THE INCREDIBLE SHRINKING RESIDUAL MARKET

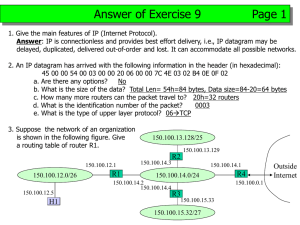

advertisement

THE INCREDIBLE SHRINKING RESIDUAL MARKET Session: PL-39 Presented by: Tom Daley, ACAS, MAAA, NCCI John Winkleman, Jr., FCAS, AIPSO Richard Amundson, FCAS, MN DOC WORKERS COMPENSATION Presented By: Tom Daley © 2000 National Council on Compensation Insurance, Inc. OUTLINE • Historical Perspective • How did it get so large? • Impact of a large residual market • What caused the shrinkage? • Ratemaking implications today • How will we keep it from growing again? © 2000 National Council on Compensation Insurance, Inc. RESIDUAL MARKET ESTIMATED ULTIMATE PREMIUMS AS OF 9/30/2000 6.0 4.80 5.0 4.39 4.09 3.96 4.0 Premium 3.0 ($Billions) 3.49 2.60 3.08 2.84 2.11 1.96 2.0 1.00 2000 1998 0.33 0.27 0.30 1997 1996 1995 1994 1993 1992* 1991* 1990* 1989* 1988* 1987 1986 0.0 0.57 1999 1.0 Policy Year ® * Excludes Maine Residual Market Pool © 2000 National Council on Compensation Insurance, Inc. HOW DID IT GROW SO LARGE? • Inadequate rates • Overly generous benefits • Lack of cost containment • Poor underwriting results © 2000 National Council on Compensation Insurance, Inc. RESIDUAL MARKET UNDERWRITING GAIN/LOSS AS OF 9/30/2000 23 0.0 -21 -40 -45 1999 126 1998 103 1997 500.0 -139 -500.0 Underwriting Gain\Loss -1000.0 ($Millions) -558 -1140 -1500.0 -1354 -1596 -2000.0 Policy Year * Excluding Maine ** Excluding Maine and New Mexico # Excluding New Mexico 1996 1995 1994 1993# 1992** 1991** 1990** 1989* 1988* 1987 1986 -2500.0 -1760 -1848 -2018 ® © 2000 National Council on Compensation Insurance, Inc. IMPACT OF A LARGE RESIDUAL MARKET • Carriers stop writing WC • AR plans grow larger and larger • Rates increase (both markets) • Employers costs rise • Movement towards self-insurance © 2000 National Council on Compensation Insurance, Inc. WHAT CAUSED THE SHRINKAGE? • Reform at all levels of stakeholder • Residual Market pricing programs • New state funds • Increased competition/capacity © 2000 National Council on Compensation Insurance, Inc. NCCI RATEMAKING IN TODAY’S ASSIGNED RISK MARKET The NCCI approach for overall indication: 1. Use total market data (most states) 2. Use AR data to establish differential over voluntary market © 2000 National Council on Compensation Insurance, Inc. RESIDUAL MARKET COMBINED RATIOS AS OF 9/30/2000 190 170 164 168 165 158 Combined Ratio 150 (%) 141 127 126 112 104 2000 98 117 1999 94 1995 1994 1993 1992* 1991* 1990* 1989* 1988* 1987 90 1986 97 1997 104 1996 110 112 1998 130 Policy Year ® * Excludes Maine Residual Market Pool © 2000 National Council on Compensation Insurance, Inc. Residual Market Policy Size Large (PY93) Vs. Small (PY2000) All NCCI States Premium Range $0 - $2,499 $2,500 -$4,999 $5,000 - $9,999 $10,000 - $49,999 $50,000 - $99,999 $100,000 - $499,999 $500,000 and over Total PY 93 Policy Count % of Total PY 2000 Policy Count % of Total 271,768 56,229 36,491 36,697 5,558 3,536 66.2% 13.7% 8.9% 8.9% 1.4% 0.9% 75,684 8,161 4,238 3,611 398 230 82.0% 8.8% 4.6% 4.0% 0.4% 0.3% 163 0.0% 6 >.01% 410,442 100.0% 92,330 100% NCCI ASSIGNED RISK RATEMAKING Biggest challenges facing NCCI: • Volatility of assigned risk data due to low volume • Increasing expense provisions as % of premium • Maintaining Servicing Carrier capacity • Affordability vs. subsidies (break-even pricing) © 2000 National Council on Compensation Insurance, Inc. HOW DOES ONE KEEP RESIDUAL MARKETS SMALL? • Strive for rate adequacy • Retain pricing programs in AR market • Help prevent erosion to reforms • Maintain a target goal of underwriting loss to voluntary premium ratio <1.0% • Examine alternative Residual Market Structures © 2000 National Council on Compensation Insurance, Inc. PRIVATE PASSENGER RATEMAKING ASSIGNED RISK John Winkleman, Jr. AIPSO RATEMAKING METHODOLOGY BASED ON SIZE OF PREMIUM TOTAL PREMIUM < $1.0M BASED ON COMPARISON TO NONSTD MARKET TOTAL PREMIUM > $1.0M BASED ON PROSPECTIVE RATING 12 Months Ending 12 /00 12 /99 12 /98 12 /97 12 /96 12 /95 12 /94 12 /93 12 /92 12 /91 12 /90 12 /89 12 /88 12 /87 12 /86 12 /85 12 /84 12 /83 12 /82 12 Months Assigneds Thousands New York PPNF Liability 1200 1000 800 600 400 200 0 12 Months Assigneds Millions Countrywide PPNF Liability 4 3 2 1 0 /82 12 /83 12 /84 12 /85 12 /86 12 /87 12 /88 12 /89 12 /90 12 /91 12 /92 12 12 Months Ending /93 12 /94 12 /95 12 /96 12 /97 12 /98 12 /99 12 /00 12 12 Months Ending 12 /0 0 12 /9 9 12 /9 8 12 /9 7 12 /9 6 12 /9 5 12 /9 4 12 /9 3 12 /9 2 12 /9 1 12 /9 0 12 /8 9 12 /8 8 12 /8 7 12 /8 6 12 /8 5 12 /8 4 12 /8 3 12 /8 2 12 Months Assigneds Thousands Countrywide OTPP Liability 400 300 200 100 0 Residual Market Pricing Richard Amundson, FCAS Actuarial Director MN Department of Commerce A Model of Residual Market Pricing Some assumptions • Assigned Risk Plan (ARP) sets prices to break even based on its own experience. • ARP’s profit or loss is allocated to the voluntary market. • Insurance is mandatory; 2 choices: voluntary or ARP. • An insured buys from market with lowest price. • Expenses are proportional to loss and will be ignored. An Instructive Example • Insurer needs $100 surplus for $200 yr-end loss. • Insurer earns 5% risk-free on invested assets. • Insurer needs a 15% return on equity. Extreme case 1: ARP has 0 percent market share. • Insurer collects $200 in premium, invests it & the $100 of surplus. • Insurer earns $15 during the year. • Year-end: insurer pays $200, has $100 plus $15 from investments. Extreme case 2: ARP has 100% market share. • Insurer has no voluntary premium, but retains responsibility for ARP’s losses. • Insurer still needs $100 of surplus: all the risk is still around and the insurer still bears it all. • Insurer has same risk as in case 1, same investment as in case 1, so needs same return. ARP must charge full $200 in order to generate same return. Regardless of ARP market share, insurer needs the full $100 surplus and the full $200 prem. FIGURE 1 MARKET RATES IN EQUILIBRIUM PREMIUM y y=x R y = ax x EXPECTED R’ R R = ARP price ax = voluntary market price LOSS The Elusive Search For Equilibrium What happens when ARP reviews rates? • ARP overcharged insureds with expected losses between R’ and R and undercharged insureds with expected losses > R. Net effect is undercharge, but analysis will not necessarily indicate rate increase. • ARP doesn’t include profit in its analysis. ARP may charge enough to pay claims: analysis on non-profit basis may show need for rate reduction. Whether analysis will show need for increase or decrease is function of distribution of expected losses. • Only sure way to remain in equilibrium is to ignore indications. Figure 2 Market Rates With ARP Pricing To Break Even PREMIUM y y=x 29.19 28.18 27.62 y = 27.62 y = ax x EXPECTED 28 29 27.62 = ARP price ax = voluntary market price LOSS How To Set ARP Rates If consensus is in favor of keeping and controlling residual market, break-even pricing is poor tool. Assuming that ARP will exist, that it should not be too burdensome on voluntary market and that it should not have wild swings in market share, then there is a reasonable solution to rate problem: Base ARP rates on industrywide experience, consistently higher than what a typical insurer would need to charge in voluntary market. Setting Specific Goals Guidelines: Bigger the voluntary market the better. Residual market should not be unaffordable. Expected assessment of residual mkt losses on voluntary mkt insureds not excessive. Rate changes should not be abrupt. Example of Specific Goals Possible goals for residual market: Market share under 1%. Rates under 150% of voluntary. Expected assessment under 0.5%. Annual rate changes < 10% (relative to voluntary market) during catch-up period. Using Goals To Set Prices Residual market can set prices as multiple of voluntary market and measure success directly from goals. Should ARP move away from break-even pricing even if already running smoothly? Yes, to prevent future problems from arising. The best time to repair the roof is when it isn’t raining. Market-based pricing gives ARP a built-in stabilizer, a governor to keep the system from breaking down. If you don’t think the system can break down: Remember the Maine If you don’t think the system can break down: State of Remember theMaine Recap: one last look at ARP’s burden If you take one idea home with you, let it be this: The burden that ARP puts on the voluntary market is not simply ARP’s bottom-line losses. The burden is reduced return on surplus, even if ARP’s return is positive. Recap: one last look at ARP’s burden An Illustration Put yourself in the shoes of the voluntary market where you have $1 million each of premium and surplus, and ARP has $500 million of premium & no surplus. If ARP expects a bottom-line gain of 1% of premium, would you like the right to the gain if it also obligates you to pay in case of a loss? If you say yes, I have some advice for you on behalf of Governor Ventura and the Minnesota guaranty fund: Stay out of Minnesota!