Department of Finance Entity Resources and Planned Performance

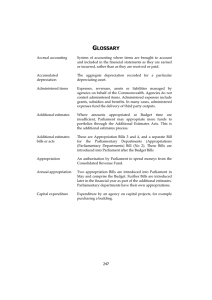

advertisement