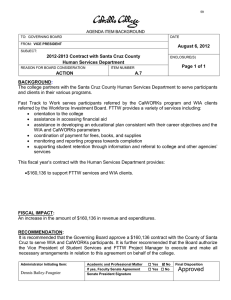

Document 17738411

advertisement