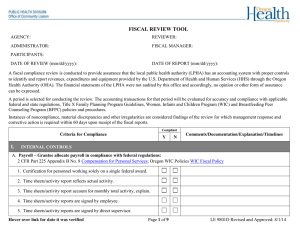

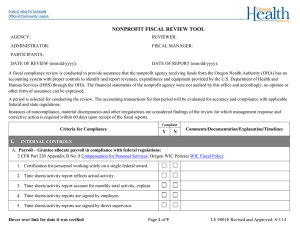

WIC FISCAL REVIEW TOOL

advertisement

WIC FISCAL REVIEW TOOL AGENCY: REVIEWER: ADMINISTRATOR: FISCAL MANAGER: PARTICIPANTS: DATE OF REVIEW (mm/dd/yyyy): DATE OF REPORT (mm/dd/yyyy): A fiscal compliance review is conducted to provide assurance that the local public health authority (LPHA) has an accounting system with proper controls to identify and report revenues, expenditures and equipment provided by the U.S. Department of Health and Human Services (HHS) through the Oregon Health Authority (OHA). The financial statements of the LPHA were not audited by this office and accordingly, no opinion or other form of assurance can be expressed. A period is selected for conducting the review. The accounting transactions for that period will be evaluated for accuracy and compliance with applicable federal and state regulations, Women, Infants and Children Program (WIC) and Breastfeeding Peer Counseling Program (BFPC) policies and procedures. Instances of noncompliance, material discrepancies and other irregularities are considered findings of the review for which management response and corrective action is required within 60 days upon receipt of the fiscal reports. Compliant Criteria for Compliance I. Y N Comments/Documentation/Explanation/Timelines INTERNAL CONTROLS A. Payroll – Grantee allocate payroll in compliance with federal regulations: 2 CFR Part 225 Appendix B No. 8 Compensation for Personal Services; Oregon WIC Policies WIC Fiscal Policy 1. Certification for personnel working solely on a single federal award. 2. Time sheets/activity report reflects actual activity. 3. Time sheets/activity report account for monthly total activity, explain. 4. Time sheets/activity reports are signed by employee. 5. Time sheets/activity reports are signed by direct supervisor. Hover over link for date it was verified Page 1 of 7 LE 9804J Revised and Approved: 4/9/14 6. Salaries and fringe benefit of general administrative personnel (e.g. executive officers, personnel administration, accounting, etc.) not easily allocable to various programs are billed on an indirect allocation basis, if applicable. B. Payroll timing process: 2 CFR Part 225 Appendix B No. 8 Compensation for Personal Services; Oregon WIC Policies WIC Fiscal Policy 1. There is a process for submission of time/activity reports and issuance of paycheck. 2. There is an accounting process to charge payroll expenditures to various grants in accounting system. 3. Payroll reports can be generated from accounting system. C. Travel: 2 CFR Part 225 Appendix B No. 43 Travel Costs; 45 CFR 74.21 Standard for Financial Management Systems 1. There is a process of approving and authorizing travel 2. Standard per diem rates and lodging rates. Per diem rates overview 3. Foreign travel is not charged to grant. 4. There are travel policies and procedures. D. Purchasing, equipment and inventory: OMB A133 Subpart C OMB A133 Subpart C; 2 CFR Part 225 Appendix B Selected Items of Costs; Oregon WIC Policies WIC Fiscal Policy LPHA’s Notice of Grant Award including: 1) Separation of duties*, 2) Authorization and approval*, 3) Custodial and security arrangements* 1. Written procurement policies and procedures for procurement of supplies, equipment and other services. 45 CFR 74.44 HHS Procurement Procedures; 45 CFR 92.36 Procurement Standards Copy of procurement policy. Hover over link for date it was verified Page 2 of 7 LE 9804J Revised and Approved: 4/9/14 2. All procurement transactions conducted provide practical, open and free competition. 45 CFR 74.43 Open and Free Competition, 45CFR 92.36 Procurement Standards 3. Grantee maintains record of procurement history. 45 CFR 74.21 Standard for Financial Management Systems 45 CFR 74.41 Recipient Responsibilities 45 CFR 92.20 HHS Standards of Financial Management Systems 4. Grantee uses purchase requisition/order system of purchasing. 45 CFR 74.21 Standard for Financial Management Systems 45 CFR 92.20 HHS Standards of Financial Management Systems Accepted Internal Control Procedures 5. Grantee has proper segregation between: 45 CFR 74.21 Standard for Financial Management Systems 45 CFR 92.20 HHS Standards of Financial Management Systems Accepted Internal Control Procedures a. Requisition b. Procurement c. Receiving 1) Verified, signed and dated 6. Invoice and expenditure processing 45 CFR 74.21 Standard for Financial Management Systems 45 CFR 92.20 HHS Standards of Financial Management Systems Accepted Internal Control Procedures Hover over link for date it was verified Page 3 of 7 LE 9804J Revised and Approved: 4/9/14 a. Expenditures/invoices billed are reasonable, allowable, allocable to the programs (WIC, BFPC) b. Approvals are obtained before payment processing. c. Expenditures are billed correctly to the appropriate program. d. Expenditures are allocated accurately between nutrition education (NE), breastfeeding (BF), administration, and other special breakouts. e. Expenditures are allocated accurately among all programs. f. Prevent duplicate payment of invoices. g. Payment for partial shipments h. Receipts for prepaid items are retained for audit. 7. Property management system includes: asset description, ID number, acquisition date, current locations, and federal share of asset. 45 CFR 74.21 Standard for Financial Management Systems 45 CFR 92.20 HHS Standards of Financial Management Systems Accepted Internal Control Procedures 8. Physical inventory taken at least once every two years. Date of last inventory: E. Allocated/assigned costs. Types of costs charged to federal programs from other departments: 2 CFR Part 225 Appendix C State/Local Wide Central Cost Allocation Plans; Oregon WIC Policies WIC Fiscal Policy 1. If subrecipient uses cost allocation method of charging federal programs, there is Certificate of Cost Allocation Plan signed by chief financial officer of the governmental unit. Copy of the certification. 2. If there is no cost allocation plan, following is a list the direct charges; indicate the basis for allocation to all programs. Hover over link for date it was verified Page 4 of 7 LE 9804J Revised and Approved: 4/9/14 a. Rent b. Insurance c. Mail room d. Utilities e. Information Technology f. Accounting/County fiscal g. Motor pool F. Indirect costs: 2 CFR Part 225 Appendix E. State/Local Indirect Cost Rate Proposal 1. Indirect rate 2. Indirect charges are allocated to all programs proportionately or appropriately. 3. If the grantee uses indirect rate to charge federal programs, there is a copy of the agreement. 4. Costs are not double charged to federal grants. Discuss: G. Other direct allowable costs: OMB A- 133 (OMB A133); 2 CFR Part 225 Appendix B. Selected Items of Costs Oregon WIC Policies WIC Fiscal Policy 1. Review of specific charges to accounts (WIC, BFPC) to determine that cost claimed is appropriate, e.g., purchase orders, invoices, travel vouchers. II. ACCOUNTING SYSTEM OMB A-133 Subpart C: OMB A133 Subpart C; 45 CFR 74.21 Standard for Financial Management Systems; 45 CFR 92.20 HHS Standards of Financial Management Systems; Accepted Internal Control Procedures A. There is an accounting system. 1. Internally developed. Purchased Hover over link for date it was verified Page 5 of 7 LE 9804J Revised and Approved: 4/9/14 B. Cost centers and accounts are maintained for each grant. Discuss. C. An annual budget is submitted to the Board of Health by the Public Health Administrator. D. There are budgetary controls to preclude obligations in excess of grant total. Discuss. E. Accounting system provides for accounts payable/encumbrances. F. The expenditures are charged to the correct grant period at year-end. Subrecipient is on cash or accrual basis of accounting. Discuss. G. Copies of revenue and expense reports. H. There are written policies and procedures for accounting controls. III. SUBRECIPIENT MONITORING: OMB A-133 Subpart B. OMB A133 Subpart B A. There are federal funds passed through to sub recipients and/or vendors (providers). If yes, list the name of contractor and amount of federal funds disbursed. B. There is a written policy and procedure for monitoring for subrecipients and vendors (providers). IV. REPORTING AND AUDIT COMPLIANCE: OMB A-133 Subpart B. OMB A133 Subpart B A. Quarterly revenue and expense report B. Quarterly time study (WIC) C. Audited financial statement and single audit: OMB A-133, Audit Reports *1) Separation of duties: No one person has complete control over more than one key function or activity (e.g., authorizing, approving certifying, disbursing, receiving, or reconciling. *2) Authorization and approval: Transactions are properly authorized. Hover over link for date it was verified Page 6 of 7 LE 9804J Revised and Approved: 4/9/14 *3) Custodial and security arrangements: Responsibility for physical security/custody of assets is separated from record keeping/accounting four those assets. Unauthorized access to assets and accounting records is prevented. Hover over link for date it was verified Page 7 of 7 LE 9804J Revised and Approved: 4/9/14