CAS Working Party on the Public-Access DFA Model Pat Crowe

advertisement

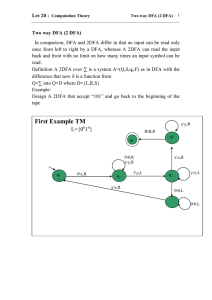

CAS Working Party on the Public-Access DFA Model Session C22 Pat Crowe November 2005 Background • Mid-1990s • Miller, Rapp, Herbers & Terry – Actuarial consulting firm in Bloomington, Illinois – Joined forces with University of Illinois (Gorvett & D’Arcy) – Created a public-access DFA model for the property-liability industry – Called DynaMo • Public-Access framework provides – Opportunity for industry peer review – Education of actuaries regarding DFA Literature on the Public-Access DFA Model • 1997 CAS DFA Seminar – D’Arcy, Gorvett, Herbers, Hettinger, Lehmann and Miller • Contingencies, Nov/Dec 1997 – D’Arcy, Gorvett, Herbers and Hettinger • 1998 CAS DFA Seminar – D’Arcy, Gorvett, Hettinger and Walling • 1999 CAS DFA Seminar – Ahlgrim, D’Arcy and Gorvett – Walling, Hettinger, Emma and Ackerman DynaMo Catastrophe Generator U/W Inputs U/W Generator Payment Patterns U/W Cycle U/W Cashflows Tax Interest Rate Generator Investment & Economic Inputs Investment Generator Investment Cashflows Outputs & Simulation Results Specific Provisions of DynaMo • Six separate, but interrelated modules Investments Underwriting Interest rate generator Catastrophes Taxation Loss reserve dev. • Multi-state • Multi-line • For each line of business – New business – 1st renewals – 2nd and subsequent renewals What Does This Model Do? • Simulates results for the next 5 years • Generates financial statements – Balance sheet – Operating statement – IRIS results • Indicates expected values and distribution of results for any value selected Key DFA Variables in DynaMo • • • • • • Financial Short-term interest rate Term structure Default potential Equity performance Inflation Mortgage pre-payment patterns • • • • • • • • • • • Underwriting Loss freq. / sev. Rates and exposures Expenses Underwriting cycle Loss reserve dev. Jurisdictional risk Aging phenomenon Payment patterns Catastrophes Reinsurance Taxes Sample DFA Model Output P R O B A B IL IT Y Distribution for SURPLUS / Ending/I115 0.16 0.13 0.10 0.06 0.03 0.00 6.8 13.9 21.1 28.2 35.4 Values in Hundreds 42.5 49.7 Outputs Available • • • • • • 5-year projections Balance sheets Income statements Loss ratio reports IRIS tests Others as needed – Select any cell of spreadsheet – Graphs and histograms Model Uses Internal • • • • • Strategic Planning Ratemaking Reinsurance Valuation / M&A Market Simulation and Competitive Analysis • Asset / Liability Management External • External Ratings • Communication with Financial Markets • Regulatory / RiskBased Capital • Capital Planning / Securitization Current Project • Working Party on the Public-Access Model – Sponsored by the Committee on Dynamic Risk Modeling – Co-Chairs: Shawna Ackerman and Rick Gorvett • Charge: to update and enhance the publicaccess DFA model Working Party Plan • Phase 1: Documentation and evaluation of the components of the existing model (1) Interest rate and inflation generator (2) Investment module (3) Financial statement development (4) Loss development and payment patterns (5) New business (6) Jurisdictional risk (7) Catastrophe module (8) Underwriting cycle (9) Taxation (10) Output Working Party Plan (cont.) • Phase 2: Identification of selected enhancements to the model – E.g., incorporate results from recent CAS/SOA research project on economic and financial scenario modeling • Phase 3: Implementation of selected enhancements • Phase 4: Ultimately, consider an “open source” framework for the public-access model Current Project For additional information, or to volunteer for the Working Party, please feel free to contact either of the co-chairs: • Rick Gorvett gorvett@uiuc.edu • Shawna Ackerman shawnaa@pinnacleactuaries.com