Document 17784343

advertisement

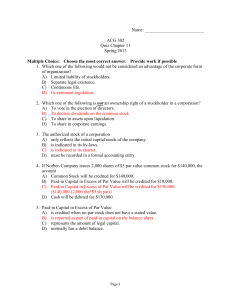

Performance Assessment Part 2 Chapter 12 101-113 Accounting 2 1. Stockholders’ equity: A. is usually equal to cash on hand B. includes paid-in capital and liabilities C. includes retained earnings and paid-in capital D. is shown on the income statement 2. The major subdivisions of the Stockholders Equity section of the balance sheet are: A. Paid-in Capital and Retained Earnings B. Common Stock and Retained Earnings C. Stock, Paid-In Capital and Retained Earnings D. Common Stock and Preferred Stock 3. The charter of a corporation provides for the issuance of 100,000 shares of common stock. Assume that 40,000 shares were originally issued and 5,000 were subsequently reacquired. What is the number of shares outstanding? A. 5,000 B. 35,000 C. 45,000 D. 55,000 4. What is the term for the excess of issue price over par of common stock? A. discount B. contra asset C. deficit D. premium 5. What is the term for the excess of par over issue price of common stock? A. discount B. contra asset C. deficit D. premium 6. The entry to record the issuance of common stock at a price above par includes a credit to: A. Organization Costs B. Treasury Stock C. Cash D. Paid-In Capital in Excess 7. The excess of cost over sales price of treasury stock should be debited to: A. Loss from Sale of Treasury Stock B. Organization Costs C. Accounts Receivable D. Paid-In Capital from Sale of T/S 8. What is the total stockholders’ equity based on the following account balances? Common Stock $500,000 Paid-In Capital in Excess of Par 40,000 Retained Earnings 190,000 Treasury Stock 20,000 A. $540,000 B. $630,000 C. $710,000 D. $750,000 9. A corporation purchases 10,000 shares of its own $20 par common stock for $35 per share, recording it at cost. What will be the effect on total stockholders’ equity? A. increase, $20,000 B. increase, $350,000 C. decrease, $200,000 D. decrease, $350,000 10. Which of the following is not a prerequisite to paying a cash dividend? A. formal action by the board of directors B. market value in excess of par value per share C. sufficient cash D. sufficient retained earnings 11. The liability for a dividend is recorded on which of the following dates? A. date of record B. date of payment C. date of announcement D. date of declaration 12. What is the dividend yield on common stock if the market price per share is $50, earnings per share is $4, dividends per share is $0.80 and investor’s cost per share is $40? A. 0.08 B. 0.016 C. 0.10 D. 0.02 99031314 Page 1 of 1