Elicitation & Elucidation of Risk Preferences Working Party 2005 CAS Annual Meeting

advertisement

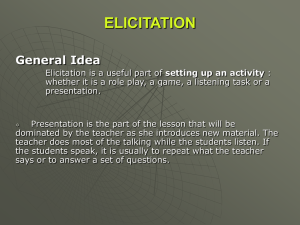

Elicitation & Elucidation of Risk Preferences Working Party 2005 CAS Annual Meeting Session C 21 Parr Schoolman / David Ruhm Elicitation & Elucidation of Risk Preferences: AUDIENCE QUESTIONS • Without looking up any information, estimate Wal-Mart’s 1999 revenue: • Put an upper and lower bound around your estimate, so that you are 95% confident that your range surrounds the actual quantity: Lower Bound________ Upper bound________ Elicitation & Elucidation of Risk Preferences: AUDIENCE QUESTIONS • Linda is 31 years old, single, outspoken and very bright. She majored in philosophy. As a student, she was deeply concerned with issues of discrimination and social justice and she participated in antinuclear demonstrations. • Rank order the following 8 descriptions in terms of the probability (likelihood) that they describe Linda: • • • • • • • • a. Linda is a teacher in an elementary school. b. Linda works in a bookstore and takes yoga classes. c. Linda is active in the feminist movement. d. Linda is a psychiatric social worker. e. Linda is a member of the League of Women Voters. f. Linda is a bank teller. g. Linda is an insurance salesperson. h. Linda is a bank teller who is active in the feminist movement. Elicitation & Elucidation of Risk Preferences: AUDIENCE QUESTIONS • You are out of town at a business meeting that runs late. As soon as you can break away, you head to the airport to catch the last flight home. If you miss the flight, which is scheduled to leave at 8:30 PM, you will have to stay overnight and miss an important meeting the next day. You run into traffic and do not get to the airport until 8:52 PM. You run to the gate, arriving there at 8:57 PM. When you arrive, either: (A) (B) You find out that the plane left on schedule at 8:30 PM, or You see the plane depart, having left the gate at 8:55 PM. Which is more upsetting (circle one)? A B Neither Elicitation & Elucidation of Risk Preferences: INTRODUCTION • Risk Management & Risk Measurement requirements are increasing: • • • • Sarbanes-Oxley Rating Agency pressures CEO Attestations of Financial Statements Result: • Companies are being required to have documented Risk Management Policies and Procedures Elicitation & Elucidation of Risk Preferences: PURPOSE These requirements provide an opportunity for management to institute a consistent viewpoint regarding risk: Some tradeoffs are acceptable, some are not Some tradeoffs are preferable to others Without a consistent policy on decisions: Senior management input on tradeoffs is confined to highest level of decisions Unconnected, ad hoc business unit decisions Elicitation & Elucidation of Risk Preferences: PURPOSE Objective Rational framework for making decisions Explicit evaluations of risk vs. return Management risk preferences codified Decision consistency Enterprise implementation Elicitation & Elucidation of Risk Preferences: KEY STEPS • Key Steps for determining a Firm’s “Risk Policy”: • • • • Define Risk Unambiguously Assess Context Determine Risk Measures Ascertain Risk Preferences (i.e., find consensus) Elicitation & Elucidation of Risk Preferences: KEY STEPS • Define Risk Unambiguously • What do you mean by “Risk”? • • • Risk of losing money or of “missing plan”? Reduction in accounting book value (or income) or lost market capitalization? Ultimate value or mark to market shortfall? Elicitation & Elucidation of Risk Preferences: KEY STEPS • Define Risk Unambiguously (continued) • What are the firms’ key risks? • • • • • Financial Operational Competitive Strategic For what time horizon? Elicitation & Elucidation of Risk Preferences: KEY STEPS • Define Risk Unambiguously (continued) A useful risk definition is: Specific, rather than ambiguous Accepted by involved parties As comprehensive as needed Elicitation & Elucidation of Risk Preferences: KEY STEPS • Examples of heuristics that could be given specific operating definitions: Build in enough profit margin to insulate capital against unexpected events and unknowable factors. (profit measure) Don’t over-concentrate the underwritten risks. (percentile) Do business in markets where the company has an identifiable, durable operating advantage. (margin) Don’t write what you don’t know. (parameter variability) Don’t deal with untrustworthy parties. (historical data) Avoid mass tort exposure. (exposure type’s aggregate loss) Elicitation & Elucidation of Risk Preferences: KEY STEPS • Risk Definition Examples: Accident Year Total Return shortfall relative to cost of capital Rolling 4-quarter income shortfall relative to cost of capital Statutory Surplus decline over the next year Ratings downgrade probability over the next 5 years Elicitation & Elucidation of Risk Preferences: KEY STEPS • Context • • • Corporate Culture Financial Characteristics Perspectives of Key Decision Makers Elicitation & Elucidation of Risk Preferences: KEY STEPS • Context - Corporate Culture • • • Age of Organization Tenure of Current Management Company History Elicitation & Elucidation of Risk Preferences: KEY STEPS • Context - Financial Characteristics • • • Financial Strength Size of Firm Ownership Structure • • Stock vs. Mutual Privately held vs. Public Elicitation & Elucidation of Risk Preferences: KEY STEPS • Context - Key Decision Makers • Sales background vs. financial background • • • Perceived relative importance of top line Time in career could influence risk appetite Life vs. P&C • • Life: Cognizant of persistency, investment risks P&C: Cognizant of catastrophe, reserve risks Elicitation & Elucidation of Risk Preferences: KEY STEPS • Risk Measures • • • Objective Transparent Appropriate • • • Timeliness vs. Accuracy Trade-off IT and Budget resource constraints Understandable Elicitation & Elucidation of Risk Preferences: KEY STEPS • Risk Measures - Objectivity • Objective: Probability of 2005 reported net income being negative. • Not too objective: Probability of very high net losses for accident year 2005. Elicitation & Elucidation of Risk Preferences: KEY STEPS • Risk Measures - Transparency • Transparent: Probability of a net loss for the line or segment. • Not so transparent: The beta of the line or segment’s net income distribution. Elicitation & Elucidation of Risk Preferences: KEY STEPS • Risk Measures – Appropriateness • Appropriate: Short-term net income distribution for property catastrophe lines. • Not that appropriate: Short-term net income distribution for long-tail lines and lines whose principal risk is surplus drain. Elicitation & Elucidation of Risk Preferences: KEY STEPS • Ascertaining Risk Preferences • Survey methods have been developed for marketing • • • • Conjoint Analysis Quality Functional Deployment (QFD) Multi-Attribute Utility Theory (MAUT) Many others as noted in paper Elicitation & Elucidation of Risk Preferences: KEY STEPS • Ascertaining Risk Preferences (continued) • Survey methods from marketing: • Example: used to find out car buyers’ preferences • • • • Younger buyers: styling, performance more important Family buyers: space, seating, mileage more important These are tradeoffs of desirable features Could be used for management risk preferences • • Determine acceptable tradeoffs Isolate those risks that management considers more important / quantify relative importance Elicitation & Elucidation of Risk Preferences: BIASES • Key Biases • Framing – Loss (Risk Seeking) vs. Gain (Risk Averse) • • • • Overconfidence in accuracy of estimates More easily remembered seems more probable • • • • • • An uncertain loss is preferred to a sure loss A sure gain is preferred to an uncertain gain Catastrophe Risk Terrorism Risk Asbestos Anchoring & Adjustments Representativeness Regret Avoidance Elicitation & Elucidation of Risk Preferences: BIASES - FRAMING Question 1: In addition to your initial wealth, you are given $1,000 and then have to choose from among the following choices: Question 2: In addition to your initial wealth, you are given $2,000 and then have to choose from among the following choices: A) Receive $1,000 with prob. p=.5 or receive $0 with prob. 1-p=.5. B) Receive $500 with probability p=1. A) Lose $1,000 with prob. p=.5 or lose $0 with prob. 1-p=.5. B) Lose $500 with probability p=1. Results: A: 25 B: 72 Results: A: 60 B: 35 Elicitation & Elucidation of Risk Preferences: BIASES - FRAMING Question 1: You have just learned that the sole supplier of a crucial component is going to raise prices. Two alternative plans have been formulated to counter the effect of the price increase. The expected Impact is: Plan A)If this plan is adopted, the company’s costs will increase by $4,000,000. Plan B) If this plan is adopted, there is a 1/3 probability that there will be no cost increases, and a 2/3 probability that the company’s costs will increase by $6,000,000. Which do you prefer? Results: A: 36 B: 61 Question 2: You have just learned that the sole supplier of a crucial component is going to raise prices. The price increase will cost the company an additional $6,000,000 in supply costs. Two alternative plans have been formulated to counter the effect of the price increase with savings in other parts of the company. The anticipated consequences of these two plans are: Plan A) If this plan is adopted, the company will save $2,000,000 in operating expenses. Plan B) If this plan is adopted, there is a 1/3 probability that the company will save $6,000,000 in operating expenses, and a 2/3 probability that no savings will be achieved. Which do you prefer? Results: A: 84 B: 12 Elicitation & Elucidation of Risk Preferences: BIASES - OVERCONFIDENCE • Without looking up any information, estimate Wal-Mart’s 1999 revenue: • Put an upper and lower bound around your estimate, so that you are 95% confident that your range surrounds the actual quantity: Lower Bound________ Upper bound________ • 23 out of 80 actuarial students’ intervals contained the actual figure ($166.8 billion). The actual probability that a randomly selected student’s range contained the actual figure was 29%, far less than 95%. • Elicitation & Elucidation of Risk Preferences: BIASES - REPRESENTATIVENESS • Linda is 31 years old, single, outspoken and very bright. She majored in philosophy. As a student, she was deeply concerned with issues of discrimination and social justice and she participated in antinuclear demonstrations. • Rank order the following 8 descriptions in terms of the probability (likelihood) that they describe Linda: • • • • • • • • • a. Linda is a teacher in an elementary school. b. Linda works in a bookstore and takes yoga classes. c. Linda is active in the feminist movement. d. Linda is a psychiatric social worker. e. Linda is a member of the League of Women Voters. f. Linda is a bank teller. g. Linda is an insurance salesperson. h. Linda is a bank teller who is active in the feminist movement. 52 out of 80 actuaries ranked “h” more likely than “f ”! Elicitation & Elucidation of Risk Preferences: BIASES – REGRET AVOIDANCE • You are out of town at a business meeting that runs late. As soon as you can break away, you head to the airport to catch the last flight home. If you miss the flight, which is scheduled to leave at 8:30 PM, you will have to stay overnight and miss an important meeting the next day. You run into traffic and do not get to the airport until 8:52 PM. You run to the gate, arriving there at 8:57 PM. When you arrive, either: (A) (B) You find out that the plane left on schedule at 8:30 PM, or You see the plane depart, having left the gate at 8:55 PM. Which is more upsetting (circle one)? A Results: A: 3 B: 60 Neither: 16 B Neither