A Macro Validation Dataset for US Hurricane Models CAS Ratemaking Seminar

advertisement

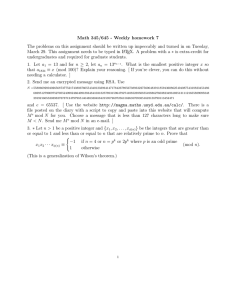

A Macro Validation Dataset for US Hurricane Models CAS Ratemaking Seminar Douglas J. Collins March 13, 2001 Hurricane Model Validation - Examples Comparisons to historical event probabilities Frequency & Severity by time period/location Comparisons to historical wind speeds at locations Individual storms Historical maximums Comparisons to historical damage and insured loss data Specific geographic area Individual company Industry 2 Macro Validation Dataset Estimated industry insured losses for All storms producing hurricane winds over land Continental US By county 1900-1999 Adjusted to 7/1/2000 level, reflecting changes in Prices Wealth Housing units Insurance utilization 3 Sample Components of Normalization Adjustment Camille, Hancock Cty, MS 297.4% Inflation 222.8% Housing Units Utilization Wealth 55.6% 36.1% 4 Limitations of dataset Normalization process Inaccuracies in industry loss estimates Unavailability of insured losses prior to 1949 Leveraging of trend factors Use of housing units as exposure measure Normalization vs. Probabilistic Random effects on historic record Probabilistic dependent on industry exposure set Probabilistic definition of event 5 Results - Continental US Frequency Cat 1 2 3 4 5 All # 0.62 0.38 0.47 0.15 0.02 1.64 % 37.8% 23.2% 28.7% 9.1% 1.2% 100.0% Normalized Losses ($M) AAL 76 243 934 1,579 41 2,873 Severity % 122 2.6% 639 8.5% 1,986 32.5% 55.0% 10,529 2,071 1.4% 1,752 100.0% 6 Results by Decade 00s 10s 20s 30s 40s 50s 60s 70s 80s 90s All F5 L5 Freq 1.5 2.0 1.5 1.7 2.3 1.8 1.5 1.2 1.6 1.3 1.64 1.80 1.48 AAL 3,194 3,626 6,440 1,669 2,712 2,321 2,874 1,096 1,363 3,435 2,873 3,327 2,218 Sev 2,129 1,813 4,293 982 1,179 1,289 1,916 913 852 2,642 1,752 1,948 1,522 7 Results by State Comparison of Normalized 20 Year Return and Expected by State TX LA MSAL FL 20 Year Expected GASC NC VANJ NYME 0 1000 2000 3000 4000 5000 6000 Estimated Industry Losses ($Millions) 8 Return Period Comparison to Model 16 14 Industry Loss ($B) 12 Norm CW Norm TX 10 Norm FL 8 Mod CW 6 Mod TX Mod FL 4 2 Exp 5 10 20 Return Period (Yrs) 9 Return Period Comparison to Model 60 50 Industry Loss ($B) Norm CW 40 Norm TX Norm FL 30 Mod CW Mod TX 20 Mod FL 10 25 50 100 Return Period (Yrs) 10 Comparison to Model - Variation by State Comparison of Model T and Normalized Expected Losses by State TX LA MSAL FL Model T Normalized GASC NC VANJ NYME - 200 400 600 800 1,000 1,200 1,400 1,600 Expected Losses ($Millions) 11 Other Uses of Dataset Generate discussion about model assumptions Benchmark for comparing models Comparisons by event Comparisons by county Modify/Create your own collind@towers.com 12