Summary of Significant Changes

advertisement

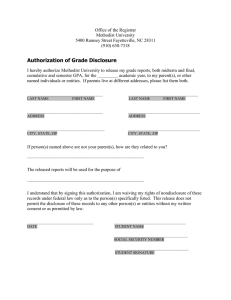

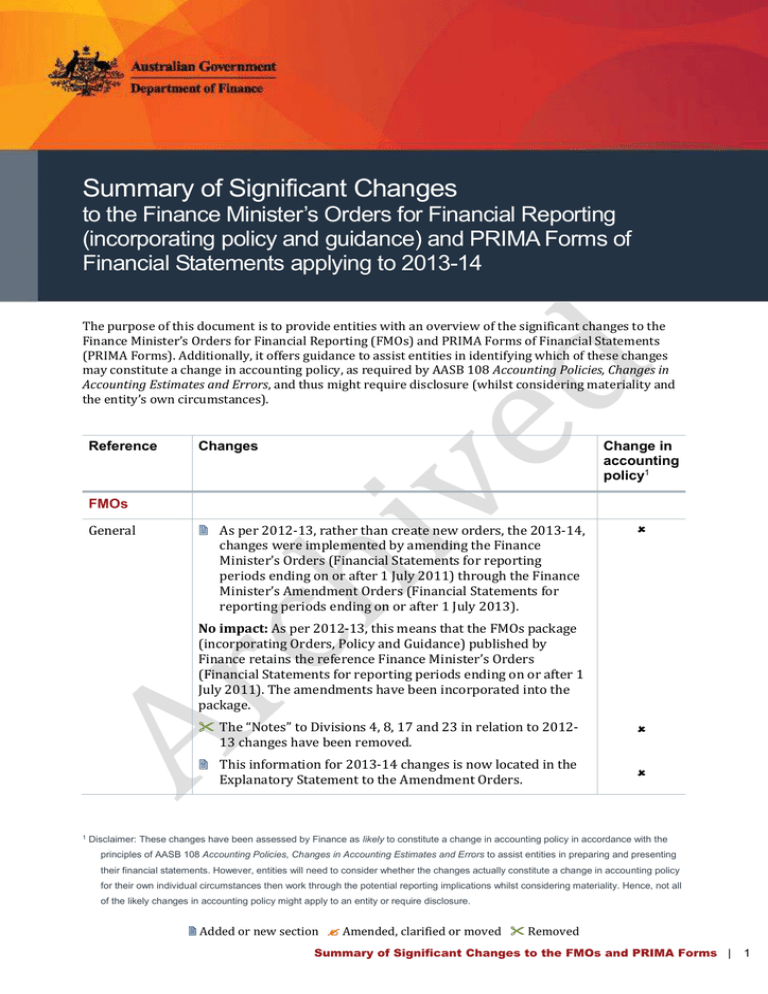

Summary of Significant Changes to the Finance Minister’s Orders for Financial Reporting (incorporating policy and guidance) and PRIMA Forms of Financial Statements applying to 2013-14 The purpose of this document is to provide entities with an overview of the significant changes to the Finance Minister’s Orders for Financial Reporting (FMOs) and PRIMA Forms of Financial Statements (PRIMA Forms). Additionally, it offers guidance to assist entities in identifying which of these changes may constitute a change in accounting policy, as required by AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors, and thus might require disclosure (whilst considering materiality and the entity’s own circumstances). Reference Changes Change in accounting policy1 FMOs General As per 2012-13, rather than create new orders, the 2013-14, changes were implemented by amending the Finance Minister’s Orders (Financial Statements for reporting periods ending on or after 1 July 2011) through the Finance Minister’s Amendment Orders (Financial Statements for reporting periods ending on or after 1 July 2013). No impact: As per 2012-13, this means that the FMOs package (incorporating Orders, Policy and Guidance) published by Finance retains the reference Finance Minister’s Orders (Financial Statements for reporting periods ending on or after 1 July 2011). The amendments have been incorporated into the package. 1 The “Notes” to Divisions 4, 8, 17 and 23 in relation to 201213 changes have been removed. This information for 2013-14 changes is now located in the Explanatory Statement to the Amendment Orders. Disclaimer: These changes have been assessed by Finance as likely to constitute a change in accounting policy in accordance with the principles of AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors to assist entities in preparing and presenting their financial statements. However, entities will need to consider whether the changes actually constitute a change in accounting policy for their own individual circumstances then work through the potential reporting implications whilst considering materiality. Hence, not all of the likely changes in accounting policy might apply to an entity or require disclosure. Added or new section Amended, clarified or moved Removed Summary of Significant Changes to the FMOs and PRIMA Forms | 1 Reference Changes Change in accounting policy1 No impact Sections containing guidance on changes applicable for the first time (e.g. “changes in 2011-12” and “third balance sheet”) have either been removed or condensed. No impact References to the financial statement “balance sheet” have been amended to “statement of financial position” for consistency with AASB 101 and the other financial statements. Impact: As discussed in the PRIMA Forms section below, entities will be required to retitle the affected statement. General edits have been made to reflect: the 2013 Machinery of Government changes; withdrawn/superseded guidance material; and the renumbering of AASB 119 (where the requirements are unchanged). No impact 4 Definitions The definition “Cost Recovery” has been amended to remove reference to a Finance Circular and to reflect changes to cost recovery. Impact: Entities are now required to refer only to the Australian Government Cost Recovery Guidelines in defining cost recovery. 8 Authoritative Requirements Guidance has been added in relation to the referencing of AASs and Interpretations for 2013-14 as a result of separate ‘not-for-profit’ and ‘for-profit’ versions. Impact: For-profit entities should take care in the applicability of AASs and Interpretations and ensure compliance with the ‘for-profit’ version, where applicable. 11 Early Adoption of Accounting Pronouncemen ts and Application of Tiers of Australian Accounting Standards The title of the Division has been amended to incorporate a new section in the Division, namely “Application of Tiers of Australian Accounting Standards”. Section 11.3 and guidance have been added to provide that, for the purposes of AASB 1053 (which came into effect this financial year), entities are required to apply Tier 1 reporting requirements. Impact: Entities would not be permitted to adopt the reduced disclosure regime, hence they would continue with current reporting requirements. Added or new section Amended, clarified or moved Removed Summary of Significant Changes to the FMOs and PRIMA Forms | 2 Reference Changes Change in accounting policy1 17 Approved Exemptions The exemption for PFCs and GBEs at section 17.1 has been removed due to changes to AASB 119 no longer permitting the choice. * Impact: PFCs and GBEs must now apply the direct to equity option. *Only applies to PFCs and GBEs where they did not previously apply the direct to equity option. 23 Director/ Senior Executive Remuneration The “Reportable salary” definition has been clarified to reflect only the specified items where they are reported on an individual’s payment summary as per Finance’s policy intent. Impact: Entities are to ensure they report as per the revised definition and items not included in the payment summary are to be excluded. Amended section 23.83G to reflect the change in AASB 119’s definition of “short-term employee benefits”. Impact: Entities will need to ensure that only employee benefits that meet the revised “short-term employee benefits” definition are categorised as such. 30 Financial Assets – General Information Added guidance to clarify that AASB 13’s fair value measurement and disclosure requirements do not apply to appropriations receivable. 33 Valuation of Non-Financial Assets Added guidance to direct entities to AASB 13 where valuation is at fair value. 45 Financial Instruments Removed section 45.51P as the disclosure requirement is no longer applicable due to a modified version of the disclosure requirement being transferred to AASB 13. No impact Impact: Entities would need to ensure they apply the updated fair value measurement requirements. Clarified and updated guidance in relation to financial instrument disclosures as a result of the withdrawal of AGN 2008/1 and the introduction of AASB 13, which amends the financial instruments suite of AASs. Impact: Entities would need to ensure they apply the updated fair value measurement and disclosure requirements. Added or new section Amended, clarified or moved Removed Summary of Significant Changes to the FMOs and PRIMA Forms | 3 Reference Changes Change in accounting policy1 87 Administered Investments Amended fair value guidance to account for the introduction of AASB 13 and changes to AASB 139. 101 Departmental Appropriations Added guidance in relation to receivables and departmental supplementation. 104 Disclosure of Appropriations Section 104.18 has been amended to remove reference to CAC Act provisions as the disclosure does not apply to CAC Act entities. Impact: Entities would need to ensure they apply the updated fair value measurement requirements. No impact No impact 120 Special Accounts and FMA Act Section 39 Investments Added section 120.11 to clarify that Table B is to be prepared on a ‘recoverable GST exclusive’ basis. 123 Competitive Neutrality and Cost Recovery Amended section 123.2 and added guidance to reflect changes to the cost recovery disclosure requirements. No impact: PRIMA Forms already requires this basis. Impact: As per Note 42 below, entities must now disclose as per the new requirements. Added or new section Amended, clarified or moved Removed Summary of Significant Changes to the FMOs and PRIMA Forms | 4 Reference Changes Change in accounting policy1 PRIMA Forms General Guidance in various financial statements and notes that disclosure of a line item is not required if an entity does not have anything to disclose for that item has been removed as this duplicates the requirements in Part K. No impact General tidy-up of the use of AAS references to improve consistency between the statements, schedules and notes. This includes the removal of detailed references where they are general in nature and do not refer to disclosure requirements (excluding changes to disclosure requirements, for example, new disclosures). No impact Various guidance (including disclosure references) have been: updated for minor changes in terminology and/or accounting standard references; amended as a result of changes to AASB 119; and amended or removed as a result of the introduction of AASB 13. Impact: Entities will need to ensure they are aware of changes to requirements, such as separation and redundancies. General improvements to the layout of various Notes have been made, such as to improve consistency between Notes. Impact: Entities should reflect these changes, where applicable. General Information on Preparation of Financial Statements References to prior and current years in PRIMA have been replaced with 20X1 and 20X2 respectively to simplify future amendments to PRIMA Forms. No impact: Entities would continue to show prior and current years (e.g. 2013 and 2014 respectively). General edits have been made to amend the title of the financial statement “balance sheet” (and references to this) to “statement of financial position” for consistency with AASB 101 and the other financial statements. As part of ongoing improvements, references to “profit or loss” have been replaced by “net cost of services” to better reflect the operating environment and reporting format adopted by Commonwealth entities Impact: Entities will be required to reflect these changes Added or new section Amended, clarified or moved Removed Summary of Significant Changes to the FMOs and PRIMA Forms | 5 Reference Changes Change in accounting policy1 accordingly. Statement of Comprehensive Income and Administered Schedule of Comprehensive Income Line item “Actuarial gains/(losses) on defined benefit plans” has been amended to “Remeasurements of defined benefit plans” in accordance with the reissuing of AASB 119. Administered Reconciliation Schedule Improvements to the general layout of the schedule have been made. Note 1 Summary of Significant Accounting Policies The Employee Benefits section has been amended (including components being reworded) to reflect changes to AASB 119, including renumbering. Impact: Entities will need to reflect this change in both the Statement and the Administered Schedule. Impact: Entities will need to reflect this change. However, entities should note that there has been no change as to what is required to be disclosed. Impact: Entities are to reflect this change as appropriate in their Note 1. As a result of AASB 13: added the Fair Value Measurement section; removed the revaluation table from the Property, Plant and Equipment (PP&E) section; and amended the wording in the PP&E and Investment Properties sections. Impact: Entities will need to ensure their Note 1 reflects these changes, as appropriate. Note 4 Own Source Income Added line items “supplementation” and “workload agreements” and associated guidance to Note 4L. Impact: Where applicable, entities will need to include these line items. Notes 7 and 26 Fair Value Measurement Added “Fair Value Measurement” Notes and guidance to comply with the implementation of AASB 13 Fair Value Measurement. Impact: Entities will need to incorporate these Notes. Added or new section Amended, clarified or moved Removed Summary of Significant Changes to the FMOs and PRIMA Forms | 6 Reference Changes Change in accounting policy1 Notes 9 and 28 Non-Financial Assets Property, plant and equipment disclosure corresponding with AASB 116.77 amended to align with changes to AASB 116 following the implementation of AASB 13. Impact: Entities will need to reflect this change, including the change in Note reference. Note 10 Payables Added guidance in relation to “statutory payable”. Note 18 Senior Executive Remuneration For Table A, relocated “annual leave accrued” to “other longterm employee benefits” in-line with changes to AASB 119. No impact Impact: Entities will need to reflect this change. For Tables B and C, amended the “reportable salary” footnote to align with changes to the FMOs. Also, bandings have been amended so as to not foresee threshold amounts. Impact: Entities will need to update their tables to reflect this. Notes 20 and 35 Financial Instruments Guidance concerning fair value and offsetting has been clarified to reflect the fact it has no relationship with new offsetting disclosure requirements in relation to financial assets and liabilities per AASB 132.42. No impact Sections of the Fair Value Measurement disclosures were removed as either they are no longer required or have been modified and transferred to the comprehensive Fair Value Measurement Note as they are now required for all assets and liabilities at fair value. Impact: Entities will continue to disclose carrying amount versus fair value amount and fair value changes due to credit risk per current practice, but would now be required to disclose all other fair value components as per the new AASB 13 requirements in the Fair Value Measurement Note. Guidance has been added to the liquidity risk table to ensure entities are following the requirements of AASB 7.B11D in relation to finance leases after the discovery of an error in PRIMA Illustrative. No impact Note 37 Appropriations Guidance to Note 37F has been amended. No impact Added or new section Amended, clarified or moved Removed Summary of Significant Changes to the FMOs and PRIMA Forms | 7 Reference Changes Change in accounting policy1 Note 42 Competitive Neutrality and Cost Recovery Due to the changes in the cost recovery disclosure, restructured the location of the competitive neutrality notes. No impact The cost recovery disclosure has been changed to reflect aggregation of cost recovery information suitable to financial statements. Impact: Entities will need to reflect this change. Added or new section Amended, clarified or moved Removed Summary of Significant Changes to the FMOs and PRIMA Forms | 8