statements Section 2: Outcomes and Planned Performance 2.1 OUTCOMES AND PERFORMANCE INFORMATION Government outcomes are the intended results, impacts or consequences of actions by the Australian Government on the Australian community. Commonwealth programs are the primary vehicle by which government agencies achieve the intended results of their outcome statements. Agencies are required to identify the programs which contribute to Government outcomes over the Budget and forward years. Each outcome is described below together with its related programs, specifying the performance indicators and targets used to assess and monitor the performance of FFMA in achieving Government outcomes. Outcome 1: Make provision for the Commonwealth’s unfunded superannuation liabilities and payments for the creation and development of infrastructure, by managing the operational activities of the Future Fund and the Nation-Building Funds, in line with the Government’s investment mandates. Outcome 1 Strategy The FFMA contributes to the achievement of the outcome through the provision of advice and support to the Future Fund Board of Guardians and through the implementation of investment decisions. This work is focused on ensuring that the assets of the Future Fund and the Nation Building Funds are invested in line with the relevant legislation and investment mandates to achieve their investment objectives. This work includes portfolio modelling, risk management, the appointment of investment managers and the application of appropriate corporate governance. The specific investment strategies applied to the investment of assets, together with the overarching investment beliefs and principles of the organisation, are detailed in the Annual Report. 149 FFMA Budget Statements Outcome Expense Statement Table 2.1 provides an overview of the total expenses for the Outcome by program. Table 2.1: Budgeted Expenses for Outcome 1 Outcom e 1: Make provision for the Com m onw ealth's unfunded superannuation liabilities and paym ents for the creation and developm ent of infrastructure, by m anaging the operational activities of the Future Fund and the Nation-Building Funds, in line w ith the Governm ent's investm ent m andates. 2011-12 Estimated actual expenses $'000 2012-13 Estimated expenses Program 1.1: Managem ent of the Investm ent of the Future Fund Special Accounts 34,212 40,789 34,212 40,789 720 720 720 720 Outcom e 1 Totals by appropriation type Special Accounts 34,932 41,509 Total expenses for Outcom e 1 34,932 41,509 Total for Program 1.1 Program 1.2: Managem ent of the investm ent of the Building Australia Fund, Education Investm ent Fund and Health and Hospitals Fund Special Accounts Total for Program 1.2 $'000 2011-12 2012-13 Average Staffing Level (num ber) 86 95 Program splits and totals are indicative estimates and may change in the course of the budget year as Australian Government priorities change. 150 FFMA Budget Statements Contributions to Outcome 1 Program 1.1: Management of the Investment of the Future Fund Program Objective The FFMA supports the Board of Guardians in investing to accumulate assets for the purpose of offsetting the unfunded superannuation liabilities of the Australian Government which will fall due on future generations. Program 1.1: Management of the Investment of the Future Fund Special Account Expenses: Future Fund Special Account Total program expenses 2011-12 Revised budget $'000 2012-13 Budget 34,212 34,212 40,789 40,789 $'000 2013-14 2014-15 2015-16 Forw ard Forw ard Forw ard year 1 year 2 year 3 $'000 $'000 $'000 42,410 42,410 43,812 43,812 Program 1.1 Deliverables Ensure all decisions of the Board of Guardians are given effect as directed by the Board within timeframes and quality levels agreed with the Board. Ensure all investments are made in accordance with relevant legislation, Investment Mandate and ministerial directions. Provide administrative services to the Board. Provide information and recommendations to the Board. Advise the Board about the performance of the Board’s functions. Make resources and facilities available to the Board. Program 1.1 Key Performance Indicators Provide assistance and advice to the Board in pursuit of achieving the Investment Mandate target return of at least 4.5 to 5.5% above the Consumer Price Index (CPI) over the long term (interpreted as rolling 10 year periods) with acceptable but not excessive risk. 151 45,210 45,210 FFMA Budget Statements Program 1.2: Management of the Investment of the Building Australia Fund, Education Investment Fund and Health and Hospitals Fund Program Objective The Nation-building Funds Act 2008 established the Education Investment Fund, the Health and Hospitals Fund and the Building Australia Fund on 1 January 2009. The role of the FFMA was extended to include supporting the Board of Guardians in the investment of the assets of these funds. Program 1.2: Management of the Investment of the Building Australia Fund, Education Investment Fund and Health and Hospitals Fund Special Account Expenses: Future Fund Special Account Total program expenses 2011-12 Revised budget $'000 2012-13 Budget 720 720 720 720 $'000 2013-14 2014-15 2015-16 Forw ard Forw ard Forw ard year 1 year 2 year 3 $'000 $'000 $'000 720 720 720 720 Program 1.2 Deliverables Ensure all decisions of the Board of Guardians are given effect as directed by the Board within timeframes and quality levels agreed with the Board. Ensure all investments are made in accordance with relevant legislation, Investment Mandate and ministerial directions. Provide administrative services to the Board. Provide information and recommendations to the Board. Advise the Board about the performance of the Board’s functions. Make resources and facilities available to the Board. Program 1.2 Key Performance Indicators Provide assistance and advice to the Board in pursuit of achieving the Investment Mandate target return for each fund of the Australian three month bank bill swap rate plus 0.3% per annum, calculated on a rolling 12 month basis while minimising the probability of capital loss over a 12 month horizon. 152 720 720 FFMA Budget Statements Section 3: Explanatory Tables and Budgeted Financial Statements Section 3 presents explanatory tables and budgeted financial statements which provide a comprehensive snapshot of agency finances for the 2012-13 budget year. It explains how budget plans are incorporated into the financial statements and provides further details of the reconciliation between appropriations and program expenses, movements in administered funds, special accounts and Australian Government Indigenous Expenditure. 3.1 EXPLANATORY TABLES 3.1.1 Movement of Administered Funds Between Years Table 3.1.1 is not included as there is no movement of administered funds between years. 3.1.2 Special Accounts Special Accounts provide a means to set aside and record amounts used for specified purposes. Special Accounts can be created by a Finance Minister’s Determination under the FMA Act or under separate enabling legislation. Table 3.1.2 shows the expected additions (receipts) and reductions (payments) for each account used by FFMA. Table 3.1.2: Estimates of Special Account Flows and Balances Future Fund Special Account (A)(D) Opening balance 2012-13 2011-12 Outcome $'000 1 - Total Special Accounts 2012-13 Budget estim ate Total Special Accounts 2011-12 estimate actual (A) = Administered (D) = Departmental Receipts Payments Adjustments 2012-13 2012-13 2012-13 2011-12 2011-12 2011-12 $'000 $'000 $'000 421,262 421,262 - - 380,864 380,864 - - - 421,262 421,262 - - - 380,864 380,864 - - 3.1.3 Australian Government Indigenous Expenditure Table 3.1.3 is not included as FFMA’s budget does not contain any specific Australian Government Indigenous Expenditure. 153 Closing balance 2012-13 2011-12 $'000 - FFMA Budget Statements 3.2 BUDGETED FINANCIAL STATEMENTS 3.2.1 Differences in Agency Resourcing and Financial Statements No material differences exist between agency resourcing and the financial statements. 3.2.2 Analysis of Budgeted Financial Statements Departmental expenditure will increase over the 2012-13 estimate year as the FFMA deepens its investment and operations resources to continue to support the Board in managing the investments of the Future Fund and other Australian Government Asset Funds. Administered expenditure will increase over the 2012-13 estimate year as the portfolio grows and develops in line with the Board’s investment strategy. 154 FFMA Budget Statements 3.2.3 Budgeted Financial Statements Tables Table 3.2.1 Departmental Comprehensive Income Statement (Showing Net Cost of Services) (for the period ended 30 June) Estimated actual 2011-12 $'000 Budget estimate 2012-13 $'000 Forw ard estimate 2013-14 $'000 Forw ard estimate 2014-15 $'000 Forw ard estimate 2015-16 $'000 EXPENSES Employee benefits Suppliers Depreciation and amortisation Total expenses 25,168 8,837 927 34,932 29,249 11,039 1,221 41,509 30,356 11,466 1,308 43,130 31,541 11,863 1,128 44,532 32,777 12,273 880 45,930 LESS: OWN-SOURCE INCOME Ow n-source revenue Other Total ow n-source revenue 34,822 34,822 41,399 41,399 43,020 43,020 44,422 44,422 45,820 45,820 Gains Other Total gains Total ow n-source incom e 110 110 34,932 110 110 41,509 110 110 43,130 110 110 44,532 110 110 45,930 Net cost of (contribution by) services - - - - - Revenue from Government - *- *- *- *- - - - - - Surplus (Deficit) attributable to the Australian Governm ent Prepared on Australian Accounting Standards basis. 155 FFMA Budget Statements Table 3.2.2: Budgeted Departmental Balance Sheet (as at 30 June) Estimated actual 2011-12 $'000 Budget estimate 2012-13 $'000 Forw ard estimate 2013-14 $'000 Forw ard estimate 2014-15 $'000 Forw ard estimate 2015-16 $'000 515 11,314 11,829 515 14,146 14,661 515 15,401 15,916 515 16,770 17,285 515 17,923 18,438 1,811 1,080 39 2,930 1,601 1,219 39 2,859 1,468 1,044 39 2,551 1,267 817 39 2,123 1,201 703 39 1,943 14,759 17,520 18,467 19,408 20,381 548 3,410 3,958 548 4,068 4,616 548 4,230 4,778 547 4,370 4,917 547 4,510 5,057 Provisions Employee provisions Other provisions Total provisions 10,498 303 10,801 12,601 303 12,904 13,387 302 13,689 14,189 302 14,491 15,022 302 15,324 Total liabilities 14,759 17,520 18,467 19,408 20,381 - - - - - ASSETS Financial assets Cash and cash equivalents Trade and other receivables Total financial assets Non-financial assets Property, plant and equipment Intangibles Other non-financial assets Total non-financial assets Total assets LIABILITIES Payables Suppliers GST Payable Total payables Net assets Prepared on Australian Accounting Standards basis. 156 FFMA Budget Statements Table 3.2.3: Budgeted Departmental Statement of Changes in Equity — Summary of Movement (Budget Year 2012-13) Table 3.2.3 is not included because FFMA does not have any changes in equity. Table 3.2.4: Budgeted Departmental Statement of Cash Flows (for the period ended 30 June) Estimated actual 2011-12 $'000 Budget estimate 2012-13 $'000 Forw ard estimate 2013-14 $'000 Forw ard estimate 2014-15 $'000 Forw ard estimate 2015-16 $'000 35,663 35,663 42,707 42,707 46,067 46,067 47,495 47,495 49,249 49,249 22,962 8,788 2,862 34,612 27,128 10,947 3,482 41,557 29,552 11,375 4,140 45,067 30,721 11,772 4,302 46,795 31,924 12,183 4,442 48,549 1,051 1,150 1,000 700 700 1,051 1,051 1,150 1,150 1,000 1,000 700 700 700 700 (1,051) (1,150) (1,000) (700) (700) OPERATING ACTIVITIES Cash received Other Total cash received Cash used Employees Suppliers Other Total cash used Net cash from (used by) operating activities INVESTING ACTIVITIES Cash used Purchase of property, plant and equipment and intangibles Total cash used Net cash from (used by) investing activities Net increase (decrease) in cash held Cash and cash equivalents at the beginning of the reporting period Cash and cash equivalents at the end of the reporting period Prepared on Australian Accounting Standards basis. 157 - - - - - 515 515 515 515 515 515 515 515 515 515 FFMA Budget Statements Table 3.2.5: Departmental Capital Budget Statement PURCHASE OF NON-FINANCIAL ASSETS Funded internally from departmental resources TOTAL RECONCILIATION OF CASH USED TO ACQUIRE ASSETS TO ASSET MOVEMENT TABLE Total purchases Total cash used to acquire assets Estimated actual 2011-12 $'000 Budget estimate 2012-13 $'000 Forw ard estimate 2013-14 $'000 Forw ard estimate 2014-15 $'000 Forw ard estimate 2015-16 $'000 1,051 1,051 1,150 1,150 1,000 1,000 700 700 700 700 1,051 1,150 1,000 700 700 1,051 1,150 1,000 700 700 Table 3.2.6: Statement of Asset Movements (2012-13) Asset Category Other property, Computer plant and softw are and equipment intangibles $'000 $'000 As at 1 July 2012 Gross book value Accumulated depreciation/amortisation and impairment Opening net book balance Total $'000 5,841 1,452 7,293 (4,030) 1,811 (372) 1,080 (4,402) 2,891 CAPITAL ASSET ADDITIONS Estim ated expenditure on new or replacem ent assets By purchase - other Total additions 700 700 450 450 1,150 1,150 Other m ovem ents Depreciation/amortisation expense Total other m ovem ents (910) (910) (311) (311) (1,221) (1,221) As at 30 June 2013 Gross book value Accumulated depreciation/amortisation and impairment Closing net book balance Prepared on Australian Accounting Standards basis. 158 6,541 1,902 8,443 (4,940) 1,601 (683) 1,219 (5,623) 2,820 FFMA Budget Statements Table 3.2.7: Schedule of Budgeted Income and Expenses Administered on Behalf of Government (for the period ended 30 June) EXPENSES ADMINISTERED ON BEHALF OF GOVERNMENT Employee benefits Suppliers Total expenses adm inistered on behalf of Governm ent Estimated actual 2011-12 $'000 Budget estimate 2012-13 $'000 Forw ard estimate 2013-14 $'000 Forw ard estimate 2014-15 $'000 Forw ard estimate 2015-16 $'000 828 327,454 861 553,991 895 592,585 931 633,545 966 677,129 328,282 554,852 593,480 634,476 678,095 1,256,568 1,264,168 2,520,736 1,697,943 1,331,663 3,029,606 1,707,374 1,493,317 3,200,691 1,775,616 1,632,854 3,408,470 1,903,167 1,750,149 3,653,316 2,520,736 3,029,606 3,200,691 3,408,470 3,653,316 454,801 3,050,310 3,323,698 3,585,066 3,842,598 454,801 3,050,310 3,323,698 3,585,066 3,842,598 2,975,537 6,079,916 6,524,389 6,993,536 7,495,914 (5,525,064) 5,525,064 (5,930,909) 5,930,909 (6,359,060) 6,359,060 (6,817,819) 6,817,819 LESS: OWN-SOURCE INCOME Ow n-source revenue Non-taxation revenue Interest Dividends Total non-taxation revenue Total ow n-source revenues adm inistered on behalf of Governm ent Gains Other gains Total gains adm inistered on behalf of Governm ent Total ow n-source incom e adm inistered on behalf of Governm ent Net Cost of (contribution by) services (2,647,255) Surplus (Deficit) 2,647,255 Prepared on Australian Accounting Standards basis. 159 FFMA Budget Statements Table 3.2.8: Schedule of Budgeted Assets and Liabilities Administered on Behalf of Government (as at 30 June) Estimated actual 2011-12 $'000 Budget estimate 2012-13 $'000 Forw ard estimate 2013-14 $'000 Forw ard estimate 2014-15 $'000 Forw ard estimate 2015-16 $'000 ASSETS Financial assets Cash and cash equivalents Other investments Other financial assets Total financial assets 1,144 78,256,592 3,410 78,261,146 1,144 83,918,656 4,068 83,923,868 1,144 89,970,448 4,230 89,975,822 1,144 96,432,750 4,370 96,438,264 1,144 103,360,786 4,510 103,366,440 Total assets adm inistered on behalf of Governm ent 78,261,146 83,923,868 89,975,822 96,438,264 103,366,440 306,756 306,756 444,414 444,414 565,459 565,459 668,841 668,841 779,198 779,198 8 8 8 8 8 8 8 8 8 8 306,764 444,422 565,467 668,849 779,206 Net assets/(liabilities) 77,954,382 Prepared on Australian Accounting Standards basis. 83,479,446 89,410,355 95,769,415 102,587,234 LIABILITIES Payables Suppliers Total payables Provisions Employee provisions Total provisions Total liabilities adm inistered on behalf of Governm ent 160 FFMA Budget Statements Table 3.2.9: Schedule of Budgeted Administered Cash Flows (for the period ended 30 June) OPERATING ACTIVITIES Cash received Interest Dividends Net GST received Total cash received Cash used Suppliers Employees Other Total cash used Net cash from (used by) operating activities INVESTING ACTIVITIES Cash received Proceeds from sale of property, plant and equipment Proceeds from sales of investments Total cash received Estimated actual 2011-12 $'000 Budget estimate 2012-13 $'000 Forw ard estimate 2013-14 $'000 Forw ard estimate 2014-15 $'000 Forw ard estimate 2015-16 $'000 1,262,241 1,844,466 3,186 3,109,893 1,697,943 1,331,663 3,410 3,033,016 1,707,374 1,493,317 4,068 3,204,759 1,775,616 1,632,854 4,230 3,412,700 1,903,167 1,750,149 4,370 3,657,686 345,690 828 34,346 380,864 378,486 861 41,915 421,262 430,496 895 45,275 476,666 487,830 931 46,703 535,464 522,825 966 48,457 572,248 2,729,029 2,611,754 2,728,093 2,877,236 3,085,438 233,743 - - - - 4,210,204 4,443,947 543,440 543,440 599,986 599,986 1,303,872 1,303,872 1,397,001 1,397,001 3,155,194 3,155,194 3,328,079 3,328,079 4,181,108 4,181,108 4,482,439 4,482,439 (2,611,754) (2,728,093) (2,877,236) (3,085,438) Cash used Investments 7,172,976 Total cash used 7,172,976 Net cash from (used by) investing activities (2,729,029) Net increase (decrease) in cash held Cash and cash equivalents at beginning of reporting period 1,144 Cash and cash equivalents at end of reporting period 1,144 Prepared on Australian Accounting Standards basis. - - - - 1,144 1,144 1,144 1,144 1,144 1,144 1,144 1,144 Table 3.2.10: Schedule of Administered Capital Budget The FFMA has no budgeted administered capital administered on behalf of the Australian Government. Table 3.2.11: Schedule of Asset Movements — Administered The FFMA has no budgeted non-financial assets administered on behalf of the Australian Government. 161