G LOSSARY

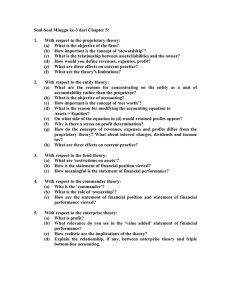

advertisement

GLOSSARY Glossary Accrual basis The accounting basis where the assets, liabilities, equity, revenues and expenses are recognised in the reporting periods to which they relate, regardless of when cash is received or paid. Accumulated depreciation The aggregate, at a given point of time, of the depreciation expenses in respect of a particular depreciable asset or class of depreciable assets. Accumulated results A component of equity and is the accumulation of operating results over the life of a reporting entity plus other adjustments and transfers required in accordance with the accounting standards. Administered investments Financial interests of the Australian Government in corporations that it controls. These interests generally reflect the net assets of such corporations and are recorded in the audited financial statements of the responsible Minister’s department. Agriculture, forestry and fishing A function in the Consolidated Schedule of Revenues and Expenses by Function. This function includes agricultural land management, agricultural water resources management, agricultural support schemes, agricultural research and extension services, forestry, and fishing. Amortisation An expense recognised systematically for the purpose of allocating the depreciable amount of an intangible asset over its useful life. . Asset realisation reserve Amounts set aside from the investment reserve to distinguish reserves remaining from disposed corporations from reserves relating to corporations that are still controlled by the Australian Government. See investment reserve. Assets Future economic benefits controlled by the entity as a result of past transactions or other past events. Associated entity An entity in which the reporting entity holds an interest in the net assets and over which the reporting entity is able to exercise significant influence, but does not have control. Investments in associated entities are measured at values which reflect the Australian Government’s share of these entities net assets. Australian accounting standards (AAS) Standards for the preparation of financial reports issued by the Australian Accounting Standards Board and its predecessor boards. Borrowing costs Interest and other costs incurred by an entity in connection with the borrowing of funds. Budget Balancing Assistance (BBA) Amounts paid under the Intergovernmental Agreement on the Reform of Commonwealth-State Financial Relations to ensure that, in the transitional years following the introduction of The New Tax System in 2000-01, each State’s budgetary position will be no worse off than had the reforms to Commonwealth-State financial relations not been implemented. Cash Cash on hand and cash equivalents. Cash accounting An accounting method which records cash receipts, payments and balances and provides reports which show the sources of cash and how cash was used. Cash equivalents Highly liquid investments with short periods to maturity which are readily convertible to cash on hand at the investor’s option and are subject to an insignificant risk of changes in value, and borrowings which are integral to the cash management function and which are not subject to a term facility. Cash on hand Notes and coins held, and deposits held at call with a financial institution. Charter of Budget Honesty Legislation establishing a new fiscal framework that aims to produce better fiscal outcomes by putting in place institutional arrangements to improve the discipline, transparency and accountability applying to the conduct of fiscal policy. 203 Class A group of revenues, expenses, assets or liabilities having a similar nature or function in the operations of the entity, for example taxation revenue. Commitments Obligations or undertakings to make future payments to other entities that exist at the end of the reporting period, and have not been recognised as liabilities in the Statement of Financial Position. Obligations include those arising under agreements equally proportionately unperformed. Undertakings are unconditional promises that are expected to create future liabilities. Consolidated Financial Statements Annual financial statements for the Australian Government prepared under section 55 of the Financial Management and Accountability Act 1997. Consolidated Statement of Financial Performance Financial statement that shows each class of revenues (using the Australian Bureau of Statistics ‘Taxes Fees and Fines Classification’) and each class of expenses (based on the Australian Bureau of Statistics ‘Economic Transactions Framework’), distinguishing the costs of providing goods and services from the costs of benefits given to the community (directly or through other governments). Consolidated Schedule of Revenues and Expenses by Function Financial statement that shows broadly the sources of revenues and how the government has allocated these resources to major policy areas (using Australian Bureau of Statistics ‘Government Purposes Classification’). Consolidated Statement Financial Performance by Sector Financial statement that shows the information provided in the Consolidated Statement of Financial Performance statement divided into the three component sectors of the Australian Government. Consolidated Statement of Financial Position Financial statement that shows the classes of assets and liabilities held at the end of the financial year appropriately classified so as to reflect economic characteristics. Consolidated Statement of Financial Position by Sector Financial statement that shows the classes of assets and liabilities split by the three component sectors of the Australian Government held at the end of the financial year appropriately classified so as to reflect economic characteristics. Contingencies Conditions, situations or circumstances that: exist at the end of the reporting period; create uncertainty as to possible gain or loss to an entity; and will be confirmed only on the occurrence or non-occurrence of one or more uncertain future events. Control of an asset The capacity of the reporting entity to benefit from the asset in the pursuit of the reporting entity’s objectives and to deny or regulate the access of others to that benefit. Control of an entity For the purposes of these financial statements, the control of another entity by the Australian Government is taken to exist where: Cultural and heritage items – the other entity is accountable to the Australian Government; and – the Australian Government has a residual financial interest in the net assets of that entity. Include works of art, artefacts, collectables, historical treasures, or similar items, which are held for their cultural, environmental or historical significance. Cultural and heritage items will be generally be: (a) held for public exhibition, education or research; and (b) protected, cared for and preserved. 204 Current asset Current liability An asset that: (a) is expected to be realised in, or is held for sale or consumption in, the normal course of the entity's operating cycle; or (b) is held primarily for trading purposes or for the short-term and is expected to be realised within twelve months of the reporting date; or (c) is cash or a cash-equivalent asset which is not restricted in its use beyond twelve months or the length of the operating cycle whichever is greater. A liability that: (a) arises and is expected to be settled in the normal course of the entity's operating cycle; or (b) is at call or due or expected to be settled within twelve months of the reporting date Defence A function In the Consolidated Schedule of Revenues and Expenses by Function. This item includes military and civil defence affairs, foreign military aid and defence research. Depreciable amount The historical cost of a depreciable asset, or other revalued amount substituted for historical cost, in the financial report, less in either case the net amount expected to be recovered on disposal of the asset at the end of its useful life. Depreciable asset A non-current asset having a limited useful life. Depreciation expense An expense recognised systematically for the purpose of allocating the depreciable amount of a depreciable asset over its useful life. Economic entity A group of entities comprising the parent entity and each of its subsidiaries. This comprises of Australian Government Departments of State, Parliamentary Departments, prescribed agencies, Australian Government authorities, Australian Government companies limited by shares and Australian Government companies limited by guarantee in which the Australian Government holds a controlling interest. Economic transactions method A previous methodology applied in recognising taxation revenue, whereby, revenue was recognised on the basis of a reliable estimate of revenue accrued in relation to balance dates falling within the reporting period. In the application of the economic transactions method, current year revenue was also affected by variations between prior year estimates and the associated actual transactions in the current year. See ‘tax liability method’ for the current methodology. Education A function in the Consolidated Schedule of Revenues and Expenses by Function. This item includes primary and secondary education, university and other higher education, technical and further education, preschool and special education, and transportation of students. Effectiveness The extent to which the entity achieved the objectives established for its operations or activities, whether those objectives were expressed in terms of outputs or outcomes. Efficiency The extent to which the entity maximised the outputs produced from a given set of inputs or minimised the input cost of producing a given level and quality of outputs. Entity Any legal, administrative or fiduciary arrangement, organisational structure or other party (including a person) having the capacity to deploy scarce resources in order to achieve objectives. Equity The residual interest in the assets of a reporting entity after deduction of its liabilities. 205 Equity instrument Any contract that evidences a residual interest in the assets of an entity after deducting all of its liabilities. Expenses Consumptions or losses of future economic benefits in the form of reductions in assets or increases in liabilities of the entity. Expenses by purpose The disaggregation of expenses by the purpose of Australian Government policy, for example defence, housing, education. Purposes are determined by applying Government Financial Statistics Reporting Principles used by the Australian Bureau of Statistics. Financial asset Any asset that is: cash; a contractual right to receive cash or another financial asset from another entity; a contractual right to exchange financial instruments with another entity under conditions that are potentially favourable; or an equity instrument of another entity. Financial instrument Any contract that gives rise to both a financial asset of one entity and a financial liability or equity instrument of another entity. Financial liability Any liability that is a contractual obligation: to deliver cash or another financial asset to another entity; or to exchange financial instruments with another entity under conditions that are potentially unfavourable. Financial position The economic condition of a reporting entity, having regard to its control over resources, financial structure, capacity for adaptation and solvency. Financial reporting Summarising information in the accounting records in accordance with accounting standards and other requirements and presenting it in financial statements designed to suit the needs of management or external users. Financial statements Consolidated Statement of Financial Performance; Consolidated Statement of Financial Position; Consolidated Statement of Cash Flows; Consolidated Schedule of Revenues and Expenses by Function; Schedule of Commitments; Schedule of Contingencies; Consolidated Statement of Financial Performance by Sector; Consolidated Statement of Financial Position by Sector; Consolidated Statement of Cash Flows by Sector; Schedule of Commitments by Sector; Schedule of Contingencies by Sector; and Notes. Financing activities Activities which relate to changing the size and/or composition of the financial structure of an entity, including equity, and borrowings not falling within the definition of cash. Fuel and energy A function in the Consolidated Schedule of Revenues and Expenses by Function. This item includes coal, petroleum, gas, nuclear affairs, and electricity. General government sector An institutional sector in the public sector. The primary function of this sector is to provide public services that are mainly non-market in nature, and for the collective consumption of the community, or involve the transfer or redistribution of income. These services are largely financed through taxes and other compulsory levies, although user charging and external funding have increased in recent years. 206 General public services A function in the Consolidated Schedule of Revenues and Expenses by Function. This item includes legislative and executive affairs, financial and fiscal affairs, foreign economic aid, general research, general services, and government superannuation benefits. General purpose financial report A financial report intended to meet the information needs common to users who are unable to command the preparation of reports tailored so as to satisfy, specifically, all of their information needs. General purpose intergovernment transactions A function in the Consolidated Schedule of Revenues and Expenses by Function. This item includes grants, advances or other transactions to other levels of government that cannot be allocated to purpose. General revenue assistance General revenue assistance is untied, that is, it is not required to be spent by the states or territories in a specified area and includes Budget Balancing Assistance, National Competition Policy Payments and Special Revenue Assistance. Grant Voluntary, non-repayable, unrequited transfers of resources from the government to external parties for the purpose of financing the operations of the recipient or meeting the cost of capital expenditure of the recipient. Health A function in the Consolidated Schedule of Revenues and Expenses by Function. It includes general hospitals, repatriation hospitals, mental health institutions, nursing homes, special hospitals, hospital benefits, medical clinics and practitioners, dental clinics and practitioners, maternal and infant health, ambulance services, medical benefits, school and other public health services, pharmaceuticals, medical aids and appliances, and health research. Heritage buildings Heritage buildings are those buildings, monuments or structures that are (or likely to become) symbolic of government, public activities, historical significance or cultural association. Highly liquid investments An asset held by the entity for the accretion of wealth by way of revenues such as interest, royalties, dividends, rentals and capital appreciation, but does not include operating assets. Housing and community amenities A function in the Consolidated Schedule of Revenues and Expenses by Function. This item includes housing and community development, water supply, household garbage and other sanitation, sewerage, urban storm water drainage, protection of the environment, and street lighting. Intangibles Assets that embody future economic benefit but do not have physical substance, for example, patents, trademarks and goodwill. Inventories Assets: held for sale in the ordinary course of business; or in the process of production, preparation or conversion for such sale; or in the form of materials or supplies to be consumed in the production of goods or services available for sale, excluding depreciable assets, as defined in Australian Accounting Standard AAS 4 ‘Depreciation’. Investing activities Activities which relate to the acquisition and/or disposal of non-current assets, including property, plant and equipment and other productive assets, and investments, such as securities, not falling within the definition of cash. Investment reserve Increase in the Australian Government’s equity (net assets) arising from recognition of administered investments in the financial statements. In effect, it represents the amount of capital needed to support administered investments. See administered investments. Liabilities Future sacrifices of future economic benefits that the entity is presently obliged to make to other entities as a result of past transactions or other past events. 207 Mining, manufacturing and construction In the Consolidated Schedule of Revenues and Expenses by Function this item includes activities relating to prospecting, mining and mineral resources development; manufacturing activities and research into manufacturing methods, materials and industrial management; and activities associated with the building and construction industry. This item excludes all activities relating to mineral fuels, and manufacturing relating to production of fuel and energy classified under fuel and energy. Minority shareholders A smaller party or group opposed to a majority, as in voting or other action who hold or own a share or shares in a company. National Competition Policy Payments The Government makes National Competition Policy Payments to the States for implementing National Competition Policy and related reforms. These reforms include a commitment to review legislation that restricts competition, to apply competitive neutrality to government business activities and to introduce specific reforms in electricity, gas, water and road transport. Net assets Total assets less total liabilities. Net foreign exchange gain Realized and unrealized gains from the translation of transactions or balances denominated in foreign currency into domestic currency terms. Net foreign exchange loss Realized and unrealized losses from the translation of transactions or balances denominated in foreign currency into domestic currency terms. Net market value The amount which could be expected to be received from the disposal of an asset in an orderly market after deducting costs expected to be incurred in realising the proceeds of such a disposal. Net result The difference between revenues and expenses and is either a surplus or a deficit. Non current physical assets Tangible non-current assets that: (a) are held by an entity for use in the production or supply of goods or services, for rental to others, or for administrative purposes and may include items held for maintenance or repair of such assets (b) have been acquired or constructed with the intention of being used on a continuing basis. Non-financial assets All assets which are not ‘financial assets’ and includes, for example, property, plant and equipment. Non taxation revenue Revenue other than taxation revenue and includes, for example, sales of goods and services, rent, interest and dividends. Notes to the financial statements Part of the financial statements. The notes disaggregate and further explain the information contained in the primary financial statements, thereby freeing those statements from details that could otherwise obscure the key financial indicators. Operating activities Activities which relate to the provision of goods and services and other activities that are neither investing nor financing activities. Operating result Revenue less expenses. Other economic affairs A function in the Consolidated Schedule of Revenues and Expenses by Function. This item includes storage, sale yards, markets, tourism and area promotion, and labour and employment affairs. Other purposes A function in the Consolidated Schedule of Revenues and Expenses by Function. This item includes public debt transactions, general purpose inter-government transactions, natural disaster relief, contingency reserve and asset sales. Outside equity interests Equity in the economic entity other than that which can be attributed to the ownership group of the parent entity. 208 Performance Proficiency of a reporting entity in acquiring resources economically and using those resources efficiently and effectively in achieving specified objectives. Personal benefits Current transfers for the benefit of individuals or households (for example, child care and family tax benefits) that do not require any economic benefit to flow back to government. Provisions and payables Liabilities that have arisen or accrued as a result of goods and services received (for example from employees) and normally do not generate an ongoing interest expense. Public financial corporations (PFC) sector An institutional sector of the public sector. It comprises of entities which perform central banking functions; accept demand, time or savings deposits; or have the authority to incur liabilities and acquire financial assets in the market on their own account. Public non-financial corporations (PNFC) sector An institutional sector of the public sector. The primary function of entities in this sector is to provide goods and services that are mainly market, nonregulatory and non-financial in nature, financed mainly through sales to the consumers of these goods and services. Public order and safety A function in the Consolidated Schedule of Revenues and Expenses by Function. This item includes police and fire protection services, law courts and legal services, prisons and corrective services, and control of domestic animals and livestock. Recognised Reported on, or incorporated in amounts reported on, the face of the primary financial statements (whether or not further disclosure of the item is made in notes thereto). Recreation and culture A function in the Consolidated Schedule of Revenues and Expenses by Function. This item includes public halls and civic centres, swimming pools and beaches, national parks and wildlife, libraries, creative and performing arts, museums, art galleries, broadcasting, and film production. Reporting entity An entity (including an economic entity) in respect of which it is reasonable to expect the existence of users dependent on general purpose financial reports for information which will be useful to them for making and evaluating decisions about the allocation of scarce resources. Reserves Amounts set aside out of operating results or other gains or increments, such as gains on revaluation of assets. Revaluation The act of recognising a reassessment of asset values for assets held for more than one year. Revenues Inflows or other enhancements, or savings in outflows, of future economic benefits in the form of increases in assets or reductions in liabilities of the entity. Sector For the purposes of these financial statements the Australian Government is looked at as a whole as well as divided into three sub-components (sectors): the general government sector, public financial corporations sector, and public non-financial corporations sector. Social security and welfare A function in the Consolidated Schedule of Revenues and Expenses by Function. This item includes sickness benefits, benefits to ex-servicemen and their dependents, invalid and other permanent disablement benefits, old age benefits, widows, orphan benefits, unemployment benefits, family and child benefits, sole parents benefits, family and child welfare, and aged and handicapped welfare. Statement of Accounting Concepts (SAC) Concepts developed by Australian Accounting Standards Board and its predecessor bodies to enunciate the conceptual framework for general purpose financial reporting. 209 Subsidiary An entity which is controlled by a parent entity. Subsidy Direct pecuniary aid furnished by government to agencies in accordance with a treaty/contract, a grant or contribution of money to secure services or resources. Taxation revenue Revenue raised by the government to fund the provision of public goods and services. Tax liability method The current methodology applied in recognising taxation revenue, whereby the revenue is recognised at the time when tax payments are due and payable. Transport and communications A function in the Consolidated Schedule of Revenues and Expenses by Function. This item includes road construction, road maintenance, parking, water transport, rail transport, air transport, pipelines, multi-mode urban transit systems, and communications. 210