Moraine Park Technical College

advertisement

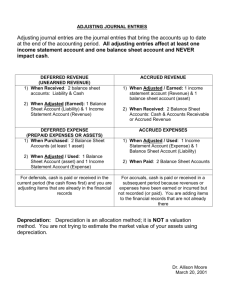

Moraine Park Technical College Accounting 1 – Problem Solving Exercise 3 – Adjusting Process 1. Using accrual accounting, revenue is recorded when _________________. A. cash is received without regard to when work is done B. work is done without regard to when cash is received C. cash is received at the time work is done D. cash is received after the work is done 2. Using accrual accounting, expenses are recorded when _____________. A. they are incurred, whether or not cash is paid B. they are incurred and paid at the same time C. they are paid before they are incurred D. they are paid after they are incurred 3. If the effect of an adjusting entry increases the balance of an expense account, __________________ describes the effect of the credit portion of the entry. A. increases a revenue account B. increases an asset C. increases a liability D. decreases a liability 4. Accrued expenses have ______________________. A. not yet been incurred, paid, or recorded B. been incurred, paid, and recorded C. been incurred, not paid, and not recorded D. paid but not yet been incurred 5. Accrued revenue has _____________________. A. been earned and cash received B. been earned and not recorded as revenue C. not been earned but recorded as revenue D. not been recorded as revenue but cash has been received 6. Deferred expenses have ____________________. A. not yet been recorded as expenses or paid B. been recorded as expenses and paid C. been incurred and not paid D. paid but not yet been recorded as expenses 7. Deferred revenue is revenue that is ____________ and/but the cash ________________. A. not earned; has been received B. earned; has been received C. earned; has not been received D. not incurred; cash has been paid 8. Adjusting entries affect at least one ___________ account. A. income statement and one balance sheet B. revenue and one expense C. asset and one liability D. revenue and one capital 9. At the end of the year, the adjusting entry for equipment depreciation was omitted. _______________ is true. A. Total assets will be understated at the end of the current year B. Statement of owner's equity will be correct for the current year C. Net income will be overstated for the year D. Total liabilities and total assets will be understated 10. At the end of the year, the adjusting entry for accrued salaries owed to employees was omitted. _________ is true. A. Salary Expense for the year was overstated B. Total liabilities at the end of the year was overstated C. Net income for the year was understated D. Owner's equity at the end of the year was overstated 11. The adjusting entry on June 30, based on a $1,200 supplies inventory and a $5,200 supplies account balance before adjustments on June 30 is: _______________________________ ______________ _________________________________ ______________ 12. A business pays weekly salaries of $15,000 on Friday for a five-day week ending on that day. The adjusting entry at the end of the period ending on Thursday is: _______________________________ ______________ _________________________________ ______________ 13. The adjusting entry to record the depreciation of equipment for 2000.00 is: _______________________________ ______________ _________________________________ ______________ 219544410 Page 1 of 1