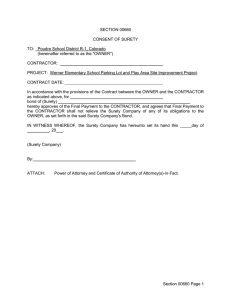

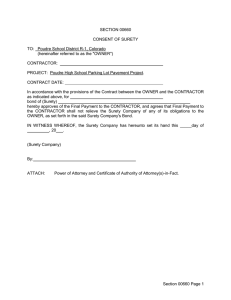

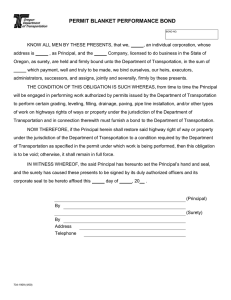

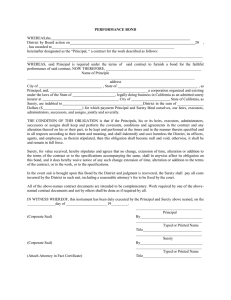

Surety – Insurance or Assurance? CAS Ratemaking Seminar Philadelphia, Pennsylvania March 2004

advertisement

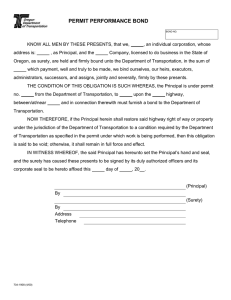

Surety – Insurance or Assurance? CAS Ratemaking Seminar Philadelphia, Pennsylvania March 2004 Gary Shook, FCAS Zurich North America Surety 101 • Surety bonds guarantee performance • Surety bonds are 3 party agreements – Surety guarantees that – Principal will perform for the benefit of – Obligee • Obligee no longer needs to ask “Can you do it?” only “For how much will you do it?” (Miller Act and Little Miller Acts) Surety 101 • Contract Surety - The Miller Act – – – – – federal contracts over $100,000 performance and payment (labor and materials) first and second tier subcontractors protected bonds not required for military contracts many states passed “Little Miller Acts” Surety 101 • Surety underwriters are professional “capability evaluators”. • Target loss ratio is 0% – do not bond principals that will not perform – u/w must know a great deal about the principal and the obligation Surety 101 • Traditional industry segments include – contract Surety – commercial Surety • • • • • court fiduciary official license and permit miscellaneous Surety 101 • Contract Surety – – – – – bid performance payment maintenance supply • U.S. infrastructure construction runs at about 10% of GDP Surety 101 • Commercial Surety – court • generally protect opposing litigant • coverage is statutory, bond forms must comply w/ statute – appeal - to stay execution of court order pending appeal from the judgment – bail bonds – mechanics lien (discharges a lien against real estate) Surety 101 • Commercial Surety – fiduciary • fiduciaries administer property held in trust • bond guarantees faithful performance of duties as ordered by the courts with jurisdiction • also includes conservators and liquidators • coverage is statutory • any and all parties with interest can file claim against the bond (obligee is usually the state or the U.S.A.) Surety 101 • Commercial Surety – fiduciary (cont’d) • protects against embezzlement, improper disbursements, loss on investments – executors of estates of deceased persons (or those presumed dead) – estates of incompetents – estates of minors (guardian bonds) – bankruptcy proceedings Surety 101 • Commercial Surety – official • covers loss of public funds – faithful performance of duties – failure of depository institution – burglary, robbery, forgery • federal and non-federal • treasurers, tax collectors, sheriffs and deputies, agents(fishing and hunting license sales), notaries Surety 101 • Commercial Surety – license and permit: bonds are often required prior to obtaining a license or permit • properly collect and remit duties, taxes – customs duties – sales and excise tax collection • properly discharge obligations under the law – return of illegally imported merchandise – statutory penalty for failure to comply with laws governing the business or activity Surety 101 • Commercial Surety – miscellaneous • statutory bonds that do not clearly fall into one of the other categories • U.S. immigrant bonds – payment of fines imposed under Immigration Act – maintenance of status and departure of non-immigrant alien – alien will not become dependent upon the state • voluntary bonds Surety 101 • Commercial Surety - Miscellaneous Bonds – – – – – – – depository bonds financial guarantees - traditional financial guarantees - credit enhancement income tax bonds lease bonds lost securities bonds workers compensation bonds Surety 101 • Commercial Surety – compliance • cigarette tax • notary • public official, court fiduciary, court guarantee – financial • WC Self-insurance • insurance premium payment bonds • sale and delivery of raw materials Loss Costs • Surety Association of America • Contract Surety – bonds classified by type of contract • primarily a function of complexity and duration – large building construction, dams, subways – bridge construction, curbs and gutters, elevators – fire escapes, guard rails, paving, mosquito control • supply, maintenance, completion, miscellaneous • bid – classification codes are also supported but loss costs are based more so on type of contract Loss Costs • Commercial Surety – primarily segmented using classification codes – myriad types of bonds are grouped by relative risk into a manageable number of loss cost classifications (i.e. risk groups) – separately done for court and fiduciary, official, license, etc. • Many surety loss costs are structured to support waning average loss/exposure ratios Individual Risk Considerations • Commercial Accounts – 3 Cs • character • capital • capacity – collateral - amount and quality – financial health – expected volume of bonds Individual Risk Considerations • Commercial Accounts – – – – credit rating (e.g. Moody’s, S&P) experience of management time in business stability of earnings • firm • industry segment Individual Risk Considerations • Contract Accounts – 3 Cs • character • capital • capacity - experience, expertise, hardware – financial well-being • quality of financial statements (e.g. CPA reviewed) • net worth (value and volatility) – geographic spread – bonded work vs. unbonded work The Three Party Agreement • This ain’t your father’s HO liability cover • Surety bonds principal in favor of obligee – the target loss ratio is zero – principals usually must execute general indemnity agreements in favor of the surety – often includes personal indemnity – after payment is made by surety to obligee, then surety seeks recovery from principal (read customer) Contract Surety Claims • Options for Surety – – – – – capital infusion takeover the contracts litigate (deny coverage) allow owner to complete provide for others to complete (tender the contracts) • Early intervention can save $$$$$$ Ground-up Incurred Severity 1,000,000,000 100,000,000 10,000,000 1,000,000 100,000 10,000 1,000 100 Ground-up Incurred Severity 13,000,000 11,700,000 10,400,000 9,100,000 7,800,000 6,500,000 5,200,000 3,900,000 2,600,000 1,300,000 0 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Severity - Claims over 1 Million 14,000,000 12,000,000 10,000,000 8,000,000 6,000,000 4,000,000 2,000,000 0 90% 91% 92% 93% 94% 95% 96% 97% 98% 99% 100% Accident Year Incurred Development Pattern 130% 120% 110% 100% 90% 80% 70% 60% 1 2 3 4 Commercial 5 6 7 Contract 8 9 Report Year Payment Patterns 120% 100% 80% 60% 40% 20% 0% 0 2 4 Commercial 6 8 10 Contract 12 14 Contract Surety Claims • Performance – completion costs in excess of job funds – delay damages – marginal fees (engineers, lawyers, architects) • Payment – labor and materials – extra work • Case Reserving is very complicated and therefore volatile Contract Surety Claims • Accident date? – loss is not typically “fortuitous” – claim files can open before a claim is made – can be outside the “policy period” • Multiple jobs typically affected – bonded and unbonded – various stages of job completion Contract Surety Claims • Probable Maximum Loss (PML) – possible to incur a loss in excess of the “limit” of the bond – typically a function of “work on hand” • Offsets include contract balances, indemnity, salvage, and subrogation – personal indemnity is not uncommon – recovery can extend for years Work on Hand 400 350 300 250 200 150 100 50 0 Job 1 Job 2 Job 3 Job 4 Complete Job 5 Job 6 On-hand Job 7 Total 400 PML 350 300 250 200 150 100 50 0 Job 1 Job 2 Job 3 On-hand Job 4 Job 5 Job 6 Contract Balance Job 7 Total Surety Reinsurance • • • • • • • Cosurety is not surety reinsurance Quota share vs. excess of loss Typically on a losses discovered trigger (XS) Aggregation Cash flow International issues Total risk includes capital market exposure Surety Reinsurance • Many P&C company information systems do not support some of the important surety statistics – – – – – post expiration “accident date” collateral contract balances credit rating net worth Surety Reinsurance • Many P&C company information systems do not support some of the important surety statistics – – – – claim counting can be different true exposure is difficult to maintain contract prices will change recoveries come in many forms Surety Reinsurance • Many P&C company information systems do not support some of the important surety statistics – work on hand (high maintenance stat) – customer number (aggregation issues) • exposure • incurred losses • contract and commercial – exposure (e.g. performance vs. payment) Enron • Bonds guaranteed delivery of oil and natural gas • $2B loss to insurance industry (includes asset write downs) • Enron loss amount – $1.1 billion in bonds • Payback • Pricing implications? Enron • Mahonia pays $200 to Enron today for $210 of gas to be delivered in 1 year • Mahonia buys a surety bond guaranteeing delivery on the paid-forward contract • Enron (secretly) contracts to buy $210 of gas from Mahonia in 1 year. • Enron has $200 cash, Mahonia has a guaranteed payment of $210 in a year Enron • Mahonia had no terminals, no storage tanks – contracts back-and-forth usually executed the same day – bond underwriters argue there was never intent or ability to use gas • One effect of the loss was many surety writers dramatically reducing capacity – e.g. from $250 million to $25 million per principal J. P. Morgan Chase vs. Continental Casualty (CNA) Federal Insurance (Chubb) Fireman’s Fund (Allianz) Hartford Liberty Mutual Lumbermens Mutual (Kemper) National Fire (CNA) Safeco St. Paul Travelers (2) J.P. Morgan Chase Settlement Principal Settlement - Rights Purchase = Net Payments $ 965 million 654 86 568 (60%ish) Enron • For the record – J.P. Morgan also had to sue for recovery of millions in LOC obligations – hundreds of millions of dollars were paid by surety companies on legitimate paid-forward bonded contracts K-Mart • K-Marts “Perfect Storm” – – – – – – – a nation in recession intense retail competition poor holiday sales 2001Q4 liquidity problems bad press from securities analysts Enron collapse lenders, insurers, and suppliers thought K-Mart sounded a lot like Enron (everyone wanted cash that K-Mart simply did not have) K-Mart • Bonds guaranteed workers compensation and liability self-insurance plans • As financial condition deteriorated, bond prices rose plus... • Collateral (cash) was required and this exacerbated the situation of cash strapped K-Mart Economic Trends 90 20 80 15 70 10 50 40 5 30 20 0 66 71 76 81 86 91 96 10 0 -5 Prime Rate Avg Chg CPI GDP Chg (96 $'s) Source: U.S. Department of Labor; Federal Reserve Board Release; Bureau of Economic Analysis, AM Best Surety L/R Surety L/R 60 Public Construction Spending v. Surety Industry C/R Industry Combined Ratio 140 125% 110 100% 75% 80 50% 50 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 Industry C/R Source: AM Best’s Aggregates & Averages; U.S. Census Bureau. Public Construction Put in Place (1996 constant $) Public Contruction 1996 $'s ($Bil) 150%