TUITION & FEE PROCESS GUIDELINE Draft Policy Review Financial Area Representatives

advertisement

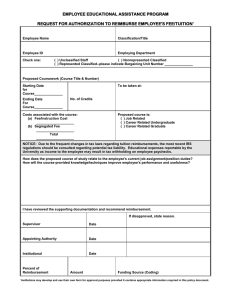

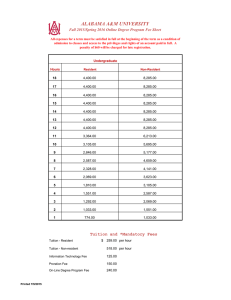

TUITION & FEE PROCESS GUIDELINE Draft Policy Review Financial Area Representatives April 21, 2008 Audit Recommendations Assign overall responsibility for the annual tuition and fees update process, and prepare process documentation to include roles, timelines, and deliverables. Establish criteria for excessive year end unexpended balances and request documentation supporting the justification for the accumulation. Tuition & Fee Process Guideline Scope Designated tuition and mandatory, college/course, laboratory or other incidental fee rates and/or changes. Communication of fee information to students and university constituents. Requirements for fee revenue Reserves. Authority for annual revenue budgets, expenditures and year-end balances (retained earnings). Authority for rate (cost) reviews. Process Guidelines and Responsibilities Establishing Designated Tuition and Mandatory Fee Rates: Board of Regents approve tuition & mandatory fee rates for two year periods. Spring following legislative year Associate VP – Financial Affairs coordinates the T&F Process in accordance with The UT System guidelines. Tuition & Fee Committee & public hearings are required. Process Guidelines and Responsibilities Establishing the Designated Tuition Rate Lowest amount possible to cover incremental changes in mandatory & fixed costs Conservative estimates of growth Cap may be imposed by UT System In FY09, our rate goes from $101/SCH to $110/SCH (+8.9%) Process Guidelines and Responsibilities In FY09, Designated Tuition is the only new discretionary source of income for UTSA E&G budgets to fund: $1.176M in required Financial Aid $2M New Faculty Recruitments $2.77M in Merit Salary increases $0.290M for Bad Debt Allowance & Texas Tomorrow Other budget increments are reallocations of previously recovered revenue (except for BoR approved mandatory fee increases.) Establishing / Changing Fee Rates or Justifications Use Fee Request Form Zero based budget approach For existing fees, requires re-validation of the rate charged to students based on budgeted semester credit hour projections and expenditures. Allows for cost analysis of current situation versus the requirements when the fee was originally established. Changes must be endorsed by VP/Provost and vetted through fee committees/student organizations as appropriate. Establishing / Changing Fee Rates or Justifications Authority of the President Upon prior review and approval of the Executive Vice Chancellor for Academic Affairs, the President can approve new or changes to: Laboratory or course fees College fees (other) Incidental fees Can be done ‘off cycle’ if necessary for exceptional circumstances. Communication of Fee Rates and Changes Committees Banner Student Information System Websites Academic Publications / Information Bulletin Other Retained Earnings Retained earnings (carryforward balances and reserves) are appropriate for: Working Capital – when expenditures precede revenue Current Operations – if projected expenses can not be covered by projected income Capital Replacement – offset economic effects of depreciation Planned Future Operations Requirements are documented each year for the AVPFinancial Affairs to review and make recommendations. Revenue Financial Assessment Sr. Director of Budget – establishes revenue targets based on CY revenue & projected enrollment or other changes. Deviations are mutually agreed upon. Expenditures monitored by fee administrators. In accordance with justification Stakeholder appropriateness test Retained earnings exceeding 15% must be approved by VPBA or designee. Periodic Review of Approved Rates AVP-Financial Affairs Authority Focus – Cost Recovery of Expenditures Are students being appropriately charged? Are Reserves being expended for the intended purpose? Is UTSA subsidizing costs and is the level of subsidy appropriate? Periodic Review of Approved Rates Recommendation to UTSA Administration about rate appropriateness. Appropriateness of expenditures within the approved justification remains the responsibility of each VP and is not the focus of this activity. Internal & External Auditors may examine that aspect (as well as the rate appropriateness.)