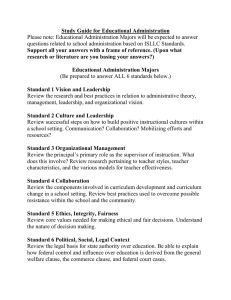

Wisconsin Workshop Presentation: March 27, 2009

advertisement

Wisconsin Workshop Presentation: March 27, 2009 Draft of February 1, 2009-not copyrighted, not to be quoted or cited without written permission What Is the Difference Between Corporation and Securities Regulation? A Comparative US-EC Perspective Richard M. Buxbaum, School of Law UC Berkeley I Introduction The substantive law on which this presentation rests is company law, but company law defined as reciprocally included in and including some aspects of capital market law. The other part of the title, however, might better be “a comparative constitutional law framework” within which these two bodies of law, including their choice-of-law elements, are embedded. The relevant elements of constitutional law bear both on the federal/state or vertical and on the interstate or horizontal allocation of authority to enact the described substantive law. Obviously, the justification 1 for this discussion arises from the current situation in which corporations can carry their home-state law to their host states much in the way natural persons once carried their personal laws of marriage, divorce and succession along with their luggage to new domiciles. The analogy may be weak, but it does suggest a further dimension for any comparative study, that of history. A first puzzle deserving this comparative inquiry: The acid test of the liberal economic order as expressed in company and capital-market law has been the battle over hostile takeovers, and that is as true of the US as of the EC. In the US, once the important state, Delaware, enacted a statute creating a defensive framework against hostile takeovers, the US Supreme Court rejected the argument that the Commerce Clause of the Constitution1 prohibited that state action. In the EC it never came to the test,2 because the federal legislative system took over the inter-state political battle between the liberal and the protectionist economic rivals and after much political tugging and hauling fashioned a federal norm. Had the European Court of Justice been pushed to rule on a Delaware-typeMember-State defensive law before 2004, however, under what Treaty-constitutional norms would it have 1 That version of it, the negative or dormant Commerce Clause, is a barrier to single-state action even in the absence of conflicting federal legislation. 2 More accurately, it has not come to the test; and my reading of the European literature is that the ECJ will not upset the political compromise that led to the Directive. Of course, some commentators may be inclined to argue that point. 2 acted? What explains the choice of this legislative route as against the judicial route taken in the US? Is it only the accident of timing, the fact that until reincorporation of publicly held corporations in such a state becomes feasible no tropism towards any such state could develop? A second puzzle: Why was Delaware able to enact the framework statute for defense against a hostile offer in the first place? Presumably, that was because its policy response to the finance-driven takeover phenomenon was driven by its role as the state of incorporation of the majority of the large publicly held corporations. That group – call it the Business Roundtable for short – had the necessary political power to obtain that legislation. The relatively few financial firms did not have the power to prevent that enactment, even if some of them also were Delaware firms. 3 In the EC, the analogous question now probably is moot, given the 13th Directive. But if the UK is the heir presumptive in Europe of the Delaware mantle, and if we assume away the reincorporation timing problem, could it, given the financial role and power of the City institutions,4 indeed have enacted – could it, in a hypothetical post-Daily Mail future – enact a similar 3 One might interpose that New York, which is the home of finance capitalism if any state is, nonetheless did enact a statute also tilting the playing field towards the target company management. There is a response to that objection, but I will not pursue it here. 4 See the discussion of the provisions of the original [London] City Takeover Code in its restriction of the target management’s defensive rights and the transfer of any “resistance” power to the shareholders in Johnston, Cambridge L J 66:422, 442f (2007). 3 statute, one that could use the possibilities of the 13th Directive to the maximum extent possible? And if it could not, might this be a sufficient ground to conclude that there will be no European Delaware, quite apart from the lively disputes about legal culture, language, political realities, and other variables that have been aired in recent years? Those puzzles led to the approach that follows. To restate the principal thesis of this presentation: In the United States as in the European Community it is the judicial branch that is in charge of these vertical and horizontal allocations of legislative power, because it is in charge of the constitutional norms that bear on this allocation. In the United States, however, that judicial role is defeasible by legislation in a way more fully discussed later. The comparative question is whether federal legislation is as defeasible within the separation of powers system of the European Community. If not – if the ECJ retains more override authority even against federal legislation – then judicial self-restraint in exercising its constitutional powers may be more important for the European Court of Justice than it is for the US Supreme Court. An implication of this thesis concerns the distinction between state restrictions on the free movement of capital and state restrictions on the right of establishment. The relative unimportance of this distinction in the US 4 constitutional architecture, when compared with that of the EC, matters. It has a direct bearing on the role of judicial self-restraint in the imposition of constitutional barriers to federal and not only to state efforts to permit or to impose restrictions on these two freedoms. To put it briefly, just as antitrust laws in the US view aim to protect competition and only through that primary goal may incidentally protect competitors, so the constitutional Commerce Clause aims to protect free markets and only incidentally to protect the economic actors at work there. The Right-of-Establishment Clause of the EC, however, may protect the market actor in a primary sense. As Grundmann has put it: “For all situations which are not exactly those decided in the Daily Mail case nor those decided in the Überseering case, the core question is whether the freedom applies directly (as in Überseering) or not (as in Daily Mail).5 To an external observer this characterization as a primary right may create some unintended consequences within the European Community that do not occur in the United States. These are admittedly rather abstract notions and need to be unpacked. Grundmann, European Company Law (Antwerpen 2006) at 502. I take “direct” and “primary” as equivalents. 5 5 II The Current Contest Over the Applicable Law A. The Terrain As is now clear beyond argument, initial corporate mobility is assured within the EC by judicial interpretations of the right of establishment guaranteed by Treaty articles 49 and 54; capital mobility in similar fashion through judicial interpretation of article 63.6 In the case of enterprises of modest capital needs, the jurisprudence developed under the first heading has led many of them to choose incorporation in the country with the most modest capitalization requirements – for now, the UK. The judicial guarantee of mobility permits these enterprises to situate their activities within any EC member state, including the home state of the entrepreneurs who formed the entity. Before the Centros line of decisions, it was the prerogative of the Member State, exercised legislatively in some, judicially in most cases, to promulgate the rules of private international law concerning the law applicable to the affairs of a foreign business entity.7 Since the Centros line was established, the state-of-incorporation alternative has been constitutionally mandated as the only legitimate version of this 6 For present purposes I ignore the different guarantees available to rights of establishment and of capital mobility when the matter involves nationals of non-Member States (article 64), as well as bilateral treaties of the FCN sort. At this point of the presentation, “affairs” not “internal affairs” is the appropriate term, since the actual definition of “affairs” is contestable and indeed is a central part of the following discussion. 7 6 former doctrine of private international law for the states of the EC.8 That constitutional command has not yet been issued by the US Supreme Court; and were it to be issued, it would have to be issued under the Commerce Clause. That difference in the constitutional texts will be one element of this presentation. In context, however, that also will require a brief look at the already mentioned question of the actual scope of the company law that falls under this private international law doctrine (be it constitutionally mandated or not). So far the story is one of initial formation of entities in the states of the EC, and more specifically of initial formation of companies that have not yet tapped capital markets. In my opinion this is an important point. The last barrier holding back the already existing and especially the publicly held company from having the option of reincorporating outside their home state is the Daily Mail barrier.9 Depending on the resolution of this matter10 – not 8 See in lieu of innumerable others Behrens, IPRax 1999, 323. 9 Decision of Sep. 27, 1988, C-81/87. As Basedow, Tulane L. Rev. 82:2119 (2008), points out (at 2134), the palpable annoyance of the ECJ at the failure of the Council to utilize legislative or treaty mechanisms to provide some appropriate degree of freedom of movement to incorporated entities not only led to the arrogation of that power by the Court but may have generated enough inertial momentum to overturn Daily Mail as well. 10 For its description, see e.g. Schon in FS Lutter(2000), 683 (and at 702 for the formal explanation of the distinction between rejection of departure and rejection of arrival of the corporation). Of course, one form of reincorporation – the cross-border fusion of two corporations – already overrides national legal barriers since Sevic Systems, C411/03, and now has been legislatively confirmed and concretized in Directive 2005/36 of Oct. 26, 2005. 7 to mention the uncertain state of affairs in the future11 -- it may become necessary to reconsider whether one Member State might become the Delaware of the EC, and if so, a Delaware more secure in its legal position than the original? B. The Constitutional and the Private-Law Frames of Reference It seems the right time, therefore, to look at the constitutional control of this migration question in comparative perspective. That such an inquiry implicates both private international law and substantive company law12 seems clear. And as already said, that also suggests a look at the history as well as at the current and possible future status of these two sets of norms. Two inter-jurisdictional issues, as mentioned, are the subject of this presentation. The first concerns the vertical division of powers; that is, the legislative relationship between Washington or Brussels on the one hand and 11 The awaited judgment of the ECJ in Cartesio, Case No. C-210/06 may resolve at least a part of this issue. An argument for ending the distinction is presented by Mucciarelli, 98:2008 EBOR 267. 12 Of course, a substantial literature already exists on this question of state competition for corporate charters, one well-summarized and critically evaluated by von Hein. For a useful debate,, compare Dammann, “Freedom of Choice in European Corporate Law,” 29 Yale J. Int’l L. 477 (2004) at 520ff with Enriques, “EC Company Law Directives and Regulations: How Trivial Are They?,” 27 U. Pa. J. Int’l L. 1 (2006) and Tröger, “Choice of Jurisdiction in European Corporate Law – Perspectives of European Corporate Governance,” 6 Eur. Bus. Org. L. Rev. 3 (2005). 8 the states or Member States on the other.13 The second concerns the traditional horizontal or interstate conflict as umpired by federal constitutional norms. This second issue unavoidably implicates the substantive content of company law. That substantive content, in turn, deserves examination under two points of view, both involving the question of a defensible state-level substantive company-law regime in light of corporate mobility through the escape hatch offered by direct reincorporation or reincorporation through merger. By “defensible” I mean a substantive content of company law that is constitutionally acceptable and politically worth contending for. First, what elements of substantive company law may still be imposed, in the federal proto-constitutional sense, by a host state that is not the state of incorporation? Second, what elements of substantive company law applicable to its own corporations may a host state be able to maintain, in Real-political terms, in the face of a potential flight through reincorporation elsewhere? Those two questions in turn also lead to comparative reflection on the very definition of company law, and that, John Armour, “Who Should Make Corporate Law? EC Legislation versus Regulatory Competition,” in After Enron (John Armour & Joseph McCahery, eds., Oxford 2006), 497. On the law and politics of statelevel rules of private international law acceptable within the post-Centros frame of reference, see the work of the Second Commission of the German Council for Private International, Vorschläge und Berichte zur Reform des europäischen und deutschen iinternationalen Privatrechts (Tübingen 2007), esp. Zimmer at 372ff. 13 9 again, in two contexts. The first context involves the much-discussed stakeholder issue, but a stakeholder issue writ large, embracing Walter Rathenau as well as Milton Friedman, bankruptcy as well as codetermination, financial-center banks as well as local communities. The second context – perhaps only an important component of the first – arises from the globalization of financial markets; namely, the modern issue of separating company law however defined from capital-market law.14 This issue circles back to the problem of federal-state competition, the vertical division of powers. II Competition with the Center A. The Starting Point – the United States It is tempting if not always productive to lay the half-century history of adapting company law to a Europe-wide common market next to the more than two centuries of that same adaptation in the United States. Productive or not, however, let me put down a few basic comparisons. Company capitalization as well as the corporate production and distribution of goods “In addressing the regulatory challenge as to which norms are most appropriate to the governance of the corporation in a globally competitive setting, boundaries between company and capital markets law become as relative as those between corporate governance, corporate social and environmental responsibility, and industrial relations.” Peer Zumbansen & Daniel Saam, “The ECJ, Volkswagen and European Corporate Law: Reshaping the European Varieties of Capitalism,” 8 German Law Journal 1027 (2007) at 1031. 14 10 began in both polities principally at the single-state level – in the United States for physical, in Europe for political and legal reasons. Given these historically grounded different starting position, both the pace and the scope of central engagement in law-making took different paths. In the United States the move first to a nationwide level of production and distribution and then to a nationwide level of financing of these nationwide activities came well before the development of a strong central government. The Civil War of the 1860s laid the groundwork for these physical developments, the Gründerjahre of the last quarter of the 19th Century the groundwork for these financial developments. Before then, essentially through the first half of the century, single-state laws (first special charter-laws; after the Jacksonian Revolution general incorporation laws) sufficed to facilitate corporate formation. And the common-law development of rudimentary doctrines of fiduciary duties sufficed to provide a basic, indeed a robust, degree of shareholder and creditor protection against misjudgment and misbehavior of these entities’ controllers. In short, as US corporations moved to a national scale of activity, the evolution of state law was able to keep pace with the evolution of the market. Of course, the resultant absence of federal-level legislation depended on one further historical fact. At least until the mid-19th Century, while the 11 state of incorporation was also the corporate seat, and especially while and to the degree that its shareholders and creditors also were based in that same state, it was there that litigation either seeking a recovery from the entity or a money or status judgment on its behalf was brought. There was no issue as to whose law would apply, since all relevant elements also were located in the forum state. As a result, if an action was brought elsewhere, especially when no assets in that other forum were available against which to enforce the judgment, these other courts in essence returned such cases to the home state, whose courts could render effective relief unavailable elsewhere.15 Then, after national economic activity made monetary but not status relief available outside the home state, it was only a short step to continue the primacy of the law of the state of incorporation in the case of disputes involving shareholders’ and even some species of creditors’ rights. At first, so long as the administrative nerve center of the entity remained in the state of incorporation, this was a natural consequence of the absence of a second logical candidate whose law “should” be used. And when, during the last quarter of the century, place of incorporation and seat could diverge, thanks to New Jersey’s offer of a modern and facilitative company law to large enterprises choosing to place their headquarters across 15 Buxbaum in FS Kegel 12 the Hudson River in New York, the situation did not change. By then the place of incorporation had been sufficiently entrenched in the common-law doctrines of the corporate conflict of laws (not, nota bene, in the statutory law), that even the courts of the seat, while accepting the placement of litigation there, applied the now settled notion that the law of the state of incorporation governed the internal affairs of the corporation. It is also a historical fact with consequences for the present that when federal legislation did appear on the scene in the United States, it was first enacted to control the large corporations’ market and social impacts, not their methods of drawing household savings into the productive sector. The statutes creating the Interstate Commerce Commission and the Federal Trade Commission were enacted decades before the law establishing the Securities and Exchange Commission. They reflected the fact that it was the corporation in its relations with its physical-factor providers and its product markets, not the corporation in its relations with its equity (and debt) capital providers which engendered trans-state problems needing federal-level solutions. The occasional suggestions for federal involvement in (traditional) company law reform, let alone for a federal company law, never 13 gained political traction when they were raised during that same era of trustand monopoly-busting.16 After the stock market crash of 1929 the protection of shareholders, at least in their capacity as investors in national capital markets, led to federal intervention. Another historical contingency dictated that this intervention be on the basis of disclosure rather than substantive regulation. The reason for that approach, which soon became a virtue and then a limitation, can be found in yet another chapter of late 19th-Century history. The investor fraud that did occur then, and much did, still largely was local fraud on local investors; the result was the enactment of individual state securities regulation, the so-called Blue Sky Laws. That legislation, and the regulatory schemes it created, was to some degree substantive and even paternalistic, at least in the major states. The political scene at the advent of the Roosevelt Administration did not permit the elimination of those state laws; indeed, their survival was guaranteed against the preemptive effect of the US Constitution’s Supremacy Clause by an explicit savings clause in the Securities Act of 1933.17 It was capital-market transparency, not substantive 16 That said, it is worth noting that the iconic federal law of that era, the Sherman Anti-Trust Law, did focus on one “internal affair” of the corporation; namely, the form in which its cartelization and monopolization behavior potential was structured. But even at the time of its adoption it was clear that the trust form was not the essential issue. 17 There are important implications here for the particular approach the US Supreme Court took in the 1980s to the state reactions to the hostile-takeover phenomenon; this is further discussed later. 14 controls on the issuance of equity and debt instruments, that was needed – and that was seen as supplemental to existing state-level statutory and common-law controls on the practices and decisions of corporate managers. B. The Starting Point – the European Economic Community in 1958 Even to an outsider, it is obvious that the creation of the European Economic Community had to result in a different engagement of the central legislative authorities. State-based financial and commercial walls had to be broken down and not merely worn down, and that for two reasons. The obvious reason, given the potential for trans-state commerce, was to create a true common market once the customs and tariff barriers thereto had been reduced and were on the way to elimination. The less obvious reason had to do with the arrival of foreign – sc. American -- enterprises more accustomed to working outside their home base than were their European counterparts of the time. Given the liberal economic policies that are the cornerstone of the Common Market, the emerging interest in cross-border production and distribution by European enterprises had to be facilitated as radically and as rapidly as possible if a US takeover of the private sector was to be avoided. The only alternative to the latter would have been a two-track economic 15 policy – a Fortress Europe approach – and it is to the enduring credit of the EEC “founding fathers” that this temptation was avoided even at the political cost of a significant first wave of foreign investment in the European private sector.18 For present purposes, however, the point is one of time and timing. The industrial and commercial bases for an EC-wide field of operations already existed; it was the legal framework that had to be built. The luxury of evolution was not an option. Central legislation was possible under the evolving proto-constitutional regime, and when necessary was promulgated. That is the story of the first wave of directives, and it need not be revisited here. Only the comparative point is relevant; namely, that specific improvements, even within a narrowly defined company-law regime let alone within the actual broadly defined one,19 if deemed urgently needed and politically feasible,20 could be and were adopted by Brussels in either directive or regulation form. The US auto-limitation to a disclosure or transparency philosophy for federal legislation was not relevant, at least as 18 In this context, too, it is still worth noting that the pressure was to reduce public and private barriers to commerce; concern with reducing barriers to the movement of capital came later. 19 “Broadly defined,” of course, from the US view of the traditional scope of that field of law. 20 This feasibility condition should not be underestimated. The first round of company-law harmonization directives on the whole concerned relatively noncontroversial issues and helped to modernize outdated national laws in a facilitative manner. See, e.g., Pirŝl, 14 Col. J. Eur. L. 277 (2008), 329f. Compare the fate of the 13th Directive! 16 to most of the substantive provisions of this first wave of federally generated uniform or harmonized Member State law.21 One other comparative point in this introductory overview concerns the Societas Europaea. Its original failure is not only the consequence of the socio-political dispute over codetermination. It also is the consequence of a lack of demand for the form. Of course this is to a degree a circular argument: Had it not been possible to drop these incremental improvements into national legislation, like a cuckoo’s egg into a wren’s nest, the all-ornothing approach of an EC-wide company law would necessarily have been on the agenda.22 That aside, however, the more important comparison is another. The century-long evolution of US state-based corporation law resulted in a slow harmonization from the bottom up, to a level at which its relative individual differences did not need further top-down harmonization. In later years, of course, the Delaware phenomenon constrained other states’ experimentation with variations in substantive detail. But even earlier, when relatively few major corporations had chosen Delaware, the degree of substantive differentiation was not large given the general acceptance of a 21 This is not to say that German or even EU capital-market regulation puts a lower value on transparency and disclosure as the cornerstones of its approach. See, e.g., Fleischer & Schmolke, ZIP 29:1501 (2008) at 1502: “Kapitalmarktrecht ist auch und gerade Informationsrecht. Es gründet auf einer umfassenden Offenlegungsphilosophie….”; more broadly Merkt, xx ZGR 532 (2007). 22 The analogous fate of EC-wide intellectual property-law regimes is instructive on this point, from both a demand and a supply perspective. 17 narrowly defined and facilitatively oriented concept of corporation law. Contrast that with the significant level of individual Member-State differences in both contexts, differences that did call for a substantial helping of top-down harmonization in the EC. Putting capital-market regulation aside for separate discussion, only rarely has the US Congress superimposed traditional company-law elements onto the state-law mix. The Clayton Act of 1914 contains an antitrust-based barrier to the election of directors from competitor firms (the interlockingdirector prohibition); and the Plant Closure Notification Act of 1986 might be read as constraining otherwise available management discretion in the field of mergers in an “internal” procedural and not only a substantive sense.23 Of course all of the manifold species of public law – from antitrust law to employment discrimination – constrain the decision-making freedom of management. Still, the mentioned two are the only ones that might even loosely be characterized as internal constraints; that is, constraints internal to rather than external to company-law regimes as US legal history and custom defines them. It is only with the enactment of the Foreign Corrupt Practices Act in 1978 and the Sarbanes-Oxley Act in 2001 that the occasional 23 Worker Adjustment and Retraining Notification (WARN) Act, 29 U.S.C.A. §§2101ff. This minor statute requires advance notice to the workforce of a target company when plant closures are likely (including as the result of a takeover). Compare art. 6(1) of the 13 th (Takeover) Directive, with its employee-notification system that depends on the nature of employee representation in the target company under the state law applicable to this relationship (which of course may be the law of the administrative seat). 18 incursions of SEC regulatory efforts into the interior spaces of company law gained a still- contested statutory foothold; and even then, in each statute essentially in the context of a disclosure philosophy.24 That it could be otherwise is the subject of the constitutional discussion later; but that it has been thus is clear. C. “Vertical” and “Horizontal” Competition and Their Relationship to Private International Law: Yesterday, Today and Tomorrow 1. Introduction It is, of course, a doctrine of the conflict of laws – of private international law – that makes much of the substantive company law of the host state impotent to temper the activities of the mobile corporation. Whether gradually evolved as the internal affairs doctrine of AngloAmerican law or directly imposed as a corollary of the “right of establishment” doctrine in consequence of the ECJ’s Treaty interpretation, the result is the same. The indirect consequences of these two evolutionary paths, however, differ sufficiently to justify some comparative reflections on the relationship of state and federal law in this field. 24 Of course, to some extent this is a matter of definition; one could argue about the characterization of some of the Sarbanes-Oxley Act requirements – see von Hein, at 324. But the justification of these requirements does rest largely on the transparency of the corporation’s governance structures and processes. 19 In the European Union of today, it is, at least in the view of an external observer, possible and perhaps likely that EU-level legislation might in time serve as a partial correction of the partial impotence of hoststate law in this post-Centros situation. If Daily Mail falls by the wayside, and reincorporation joins initial incorporation as a form of corporate mobility, these questions will gain further political urgency and move higher up the priority ranking for the Brussels actors. In any event, that would be protection supplementing whatever host-state protection the ECJ itself, without central legislative guidance, may in the future accept as to those elements of company law that go beyond the core owner-manager/ principalagent elements. These questions of central and of host-state rules, whether driven by the worker-protection (including codetermination), creditor-protection, or civil-procedure elements of many European company-law codes, are major subjects of academic commentary and political controversy today. In the United States of today, however, even if the current financial crisis is taken into account, a correction from Washington of similar magnitude is not on the agenda. Given the fact that except for the takeover-defense area state codes do not go beyond the mentioned core owner-manager context, it also 20 is not as necessary.25 If a well-functioning centralized capital-market regulatory regime indirectly but substantially reduces owner-manager conflicts, then the main reform issues for those aspects of corporation law that lie outside the investor-regulation sector still will be contested at the horizontal, state-of-incorporation versus host-state level – between Delaware and, say, California. I do not wish to minimize the salience of Mark Roe’s historically derived argument that threats of federal legislation are a constraint on both legislative and judicial adventures on the part of those states – really, of the one state, Delaware – whose corporation law matters. My point relativizes but does not contradict that possibility. Were the US definition of corporation law as broad as, for example, the German one, occasions for the exercise of central power to shape US corporation law would be more frequent. But given our narrow definition, those occasions are fewer. I shall, later in this presentation, look at these occasions in more detail. For now, it is the general point arising from our historically contingent definition of the subject matter that needs emphasis. Let me first, therefore, look at the possibilities of interstate legislative competition within the relatively soft 25 I recognize, but put aside as more symbolic than real, the issue of federal limits on executive compensation at least for that sector of the economy receiving federal financial support. 21 constraint of the oversight regime in the US, the Commerce Clause of the Constitution. 2. The Constitutional Framing of the Division of Powers in the US Since Delaware corporation law is de facto the generally applicable legal regime, and since all states of the American Union sail under the economic-liberalism flag, – meaning essentially facilitative rather than regulatory rules for corporate structure and behavior – what interstate competition there is occurs at the margins. The degree of competing economic ideologies even now still afloat within the European Union is unknown in the United States, with one exception. That exception, however, – the “margin of appreciation” that target-company directors have to rebuff unwanted merger and takeover efforts – is a central point of departure for the balance of this discussion. I therefore take that subject as one of the two substantive company-law issues within which to frame the following discussion. But in order to extend the discussion of this conflict of competence, I will take a far less significant problem as the other bookend; namely, the minimum-capitalization issue. But first the overall constitutional framework. 22 As then-Professor Felix Frankfurter pointed out already in the 1930s, the broadly interpreted Commerce Clause of the US Constitution, especially its so-called Dormant Commerce Clause subset, meant that the only weapon the individual state had with which to regulate elements of interstate commerce was the laissez-faire weapon.26 The more important point for comparative purposes, however, is another. Congress always has had the power to use the Commerce Clause as its constitutional warrant to regulate economic activities and structures on any basis, whether liberal or dirigiste.27 Only politics, not the constitution, constrains these actions. As a result, given sufficient political impulse, federal regulatory corrections inhibiting the free movement of capital could be adopted either directly or through delegation of that inhibitory authority to the states. Neither form of these incursions would be limited to classic public-law subjects like environmental or antitrust law; both could include traditionally defined company-law subject matter.28 The US Supreme Court of course has approved the use of 26 Felix Frankfurter, The Commerce Clause Under Marshall, Taney and Waite (Chapel Hill 1937), esp. at 100. See generally to this point Richard Buxbaum & Klaus Hopt, Legal Harmonization and the Business Enterprise (Berlin 1988) at 46ff. 27 It has been eloquently argued that the treaty-based quasi-constitutional framework of the European Economic Community and its later incarnations is a liberal-economic framework that may not so easily be manipulated for dirigiste purposes.27 The test of that proposition lies for now with the ECJ, a major reason for comparing the constitutional power the two high courts have defined for or arrogated to themselves. 28 This is more and more recognized in the European understanding of US company law; see again von Hein 324f. 23 the authority granted the Congress under the affirmative Commerce Clause to enact legislation that restricts interstate commerce. Indeed, practically speaking, the principal purpose and exercise of the affirmative Commerce Clause is to regulate, not to liberate, interstate commerce. But the Court has done something more sensitive. It has approved Congressional use of the affirmative grant of authority under the Commerce Clause to delegate to the states the right to enact restrictive legislation that it would have stricken down under the dormant Commerce Clause. 3. A Comparative Perspective on the EU Situation That important constitutional point leads to the first of my two substantive examples, the norms at issue in Centros. I will assume that an EU regulation setting uniform minimum capitalization requirements, however qualified,29 would not be struck down under the Centros line of argument. For this kind of non-discriminatory central legislation, the primary-right nature of the Establishment Clause presumably would not matter.30 But that rights characterization might matter were this a directive 29 Or, more sensibly, a directive authorizing a range of state legislation within a narrow minimummaximum range of capital requirements, and distinguishing between large/small or privately/publicly owned entity types. Again, of course, if the EU Treaty is as “instinct with” the economic context of human rights and due process as the ECJ recently intimated in the Kadi judgment, some might wish to argue this point. 30 24 straightforwardly authorizing Member States to apply their substantive minimum-capitalization requirements to an entity incorporated elsewhere (with whatever threshold conditions bearing on pseudo-foreign status attributes the directive might set). Suppose the Council did not collectively share the implicit view of the ECJ that the concept of establishment31 was so central an entitlement that Denmark could not ask the incorporators-owners, so long as they were Danish subjects, to use Danish law if they intended to limit their establishment to Denmark and seek no equity capital beyond their own bank account.32 Put more generally, suppose the political decision was that no significant interstate interest is implicated by incorporating a Momand-Pop store. In 1972 Eric Stein opined that the Council was limited to enact directives that brought national company law provisions only so close to one another as was needed to permit the Common Market to function.33 Whether that subsidiarity principle avant la lettre could be converted into judicial acceptance of Council legislation permitting the mentioned state- 31 And perhaps, by analogy, of capital movements. And the very form of incorporation – as UK Company Limited by Shares or as GmbH – under current law bars the incorporators from seeking equity capital from others, at least through the organized capital markets. 32 Eric Stein, Harmonization of European Company Laws – National Reform and Transnational Coordination (1971) at 77. This point, though not my question, also is noted by Piršl, supra n. x at 331 n. 363. 33 25 level variation in capitalization requirements may be a more debatable question today, after interim Treaty revisions and the arrival of Centros and its progeny, especially Inspire Art.34 From a comparative perspective, however, this is an important point. It is moot in fact since no US state law bothers to make minimum capitalization a condition precedent to corporate status, but hypothetically speaking I have no doubt about the constitutional legitimacy of any such Congressional authorization, enacted under the Commerce Clause. Now the other example: The comparative history of legislation responding to the phenomenon of the hostile takeover, and of judicial treatment thereof, is both real not hypothetical, and separately instructive because in the US it does not involve any federal legislation of the target company.35 It is useful to compare the outcome of the implementation of the 13th Directive with its US counterpart, even if and indeed because the Directive’s applies both to the bidder and to the target. The political compromise that gained the Directive’s passage permits each Member State to enact legislation that in turn permits corporations incorporated there to delegate to its managerial organ(s) authority to 34 Case C-167-01, [2003] ECR I-10155]. 35 With a few exceptions at the margins. The management of the target company must take a position on the desirability of the tender offer, and if choosing to repurchase issued shares as a defensive maneuver may not discriminate by excluding the bidder from participating in that opportunity. 26 emplace a variety of devices constraining the ability of a hostile bidder to succeed in a takeover. I make that assertion fully conscious of the fact that for management’s actions the Directive does enshrine a principle of neutrality as a default principle, purportedly limiting the target’s Board of Director-level margin of appreciation in this regard. But at the shareholder level, it authorizes the state of incorporation to allow shareholder action to promulgate or permit management to promulgate defensive barriers that may frustrate takeover bids. 36 In the present state of affairs, a state-approved charter provision permitting more aggressive defensive maneuvering than the legislated principle of defensive neutrality could bear 37 presumably would initially be tested by the ECJ, on the basis of its reading of the scope of the 13th Directive itself. To that extent it would not be a constitutional decision. But the compatibility of art. 9 with the Treaty, even if not a real question within the EU is at least in the abstract a constitutional issue and deserves a comparative look. 4. 36 The Dormant Commerce Clause at Work So far as I understand, the full reach of art. 9 of the Directive in this regard has not yet been tested. 37 A strong recent example is that of the Italian Consob delegation of authority to Italian companies to make maximum use of the defensive weaponry arguably permitted under that Directive. 27 That comparison is additionally useful because it puts the horizontal competition between the state of incorporation and some other legitimately concerned state into a new light. In the US, the conclusion one might draw from the predecessor to CTS, Edgar v. Mite,38 that the internal affairs doctrine has constitutional underpinnings, is not solid. The effort of the host state there to impose its anti-takeover legislation on a corporation incorporated elsewhere failed under the Dormant Commerce Clause, but more particularized extraterritorial claims, whether based on the pseudoforeign status of the affected corporation39 or on particularized issues tinged with creditor-protection40 or civil-procedure implications,41 have not been successfully challenged to date.42 But comparative reflection on this state of affairs discloses a paradox as interesting for EU as it is for US law. In this same field of anti-takeover norms, a field it has chosen to characterize as traditional corporation law 38 457 U.S. 624 (1982). 39 That, of course, is the famous §2215 of the California Corporations Code; see now to this whole complex von Hein, supra n. xx, at 454ff. 40 Exemplified by the New York statutory imposition of direct liability for unsatisfied wage claims against a corporation on its principal shareholders, in §1320 of the Business Corporation Law. 41 See, e.g., §800 of the California statute applying its version of the contemporary-ownership standing requirement for derivative actions to suits on behalf of any corporation, domestic or foreign. 42 The line of US Supreme Court cases culminating in Order of United Commercial Travelers of America v. Wolfe, 331 U.S. 586 (1947), arguably mandating the law of the state of incorporation (see especially Comment [von Falkenhausen], Cornell L. Q. 37:441, 446f (1952)), involve premium-payment and similar issues under mutual insurance contracts and have not been generalized to this extent. 28 because leading state codes have so characterized it, the Supreme Court has rationalized its acceptance of similarly restrictive legislation by (and so far only by) the state of incorporation43 even in the absence of Congressional authorization thereof. Some details will make this clear. The device emplaced in the CTS case was the flip-in – the issuance (by the Board of Directors, not the shareholders) of rights to non-tendering shareholders to purchase common shares at a price low enough to dilute the proportional ownership of the shares purchased through the tender-offer by the hostile bidder; dilute it to a degree sufficient to preclude the hostile bid. Putting aside various corrections at the margins, the emplacement of these plans generally has been judicially approved, at the state level, within the context of directorial authority constrained only by a subject-specific concept of the so-called “intermediate level of review.” Even as these contingent dilution devices were countered by bidders and found wanting in the takeover marketplace, state legislatures came to the aid of locally incorporated companies by authorizing or even enacting, as default provisions, stronger anti-takeover weapons. After hesitating to enter this arena, even Delaware enacted a strong statute deserving brief paraphrasing, especially because of its “sticky-default” form: Once a person 43 CTS v. Dynamics Corp. of America, 481 U.S. 69 (1987). 29 acquired 15% of the target’s stock and had not in that first bid acquired 85% of the stock, it faced a barrier that in terms of tender-offer financing could well be a deal breaker. It could not for three years thereafter carry out a follow-up merger unless the target directors prior to that threshold date had approved that (prospective) merger, or unless after the threshold acquisition the board approved it and two-thirds of the voting stock not owned by the acquirer authorized it. While the Delaware statute has not been before the US Supreme Court, intermediate federal courts have approved it and I have no doubt it would pass muster under the teachings of the CTS decision. The two principal reasons for that conclusion lead us to a critical comparative constitutional issue: The statute applies only to corporations incorporated in the enacting state; and rules concerning shareholder voting are an inherent and traditional element of state corporation law. These two considerations trump any argument concerning mobility of capital. Some quotations make the point: “The primary purpose of the Act is to protect the shareholders of Indiana corporations….Dynamics’ argument that the Act is unconstitutional ultimately rests on its contention that the Act will limit the number of successful tender offers….[T]his result would not substantially affect our Commerce Clause analysis….The very commodity that is traded in the ‘market for corporate control’ – the corporation – is one that owes its existence and attributes to state law. Indiana need not define these commodities as other 30 States do; it need only provide that residents and nonresidents have equal access to them….Accordingly, even if the Act should decrease the number of successful tender offers for Indiana corporations, this would not offend the Commerce Clause.” In short, the Court has subordinated federal Commerce Clause principles to the private-law side of the conflict of laws. This is a different and more significant outcome than merely approving a federal statute that would permit the states to enact such authorizing legislation. 5. The Political Aspects of Establishment and of Capital Mobility While the 13th Directive is based on the authority granted in Treaty art. 44(2), which is in formal terms part of Chapter 2’s right of establishment, its Preamble, interestingly, also references the problem of capital mobility.44 In functional terms, I would characterize the Directive as focused on the mobility of capital. Therefore, again from a US perspective, I would assume that its provisions, in particular its art. 9, would be found compatible with the Treaty.45 If so, the situation is essentially similar – as to this point – with that emanating from CTS. But this only sharpens the 44 Preamble, par. 20. 45 This approach indirectly implies a disjunction between the rights and duties of the bidder and those of the target, since art. 9 necessarily focuses on the law of the state of incorporation. Thus the functional equivalence of the US approach is evident. 31 contrast with the minimum-capitalization issue, with its judicial supervision based on the right of establishment As a result, the legal space available to the Council of Ministers to respond to political demands for more control of these fugitive entities might be limited to variations on the creation of an EU-wide minimum-capital requirement. A first consequence, though in my view a minor one, is that this constrained freedom of central legislation probably would generate political contests over directives promulgating a more thoroughgoing set of minimum standards. To speculate with one example: A minimum capitalization requirement applicable to the small and closely held company (as defined) would be a response demonstrating both the narrow range of legislative techniques and the expectable range of political opposition. In this hypothetical example, total opposition to any non-trivial limit might be limited to one Member State, say the UK. Even if the legislative regime chosen could override a single-state opponent, however, a number of Member States might well disagree over the compromise level above the minimal one. From my external perspective, that would be a second-best solution; second-best from a constitutional perspective, though perhaps best from a policy perspective. 32 It is clear, of course, that modern and in my opinion sound views concerning the trivial role minimum capitalization requirements play in the arena of creditor protection also would play a role in the rejection of, say, German political demands for this form of threshold requirement. But it might well be argued that it is a constitution the ECJ is expounding, not the contemporary economic version of Herbert Spencer’s Social Darwinism. In that case, at the federal level, efficiency considerations of the kind that under Centros would condemn single-state efforts of this sort might well not play a dispositive role. At this central level efficiency might not be a right, only a necessity and not the only necessity. Preferable from a policy perspective, therefore, would be constitutional acceptance of federal legislation permitting state legislation to impose some host-state requirements, whether based on the nature of the foreign corporation46 or on the specific local norm, at least if justified on some ground more compelling than Irish households’ preference for Irish potatoes. Whether such elements would stay within the margin of appreciation afforded by the ECJ’s constitutional control is for others to discuss. But if the hostile bid-frustration power granted by the 13th Directive is acceptable, then an important aspect of interstate commerce already has been sacrificed 46 That is, on the pseudo-foreign corporation policy, exemplified by the California legislation. 33 to local preference. In the US, at least, the political preference of the Supreme Court for the Business Roundtable over the adventurers of Michael Milken’s Wall Street was widely shared, making the somewhat shabby cover of the CTS decision under the internal affairs doctrine acceptable. Today’s hostile takeover scene, however, is more an industrially than financially driven phenomenon, and a similar rationalization for the European-level compromise would be less convincing. IV Conclusion And that leads to my comparative conclusion: In the US, a major state restriction on interstate commerce has been accepted under the internalaffairs norm of the conflict of laws, but the converse is not true. The Dormant Commerce Clause has not been used to prohibit minor restrictions by a host state, at least so long as these are no more onerous than those there imposed on its own subects.47 Further, federal permission of host-state restrictive legislation presumably would be acceptable. If in the EU the identical major restriction is similarly acceptable, but minor host-state restrictions, even if federally authorized, were to be prohibited under the 47 Delaware’s contrary soi-disant decisions are irrelevant. 34 establishment wing of the mobility of commerce norm, a good deal of pressure would be placed on a federal legislative agenda. I will allow myself one unfair characterization: If the EU jurisprudence can accept art. 9 of the 13th Directive but not Germany’s minimum-capitalization argument, then from a functional understanding of the mobility of capital and of its users that jurisprudence is straining at a gnat while swallowing a camel. But however characterized, the balance of the comparative conclusions I draw from this review returns to the title. If the current jurisprudence puts as much of the future of modern company law on the federal agenda as here predicted, a European Delaware would not only be unlikely but an irrelevancy. 35