University of Utah Sales Tax Update October 17 , 2007

advertisement

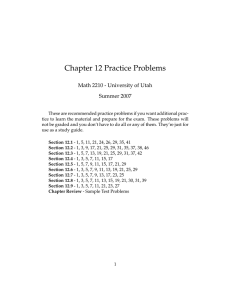

University of Utah Sales Tax Update October 17th, 2007 Presented by: Laura Howat, CPA Associate Director, Accounting Operations & Controls Phone: 581-6699 Email: laura.howat@admin.utah.edu University of Utah Sales Tax Update October 17th, 2007 New Rates Reduced sales tax on food & food ingredients Streamlined Sales Tax Changes effective January 1, 2008 Brief Review of Certain Sale Tax Provisions New Sales Tax Rates Effective April 1, 2007 New sales tax rates The new base sales tax rate is 6.85% for Salt Lake County New Sales Tax Rates If you do business in another county, please check the Utah State Tax Commission table http://tax.utah.gov/sales/rates/07q 2combined.xls Reduction in Sales Tax for Food & Food Ingredients Effective January 1, 2007 There was a new 2% reduction in sales tax for certain food and food ingredients Which foods qualify for the 2% reduction in sales tax is VERY complicated Reduction in Sales Tax for Food & Food Ingredients If your department serves or sells food, please look over the Utah State Tax Commission link outlining the new reduced rate for food and food ingredients. http://www.tax.utah.gov/sales/food _rate.html#legislation Reduction in Sales Tax for Food & Food Ingredients Food sales qualifying for the new 4.85% Salt Lake County rate are reported on a separate monthly sales tax report http://www.acs.utah.edu/afs/forms/ Sales_Tax_Report_food.pdf Streamlined Sales Tax (SST) SST is a nationwide effort by governments to standardize sales tax collection and administration Utah, along with many other states, adopted legislation to approve SST SST effective July 1st, 2006 Utah already postponed SST twice How is SST different? New tax forms Sales tax will be determined by where products are delivered Taxable portion of transaction may change Multi-state standardized definitions have been adopted SST Sourcing Sourcing is defined as attributing a sale to a specific taxing jurisdiction in order to determine tax rate to charge Utah sales tax would change sourcing from point of sale, to point of delivery SST During the 2006 General Session, the Utah Legislature adopted S.B. 233, Sales and Use Tax Revisions. In part, S.B. 233 eliminated point of delivery sourcing for required sales and use tax. This means that Utah sellers will continue to collect and remit sales and use tax in the traditional point of sale manner. SST In other words, SST is dead At least for now The information presented regarding point of sale versus point of delivery sourcing is subject to change based on further action by the Utah Legislature Clarification on Photocopies A 2007 bill clarifies that State Institutions of Higher Ed must collect and remit sales tax on photocopies Governmental entity exemption on photocopies does not apply Sales Tax Changes Effective January 1, 2008 Reduces the state sales tax rate from 4.75% to 4.65% Increases the resort communities tax from up to 1% to up to 1.1% Sales Tax Changes Effective January 1, 2008 Provides that the sales tax imposed on food and food ingredients is the sum of: (1) 1.75% state sales tax; (2) 1% local option sales tax; and (3) .25% county option sales tax (or the .25% state tax imposed if a county has not enacted a county option sales tax) Total 3% Sale “Sale” means any transfer of title, exchange, or barter of tangible personal property or any other taxable item or service for consideration, within the state of Utah. (Utah Code Ann. Sections 59-12-103(1), 59-12-102.) Some sales cause confusion Consignment sales of property require assessment and collection of sales tax Fundraising sales of property are subject to sales tax (Utah sales tax exemption for fundraising sales is for K-12 only) Sales Tax-Meals Sales tax applies to certain services, including sales of meals [Utah Code Ann. § 59-12103(1)(e)] Sales of Food-Tourism Tax? Salt Lake County has adopted the Tourism Tax This is an extra 1% tax imposed on all prepared foods and beverages Tourism tax separately reported to General Accounting Tourism Tax Applies to soda fountains Luncheonettes Restaurants Catering Coffee shops Concessions Tourism Tax In general, sale of prepared food for immediate consumption Does not apply to packaged food Applies to packaged food sold when prepared food also sold Does not apply when activity/outlet serves prepared food only occasionally Sales Tax Exemptions Utah sales to the University for items used by the University for our mission are exempt from Utah sales tax To qualify for the exemption, the purchase must be made with University funds The purchaser must present a completed exemption certificate to the seller Sales Tax Exemptions-Other States The University’s Utah sales tax exemption certificate does NOT apply to purchases outside of Utah If your department is conducting business in another state, contact Tax Services and we can investigate a potential sales tax exemption in such state Sales Tax Exemptions-Other States See Tax Services website for current sales tax exemptions in other states http://www.tax.utah.edu/ University Sales to Purchaser Exempt from Tax If a sale is made to a purchaser who is exempt from tax, the purchaser must present a valid Utah State Exemption Certificate. (Utah Code Ann. 59-12-106(2).) Exempt sales are not exempt from being reported to the state so you must include exempt sales on the General Accounting Monthly Sales Tax Report. Sales Tax Exemptions How does a religious or charitable institution get a Utah sales tax exemption number? Complete an Application for Sales Tax Exemption Number for Religious or Charitable Institutions, Form TC-160 See Tax Services website for details and links Transient Room Tax Salt Lake County has adopted the transient room tax This is a 4.75% tax on the rental of hotel or motel rooms Transient room tax is separately reported to General Accounting Sales Tax Process Sales tax returns are due by the last day of the month following the sales month Penalties and interest are assessed on late filing of returns or late payment of sales tax General Accounting consolidates departmental sales tax information so that the University can prepare its monthly sales tax return Sales Tax Process The University’s form “Utah Sales Tax Monthly Report” is due to General Accounting by the 15th of the month following the sales month Please submit departmental reports timely Utah Sales Tax Monthly Report Start with total taxable sales Do not include inter-departmental transactions Back out any out of state sales Total sales should be total Utah taxable sales Utah Sales Tax Monthly Report Subtract tax exempt sales where the purchaser was tax exempt Subtract refunds Calculate net taxable sales Calculate tax according to the form Designate chartfield for the payment of sales tax Include a contact, contact phone number & email Record Keeping Requirements Tax Commission Rule R865-19S-22 Sellers are required to keep complete records used to determine the amount of sales tax liability Records must be retained for three years from the filing date of the returns All records are open to the Tax Commission for examination University departments must maintain back-up documentation for sales and sales tax liability for three years Record Keeping Requirements Tax Commission Rule R865-19S-22 Records Required Show gross receipts from sales or rental payments from leases of tangible personal property, or services performed in connection with tangible personal property made in Utah regardless of whether the retailer considers the receipts to be taxable or non-taxable Show deductions and exemptions allowed by law and claimed in filing sales tax returns Show bills, invoices, or similar evidence of all tangible personal property purchased for sale, consumption, or lease in Utah Record Keeping Requirements Tax Commission Rule R865-19S-22 Records Required con’t Include the normal account books maintained by an ordinarily prudent business person, together with supporting documents of original entry such as: bills, receipts, invoices, and cash register tapes All schedules or working papers used in the preparation of tax returns must also be maintained University of Utah Sales Tax Update October 17th, 2007 Presented by: Laura Howat, CPA Associate Director, Accounting Operations & Controls Phone: 581-6699 Email: laura.howat@admin.utah.edu ???Questions????