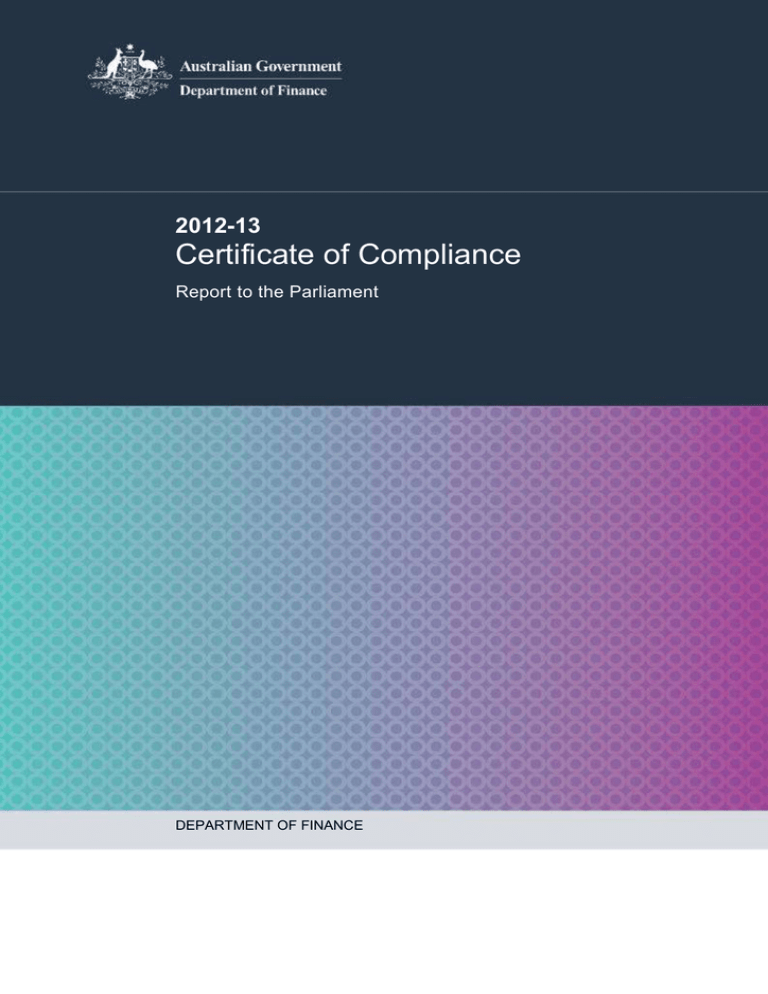

Certificate of Compliance 2012-13 Report to the Parliament

advertisement

2012-13 Certificate of Compliance Report to the Parliament DEPARTMENT OF FINANCE 2012-13 Certificate of Compliance Report to the Parliament DEPARTMENT OF FINANCE DEPARTMENT OF FINANCE ISSN: 1838-6865 (Print) ISSN: 1838-6873 (Online) Creative Commons Licence With the exception of the Commonwealth Coat of Arms, the Certificate of Compliance Report to the Parliament 2012-2013 is issued under a Creative Commons BY licence. The terms of the BY licence can be found here: http://creativecommons.org/licenses/by/3.0/au/. The document must be attributed: ’Commonwealth of Australia, Certificate of Compliance Report to the Parliament 2012-2013’. Use of the Coat of Arms The terms under which the Coat of Arms can be used are detailed on the following website: http://www.itsanhonour.gov.au/coat-arms/ Acknowledgements Photographs taken by Steve Keough, Steve Keough Photography Other photographs from the Department of Finance collections. ii Foreword Foreword by the Minister This is the fifth public report on the annual Certificate of Compliance (Certificate) process for agencies under the Financial Management and Accountability Act 1997 (FMA Act). It aggregates individual agency results for the 2012-13 financial year. Since its introduction in 2006-07, the Certificate process has resulted in improved understanding of, and compliance with, the Australian Government’s financial management framework. In this way, the Certificate has played an important role in ensuring agencies are accountable for the public resources they manage. The chief executives of all agencies under the FMA Act are required to provide a completed Certificate to their portfolio Minister each year. The Certificate process is an important means of identifying and disclosing instances of non-compliance with the financial management framework, as a basis for continuous improvement within agencies and more broadly. Overall, agencies have again reported relatively low levels of non-compliance when compared to the many millions of financial transactions they undertake each year on behalf of Government. It is important to assess the results in that context. For the 2012-13 reporting period, agencies reported an increase in non-compliance of about 10 percent compared to last year. That said, this result is still comparable to performance over the past four years. As in previous years when reported non-compliance has increased, this is strongly correlated to changed financial management framework requirements. This year’s increase is due to the introduction of mandatory reporting requirements in the Commonwealth Procurement Rules (CPRs), which came into effect on 1 July 2012. Removing the impact of this new requirement, overall non-compliance is in line with the downward trend experienced over previous years. From 1 July 2014, Commonwealth entities operating under the FMA Act or the Commonwealth Authorities and Companies Act 1997 will operate under the the Public Governance, Performance and Accountability Act 2013 (PGPA Act). The PGPA Act moves from a prescriptive compliance-based approach to financial management to a broader principles-based approach to performance and resource management. Instead of legislative provisions that focus on process, the PGPA Act contains a stronger focus on duties, internal controls and risk. The new framework will continue to provide assurance to the public that an appropriate standard of accountability and assurance is in place and resources are being well managed. Any future compliance reporting will be considered in the context of the new framework. Mathias Cormann Minister for Finance January 2014 iii Contents Foreword iii Contents iv Introduction 2 Part 1: 2012-13 results by category 21 Part 2: 2012-13 results by portfolio group 33 Appendix: List of portfolio groups for Certificate purposes 46 iv Introduction 1. Introduction This is the fifth annual Report to the Parliament on the Certificate of Compliance (Certificate) process. The Report provides an aggregate analysis of agency results for the 2012-13 financial year. 2. The Certificate The Certificate process aims to improve understanding of the financial management framework, and strengthen agency processes, through the identification of non-compliance issues and undertaking of action to improve processes. The Certificate promotes continuous improvement within agencies. Analysis of Certificate results also provides an opportunity for the Department of Finance (Finance) to identify issues across agencies, thereby highlighting elements of the framework that may require improvement. The chief executives of all agencies under the Financial Management and Accountability Act 1997 (FMA Act) are required to provide a completed Certificate to their portfolio Minister by 15 October each year. The Certificate is also copied to the Minister for Finance (Finance Minister).1 The Certificate covers the financial year, 1 July to 30 June. Seven rounds of reporting have been completed to date since 2006-07. This year, 110 FMA Act agencies were required to prepare Certificates. The Certificate process is based on a self-assessment by agency chief executives. It provides a comprehensive overview of each agency’s compliance with the financial management framework. Chief executives are required to certify their agency’s compliance during the previous financial year with: 1 2 3 the FMA Act the Financial Management and Accountability Regulations 1997 (FMA Regulations) the Finance Minister’s delegations to agency chief executives, as amended from time-to-time 2 selected financial management policies of the Commonwealth.3 A separate process applies to entities under the Commonwealth Authorities and Companies Act 1997. For further information, see Finance Circular 2008/05: Compliance Reporting – CAC Act Bodies and Finance Circular 2011/06: CAC Act compliance: Departmental responsibilities. See the Financial Management and Accountability (Finance Minister to Chief Executives) Delegation 2010 and the Financial Management and Accountability (Finance Minister to Finance Secretary) Delegation 2010, which were in force during the 2012-13 financial year. For the 2012-13 year, chief executives were required to certify compliance with: the cost recovery policy, as outlined in the Australian Government Cost Recovery Guidelines; the policy on contingent liabilities, as outlined in the Guidelines for Issuing and Managing Indemnities, Guarantees, Warranties and Letters of Comfort; the policy on foreign exchange risk 2 All instances of non-compliance must be reported in the Certificate, focusing on action taken by agencies to improve their processes. The requirements of the FMA Act and FMA Regulations mean that compliance is not assessed based on materiality. That is, where instances of non-compliance are identified with no or immaterial financial consequences, they must still be reported in the Certificate. However, it is not intended that all actions and transactions of an agency be checked. It is expected that chief executives will ensure that their agency has sufficient processes and controls in place to provide reasonable confidence that staff members are complying with the financial management framework. The processes, systems and controls that chief executives put in place to promote compliance with the financial management framework may vary between agencies, depending on their size, operations, structure and activities. In most cases, these processes and controls are an extension of those processes that give confidence to the chief executive on matters such as the use of delegations and budgetary management. Chief executives therefore complete the Certificate based on their agency’s internal control mechanisms, management and audit committee advice. In 2012-13, 110 FMA Act agencies reported a combined total of 14,027 instances of non-compliance. This outcome represents an increase of approximately 10 percent from the 2011-12 results (see ‘Overall Trends’). The instances of non-compliance reported in agency Certificates generally arise from one or more of the following: inaction by individuals, such as not seeking the necessary approvals for particular expenditure lack of timely action by individuals, such as not banking public money within the required timeframe or not meeting the timeframe to report publicly on contracts entered into over a certain threshold particular actions taken by individuals, such as relying on an outdated delegation or drawing right lack of awareness of key requirements, due to changes in staffing, structures or activities system or process issues, either at the agency or sub-agency level. The Certificate also requires chief executives to state whether the agency is operating within the agreed resources for the current financial year and to certify that the agency has adopted appropriate management strategies for risks that may affect its financial sustainability. 3. Structure of the Report The Report records the outcomes of the 2012-13 Certificate process at a ‘portfolio group’ level, drawing on data contained in the individual Certificates prepared by FMA Act agencies. For the purposes of this report, a portfolio group comprises all agencies within the relevant portfolio as at 30 June 2013. In 2012-13, there were 20 management requirements, as outlined in the Australian Government Foreign Exchange Guidelines; the requirements for the management of special accounts, as outlined in the Guidelines for the Management of Special Accounts; and the policy on the management of property, as outlined in the Commonwealth Property Management Guidelines. 3 portfolio groups comprised of 110 agencies.4 The agencies comprising each portfolio group for the 2012-13 financial year are listed in the Appendix. In their individual Certificates, agencies report instances of non-compliance against specific sections and subsections of the FMA Act, FMA Regulations, the Finance Minister’s delegations to agency chief executives and selected policies of the Commonwealth. Six categories are used to report on these results in a meaningful way.5 These categories represent key elements of the financial management framework: i. the commitment of public money by agencies ii. the use of drawing rights by agencies iii. the proper use of financial resources iv. banking and investment by agencies v. the maintenance of agency accounts and records vi. miscellaneous requirements. Part 1 reports on instances of non-compliance by type. The combined total of 14,027 reported instances of non-compliance is presented against the six categories. Part 2 reports on instances of non-compliance by portfolio grouping. The data is presented as a percentage of each portfolio group’s share of the combined total of 14,027 reported instances of non-compliance. 4. Overall Trends Seven rounds of reporting have been completed to date, covering the 2006-07 to 2012-13 financial years. As noted in previous reports, considerable work has been undertaken by agencies to strengthen internal controls and reporting processes since the introduction of the Certificate. The maturing of agencies’ internal mechanisms, and the more systematic identification and remediation of instances of non-compliance, is reflected in the number of instances of non-compliance reported by agencies over the seven rounds of reporting. At an aggregate level, agencies reported a relatively low number of instances of non-compliance in the first round of reporting (2006-07), followed by an increase in reported instances of non-compliance in round two (2007-08), as internal systems bedded down and matured. Instances of non-compliance halved in 2008-09, to a level somewhat above the total reported in 2006-07, as agencies sought to address the issues identified in the first two rounds of reporting. In 2009-10, there was a relatively small increase in reported instances compared to 2008-09, as agencies worked to implement new reporting requirements, as a result of the introduction of the Commonwealth Grant Guidelines (CGGs). The results for 2011-12 continued the decreasing trend in reported non-compliance reflecting continuous improvement, both in agency processes and across the framework more broadly. 4 For the purposes of this report, the four Departments of the Parliament – the Department of the Senate, the Department of the House of Representatives, the Department of Parliamentary Services and the Parliamentary Budget Office – are treated as a single portfolio group, as is the Department of Veterans’ Affairs. This represented the functional structure of the previous Government’s Administrative Arrangements in effect during the 2012-13 financial year. This is prior to Administrative Arrangements Order issued on 18 September 2013 which restructured portfolios. 5 See Finance Circular 2013/03: Certificate of Compliance – FMA Act Agencies, for further information on the reportable instances against the six categories and the Summary of Compliance Requirements. 4 The 2012-13 results reflect a small increase of reported instances of non-compliance, due to the impact of the new reporting requirements in the Commonwealth Procurement Rules (CPRs), which involve publicly reporting contracts within 42 days. Overall, there was a reduction in reported non-compliance against four categories and an increase in two categories. This is discussed further under ‘Results against the Six Categories’. Decreases, due to continuous improvement, can be balanced against short-term increases in reported non-compliance with the introduction of new requirements. The reduced non-compliance against four of the six categories demonstrates agencies’ continuing commitment to improve processes and staff members’ understanding, in order to address non-compliance. For example, in 2012-13, several agencies have significantly reduced non-compliance with the requirements involving documenting approvals committing public money. This reinforces the positive impact of the Certificate in encouraging agencies to improve their systems and processes. Chart A: Instances of non-compliance: trends over seven years Chart A tracks the total number of reported non-compliance over the seven years of the Certificate. The dotted line for 2012-13 removes the impact of non-compliance with the new requirement in the CPRs. This demonstrates the continuing downward underlying trend in non-compliance and the impact that introducing new requirements can have. 5. Context The total number of instances of non-compliance reported by agencies can be contrasted with the substantial number and scope of financial activities undertaken by agencies. While no accurate estimate is available, agencies as a whole undertake many millions of financial activities valued at several billion dollars each financial year. 5 By way of example: the Australian Taxation Office, which employed over 22,000 ongoing staff, has advised that in the 2012-13 financial year it processed over 13.7 million refunds valued in excess of $95 billion the Treasury, which employed 920 full-time equivalent staff as at 30 June 2013, has advised that it processed more than 180,000 financial transactions in 2012-13, involving $12.0 billion in receipts to the Treasury and $88.1 billion in payments the Department of Defence has advised that in the 2012-13 financial year it undertook approximately 1.7 million financial transactions the Defence Materiel Organisation, which employed over 5,500 staff across Australia, has advised that it undertook over 640,000 financial transactions during 2012-13 with a value over $9.9 billion the Department of Social Services has advised that the former Department of Families, Housing, Community Services and Indigenous Affairs, processed 118,668 payments during 2012–2013 the Australian Customs and Border Protection Service has advised that it employs approximately 5,500 staff in 54 locations across Australia, who processed 655,031 transactions during 2012-13, involving payments of over $1.5 billion and receipts of more than $13.2 billion small agencies are also required to manage large volumes of transactions relative to their size and often in complex circumstances (e.g. the Administrative Appeals Tribunal has advised that in 2012-13 it processed just under 12,000 financial transactions). While the number of reported instances of non-compliance is significant, the level of reported non-compliance is low when compared to the substantial number of government financial activities occurring each year. 6. Results against the Six Categories Chart B records the combined total of all (14,027) instances of non-compliance reported in 2012-13 against six categories. Since the introduction of the Certificate, reported non-compliance has been concentrated in two key areas: the commitment of public money banking and investment by agencies. In 2012-13, there was a decrease in non-compliance with the banking and investment requirements, compared to previous years. 6 Chart B: Percentage of all non-compliance by category for 2012-13 Note that there were zero instances of non-compliance reported against category 5 the maintenance of agency account and records, in 2012-13. i. The commitment of public money by agencies Chart C: Instances of non-compliance: Category 1 - the commitment of public money by agencies from 2006-07 to 2012-13 7 This category combines all reported instances of non-compliance with section 32B, 32C, 32D, 32E and 44 of the FMA Act, FMA Regulations 7 to 12 and FMA Regulation 16.6 Section 44 of the FMA Act requires an agency chief executive to manage the affairs of the agency in a way that promotes proper use of the Commonwealth resources for which the chief executive is responsible. Proper use means efficient, effective, economical and ethical use that is not inconsistent with the policies of the Commonwealth. This section provides authority for a chief executive (and delegates) to make, vary or administer arrangements on behalf of the Commonwealth in relation to the affairs of the agency. The majority of instances of non-compliance reported against this section relate to agency staff not been delegated the power to enter into contracts. Section 32B of the FMA Act and FMA Regulation 16 provides the authority for chief executives (and delegates) to make, vary or administer any arrangement, grant or program specified in Schedule 1AA to the FMA Regulations. FMA Regulations 7-12 regulate agency commitments to spend public money. Regulations 7, 7A and 7B require officials performing duties in relation to procurement, grants administration or the procurement of cleaning services to act in accordance with the CPRs, CGGs and the Commonwealth Cleaning Services Guidelines respectively which are legislative instruments. Regulations 8, 9, 10 and 10A set out approval requirements and processes for entering into spending proposals, while Regulation 12 sets out the recording requirements for decisions relating to the approval of spending proposals. FMA Regulation 11 sets out the approval requirements for loan guarantees. Category one accounted for 83.7 percent of all non-compliance reported in 2012-13 (68.0 percent in 2011-12). This represented a total of 11,734 instances of non-compliance compared to 8,708 in 2011-12. The vast number of transactions involving the expenditure of public money by agencies each year means that the majority of instances of non-compliance will continue to be reported under this category. It is also important to note that the introduction, from time-to-time, of revised financial management framework requirements may give rise to additional instances of non-compliance, as agencies work to implement the changed requirements. The increase of reported instances of non-compliance in 2012-13 was due to the introduction of new requirements in the CPRs in July 2012, involving reporting on AusTender7 within 42 days of entering into (or amending) contracts at or above the reporting threshold. This resulted in 4,050 instances of non-compliance (approximately 35 percent of Category one), which was partially off-set by the reduction of non-compliance against the Commonwealth’s grants framework requirements. 6 7 Changes were made to the FMA Act and Regulations in 2012. The changes are reflected in the 2012-13 reporting period. AusTender is the central web-based facility for the publication of Australian Government procurement information, including business opportunities, annual procurement plans and contracts awarded. 8 ii. The use of drawing rights by agencies Chart D: Instances of non-compliance: Category 2 - the use of drawing rights by agencies from 2006-07 to 2012-13 This category combines all reported instances of non-compliance with sections 26 and 27 of the FMA Act. Drawing rights provide controls around the expenditure of public money and the use of appropriations. Drawing rights are a statutory control over who may make payments of public money. They also allow for conditions and limits to be set by the Finance Minister (or the Finance Minister’s delegates) in relation to payments. Sections 26 and 27 of the FMA Act govern the issuance of drawing rights and limit certain activities to those officials or Ministers who have been issued with drawing rights. Category two accounted for 4.4 percent of all non-compliance reported in 2012-13. This represented a total of 622 instances of non-compliance. This is a decrease from the 857 instances (6.7 percent) reported in 2011-12, reflecting process improvement by agencies. 9 iii. The proper use of financial resources Chart E: Instances of non-compliance: Category 3 - the proper use of financial resources from 2006-07 to 2012-13 This category combines all reported instances of non-compliance with sections 14, 15 and 60 of the FMA Act and FMA Regulation 21. Section 14 of the FMA Act provides that an official or Minister must not misapply public money or improperly dispose of, or improperly use, public money. Section 15 establishes liability for the loss of public money in an official’s or Minister’s nominal custody at the time of the loss, and the circumstances in which the Commonwealth may recover such a loss (i.e. where an official or Minister caused or contributed to the loss by misconduct, or by a deliberate or serious disregard of reasonable standards of care). Section 60 of the FMA Act provides that an official or Minister must not use a Commonwealth credit card, or credit card number, to obtain cash, goods or services otherwise than for the Commonwealth. This includes misuse of Cabcharge vouchers. Section 60 also makes provision for the FMA Regulations (i.e. Regulation 21, see below) to authorise other uses, provided that the Commonwealth is reimbursed in accordance with the Regulations. The reported instances include circumstances where there is a mistaken use of a Commonwealth credit card for coincidental private expenditure, which is repaid to the Commonwealth as well as instances of fraud which are prosecuted. FMA Regulation 21 gives an agency chief executive the power to authorise the holder of a Commonwealth credit card to use the card to pay a claim that includes both official and coincidental private expenditure, and to specify arrangements for the cardholder to repay the Commonwealth for any coincidental private expenditure. Regulation 21 also requires the repayment of any coincidental private expenditure. Category three accounted for 6.5 percent of all non-compliance reported in 2012-13. This represented a total of 907 instances of non-compliance. This is a slight increase from the 656 instances (5.1 percent) reported in 2011-12 and relates to increased reported instances of misuse of Commonwealth credit cards. Agency responses indicate that appropriate follow-up action has been undertaken for both accidental 10 misuse, which forms the majority of reported instances, and suspected fraudulent use of Commonwealth credit cards. Agencies reported that suspected credit card fraud identified during the reporting period resulted in police investigations and criminal prosecutions. iv. Banking and investment by agencies Chart F: Instances of non-compliance: Category 4 - banking and investment by agencies from 2006-07 to 2012-13 This category combines all reported instances of non-compliance with sections 8, 9, 10, 11, 13, 16, 34, 38, 39, 40 and 47 of the FMA Act and FMA Regulations 17, 18, 19, 19A and 20. Section 8 of the FMA Act permits the Finance Minister to enter into agreements with banks for the conduct of the Commonwealth’s banking, while section 9 allows the Finance Minister to open and maintain official bank accounts. These powers have been delegated by the Finance Minister to agency chief executives. Section 10 of the FMA Act requires public money to be promptly banked (Regulation 17 defines this as the next banking day unless otherwise approved by a chief executive), while section 11 prohibits the deposit of public money in any account other than an official account. Regulation 18 requires an official who receives public money in a non-bankable currency to safeguard the money. Section 13 of the FMA Act prohibits the withdrawal of money from an official account without proper authority. Regulations 19 and 19A set out requirements for making cash advances and for other withdrawals from official accounts and internal transfers between accounts. Section 16 of the FMA Act permits the Finance Minister to issue special instruction about the handling of special public money including the investment of special public money. Section 34 of the FMA Act permits the Finance Minister to waive, postpone or defer debts owed to the Commonwealth, and to allow the payment of debts owed to the Commonwealth by instalments. This power has been delegated by the Finance Minister to chief executives. Where the delegated power is not complied with, this is reportable against the Delegation. 11 Section 47 of the FMA Act requires an agency chief executive to pursue recovery of each debt for which the chief executive is responsible, unless the debt has been written off as authorised by an Act, or the chief executive is satisfied that the debt is not legally recoverable or considers that it is not economical to pursue recovery. Section 38 of the FMA Act facilitates credit card arrangements by permitting the Finance Minister to enter into arrangements with banks for the short-term borrowing of money by way of advances. This power has been delegated by the Finance Minister to chief executives. Section 39 of the FMA Act permits the Finance Minister and Treasurer, or their delegates, to invest public money in authorised investments and defines such investments. The effect of this section is that agency chief executives may only invest public money if delegated by the Finance Minister or Treasurer and may only invest in a conservative class of investments, such as bank deposits and Commonwealth and State securities, unless otherwise authorised by the FMA Regulations or an Act. Section 40 of the FMA Act requires officials who receive securities in the course of their duties to deal with them in accordance with Regulation 20 (i.e. issue a receipt, maintain a register and take reasonable steps to safeguard the securities). Category four accounted for 4.2 percent of all non-compliance reported in 2012-13. This represented a total of 590 instances of non-compliance. This is a significant decrease from the 2,282 (17.9 percent) reported in 2011-12, and is the result of three portfolios improving processes for banking and debt recovery. v. The maintenance of agency accounts and records Chart G: Instances of non-compliance: Category 5 - the maintenance of agency accounts and records from 2006-07 to 2012-13 12 This category combines all reported instances of non-compliance with sections 44A, 48, 49, 50 and 51 of the FMA Act. Section 44A of the FMA Act requires an agency chief executive to give the responsible Minister such reports, documents and information on agency operations as the Minister requires. It also requires a chief executive to provide the Finance Minister with information on the financial affairs of the agency. Under section 50 of the FMA Act, the Finance Minister may also request financial statements covering a period of less than a financial year. Section 48 of the FMA Act requires a chief executive to ensure that accounts and records of the agency are kept as required by the Finance Minister’s Orders. Section 49 of the FMA Act requires the preparation of annual financial statements for scrutiny by the Auditor-General. Section 51 of the FMA Act clarifies the responsibilities of affected chief executives for the preparation of financial statements where an agency ceases to exist or following a transfer of agency functions. No instances of non-compliance were reported against category five in 2012-13, compared to the one instance reported in 2011-12. vi. Miscellaneous requirements Chart H: Instances of non-compliance: Category 6 - miscellaneous requirements from 2006-07 to 2012-13 This category combines the remaining instances of non-compliance, relating to selected government policies,8 the Finance Minister’s delegations to chief executives and the sections of the FMA Act and Regulations listed below. 8 Section 12 of the FMA Act facilitates arrangements for the receipt and spending of public money by persons outside the Commonwealth (4 instances of non-compliance). Footnote 3 lists the policies to be reported in the Certificate. 13 Section 41 of the FMA Act requires the proper use of public property by officials and Ministers (47 instances of non-compliance). Section 42 of the FMA Act specifies the liability of officials and Ministers for the loss of public property (2 instances of non-compliance). Section 43 of the FMA Act contains the requirements for making gifts of public property (8 instances of non-compliance). Section 45 of the FMA Act requires a chief executive to implement an agency fraud control plan (2 instances of non-compliance). Section 46 of the FMA Act and FMA Regulation 22C require a chief executive to establish and maintain an audit committee for the agency (2 instances of non-compliance). FMA Regulation 22D requires a chief executive to prepare budget estimates in the form specified by the Finance chief executive (2 instances of non-compliance). FMA Regulations 32 and 33 contain the requirements for the transfer of employee entitlements between agencies (51 instances of non-compliance). This category includes selected government policies (44 instances of non-compliance), including the management of indemnities (13 instances of non-compliance), the management of special accounts (29 instances of non-compliance), and property management (2 instances of non-compliance). The Finance Minister's delegations to agency chief executives (12 instances of non-compliance). Category six accounted for 1.2 percent of all non-compliance reported in 2012-13. This represented a total of 174 instances of non-compliance. This is a decrease from the 294 instances (2.3 percent) reported in 2011-12. 7. Continuous Improvement by Chief Executives 7.1. Internal controls and agency processes A key feature of the current financial management framework is that chief executives are directly responsible for the management of the resources of their agency. Part 7 of the FMA Act sets out the specific responsibilities of chief executives. In particular, section 44 places a special responsibility on chief executives to manage the affairs of their agency in a way that promotes the ‘proper use’9 of the Commonwealth resources for which they are responsible. This broad responsibility to manage the affairs of an agency in a way that promotes proper use of Commonwealth resources is complemented by other requirements in Part 7 of the FMA Act, such as the requirements relating to audit committees, financial reporting and fraud control plans. Agency chief executives complete the Certificate based on their agency’s internal control mechanisms, management and audit committee advice. It is not intended that all actions and transactions of the agency must be checked. It is, however, expected that chief executives will ensure that the agency has sufficient processes and controls in place to provide reasonable confidence that staff members are complying with the financial management framework. 9 Proper use means efficient, effective, economical and ethical use that is not inconsistent with the policies of the Commonwealth. In managing the affairs of their agency, chief executives must comply with the FMA Act and Regulations and any other law. 14 The Certificate process promotes continuous improvement within agencies. It also provides an opportunity for Finance to identify issues that are common across agencies, thereby highlighting elements of the financial management framework that may require improvement. Significantly, chief executives are required to report on the action they have taken to address reported instances of non-compliance. This is a key aspect of the Certificate process. Chief executives should ensure that their systems are robust and identify non-compliance with a view to process improvement. Agencies’ Certificate processes should be proportionate to their size, financial activities and financial management arrangements. Chief executives should ensure that their agencies employ effectively targeted quality assurance activity to support the self-assessment Certificate process. Risk-based reviews of transactions and internal controls give greater consistency and confidence in reported results. Chart I: Corrective strategies reported by agencies in 2012-13 Similar to previous years, the 2012-13 Certificate results indicate that agencies have adopted, or will adopt, a variety of corrective strategies to address non-compliance. The main strategies reported by agencies were: communication and education – including reminders to staff, the provision of additional internal advice, training and counselling (30.6 percent) correcting systems or processes – including reviewing drawing rights, changing purchase order arrangements, establishing automated reporting, and introducing further approval and authorisation processes (16.9 percent) reviewing internal controls – including reviewing delegations and undertaking internal audits and system reviews (8.4 percent) formal investigations, which may lead to sanctions or other action (1.6 percent) a combination of the above strategies (42.5 percent). 15 7.2. Managing financial risks Balancing increasing demands against finite financial resources is an important part of a chief executive’s role. The Certificate requires chief executives to state whether the agency is operating within agreed resourcing levels and to certify that their agency has adopted appropriate management strategies to mitigate key risks that may affect financial sustainability. Financial sustainability, in this context, is the ability of the agency to meet existing requirements without the need for supplementary resourcing. This includes the management of capital and long-term assets and liabilities. Where known risks may affect the financial sustainability of an agency and appropriate management strategies have not or cannot be taken, an explanation must be provided in the Certificate. In 2012-13, 32 agencies reported that, although they are operating within agreed resources, they have identified risks to their financial sustainability. These risks are being actively managed and include issues such as increasing cost pressures from the requirement to deliver new programs without additional resources. One agency reported that they were currently operating beyond agreed resourcing levels, however they stated that they were implementing strategies to mitigate projected overspends. The main issues reported by agencies include: not operating within agreed resources (0.9 percent) increasing cost pressures, such as due to new policy initiatives that an agency is required to deliver (10.0 percent) may need to access cash reserves, now or in the future, or seek additional funding. These agencies have sought, or obtained, approval from the Finance Minister for an operating loss for the financial year, for reasons such as, differences between revenue and expenses, accounting treatments, one-off costs or higher net expenditure (14.6 percent) the need to seek supplementation for the financial year due to increasing demand (4.5 percent). Chart J: Financial sustainability issues reported by agencies 16 8. Continuous improvement by Finance While chief executives are responsible for preparing Certificates and improving compliance within their agencies, Finance is responsible for the administration of the financial management framework and the Certificate process at a whole-of-government level. It provides support to agencies through its administration of the Certificate process and the provision of education and guidance on the budget and financial management frameworks. Finance undertakes five broad tasks as part of its responsibility to administer the Certificate process. 8.1. Written guidance and day-to-day support to agencies on Certificate requirements and the financial management framework Finance issues written guidance to agencies on key aspects of the financial management framework and financial policies. This guidance includes Finance Circulars, the Financial Management Guidance Series, policy guidelines and other material available on the Finance website at http://www.finance.gov.au. Finance has provided written guidance to agencies for each round of Certificate reporting in five Finance Circulars since 2006. The guidance for the 2012-13 process is contained in Finance Circular 2013/03: Certificate of Compliance – FMA Act Agencies issued in May 2013. The Finance Circular provides guidance to agencies on the Certificate process for 2012-13. It includes a summary table containing all the relevant compliance elements of the FMA Act and Regulations, which was updated to reflect recent changes in legislation during 2012-13. The Finance Circular also includes additions to the frequently asked questions section, based on queries from agencies. Finance also provides day-to-day advice to agencies on the administration of the Certificate process and the application of the financial management framework more generally. This represents a significant ongoing commitment from Finance, and the Finance Secretary has urged all agency chief executives to consult with Finance as necessary on financial management framework issues, as early consultation can lead to better compliance outcomes. 8.2. Aggregate analysis of Certificates and reporting on outcomes to key stakeholders Finance provides advice to the Finance Minister on the Certificate outcomes. Following previous rounds, the Finance Minister has written to portfolio Ministers informing them of the results of the Certificate process and suggesting that Ministers discuss the results with their portfolio chief executives, if they had not already done so. Similarly, the Finance Minister will write to the Prime Minister and portfolio Ministers about the 2012-13 results and the tabling of the Report to the Parliament. In addition, at the conclusion of each Certificate reporting round: the Finance Secretary writes to all agency chief executives informing them of the overall results of the Certificate process and offering Finance’s assistance to address issues identified in agency Certificates Finance discusses the aggregate outcomes of the Certificate process with agency chief financial officers (CFOs) Finance meets with agencies that identified significant issues 17 Finance reviews current guidance on the Certificate process, based on feedback from agencies and the Australian National Audit Office (ANAO). 8.3. Follow-up on the 2012-13 Certificate process Finance adopts a proportional and risk-based approach to follow-up on Certificate results. Agencies are categorised as either high-risk, medium-risk or low-risk based on agency size and transactions; trends in non-compliance; unusually high or low levels of reported non-compliance; and the outcomes of previous follow-up activity and reports. Finance will be undertaking a range of follow-up activities in respect to the 2012-13 Certificate process, including: seeking feedback from portfolio CFOs on results and key trends informing agency chief executives and CFOs about key trends reviewing compliance processes, in light of lessons learned and the new principle-based Public Governance, Performance and Accountability Act 2013 (PGPA) framework considering financial management framework guidance, given this year’s results and in the context of the new PGPA framework providing training and workshops, drawing on lessons learned continuing to raise awareness of the new procurement reporting requirements, which significantly contributed to agency non-compliance in 2012-13 consulting with agencies based on the risk-rating of the agency which is assessed by Finance: - high-risk agencies are requested to meet with Finance to discuss remediation strategies - medium and low-risk agencies are invited to discuss any financial management framework concerns with Finance - all agencies are invited to information sessions on the Certificate process which are provided by Finance. 8.4. Improving guidance and education At the conclusion of each reporting round, Finance has met with a number of agency CFOs, including those agencies categorised as high-risk, due to their trends in non-compliance. These meetings provide CFOs with an opportunity to discuss how their internal control mechanisms and mitigation strategies are being improved. They also provide CFOs and their staff with an opportunity to raise specific issues that relate to their agency and clarify their understanding of particular financial management framework requirements. Education and guidance are an important part of Finance’s strategy to improve understanding of, and compliance with, the financial management framework. Finance provides a suite of advice, training, guidance and tools to support agencies, ranging from base-level introductory training to technical and/or specific advice and training. Finance regularly provides workshops and targeted training, focusing on the key risk areas or changes to the financial management framework that account for the highest instances of non-compliance. Finance has provided a number of whole-of-government information sessions on the updated CGGs and is continuing to work with agencies to provide information sessions to specific agencies. 18 Finance is also working with stakeholders to develop a whole-of-government grant agreement template, to be used by agencies when entering into low-risk grants. The template seeks to improve and streamline grant agreements between the Australian Government and grant recipients, particularly the not-for-profit sector. Finance is currently working with agencies piloting and using the template. Finance maintains the Model Chief Executive’s Instructions (CEIs). The Model CEIs seek to improve the consistency across agencies and help staff members understand and comply with the key requirements of the financial management framework. The Model CEIs were updated following amendments to the grants framework with the release of the second version of the CGGs in May 2013. Finance coordinates an interagency community of practice forum on financial framework training and skills development. The purpose of this group is to ensure that staff of Australian Government bodies have access to the right tools and training to understand their responsibilities under the financial management framework. This forum is used to share ideas, support and discuss financial training needs and develop, pilot and evaluate new or updated training materials. This community of practice played a key role in the design and development of the Financial Management and Budget (FMB) training program. The FMB training program provides information about whole-of-government financial framework requirements. It comprises three training modules that introduce key aspects of the financial management and budget frameworks and explain how the different legislation, policies and processes interact to support decision-making and ensure the proper use of public resources. The FMB training program’s modular approach is designed to support a range of flexible delivery options. It will: be a useful training tool to disseminate information to Australian Government entities and their staff when changes to the financial framework occur contribute to efficiencies across the Australian Government by reducing training development costs. In November 2012 and February 2013, pilots of the FMB program were delivered to 492 participants from 60 Australian Government entities. 89 percent of participants rated the overall program as excellent or very good, and 98 percent reported that other staff from their organisation would find the program useful. In June 2013, the FMB training program was publicly released. Finance is currently reviewing the FMB training material to address changes to the resource management framework arising from the commencement of the PGPA Act on 1 July 2014. Finance will continue to convene the community of practice to ensure that government entities are aware of changes to the FMB training materials and the implementation of the PGPA Act. In October 2013 Finance provided FMB training to small government entities (i.e. those with fewer than 500 staff). This training was attended by 125 participants from 21 entities who provided very positive feedback on the training. Further FMB sessions for small agencies are proposed for 2014. 8.5. Improving and clarifying the financial management framework As part of Finance’s role of continuous improvement of the financial framework, the Public Management Reform Agenda (PMRA) seeks to modernise the financial framework of the Australian Government so that it will support high quality resource management and performance now, and into the future. The PGPA Act is 19 the cornerstone of the broader PMRA aimed at improving productivity, efficiency and transparency in the public sector. The work of updating the financial framework commenced with the Commonwealth Financial Accountability Review in December 2010. During 2011-12, Finance released a series of 13 issues papers to Commonwealth entities to facilitate discussion on financial management and performance. A discussion paper was publicly released on 27 March 2012, which was accompanied by an extensive program of consultation. Feedback from stakeholders, including within government, with state and territory officials, the private sector and academia, was taken on board and firmer propositions were put forward again in a position paper on 23 November 2012. On 16 May 2013, the PGPA Bill 2013, consolidating the Commonwealth financial framework legislation within a single Act, was introduced into the Parliament of Australia. Subsequently the Joint Committee of Public Accounts and Audit (JCPAA) conducted an inquiry into the PGPA Bill and tabled their report on 4 June 2013. The PGPA Act was passed by the Parliament on 28 June 2013 and received Royal Assent on 29 June 2013. Before the operative provisions of the PGPA Act come into effect on 1 July 2014, Finance is working with relevant stakeholders to make consequential amendments to other legislation, and develop rules and guidance material to support the implementation of the PGPA Act. The Certificate process will be reconsidered in the context of the new PGPA framework. 9. Australian National Audit Office In more recent years, the ANAO has increased its focus on legislative compliance as part of its financial statement audit coverage. The 2012–13 interim audits identified that, generally, agencies continue to maintain updated listings of the laws, regulations and associated government policies that are relevant to their responsibilities. Agencies also have well‐established processes to monitor compliance with legislation. Processes are implemented by agencies to review the effectiveness of how the agency is monitoring compliance with the relevant laws, regulations and applicable government policies to enable chief executives to provide an annual Certificate to their Minister.10 10 See ANAO Audit Report No.49 2012–13, Interim Phase of the Audits of the Financial Statements of Major General Government Sector Agencies for the year ending 30 June 2013, p 40. 20 Part 1: 2012-13 results by category Introduction Table 1 and Chart 1 report on the combined total of all (14,027) instances of non-compliance reported in 2012-13 against six categories, comprising key elements of the financial management framework for FMA Act agencies: i. the commitment of public money by agencies ii. the use of drawing rights by agencies iii. the proper use of financial resources iv. banking and investment by agencies v. the maintenance of agency accounts and records vi. miscellaneous requirements. Tables 1.1 to 1.6 and Charts 1.1 to 1.6 report on each portfolio group’s share of reported instances of non-compliance in 2012-13 against the six categories. For example, Table 1.1 and Chart 1.1 record that the Finance and Deregulation portfolio group reported 3.3 percent of all (11,734) instances of non-compliance relating to Category 1. Note that there are no tables or charts for category 5 (the maintenance of agency accounts and records) as there were no reported instances of non-compliance in 2012-13. 21 Table 1: Percentage of all non-compliance by category 2011-12 Category i. the commitment of public money by agencies Percentage 2012-13 Instances Percentage Instances 68.0% 8,708 83.7% 11,734 ii. the use of drawing rights by agencies 6.7% 857 4.4% 622 iii. the proper use of financial resources 5.1% 656 907 iv. banking and investment by agencies 17.9% 2,282 6.5% 4.2% v. the maintenance of agency accounts and records <0.1% 1 0 2.3% 294 0.0% 1.2% 174 12,798 100.0% 14,027 vi. miscellaneous requirements Instances of non-compliance 100.0% Chart 1: Instances of non-compliance by category from 2011-12 to 2012-13 22 590 Table 1.1: Category 1 (the commitment of public money by agencies) by portfolio grouping 83.7 percent (11,734 instances) of all non-compliance related to Category 1 – the commitment of public money by agencies. Table 1.1 records each portfolio group’s share of Category 1. Portfolio group’s share of all non-compliance reported for Category 1 Defence 2011-12 2012-13 Percentage Instances Percentage Instances 40.0% 3,479 24.5% 2,879 Foreign Affairs and Trade 3.2% 283 13.3% 1,560 Health and Ageing 6.1% 531 12.7% 1,495 22.9% 1,995 11.0% 1,290 Industry, Innovation, Climate Change, Science, Research and Tertiary Education 3.0% 260 9.8% 1,150 Attorney-General's 7.2% 625 6.8% 796 Agriculture, Fisheries and Forestry 0.4% 38 3.7% 428 Finance and Deregulation 1.7% 146 3.3% 391 Sustainability, Environment, Water, Population and Communities 3.5% 306 3.0% 347 Human Services 1.7% 148 2.0% 237 Immigration and Citizenship 4.4% 382 1.7% 196 Regional Australia, Local Government, Arts and Sport 0.7% 58 1.5% 174 Treasury 2.3% 204 1.4% 167 Prime Minister and Cabinet 0.4% 38 1.4% 165 Infrastructure and Transport 0.5% 42 1.3% 151 Resources, Energy and Tourism 0.4% 38 1.1% 125 <0.1 2 1.0% 116 Families, Housing, Community Services and Indigenous Affairs 0.5% 43 0.3% 36 Veterans' Affairs 0.2% 12 0.1% 16 Broadband, Communications and the Digital Economy 0.4% 34 0.1% 15 Climate Change and Energy Efficiency 0.5% 44 N/A N/A 100.0% 8,708 100.0% 11,734 Education, Employment and Workplace Relations Parliament of Australia Total 23 Chart 1.1: Category 1 (the commitment of public money by agencies) by portfolio grouping Chart 1.1 presents the 2012-13 data reported in Table 1.1 in graphical form. Note: ‘Other’ includes portfolio groups whose share of the total is less than 1.5 percent 24 Table 1.2: Category 2 (the use of drawing rights by agencies) by portfolio grouping 4.4 percent (622 instances) of all non-compliance related to Category 2 – the use of drawing rights by agencies. Table 1.2 records each portfolio group’s share of Category 2. Portfolio group’s share of all non-compliance reported for Category 2 Industry, Innovation, Climate Change, Science, Research and Tertiary Education 2011-12 Percentage 2012-13 Instances Percentage Instances - - 28.9% 180 Treasury 26.8% 230 24.1% 150 Finance and Deregulation 30.5% 262 9.2% 57 Health and Ageing 8.1% 69 8.4% 52 Education, Employment and Workplace Relations 3.6% 31 8.0% 50 Human Services 2.7% 23 7.9% 49 Attorney-General's 0.3% 3 5.1% 32 Prime Minister and Cabinet 6.2% 53 3.1% 19 Parliament of Australia 3.5% 30 2.1% 13 Families, Housing, Community Services and Indigenous Affairs 1.1% 9 1.3% 8 Immigration and Citizenship 0.7% 6 1.1% 7 Infrastructure and Transport - - 0.3% 2 Regional Australia, Local Government, Arts and Sport - - 0.3% 2 Defence 9.0% 77 0.2% 1 Agriculture, Fisheries and Forestry 3.3% 28 - - Foreign Affairs and Trade 0.1% 1 - - Resources, Energy and Tourism 0.7% 6 - - Sustainability, Environment, Water, Population and Communities 1.8% 15 - - Broadband, Communications and the Digital Economy - - - - Veterans' Affairs - - - - Climate Change and Energy Efficiency Total 1.6% 14 N/A N/A 100.0% 857 100.0% 622 25 Chart 1.2: Category 2 (the use of drawing rights by agencies) by portfolio grouping Chart 1.2 presents the 2012-13 data reported in Table 1.2 in graphical form. Note: ‘Other’ includes portfolio groups whose share of the total is less than 1.5 percent 26 Table 1.3: Category 3 (the proper use of financial resources) by portfolio grouping 6.5 percent (907 instances) of all non-compliance related to Category 3 – the proper use of financial resources. Table 1.3 records each portfolio group’s share of Category 3. Portfolio group’s share of all non-compliance reported for Category 3 Defence Treasury Education, Employment and Workplace Relations Foreign Affairs and Trade Industry, Innovation, Climate Change, Science, Research and Tertiary Education 2011-12 2012-13 Percentage Instances Percentage Instances 15.1% 99 13.8% 125 7.6% 50 12.7% 115 19.8% 130 12.0% 109 4.9% 32 11.7% 106 8.2% 54 11.1% 101 12.5% 82 10.0% 91 Families, Housing, Community Services and Indigenous Affairs 4.4% 29 7.3% 66 Human Services 3.5% 23 6.5% 59 Sustainability, Environment, Water, Population and Communities 3.7% 24 3.6% 33 Broadband, Communications and the Digital Economy 2.1% 14 2.6% 23 Finance and Deregulation 1.2% 8 1.7% 15 Prime Minister and Cabinet 0.8% 5 1.4% 13 Resources, Energy and Tourism 1.7% 11 1.4% 13 Infrastructure and Transport 1.0% 6 1.0% 9 Agriculture, Fisheries and Forestry 2.4% 16 0.9% 8 Veterans' Affairs 1.1% 7 0.9% 8 Parliament of Australia 2.1% 14 0.6% 5 Health and Ageing 0.6% 4 0.4% 4 Immigration and Citizenship 3.2% 21 0.3% 3 Regional Australia, Local Government, Arts and Sport 1.7% 11 0.1% 1 Climate Change and Energy Efficiency 2.4% 16 N/A N/A 100.0% 656 100.0% 907 Attorney-General's Total 27 Chart 1.3: Category 3 (the proper use of financial resources) by portfolio grouping Chart 1.3 presents the 2012-13 data reported in Table 1.3 in graphical form. Note: ‘Other’ includes portfolio groups whose share of the total is less than 1.5 percent 28 Table 1.4: Category 4 (banking and investment by agencies) by portfolio grouping 4.2 percent (590 instances) of all non-compliance related to Category 4 – banking and investment by agencies. Table 1.4 records each portfolio group’s share of Category 4. Portfolio group’s share of all non-compliance reported for Category 4 2011-12 2012-13 Percentage Instances Percentage Instances 43.4% 990 32.6% 192 Defence 2.9% 65 18.3% 108 Health and Ageing 2.6% 60 9.8% 58 Attorney-General's 4.5% 103 6.6% 39 Treasury 7.2% 163 6.3% 37 17.5% 400 5.9% 35 Finance and Deregulation 1.2% 28 5.1% 30 Prime Minister and Cabinet 4.7% 108 5.1% 30 Immigration and Citizenship 9.3% 212 3.2% 19 Sustainability, Environment, Water, Population and Communities 2.6% 59 2.9% 17 Foreign Affairs and Trade 0.9% 21 2.2% 13 Agriculture, Fisheries and Forestry 1.3% 29 1.0% 6 Parliament of Australia 1.0% 22 0.3% 2 - - 0.3% 2 Human Services Industry, Innovation, Climate Change, Science, Research and Tertiary Education Regional Australia, Local Government, Arts and Sport Infrastructure and Transport - - 0.2% 1 Resources, Energy and Tourism 0.1% 2 0.2% 1 Education, Employment and Workplace Relations 0.3% 7 - - Veterans' Affairs 0.5% 12 - - Broadband, Communications and the Digital Economy - - - - Families, Housing, Community Services and Indigenous Affairs - - - - Climate Change and Energy Efficiency Total <0.1% 1 N/A N/A 100.0% 2,282 100.0% 590 29 Chart 1.4: Category 4 (banking and investment by agencies) by portfolio grouping Chart 1.4 presents the 2012-13 data reported in Table 1.4 in graphical form. Note: ‘Other’ includes portfolio groups whose share of the total is less than 1.5 percent 30 Table 1.6: Category 6 (miscellaneous requirements) by portfolio grouping 1.2 percent (174 instances) of all non-compliance related to Category 6 – miscellaneous requirements. Table 1.6 records each portfolio group’s share of Category 6. See page 13 for further information on this category. Portfolio group’s share of all non-compliance reported for Category 6 2011-12 2012-13 Percentage Instances Percentage Instances 52.4% 154 37.9% 66 Education, Employment and Workplace Relations 0.7% 2 19.0% 33 Finance and Deregulation 8.5% 25 9.2% 16 Immigration and Citizenship 4.1% 12 8.1% 14 Defence 5.1% 15 5.2% 9 Prime Minister and Cabinet 1.7% 5 4.0% 7 Sustainability, Environment, Water, Population and Communities 5.5% 16 3.5% 6 Attorney-General's 4.8% 14 2.3% 4 Parliament of Australia 0.3% 1 2.3% 4 Foreign Affairs and Trade Treasury 0.3% 1 1.7% 3 Infrastructure and Transport - - 1.7% 3 Resources, Energy and Tourism - - 1.7% 3 0.3% 1 1.1% 2 10.2% 30 1.1% 2 Families, Housing, Community Services and Indigenous Affairs 1.4% 4 0.6% 1 Health and Ageing 1.0% 3 0.6% 1 Broadband, Communications and the Digital Economy 3.4% 10 - - Regional Australia, Local Government, Arts and Sport 0.3% 1 - - Human Services - - - - Veterans' Affairs - - - - Climate Change and Energy Efficiency - - N/A N/A 100.0% 294 100.0% 174 Agriculture, Fisheries and Forestry Industry, Innovation, Climate Change, Science, Research and Tertiary Education Total 31 Chart 1.6: Category 6 (miscellaneous requirements) by portfolio grouping Chart 1.6 presents the 2012-13 data reported in Table 1.6 in graphical form. Note: ‘Other’ includes portfolio groups whose share of the total is less than 1.5 percent 32 Part 2: 2012-13 results by portfolio group Introduction Table 2 and Chart 2 report on each portfolio group’s share of the combined total of all (14,027) reported instances of non-compliance in 2012-13. For example, Table 2 and Chart 2 record that the Finance and Deregulation portfolio group reported 3.6 percent of all (14,027) instances of non-compliance. Charts 2.1 to 2.20 report on the types of non-compliance reported by each portfolio group, against six categories, comprising key elements of the financial management framework for FMA Act agencies: i. the commitment of public money by agencies ii. the use of drawing rights by agencies iii. the proper use of financial resources iv. banking and investment by agencies v. the maintenance of agency accounts and records vi. miscellaneous requirements. For example, Chart 2.7 records that the types of non-compliance reported by the Finance and Deregulation portfolio group related to Category 1 (the commitment of public money by agencies), Category 2 (the use of drawing rights by agencies), Category 3 (the proper use of financial resources), Category 4 (banking and investment by agencies) and Category 6 (miscellaneous requirements). Chart 2.7 also records the proportion of instances of non-compliance relating to the above categories. 33 Table 2: Percentage of all non-compliance by portfolio grouping 2011-12 Portfolio group’s share of all noncompliance reported 2012-13 Percentage Instances Percentage Instances 29.2% 3,735 22.3% 3,122 Foreign Affairs and Trade 2.6% 338 12.0% 1,682 Health and Ageing 5.2% 667 11.4% 1,610 16.9% 2,165 10.6% 1,482 Industry, Innovation, Climate Change, Science, Research and Tertiary Education 5.8% 744 10.4% 1,468 Attorney-General's 6.5% 828 6.9% 962 Human Services 9.3% 1,184 3.8% 537 Treasury 6.3% 801 3.8% 535 Finance and Deregulation 3.7% 469 3.6% 509 Agriculture, Fisheries and Forestry 0.9% 112 3.2% 444 Sustainability, Environment, Water, Population and Communities 3.3% 420 2.9% 403 Immigration and Citizenship 4.9% 633 1.7% 239 Prime Minister and Cabinet 1.6% 209 1.7% 234 Regional Australia, Local Government, Arts and Sport 0.5% 70 1.3% 179 Infrastructure and Transport 0.4% 48 1.1% 166 Resources, Energy and Tourism 0.4% 57 1.0% 142 Parliament of Australia 0.5% 69 1.0% 140 Families, Housing, Community Services and Indigenous Affairs 0.7% 85 0.8% 111 Broadband, Communications and the Digital Economy 0.5% 58 0.3% 38 Veterans' Affairs 0.2% 31 0.2% 24 Climate Change and Energy Efficiency 0.6% 75 N/A N/A 100.0% 12,798 100.0% 14,027 Defence Education, Employment and Workplace Relations Total 34 Chart 2: Percentage of all non-compliance by portfolio grouping for 2012-13 Chart 2 presents the 2012-13 data reported in Table 2 in graphical form. Note: ‘Other’ includes portfolio groups whose share of the total is less than or equal to 1.5 percent 35 Chart 2.1: Agriculture, Fisheries and Forestry portfolio group Chart 2.2: Attorney-General's portfolio group 36 Chart 2.3: Broadband, Communications and the Digital Economy portfolio group Chart 2.4: Defence portfolio group 37 Chart 2.5: Education, Employment and Workplace Relations portfolio group Chart 2.6: Families, Housing, Community Services and Indigenous Affairs portfolio group 38 Chart 2.7: Finance and Deregulation portfolio group Chart 2.8: Foreign Affairs and Trade portfolio group 39 Chart 2.9: Health and Ageing portfolio group Chart 2.10: Human Services portfolio group 40 Chart 2.11: Immigration and Citizenship portfolio group Chart 2.12: Infrastructure and Transport portfolio group 41 Chart 2.13: Industry, Innovation, Climate Change, Science, Research and Tertiary Education portfolio group Chart 2.14: Parliament of Australia portfolio group 42 Chart 2.15: Prime Minister and Cabinet portfolio group Chart 2.16: Regional Australia, Local Government, Arts and Sport portfolio group 43 Chart 2.17: Resources, Energy and Tourism portfolio group Chart 2.18: Sustainability, Environment, Water, Population and Communities portfolio group 44 Chart 2.19: Treasury portfolio group Chart 2.20: Veterans' Affairs portfolio group 45 Appendix: List of portfolio groups for Certificate purposes Appendix Composition of Portfolio Groups as at 30 June 2013 Agriculture, Fisheries and Forestry portfolio group: Australian Fisheries Management Authority Australian Pesticides and Veterinary Medicines Authority Department of Agriculture, Fisheries and Forestry Attorney-General’s portfolio group: Administrative Appeals Tribunal Attorney-General’s Department Australian Commission for Law Enforcement Integrity Australian Crime Commission Australian Customs and Border Protection Service Australian Federal Police Australian Human Rights Commission Australian Institute of Criminology Australian Law Reform Commission Australian Security Intelligence Organisation Australian Transaction Reports and Analysis Centre CrimTrac Agency Family Court of Australia Federal Court of Australia Federal Magistrates Court of Australia Insolvency and Trustee Service Australia Office of the Australian Information Commissioner Office of Parliamentary Counsel Office of the Director of Public Prosecutions 46 Broadband, Communications and the Digital Economy portfolio group: Australian Communications and Media Authority Department of Broadband, Communications and the Digital Economy Telecommunications Universal Service Management Agency Defence portfolio group: Defence Materiel Organisation Department of Defence Education, Employment and Workplace Relations portfolio group: Department of Education, Employment and Workplace Relations Fair Work Commission Office of the Fair Work Building Industry Inspectorate Office of the Fair Work Ombudsman Safe Work Australia Seafarers Safety, Rehabilitation and Compensation Authority (Seacare Authority) Families, Housing, Community Services and Indigenous Affairs portfolio group: Australian Institute of Family Studies Department of Families, Housing, Community Services and Indigenous Affairs Workplace Gender Equality Agency Finance and Deregulation portfolio group: Australian Electoral Commission ComSuper Department of Finance and Deregulation Future Fund Management Agency Foreign Affairs and Trade portfolio group: AusAID Australian Centre for International Agricultural Research Australian Secret Intelligence Service Australian Trade Commission Department of Foreign Affairs and Trade 47 Health and Ageing portfolio group: Australian National Preventive Health Agency Australian Organ and Tissue Donation and Transplantation Authority Australian Radiation Protection and Nuclear Safety Agency Cancer Australia Department of Health and Ageing Independent Hospital Pricing Authority National Blood Authority National Health and Medical Research Council National Health Funding Body National Health Performance Authority Private Health Insurance Ombudsman Professional Services Review Scheme Human Services portfolio group: Department of Human Services Immigration and Citizenship portfolio group: Department of Immigration and Citizenship Migration Review Tribunal and Refugee Review Tribunal Industry, Innovation, Climate Change, Science, Research and Tertiary Education portfolio group: Australian Research Council Australian Skills Quality Authority Clean Energy Regulator Climate Change Authority Department of Industry, Innovation, Climate Change, Science, Research and Tertiary Education IP Australia Tertiary Education Quality and Standards Agency 48 Infrastructure and Transport portfolio group: Australian Transport Safety Bureau Department of Infrastructure and Transport Parliament of Australia portfolio group: Department of Parliamentary Services Department of the House of Representatives Department of the Senate Parliamentary Budget Office Prime Minister and Cabinet portfolio group: Australian National Audit Office Australian Public Service Commission Department of the Prime Minister and Cabinet National Mental Health Commission Office of National Assessments Office of the Commonwealth Ombudsman Office of the Inspector-General of Intelligence and Security Office of the Official Secretary to the Governor-General Regional Australia, Local Government, Arts and Sport portfolio group: Australian Sports Anti-Doping Authority Department of Regional Australia, Local Government, Arts and Sport National Archives of Australia National Capital Authority Old Parliament House Resources, Energy and Tourism portfolio group: Department of Resources, Energy and Tourism Geoscience Australia National Offshore Petroleum Safety and Environmental Management Authority 49 Sustainability, Environment, Water, Population and Communities portfolio group: Bureau of Meteorology Department of Sustainability, Environment, Water, Population and Communities Great Barrier Reef Marine Park Authority Murray-Darling Basin Authority National Water Commission Treasury portfolio group: Australian Bureau of Statistics Australian Competition and Consumer Commission Australian Office of Financial Management Australian Prudential Regulation Authority Australian Securities and Investments Commission Australian Taxation Office Commonwealth Grants Commission Corporations and Markets Advisory Committee Department of the Treasury Inspector-General of Taxation National Competition Council Office of the Auditing and Assurance Standards Board Office of the Australian Accounting Standards Board Productivity Commission Royal Australian Mint Veterans’ Affairs portfolio group: Department of Veterans’ Affairs 50