Document 17736833

advertisement

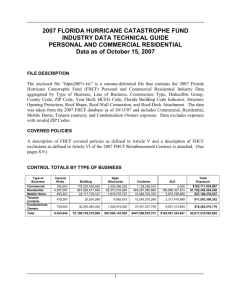

Creation of Citizens Property Insurance Corporation Citizens was created in 2002 in the merger of the state’s two insurers of last resort, the Florida Windstorm Underwriting Association (FWUA) and the Florida Residential Property and Casualty Joint Underwriting Association (FRPCJUA). The merger has allowed Citizens to become exempt from all federal taxes, resulting in millions of dollars in annual savings. Citizens is also designed to realize additional administrative and economic efficiencies over its predecessor organizations. Quick Reference – FWUA: created in 1972 to provide wind-only coverage in coastal regions. – FRPCJUA: created in December, 1992 following Hurricane Andrew for Floridians unable to find homeowners insurance. 2 Citizens Board of Governors 3 Member Appointed By County Occupation Bruce Douglas Chairman Governor St. Johns County Chief Executive Officer Douglas Capital Management Gloria Fletcher Vice Chair President of the Senate Alachua County Gloria W. Fletcher, P.A. Richard DeChene Governor Leon County Retired - CNA Allan Katz Chief Financial Officer Leon County Attorney Akerman Senterfitt Andrea “Andy” Bennett Chief Financial Officer Manatee County President A.M. Bennett & Company Carol Everhart President of the Senate Pinellas County Vice President BB&T Jay Odom Speaker of the House Okaloosa County President Crystal Beach Development Company of Northwest Florida Earl Horton Speaker of the House Pinellas County Executive Vice President Bouchard Insurance, Inc. Staff/Facilities Location Jacksonville Main Office - 6676 Corporate Center Parkway 377 Jacksonville - 8301 Cypress Plaza Drive 105 Tallahassee Main Office - Monroe Park Towers 101 N. Monroe Street 59 Tallahassee – Citizens Centre 2101 Maryland Circle 116 Tampa 302 Knights Run Avenue 153 TOTAL Total employees does not include contract consultant or temporary employees 4 # of Employees 810 Employees Overview of Accounts Each of the following three accounts are separate statutory accounts and have separate calculations of surplus, plan year deficit and assessment bases. Assets may not be commingled or used to fund losses in another account. • Personal Lines Account (PLA) - Multi-peril policies – Former FRPCJUA : Homeowners, mobile homeowners, dwelling fire, tenants, condominium unit owners and similar policies. • Commercial Lines Account (CLA) - Multi-peril policies – Former FPCJUA: Condominium association, apartment building and homeowners association policies. – Currently developing statutorily mandated commercial non-residential program. • High-Risk Account (HRA) – Wind-only policies – Former FWUA: Personal lines wind-only policies, commercial residential wind-only policies and commercial non-residential wind-only policies issued in coastal HRA eligible areas. – In the process of introducing statutorily mandated multi-peril residential and commercial policies to be written in eligible areas. 5 Citizens Coverage Areas 6 • The Personal and Commercial Lines Accounts write personal and commercial residential coverage, respectively, in all 67 counties. • The High-Risk Account (HRA) writes in 29 counties. PLA Risk Counts–12/31/07 7 CLA Risk Counts– 12/31/07 8 1,200,000 $300,000 1,000,000 $250,000 800,000 $200,000 600,000 $150,000 400,000 $100,000 200,000 $50,000 - $0 2004 9 2005 2006 2007 Exposure (Coverages A & C Only) (millions) Policy Count PLA/CLA Policy and Coverage Trend P T & HRA Risk Counts – 12/31/07 10 HRA Policy and Coverage Trend HRA Policy Count (PIF) and Risk Exposure (TIV) 500,000 $250,000 400,000 $200,000 Policy Count 350,000 300,000 $150,000 250,000 200,000 $100,000 150,000 100,000 $50,000 50,000 - $0 2004 11 2005 2006 Nov 2007 Exposure (Coverages A & C Only) (millions) 450,000 PIF * TIV (Cov A & C Only) * Risk Count Growth by Account – as of 12/31/07 Risk Count Growth 900,000 800,000 700,000 Risk Counts 600,000 PLA 500,000 CLA 400,000 HRA 300,000 200,000 100,000 2004 12 2005 2006 2007 Florida Residential Admitted Market Breakdown All Other 17% Florida Domestics 34% 13 Citizens 21% "Pup" Companies 28% The Florida residential property insurance admitted market is divided into 4 major parts based on policy counts: Citizens – 21% “Pups” of the major national writers – 28% Florida-only domestic companies – 34% Others, including USAA, etc. – 17% PLA Policy Trends PLA Policy Count Trend PLA Policy Counts by Policy Form MHO3 11% 1,000,000 900,000 MHO4 0% DP1 3% DP3 22% MDP1 10% Tenant DP1 DP3 Number of Policies 800,000 HO3 700,000 Mobile Homeowners 600,000 Condo Unit Owners HO6 7% HO4 HO6 MDP1 HO4 0% Dwelling MHO3 HO3 47% 500,000 MHO4 Homeowner 400,000 2004 2005 2006 Homeowner 245,635 179,969 340,675 410,600 Dwelling 113,180 122,169 185,952 221,992 Condo Unit Owner 27,124 25,757 47,338 59,038 Mobile Homeowner 23,244 59,195 166,757 190,502 Tenant 6,305 2,117 2,870 4,420 300,000 Nov 2007 200,000 100,000 2004 14 2005 2006 Nov 2007 CLA Policy Trends CLA Risk Count Trend (Includes only non-special class risks) CLA Risk Counts by Product Homeow ners Associations 13% 100,000 Apartment Buildings 17% 90,000 80,000 Number of Policies 70,000 Homeowners Associations 60,000 50,000 Condo Associations 40,000 30,000 Apartment Buildings 20,000 Apartment Buildings Condo Associations Condo Associations 70% Homeow ners Associations 10,000 Note: The assumption of the Poe Group commercial residential policies during 2006 caused a large portion of the significant increase in risk counts. 2004 2005 2006 Nov 2007 2004 15 2005 2006 Nov 2007 Apartment Buildings 4,948 3,680 16,939 14,919 Condo Associations 12,137 9,651 50,339 63,462 Homeowners Associations 2,008 1,944 8,861 12,005 Determination of Rates • Starting in 2002, rates were based on the “top twenty” insurers • Citizens rates were chosen to be equal to the highest rated company in a particular territory • Citizens’ rates were set to be uncompetitive • Only eligible for insurance with Citizens if you could not get insurance elsewhere 16 Rates • In 2006, the “highest rated” mandate was relaxed • Citizens’ rates were ordered to be based on actuarial principles • Rate indications showed Citizens’ rates to be inadequate • Rate increases went into effective 1/1/2007 • A policyholder is now eligible for coverage by Citizens only if any offers from admitted insurers are more than 15% higher than Citizens’ rates for comparable coverage 17 Rates • The rate increases effective January 1, 2007 were rescinded by legislative action. Any amounts collected were ordered to be refunded, and rates were frozen at 12/31/06 levels for all of 2007 and 2008 • Thereafter, Citizens will submit recommended rates to OIR and OIR will set rates within 45 days; no challenge is allowed. • The senate is considering a bill that would extent the rate freeze until 1/1/2010 with severe restrictions on rate increases in years 2011, 2012, 2013 18 Depopulation Programs and Projections Only non-bonus takeout contracts for PLA and HRA are currently available. Assuming carrier must remove during the 18-month contract period a minimum of either: • 10,000 policies with wind coverage; or • Policies with wind coverage with TIV (coverages A, B, C, and D) of $2 billion. Each assumption during a contract period must remove a minimum of either: • 2,500 policies; or • TIV of $500 million. Policies must be retained by the assuming carrier for a minimum of three (3) years. CLA takeout program being developed. Projected implementation to occur in 2008. Projected number of policies to be assumed during 2008: • • 19 PLA: 320,000 CLA: 5,500 Historical Depopulation – Policy Counts Policies Removed During the Year (as Portion of Total Policies) 1,800,000 1,600,000 Policy Count 1,400,000 1,200,000 Policies Removed 1,000,000 800,000 Remaining Policies 600,000 400,000 200,000 2003 Policy Removal PLA HRA Total Policies Removed Total Policies Remaining 20 2004 2005 12/31/2003 2006 2007 12/31/2004 12/31/2005 12/31/2006 12/31/2007 145,959 218,128 26,225 247,923 12,457 75,556 41,628 28,219 158,416 293,684 67,853 247,923 820,255 873,996 810,017 1,298,922 1,344,240 28,219 - - Capital Build-UP Incentive Program • Created in 2006 for the purpose of increasing the availability of residential property insurance • The Florida legislature appropriated $250 Million for use in providing Surplus Notes to qualified companies • Estimated that 1.7 million policies were written by other companies as a result of this program • This program has also lead to 165K policies being removed from Citizens • Estimated that 480K policies have been kept of Citizens due to this program 21 Capital Build-UP Incentive Program – Goals 22 • Further spread of hurricane risk to new capital in Florida • Continued depopulation of Citizens • Mitigation of policy growth in Citizens • Reduction in exposure and assessment potential for Florida • Currently considering making more capital available for 2008 Wind Mitigation Credits • In 2001, there were changes to the Florida Building Codes • ARA conducted a study to quantify the impact of the new building codes • Studied characteristics such as roof covering, roof shape, roof-to wall connections, openings, building height, roof framing, etc • Developed hurricane severity relativities • OIR has mandated wind premium discounts based on results of this study 23 Windstorm Mitigation Credit Statistics – as of 9/30/07 For Personal Residential and Commercial Residential Policies Only Program 24 Number of Policies including wind Number of Policies with WMC Percentage of Policies with WMC Total Wind Mitigation Credits Personal Residential – Multi Peril 628,662 189,536 30% $87,790,347 Personal Residential – Wind Only 358,581 185,424 52% $144,516,217 Commercial Residential – Multi Peril 10,897 4,917 45% $44,881,524 Commercial Residential – Wind Only 16,746 5,622 34% $70,439,886 Total Residential 1,014,886 385,499 38% $347,627,974 Reduction in Coverage 25 • Offer higher hurricane deductibles • Exclude screen enclosures – offer buyback • Exclude sinkhole coverage – offer buyback • Limit HO coverage A amount to $1 million • Offer lower coverage B coverage • Over $750K and in a WBDR, must have storm shutters • Within 2,500 of coast, must be built to Code Plus (built after 1/1/2009) Florida Hurricane Cat Fund • Purpose : Improve the availability and affordability of property insurance in Florida by providing inexpensive reinsurance to insurers • Created in 1993 after Andrew • Under the control and direction of the State Board of Administration of Florida (SBA - Board of Trustees: Governor, CFO, Attorney General ) • Nine member committee – 3 Consumer reps, 3 industry business professionals (agent, reinsurer, primary insurer), 3 technical professionals (meteorologist, engineer, & actuary) • Participation is mandatory • FHCF provides more then 50% of all reinsurance coverage in the state 26 Florida Hurricane Cat Fund 27 Insurers pay the FHCF a premium based on their proportionate residential risk in the state – $1.4B of premium in 2007 Insurers have individual retentions – Industrial-wide retention of $6.1B in 2007 After the retention is filled, FHCF reimburses insurers for 90% of their covered residential losses; insurers pay 10% co-payment (There are 25% and 45% co-payment options available) FHCF’s total liability is defined and limited statutorily – maximum 2007 liability was $27.85B FHCF - Funding 28 The FHCF receives annual reimbursement premiums from participating insurers; these premiums are actuarially set to be equal to the average annual expected loss for the FHCF If losses occur, and accumulated reimbursement premiums are insufficient to pay claims, the FHCF can issue tax-exempt bonds secured by emergency assessments for up to 30 years on a broad range of P&C insurance premiums in the state (This liability for losses is limited to the lesser of the statutory maximum or what the FHCF can raise in the capital markets) The “post-event” bonds would be repaid by an ongoing emergency assessment of up to 6% per year on direct premiums for most P&C lines of business in Florida (current assessment base is $37.4B) The FHCF has one tax-exempt bond issue outstanding in the amount of $1.35B with a final maturity of 2012, secured by a 1% emergency assessment FHCF - Liquidity 29 $2.8 B of proceeds from 2006 pre-event extendible note transaction $1.0 B from 2006 reimbursement premiums $1.4 B collected from 2007 reimbursement premiums Total of $5.2 B on hand Funding the FHCF 30 Citizens’ Financial Highlights • 2007 net income of $1.46 b on net earned premium of $3.16b • 2008 budgeted income of $1.54 b • 2008 year end surplus of $4.18 b • Cash and investments of over $10 b • Cash paying ability before emergency assessments of over $22 b – This includes premium revenue, surplus, pre-event financing, and FHCF reimbursements 31 Assessment Base is Broad and Diverse All Others $8.48 B 24% Total Premium Subject to Assessment Direct Written $33.3B Surplus Lines $4.1B Total Commercial $3.80 B 11% $37.4B Homeowners $7.70 B 22% 32 Auto $14.86 B 43% Assessment Base is Broad and Diverse The following lines are subject to assessment in 2008: Fire Allied Lines Multiple Peril Crop Farmowners Multiple Peril Homeowners Multiple Peril Commercial Multiple Peril (non liability) Commercial Multiple Peril (liability portion) Mortgage Guaranty Ocean Marine Inland Marine Financial Guaranty Earthquake Other Liability Products Liability 33 Private Passenger Auto No Fault Other Private Passenger Auto Liability Commercial Auto No Fault Other Commercial Auto Liability Private Passenger Auto Physical Damage Commercial Auto Physical Damage Aircraft (all perils) Fidelity Surety Burglary and Theft Boiler and Machinery Credit Aggregate Write-Ins Community Association Self - Insurance Citizens’ Assessment Types1 Non-homestead assessment – levied on non-homestead Citizens’ policyholders, up to a total of 10% of premium for each account with a deficit (up to 30% total); billed immediately Citizens policyholder surcharge – levied on all Citizens’ policyholders up to an additional 10% of premium of premium for each account with a deficit (up to 30% total); billed on renewal/new business Additional Citizens policyholder assessment – levied on all Citizens’ policyholders up to 10% of premium for each account with a deficit (up to 30% total); billed on renewal/new business Regular assessment – levied on all non-Citizens property and casualty policyholders up to 10% of premium for each account with a deficit (up to 30%); billed on renewal/new business Emergency assessments – levied on all P&C policyholders up to 10% of premium (per account); this assessment is collected for as many years as necessary to cover deficits, but not exceed 10% per account in a calendar year (per account). 34 PLA/CLA Projected Claims Paying Resources (2008 Hurricane Season) (Not to scale) $14.656 Billion 1 in 220-year PML Citizens’ Policyholder Surcharge - $800 Million Additional Assessment $800M Regular Assessments $5.800 Billion 100 Year PML - $8.59 Billion Non Homestead Assessments $140 million 100 Year PML - $9.278 Billion $7.116 Billion 1 in 68-year PML Remaining Surplus - $1.302 Billion As of 12/31/07 $5.814 Billion 1 in 49-year PML 1 in 27-year PML 10% of $2.019 B or $202 M from Surplus FHCF Recovery - TICL (90% of $2.019 Billion= $1.817 Billion) FHCF Recovery - Regular 10% of $2.826 B or $283 M from Surplus 1 in 5-year PML 35 Liquidity Target $3.794 Billion (90% of $2.826 Billion xs $969 Million) $2.543 Billion FHCF Attachment Point - $969 Million Surplus - $969 Million $0.969 Billion HRA Projected Claims Paying Resources (2008 Hurricane Season) (Not to scale) $14.615 Billion 1 in 100-year PML Emergency Assessments $2.032 Billion (.40% for 30 years) 100 Year PML $14.615 Billion As of 12/31/07 $12.583 Billion 1 in 76-year PML Remaining Citizens’ Policyholder Surcharge $330 Million 1 in 55-year PML 1 in 5-year PML $9.847Billion 10% of $3.42 B ($ 342M) from AAs +CPS FHCF Recovery - TICL 10% of $4.79 B ($ 479 M) from AAs + CPS FHCF Recovery - Regular 1 in 31-year PML 1 in 6-year PML Remaining Regular Assessments - $2.406 Billion (90% of $3.420 Billion) $3.078 Billion (90% of $4.789 Billion xs $1.638 Billion) $4.310 Billion FHCF Attachment Point $1.638 Billion Citizens NH+ Additional Assessment + CPS - $213 M Surplus - $1.425 Billion 36 Liquidity Target $6.427 Billion $1.638 Billion $1.425 Billion Claim Stats for 2004-2005 Hurricanes as of 12/31/07 Claim Payments by Hurricane 2004-2005 10% Hurricane 42% 20% Total Claims Payments % of Total Payments Charley 530,837,268 10% Frances 1,075,967,150 20% Ivan 837,407,191 15% Jeanne 431,944,992 7% Dennis 85,128,853 2% Katrina 191,229,225 4% 7,329,607 0% Wilma 2,313,717,737 43% TOTAL 5,381,250,727 100% Rita 15% 0% 4% 37 7% 2% Charley Frances Ivan Katrina Rita Wilma Jeanne Dennis Data includes PLA, HRA, and CLA claims. Insured Losses in Florida 2004-2005……..Who Paid ($ in 000's) Storm Charley Frances Ivan Citizens' Florida Insured Losses (Net of Losses FHCF) $ Jeanne 10,158,405 7,952,636 3,314,848 $ 3,634,646 % 536,360 1,111,990 947,376 5% 14% 29% 444,297 12% FHCF Losses $ % 2,271,452 1,516,459 405,162 22% 19% 12% 309,954 9% Net Governmental Losses $ % 2,807,812 2,628,449 1,352,538 28% 33% 41% 754,251 21% 2004 TOTAL $ 25,060,535 $ 3,040,023 12% $ 4,503,027 18% $ 7,543,050 30% Dennis Katrina Rita $ 297,399 853,000 25,243 $ 93,563 216,647 9,304 31% 25% 37% $ 373 241 0 0% 0% 0% $ 93,936 216,888 9,304 32% 25% 37% 1,675,057 17% 4,767,516 49% 6,442,573 67% Wilma 2005 Total 9,659,383 $ 10,835,025 $ 1,994,572 18% $ 4,768,130 44% $ 6,762,702 62% 2004 - 2005 Total $ 35,895,560 $ 5,034,595 14% $ 9,271,157 26% $ 14,305,752 40% FL quasi-governmental entities paid almost 40% of 2004-2005 losses (even without considering FIGA payments for Poe insolvency) 38 Reported Claims and Complaints 180,000 12% 156,274 160,000 120,000 10% 8% 7.70% 100,000 6% 80,000 5.09% 4.01% 60,000 51,634 4% 33,233 40,000 20,821 20,000 0 Frances Ivan Jeanne Total Claims Reported 39 0.67% 6,196 Charley 2% 24,599 16,805 0.11% 0.02% Dennis Katrina Percentage of Complaints 896 Rita 0% Wilma Percentage of Complaints Total Claims Reported 140,000 10.06% 9.60% Florida Residential Property Insurance Market = Quasi-governmental entity FIGA (Florida Insurance Guaranty Assoc.) Private Insurers (5.2 million policies; 205 insurers) Residential Policyholders (6.5 million risks) 40 Private Reinsurers (approx. 125) FHCF ($28 B in coverage; approx. 50% mkt share) Citizens (1.3 million policies) $10 billion residential premium (estimated), representing $2 trillion of insured property value